Sofi Crypto Investing: A Bold New Era in Financial Services

Sofi crypto investing is making waves as the company prepares to relaunch its digital asset trading services, tapping into the burgeoning interest in cryptocurrency. With innovations in fintech and blockchain technology, Sofi is setting a precedent for the future of financial services, combining regulated banking with crypto offerings. The forthcoming integration of blockchain-powered remittances will further enhance user experience, positioning Sofi as a key player in the quickly evolving landscape of digital finance. As competition heats up in the realm of crypto financial services, the anticipated relaunch is expected to cater to a growing demographic eager for seamless digital asset investing. Emphasizing choice and control, Sofi aims to equip members with the tools needed to thrive in a digitized economy, highlighting its commitment to delivering innovative financial solutions.

The latest developments surrounding Sofi’s cryptocurrency ventures represent a significant shift in the landscape of digital finance and asset management. By reintroducing its services related to blockchain technology and crypto investing, Sofi is poised to take advantage of the surging interest in decentralized finance and digital currencies. The fintech giant’s initiatives not only promise to streamline transactions through blockchain remittances but also facilitate broader access to digital asset portfolios. This strategic focus on evolving financial technologies aims to empower users to engage confidently with cryptocurrencies and related financial products. As Sofi continues to innovate within the fintech space, it reinforces its mission to revolutionize how we perceive and interact with money.

The Future of Sofi Crypto Investing Under New Innovations

As Sofi relaunches its crypto investing services, the fintech giant aims to redefine how users engage with digital assets. The integration of blockchain technology into their offerings showcases a commitment to providing innovative financial services that cater to the growing interest in cryptocurrencies. With plans to allow trading of popular cryptocurrencies such as Bitcoin and Ethereum, Sofi is positioning itself as a key player within the rapidly evolving crypto landscape. As digital asset investing becomes mainstream, Sofi’s strategic relaunch focuses on not just accessibility but also security and regulatory compliance.

Moreover, by offering a seamless user experience, Sofi is leveraging its technology, particularly through its partnership with Galileo, to enhance the investing journey. Users will soon find it easier to manage and diversify their holdings within the crypto space. This move aligns with the company’s broader strategy to intertwine fintech innovations with traditional banking practices, ensuring that every user has the necessary tools to navigate the complex world of crypto with confidence.

Transforming Fintech with Blockchain Remittances and Crypto

Sofi is set to disrupt the traditional remittance landscape by implementing blockchain-powered solutions, which promise more efficient and transparent money transfers across borders. The integration of these technologies allows Sofi to offer international remittance services that are not only faster but also potentially more cost-effective. In a world where cross-border payments dominate the financial services sector, Sofi’s approach to using blockchain can mitigate some of the significant pain points faced by users today, such as high fees and delayed transfers.

These innovations are critical as the global remittance market is valued at an astonishing $93 billion, indicating the immense potential for fintech companies like Sofi to capture market share. By combining remittance services with crypto investment options, Sofi is creating a comprehensive financial ecosystem that empowers users. This synergy between blockchain remittances and digital asset investing provides customers an integrated platform to manage their finances efficiently while capitalizing on the growth potential of the crypto market.

How Sofi Crypto Services Are Shaping Financial Choices

Sofi’s commitment to enhancing user choice in financial services is exemplified through its revamped crypto offerings. The company’s ability to provide diverse investment options, ranging from popular cryptocurrencies to innovative services like staking and crypto-backed lending, is a game changer in the fintech industry. By catering to the increasing demands for digital assets, Sofi is not just keeping up with market trends; it is leading the charge by offering a suite of services that encourages informed investing.

Furthermore, this focus on flexibility extends beyond mere investment options. Sofi is educating its users on how to utilize these digital assets effectively, fostering a culture of informed investing. This approach helps demystify the complexities associated with cryptocurrencies, allowing a wider audience to participate in the financial revolution. By empowering its users with knowledge and resources, Sofi is redefining what it means to engage with digital finance.

The Impact of Layered Financial Services on Crypto Adoption

The recent advancements in Sofi’s services, particularly surrounding the integration of cryptocurrencies into traditional banking frameworks, signify a pivotal shift in how users perceive and engage with digital assets. By layering crypto investing onto its existing financial service suite, Sofi is encouraging higher rates of adoption. This blend of services not only provides users with the ability to trade but also to utilize their assets in various applications, such as payments and remittances.

As users gain access to these integrated options, the barriers to cryptocurrency adoption are notably diminished. The seamless transition between investing and practical usage of cryptocurrency illustrates a mature understanding of user needs in today’s rapidly evolving financial landscape. Sofi’s strategic positioning as a one-stop-shop for both traditional and digital financial services sets a promising precedent for how fintech companies can contribute to broader cryptocurrency acceptance.

Navigating Regulatory Challenges in Crypto Financial Services

As Sofi reintroduces its crypto investing features, it is also focusing on navigating the complex regulatory landscape of cryptocurrency. The U.S. Office of the Comptroller of the Currency (OCC) has granted Sofi Bank N.A. federal clearance to provide crucial services such as crypto custody and stablecoin reserve offerings. This regulatory approval positions Sofi uniquely at the intersection of fintech innovation and compliance, fostering trust among its users.

Emphasizing compliance not only safeguards user assets but also enhances Sofi’s credibility in an industry often marred by controversy. By maintaining a proactive approach to regulation, Sofi can focus on innovation without compromising security or user confidence. This framework allows Sofi to roll out new features and services that align with regulatory standards, paving the way for sustainable growth in the crypto market.

Blockchain Technology: The Backbone of Sofi’s Financial Ecosystem

At the heart of Sofi’s new financial innovations lies robust blockchain technology, which enables sophisticated features like instant remittances and secure crypto transactions. By harnessing the power of blockchain, Sofi is not only enhancing the speed of money transfers but also increasing transparency and reducing costs. These advantages are crucial for consumers who demand swift services without the burden of exorbitant fees or hidden charges.

Additionally, blockchain’s ability to provide traceable and immutable transaction records significantly improves the security of digital assets. As cyber threats loom ever larger in the financial sector, Sofi’s commitment to leveraging blockchain technology underscores its mission to protect user investments. This technological backbone not only elevates Sofi’s service offerings but also positions the company as a leader in the growing trend of blockchain remittances and digital asset investing.

Expanding Access to Digital Asset Investing through Education

As Sofi revitalizes its crypto investing platform, the company is simultaneously focused on educating its members about digital assets and the broader implications of cryptocurrency. Education is paramount in demystifying the complex world of crypto, especially for new investors who may feel intimidated by the volatility and intricacies of these markets. Through webinars, educational content, and how-to guides, Sofi is empowering its community to make informed decisions.

By fostering a knowledgeable user base, Sofi not only encourages responsible investing but also helps mitigate the risks usually associated with cryptocurrency. The company’s focus on comprehensive educational initiatives signifies its role as a trusted partner in users’ financial journeys. Ultimately, this commitment to user education will likely contribute to increased engagement and participation in digital asset investing, propelling Sofi’s mission forward.

Sofi’s Vision: A Seamless Blend of Traditional and Digital Finance

The overall vision for Sofi’s future is a seamless blend of traditional banking practices with cutting-edge fintech innovations, particularly in digital asset investing. By simplifying access to both banking and cryptocurrency services, Sofi is aiming to create an ecosystem where users can fluidly transition between various financial products. This capability is becoming increasingly important as consumers seek integrated solutions that cater to their diverse financial needs.

Sofi’s strategy reflects a broader trend in the finance industry, where the lines between traditional and digital services are blurring. By positioning itself at this convergence, Sofi is well-equipped to attract a diverse clientele, including both seasoned investors and those new to digital assets. This holistic approach not only enhances customer satisfaction but also fortifies Sofi’s competitiveness in a dynamic market landscape.

The Role of User Experience in Sofi’s Crypto Offerings

Sofi understands that the user experience is paramount when it comes to engaging with crypto services. In an industry where user interface can significantly affect customer retention, the company is focused on creating a streamlined and intuitive experience for its members. Ease of use will be a critical factor as Sofi seeks to attract individuals from varying backgrounds who may be interested in digital assets but lack technical know-how.

By prioritizing user-friendly design and customer support, Sofi aims to demystify the process of crypto investing, making it more accessible to a wider audience. This consideration reflects the company’s commitment to not only meet the demand for crypto financial services but to enhance overall user satisfaction and retention. As more users engage with digital currencies, the focus on user experience will be a significant differentiator for Sofi in the competitive fintech landscape.

Frequently Asked Questions

What is Sofi’s approach to crypto investing in the new relaunch?

Sofi’s relaunch of crypto investing focuses on enabling users to buy, sell, and hold leading cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). This initiative is part of Sofi’s broader strategy to integrate blockchain innovations into its fintech services, providing members with more options and greater control over their digital asset investments.

How does Sofi integrate blockchain remittances with crypto investing?

Sofi is leveraging blockchain technology to enhance its remittance services, allowing users to send money across borders with near-instant deposits. This integration not only improves traditional remittance processes but also prepares the ground for users to engage in crypto investing, creating a seamless experience between sending money and investing in digital assets.

What digital asset investing features can Sofi members expect after the crypto relaunch?

After the relaunch, Sofi members will have access to a range of digital asset investing options, including trading popular cryptocurrencies like Bitcoin and Ethereum. Planned features may expand to include stablecoins, staking opportunities, and crypto-backed lending, all designed to enrich the Sofi platform’s offerings and meet the growing demand for fintech innovations.

How does Sofi’s crypto financial services contribute to financial autonomy?

Sofi’s crypto financial services aim to empower users by providing tools for safe investment in digital assets and easy access to international remittances. By combining regulated banking with innovative blockchain solutions, Sofi is committed to helping members achieve greater financial autonomy and flexibility in managing their investments and funds.

What are the implications of Sofi’s relaunch of crypto investing for the fintech industry?

Sofi’s relaunch of crypto investing signals a shift in the fintech industry, where traditional financial services are increasingly merging with innovative blockchain solutions. This move responds to the surging demand for crypto adoption and positions Sofi as a leader in digital asset investing, potentially influencing competitors to adopt similar strategies in delivering comprehensive crypto financial services.

| Key Point | Details |

|---|---|

| Sofi Relaunches Crypto Investing | Sofi is reintroducing its crypto investing platform, enabling users to trade major cryptocurrencies such as Bitcoin and Ethereum. |

| Blockchain-Powered Remittances | The company is incorporating blockchain technology to facilitate international money transfers, enhancing transparency and speed. |

| CEO Anthony Noto’s Vision | Noto believes financial services are being reinvented through crypto innovations, aiming to offer more choice and control to members. |

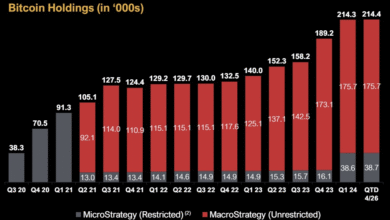

| Record Financial Performance | In Q1 2025, Sofi reported $772 million in revenue and $71 million in net income, with membership growth and significant total assets. |

| Expansion Plans | Sofi plans to introduce additional crypto features such as stablecoins, staking, and crypto-backed lending through its tech branch, Galileo. |

Summary

Sofi crypto investing marks a significant development in the evolving financial landscape as the company reinvents its offerings to cater to the growing demand for digital assets. With the integration of blockchain technology into remittances and the launch of its crypto trading platform, Sofi is positioned to lead the charge in the fintech sector. This not only enhances user experience but also ensures that consumers have access to modern financial tools that empower them in their investment journeys.