RWA Tokenization: The Future of Finance in UAE’s Landscape

RWA tokenization is revolutionizing the financial landscape by seamlessly merging real-world assets with the transformative power of blockchain technology. In the UAE, a robust regulatory framework is paving the way for this innovation, allowing firms like Mavryk Dynamics to spearhead initiatives that could reshape investment opportunities. As discussed by CEO Alex Davis, the recent $3 billion agreement for real-world asset tokenization involving MAG showcases the potential for ultra-luxury properties to become accessible to a global audience. Furthermore, the introduction of ARVA tokens adds another dimension to this ecosystem, broadening investor participation while adhering to established regulations. With projections of ‘hockey stick growth’ in the finance sector, it’s clear that real-world asset tokenization is not just a trend but a pivotal shift in how we view and interact with investments.

The concept of tokenizing physical assets, often referred to as asset-backed tokenization, is gaining traction as a means to enhance liquidity and accessibility in the investment market. By leveraging blockchain technology, entities can create a digital representation of tangible resources such as real estate or commodities, thereby facilitating transactions in a secure and efficient manner. This innovative approach aligns with the UAE’s proactive stance on blockchain regulation, propelling companies like Mavryk Dynamics to the forefront of this evolution. As the market evolves, the regulatory clarity surrounding ARVA tokens further supports a diverse influx of investors looking to capitalize on tokenized assets. Ultimately, the rise of real-world asset tokenization marks a significant transformation in finance, promising to streamline cross-border dealings and democratize access to investment opportunities.

Understanding RWA Tokenization

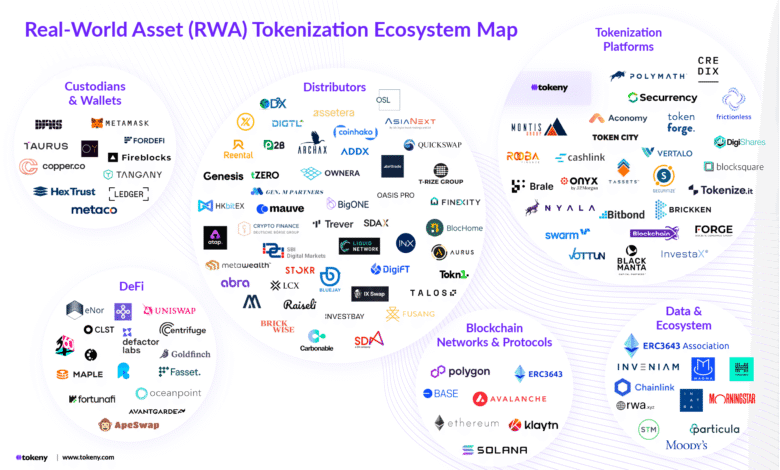

Real-world asset (RWA) tokenization refers to the process of converting tangible assets, such as real estate or commodities, into digital tokens that are secured and recorded on a blockchain. This transformation not only enhances the liquidity of these assets but also simplifies ownership transfer and transaction processes. Through this technology, investors can buy fractional ownership in high-value assets, making investments more accessible to a broader audience. The RWA tokenization market is gaining traction as more financial institutions and companies recognize its potential to innovate traditional asset management.

With blockchain’s transparency and security features, RWA tokenization eliminates many barriers to entry in global investing. Investors are no longer confined to the traditional methods of buying and selling physical assets, which can be cumbersome and slow. By employing tokenization, firms can offer real estate investments via blockchain platforms, thereby allowing for fractional investments and global participation. This democratization of investment opportunities illustrates the future of finance, where liquidity is enhanced, and access to traditionally illiquid assets is broadened.

UAE’s Regulatory Sandbox for Blockchain Innovations

The United Arab Emirates has established itself as a pioneer in blockchain regulation by creating a flexible regulatory sandbox that encourages innovation in the tokenization of real-world assets. This framework enables businesses to operate within a supervised environment, mitigating risks while experimenting with new technologies related to finance and assets. Unlike many other jurisdictions, which often impose stringent regulations, the UAE’s adaptive policies foster an ecosystem ripe for growth, especially in the tokenization space.

By setting up such a regulatory environment, the UAE has attracted significant attention from global investors and companies looking to tokenize assets. The recent collaboration involving Multibank Group and MAG to develop a $3 billion tokenization project showcases the potential of this sandbox approach. It enables local businesses to explore innovative financial solutions while providing a pathway for regulatory compliance. This method is crucial in aligning the rapid advancements of blockchain technology with sustainable financial practices.

The Role of ARVA Tokens in RWA Tokenization

Asset Referencing Virtual Assets (ARVA) tokens play an essential role in facilitating the RWA tokenization process within the UAE’s regulatory framework. These tokens are meticulously crafted to comply with local regulations, thus providing a reliable method for issuing and trading tokenized assets. Unlike traditional securities, ARVA tokens can be marketed to retail investors globally. This broad accessibility significantly expands the potential investor base, allowing for greater participation in investment opportunities tied to real-world assets.

ARVA tokens require detailed documentation and adherence to the regulatory standards established by the UAE’s authorities. By offering a framework that emphasizes compliance without stifling innovation, the UAE ensures that tokenized investments can flourish in a secure environment. This approach not only benefits the issuers by enhancing complexity but also empowers investors by allowing them to engage in markets previously unavailable to them. Ultimately, ARVA tokens exemplify how strategic regulatory approaches can catalyze the growth of innovative financial products.

Mavryk Dynamics and the Future of Financial Markets

Mavryk Dynamics is at the forefront of transforming financial markets through its innovative approach to RWA tokenization. As highlighted by CEO Alex Davis, the company’s platform is integral in managing the operations related to the tokenization of real-world assets, streamlining the processes that traditionally hinder such advancements. The company’s focus on building a fully interoperable ecosystem reflects a forward-thinking strategy that embraces the potential of blockchain technology in reshaping how assets are traded and managed.

Looking ahead, Mavryk Dynamics envisions a financial landscape in which RWA tokenization accelerates rapidly, characterized by a ‘hockey stick’ growth trajectory. This means that, following a period of steady development, the demand for tokenized assets will surge unexpectedly, transforming investment paradigms. By aligning advanced technology with evolving investor needs, Mavryk sets the stage for a new era where finance is effortlessly integrated into daily life, underscoring the increasing importance of on-chain solutions.

Enhancing Capital Efficiency through Tokenization

The integration of tokenization into capital markets brings forth the promise of enhanced capital efficiency. By transforming traditional assets into digital tokens, companies can streamline their funding processes, making it easier to raise capital while offering greater liquidity to investors. The tokenization of properties and other real-world assets allows for fractional ownership, which gives investors access to quality assets without needing substantial capital upfront. This ability to democratize investment opens exciting new opportunities for capital formation and wealth generation across diverse investor profiles.

Moreover, enhanced capital efficiency through tokenization leads to reduced transaction costs and compliance burdens associated with traditional assets. As seen in the UAE’s recent developments in collaboration with Mavryk Dynamics, the seamless integration of blockchain technology within existing financial practices promises to set a new standard for capital markets. As tokenization matures, it will likely unlock even greater efficiencies, paving the way for a robust, decentralized finance ecosystem that benefits a wider array of stakeholders.

The Journey to Global RWA Tokenization Leadership

The UAE is poised to become a global leader in the RWA tokenization space by establishing regulatory frameworks that promote innovation while protecting investors. The proactive stance taken by local authorities, including the creation of a regulatory sandbox, allows businesses like Mavryk Dynamics and MAG to test and implement groundbreaking financial solutions without fear of regulatory pushback. This foresight sets the country apart from regions where regulatory uncertainty can halt innovation.

As various countries look to the UAE as a model for their approaches to blockchain and asset tokenization, it becomes increasingly clear that a well-defined regulatory structure is essential for fostering creativity within financial markets. By continually adapting regulations to emerging technologies and market demands, the UAE ensures its position at the forefront of RWA tokenization, potentially influencing how financial systems operate on a global scale.

Challenges Facing RWA Tokenization Globally

Despite the promising landscape for RWA tokenization, multiple challenges persist on a global scale. Differing regulations across jurisdictions create a fragmented environment for tokenized assets, making it difficult for businesses to operate seamlessly. Regulatory uncertainty may deter potential investors and innovators from entering the market, and the absence of a cohesive framework can hinder the widespread adoption of tokenization strategies.

In addition, the variable understanding of what constitutes a security across jurisdictions adds complexity to the tokenization process. Unlike in the UAE, where clear guidelines exist for ARVA tokens, other regions may apply traditional security laws inequitably, limiting the scope of innovation. Overcoming these hurdles will require a global dialogue to harmonize regulations and develop standards that facilitate the safe and effective implementation of RWA tokenization.

Investor Perspectives on RWA Tokenization and Market Growth

As the RWA tokenization market continues to evolve, investor perspectives are crucial in shaping its growth trajectory. By providing broader access to high-value assets, tokenization attracts a diverse pool of investors who may have previously been excluded from traditional markets. The potential for significant returns on investment, coupled with technological advancements, captivates interest and fosters increased participation in tokenized markets.

Investors are increasingly aware of the advantages that come with blockchain’s transparency and the promise of enhanced liquidity in tokenized assets. The more informed an investor is about these emerging opportunities, the more likely they are to engage with RWA tokenization. As advancements continue and regulatory environments become more conducive, the perception of tokenization will shift from niche to mainstream, further amplifying market growth.

The Future of Finance: On-Chain Solutions and RWA Tokenization

The future of finance is undoubtedly tied to the integration of on-chain solutions and real-world asset tokenization. As businesses and investors embrace blockchain technology, financial transactions are expected to become faster, more efficient, and secure. This transition towards a fully digital financial ecosystem will enable users to interact effortlessly with their investments, automate procedures, and simplify asset management.

With the ongoing advancements in RWA tokenization, the idea of owning a piece of an asset seamlessly will soon become a reality for many. Automated systems will not only allow for instant payouts but also enable more users to diversify their portfolios without significant barriers. As Alex Davis envisions, the growing trend of personalized investments, such as bespoke ETFs, will demonstrate how on-chain finance can merge effortlessly with daily economic activities, revolutionizing the way we understand and interact with financial assets.

Frequently Asked Questions

What is real-world asset tokenization and how does it work?

Real-world asset tokenization (RWA tokenization) is the process of converting physical assets, such as real estate or commodities, into digital tokens that can be traded on a blockchain. This allows for fractional ownership, increased liquidity, and easier transferability of the assets, making it accessible to a wider range of investors.

How is the UAE leading in RWA tokenization?

The UAE is leading in RWA tokenization through its progressive regulatory framework that fosters innovation while ensuring compliance. The establishment of a regulatory sandbox allows companies such as Mavryk Dynamics and MAG to tokenize high-value assets like ultra-luxury properties, facilitating a seamless integration of traditional finance with blockchain technology.

What are ARVA tokens and their significance in RWA tokenization?

ARVA tokens, or Asset Referencing Virtual Assets, are a new class of tokens introduced in the UAE designed specifically for the tokenization of tangible real-world assets. Unlike traditional securities, ARVA tokens can be offered to retail investors globally, broadening access to investment opportunities and enhancing liquidity in the market.

What role does Mavryk Dynamics play in RWA tokenization initiatives?

Mavryk Dynamics is central to the RWA tokenization initiatives in the UAE, managing technology and marketplace operations. They aim to create an interoperable ecosystem that aligns with regulatory standards and data requirements, facilitating the effective trading and management of tokenized assets.

What is the future outlook for RWA tokenization according to industry experts?

Industry experts, including Mavryk Dynamics CEO Alex Davis, project a ‘hockey stick-style growth curve’ for RWA tokenization by 2030. This suggests that while initial growth may be slow, an explosive increase in adoption and integration of tokenized assets in daily finance is anticipated, transforming how assets are owned and managed.

How does the UAE’s regulatory approach to RWA tokenization compare to other regions?

The UAE’s regulatory approach to RWA tokenization is more adaptive and supportive compared to regions like the U.S., which often adopts a more cautious stance with regulatory enforcement. The UAE’s regulatory sandbox encourages innovation, allowing for the development of robust frameworks that can effectively manage and facilitate the tokenization of real-world assets.

Can retail investors participate in RWA tokenization through ARVA tokens?

Yes, retail investors can participate in RWA tokenization through ARVA tokens, as they are not classified as securities. This regulatory distinction allows a broader range of investors to access the benefits of investing in tokenized real-world assets.

What benefits does RWA tokenization bring to investors?

RWA tokenization offers numerous benefits to investors, including increased liquidity, fractional ownership of high-value assets, reduced barriers to entry, and the potential for automated income streams through digital wallets. This democratizes access to investments that were previously limited to institutional investors.

What challenges does the United States face in developing an RWA tokenization framework?

The United States faces challenges in developing an effective RWA tokenization framework due to its stringent securities regulations, which may require a reevaluation or overhaul of existing laws. Without a more flexible regulatory environment, innovation in real-world asset tokenization may be stifled.

How can RWA tokenization impact the global financial landscape?

RWA tokenization has the potential to significantly impact the global financial landscape by increasing capital efficiency, making investments more accessible across borders, enhancing liquidity in asset markets, and facilitating seamless transactions. This transformation could lead to a more democratized and integrated financial system.

| Key Point | Details |

|---|---|

| Regulatory Environment in UAE | The UAE is a leader in adapting regulatory frameworks that favor RWA tokenization, contrasting with more restrictive approaches elsewhere. |

| ARVA Tokens | Designed specifically for the tokenization of tangible RWAs, allowing for a broader range of investors, including retail. |

| MAG’s Role | MAG is actively involved in tokenizing ultra-luxury properties, making investment more accessible globally. |

| Global Trading and Settlement | The agreement between Multibank Group and MAG facilitates the trading and settlement of tokenized RWAs. |

| Future Projections | Expectations for RWA tokenization by 2030 suggest a sharp growth curve, leading to seamless integration into daily finance. |

Summary

RWA tokenization is set to transform the financial landscape, with the United Arab Emirates leading the way in establishing robust regulatory frameworks that promote innovation. The ambitions of companies like Mavryk Dynamics and MAG, along with pioneering mechanisms such as ARVA tokens, are paving the path for global investment accessibility and efficiency in real estate and beyond. Looking forward, the predicted ‘hockey stick’ growth curve suggests a future where on-chain finance and tokenized assets will become part of everyday transactions, revolutionizing how we engage with investments.