Robinhood Blockchain: Preparing for a Major Crypto Leap

Robinhood blockchain is poised to make waves in the cryptocurrency landscape, with whispers of an ambitious launch aimed at reshaping how users engage with digital assets. Insiders claim that the American financial services firm is striving to establish its own blockchain, evaluating notable players like Arbitrum and Solana as strategic partners for this pioneering development. This initiative aligns with Robinhood’s ongoing efforts to enhance its crypto trading platform, expanding its services to new international markets. As the cryptocurrency sector continues to gain momentum, the emergence of the Robinhood blockchain reflects the firm’s commitment to innovation and adaptation in a competitive landscape. With these advancements, Robinhood is not only staying relevant but also setting the stage for future crypto enthusiasts and traders alike.

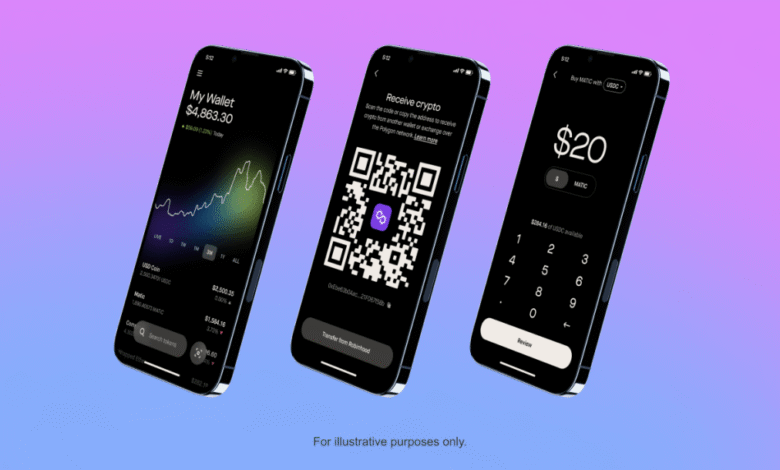

The Robinhood blockchain concept introduces a novel prospect in the realm of digital finance, as the platform seeks to revolutionize cryptocurrency trading for its growing user base. By considering strategic partnerships with cutting-edge solutions like the Arbitrum blockchain and Solana, Robinhood aims to enhance its operational framework and provide unique offerings to traders. This initiative is reminiscent of broader trends within the crypto space, where firms increasingly recognize the value of proprietary blockchain technology. As many of its competitors like Coinbase have already taken significant steps towards developing their own infrastructures, Robinhood’s push into blockchain development is a calculated move to amplify its crypto capabilities. Ultimately, this endeavor could pave the way for an enriched trading experience that bridges traditional finance with the dynamic world of digital currencies.

Robinhood’s Blockchain Development Plans

Robinhood’s ambitious move into blockchain technology signifies a bold step towards expanding its service offerings in the competitive landscape of cryptocurrency trading. As the firm explores the possibility of launching its own blockchain, it is eyeing collaborations with innovative partners in the crypto space, particularly noteworthy names like Arbitrum and Solana. This development could potentially revolutionize how users engage with U.S. equities, enabling seamless trading experiences for European clients, which reflects Robinhood’s commitment to enhancing its market presence globally.

Moreover, the implications of Robinhood’s blockchain development are profound. By building a proprietary network, the company can leverage decentralized technology to improve transaction speeds and reduce fees for its users, thus enhancing the overall trading experience. With the rapid growth of its crypto division—evidenced by a staggering 77% rise in transaction-based revenues—this initiative aligns perfectly with Robinhood’s strategic goal of solidifying its stance in the digital assets market. As competitors like Coinbase and Kraken have taken bold steps with their own chains, Robinhood aims to level the playing field in a constantly evolving industry.

The Potential of the Solana Partnership

As Robinhood considers potential collaborations, its engagement with Solana could yield significant advantages given Solana’s high-performance blockchain capabilities. Known for its impressive speed and low transaction costs, Solana’s platform is well-equipped to support Robinhood’s initiative of creating an efficient trading ecosystem. By leveraging Solana’s technology, Robinhood could enhance its users’ experience in cryptocurrency trading, allowing for swift transactions and better scalability as user demand increases.

Furthermore, the Solana partnership could position Robinhood favorably in the market, tapping into a vibrant community of developers and innovators already engaged with the Solana ecosystem. This could facilitate additional layers of functionality and features on Robinhood’s platform, ultimately driving user engagement and retention. With Solana’s growing reputation among blockchain developers, the collaboration may also offer Robinhood access to a wealth of resources and expertise, further bolstering its blockchain development efforts.

Understanding the Role of Arbitrum in Robinhood’s Blockchain Strategy

Alongside Solana, Arbitrum stands out as another potential partner for Robinhood as it navigates its blockchain development. As a leading Ethereum Layer 2 solution, Arbitrum is designed to improve transaction speeds and reduce costs on the Ethereum network, which aligns perfectly with Robinhood’s goals of providing a user-friendly and economically viable trading platform. This strategic choice could allow Robinhood to enhance the trading experience for its clients while minimizing potential congestion often experienced on the Ethereum mainnet.

Incorporating Arbitrum into Robinhood’s blockchain strategy could also mean better access to decentralized finance (DeFi) functionalities, allowing users to engage in a broader spectrum of financial activities, from trading to staking. This partnership could place Robinhood at the forefront of innovation in the crypto space, as it could offer unique features that blend traditional trading with cutting-edge blockchain technology. As the cryptocurrency landscape evolves, aligning with Arbitrum could provide Robinhood with a competitive edge to capture more market share in crypto trading.

Robinhood Crypto Trading: A Game Changer in the Industry

The advent of Robinhood’s blockchain initiative is set against the backdrop of a rapidly evolving cryptocurrency trading market. As it prepares to launch its blockchain, Robinhood is already recognized as a significant player in the crypto space, thanks to its user-friendly platform and commission-free trading model. With rising consumer interest in digital assets, Robinhood’s previous success in crypto trading, characterized by a doubling of cryptocurrency transaction revenues to $252 million, showcases the potential impact this blockchain development could have on user engagement.

By integrating blockchain technology, Robinhood can enhance transparency and security in crypto transactions—key factors that resonate with users in today’s financial environment. The combination of Robinhood’s existing popularity in crypto trading with innovative blockchain solutions will likely attract new users and retain its current customer base, reinforcing its position as a leader in the digital asset landscape. In an industry characterized by rapidly changing technologies and user expectations, Robinhood’s proactive approach toward adopting blockchain solutions to enhance its trading platform bodes well for its future.

The Competitive Landscape of Crypto Services

As Robinhood develops its own blockchain strategy, it is essential to consider the competitive landscape of cryptocurrency services. With established players like Coinbase and Kraken already innovating their platforms, Robinhood must differentiate itself to succeed. The competition has intensified, with companies focusing not only on trading services but also on providing comprehensive digital asset solutions. By leveraging its blockchain project, Robinhood could create new opportunities for users, which may lead to increased market share in an ever-expanding crypto economy.

This competitive nature pushes Robinhood to continually adapt and innovate. The firm’s blockchain initiative could serve as a pivotal factor enabling it to offer unique features, attract new customers, and redefine its current offerings. As the cryptocurrency market matures, investing in blockchain technology could provide Robinhood a unique advantage, but it will need to execute this strategy effectively to not only catch up with its competitors but also to lead in the evolving digital landscape.

Harnessing Blockchain for Global Financial Inclusion

Robinhood’s potential blockchain initiative holds promise for driving global financial inclusion, particularly as it aims to cater to European clients wanting to trade U.S. equities. By developing a decentralized system, Robinhood can provide greater access to financial services for users who may have previously faced barriers due to geographical limitations or high costs associated with traditional trading platforms. The utilization of blockchain technology can democratize access to trading and investment opportunities, making it easier for individuals from diverse backgrounds to participate in global markets.

Additionally, the integration of blockchain into Robinhood’s services could enhance trust among users as it leverages transparency and security. With many individuals wary of traditional banking systems, a blockchain-based platform might offer a more reliable alternative. By focusing on financial inclusion through blockchain, Robinhood aligns its mission with broader global initiatives while attracting a wider audience seeking accessible trading experiences in a secure environment.

Innovations in Financial Technology through Blockchain

The advancements in financial technology brought on by blockchain are revolutionary, allowing firms like Robinhood to rethink and innovate their existing service models. Blockchain can streamline processes such as settlement times, reduce fraud, and enhance data security, which are crucial factors for any trading platform. As Robinhood explores its own blockchain, it stands to benefit from these technological enhancements that can lead to improved efficiency and lower operational costs.

Furthermore, advancing technology in finance can catalyze new product offerings and revenue streams for Robinhood. By embracing blockchain, the firm may develop novel trading instruments and features that cater to advanced traders and novice investors alike, thus enhancing their overall trading experience. The intersection between traditional finance and blockchain technology presents an exciting frontier for Robinhood as it aims to lead in this dynamic space.

Future Projections for Robinhood’s Blockchain Initiative

Looking ahead, Robinhood’s blockchain initiative may pave the way for a transformative shift in its business model and user engagement. As it delves deeper into blockchain technology, the firm is likely to implement innovative features and tools that could redefine the user trading experience. These advancements could also help Robinhood capture the attention of institutional investors, who are becoming increasingly interested in the crypto space, thereby opening new channels for growth and revenue.

The future of Robinhood within the blockchain ecosystem will depend heavily on the execution of its strategy. With ongoing negotiations with potential blockchain partners like Solana and Arbitrum, the firm faces both opportunities and challenges ahead. If executed effectively, this initiative could not only solidify Robinhood’s existing customer base but also attract new users, establishing it as a formidable player in the integrated landscape of traditional finance and crypto trading.

The Impact of Regulatory Landscape on Blockchain Initiatives

As Robinhood explores its blockchain initiatives, it must also navigate the complex and evolving regulatory environment surrounding cryptocurrencies. Regulatory considerations can significantly influence how companies approach blockchain technology, shaping everything from the security of transactions to the legal compliance of crypto offerings. Robinhood’s blockchain strategy will need to incorporate these factors to ensure compliance and build trust with its user base.

Additionally, the regulatory landscape could dictate how effectively Robinhood’s blockchain integrates with traditional financial markets. Regulatory clarity around digital assets will be crucial for the firm to capitalize on its blockchain initiative and ensure that it remains competitive in an increasingly scrutinized market. Navigating these regulations, while keeping innovation at the forefront, will be a delicate balance for Robinhood, but also presents an opportunity to set industry standards and lead responsibly in the blockchain space.

Frequently Asked Questions

What is the Robinhood blockchain and how does it relate to Robinhood crypto?

The Robinhood blockchain is a proprietary blockchain network reportedly being developed by Robinhood to facilitate trading and other services for its clients, especially in Europe. The initiative aims to enhance Robinhood crypto trading possibilities, leveraging relationships with blockchain powerhouses like Solana and Arbitrum.

How does the Solana partnership factor into Robinhood blockchain development?

The partnership with Solana is one of the potential collaborations being considered in Robinhood blockchain development. By integrating Solana’s capabilities, Robinhood aims to build a robust and scalable network that can support cryptocurrencies and other digital assets.

What advantages will the Arbitrum blockchain bring to Robinhood’s blockchain initiative?

Incorporating the Arbitrum blockchain into Robinhood’s blockchain initiative could enhance transaction efficiency and scalability. As a well-regarded Ethereum layer two solution, Arbitrum could help facilitate faster and cheaper transactions, thus improving the overall user experience for Robinhood crypto traders.

When is the Robinhood blockchain expected to launch?

While no official launch date has been announced for the Robinhood blockchain, insiders suggest that negotiations with potential partners are ongoing. The launch may coincide with the finalization of an agreement, but specific timelines remain unclear at this stage.

How will Robinhood’s blockchain affect crypto trading on its platform?

Robinhood’s blockchain is designed to streamline and optimize crypto trading on its platform, potentially allowing users to trade U.S. equities alongside various cryptocurrencies seamlessly. This integration is aimed at bolstering Robinhood’s position in the digital asset market.

What is the role of Robinhood’s cryptocurrency division in its blockchain strategy?

Robinhood’s cryptocurrency division plays a crucial role in its blockchain strategy by providing insights and revenue derived from crypto trading. With substantial increases in transaction revenues, this division underpins the demand for a dedicated blockchain to enhance service offerings.

What recent trends in blockchain does Robinhood’s initiative reflect?

The Robinhood blockchain initiative reflects a broader trend within the financial services industry, where firms are developing proprietary blockchains to stay competitive. Other companies like Coinbase and Kraken have also launched similar projects, indicating a significant shift towards blockchain adoption in finance.

How are Robinhood’s financial results influencing its blockchain development?

Robinhood’s impressive financial results and significant growth in transaction-based earnings have provided the company with the resources and motivation to invest in blockchain development. The success of its crypto division, which saw revenues double, likely supports the push towards establishing a proprietary blockchain.

| Key Point | Details |

|---|---|

| Robinhood’s Blockchain Initiative | Robinhood is reportedly developing its own blockchain to facilitate European clients’ trading of U.S. equities. |

| Potential Partners | Arbitrum (Ethereum L2) and Solana (L1) have been evaluated as potential partners. |

| Competitor Developments | Competitors like Coinbase (Base chain) and Kraken (Ink network) have already launched their proprietary blockchains. |

| Financial Performance | In Q1 2025, Robinhood reported a 50% year-over-year revenue increase, with significant contributions from its crypto division. |

Summary

Robinhood blockchain initiatives are unfolding as the firm aims to establish a proprietary network that can enhance trading for European clients interested in U.S. equities. This strategic move aligns with industry trends where competitors like Coinbase and Kraken have already introduced their blockchain solutions. As Robinhood continues negotiating potential partnerships with tech leaders like Arbitrum and Solana, its entry into the blockchain space will likely bolster its position in the rapidly evolving digital asset landscape.