Bitcoin Layer 2: Stacks Partners to Boost Adoption in Asia

Bitcoin Layer 2 solutions are gaining momentum as innovative protocols like Stacks pave the way for enhanced scalability and utility in the cryptocurrency space. This breakthrough technology allows for the development of decentralized applications (dApps) and smart contracts on the Bitcoin blockchain, significantly increasing its functionality beyond just a store of value. In recent news, the Stacks Asia DLT Foundation has announced an exciting partnership with EVG and Aspen Digital aimed at driving Bitcoin adoption across Asia. The collaboration seeks to establish Stacks as the primary layer for Bitcoin utility by leveraging high-growth markets and engaging local communities. With initiatives focused on education and outreach, this partnership represents a crucial step towards the widespread acceptance of Bitcoin in various sectors, especially in booming economies such as South Korea and Vietnam.

The evolution of Bitcoin into a multi-faceted platform can be perceived through the lens of second-layer protocols, which serve to enhance its capabilities. Known as Bitcoin layer two technologies, these solutions are vital in transforming the cryptocurrency landscape by enabling more efficient transactions and diverse functionalities. A recent collaboration involving the Stacks project, Everest Ventures Group (EVG), and Aspen Digital is set to stimulate Bitcoin utilization across Asian markets. This strategic initiative aims to foster deeper connections within local web3 communities, facilitating a broader understanding of how Bitcoin can operate as a dynamic digital asset. By addressing the region’s unique cultural and economic contexts, these partners intend to accelerate not just adoption, but the overall enhancement of the Bitcoin ecosystem across Asia.

The Role of Stacks in Bitcoin Layer 2 Ecosystem

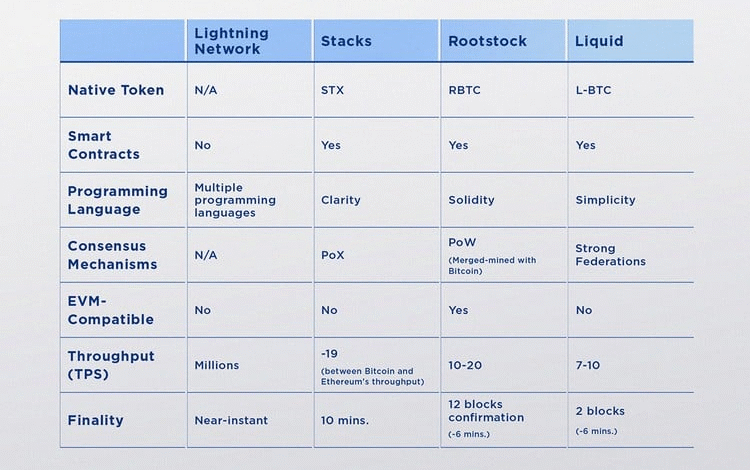

Stacks is revolutionizing the Bitcoin ecosystem by introducing a layer two (L2) solution that enhances the utility of Bitcoin beyond its traditional role as a store of value. This innovative protocol allows developers to build decentralized applications (dApps) and smart contracts directly on the Bitcoin network, effectively transforming Bitcoin into a programmable asset. With the recent partnership with EVG and Aspen Digital, the Stacks protocol is set to gain traction in Asia, where the demand for blockchain solutions is rapidly increasing.

Layer 2 technologies, like Stacks, play a crucial role in addressing scalability issues associated with Bitcoin transactions. By enabling faster and more cost-effective interactions, Stacks positions itself as a vital component of the Bitcoin infrastructure. In high-growth markets across Asia, this protocol could facilitate numerous applications, from decentralized finance (DeFi) to secure digital identities, hence driving increased Bitcoin adoption and utilization in these regions.

Strategies to Boost Bitcoin Adoption in Asia

The partnership between Stacks, EVG, and Aspen Digital marks a strategic initiative to bolster Bitcoin adoption in Asia, specifically targeting countries with burgeoning blockchain ecosystems. By organizing investor events and marketing tailored to local cultures, these organizations aim to educate potential users and investors about the benefits of Bitcoin and the unique capabilities of Stacks as a L2 solution. This localized approach not only raises awareness but also fosters a sense of community around Stacks.

Moreover, engaging high-net-worth individuals and institutional investors through Aspen Digital’s wealth management network presents a significant opportunity to showcase the potential of Stacks. By illustrating use cases that demonstrate real-world applications of Bitcoin as a versatile financial tool, the collaboration aims to attract investments that can supercharge the adoption of this revolutionary protocol in Asia.

The Significance of the EVG Partnership for Bitcoin Utility

The EVG partnership with Stacks is particularly impactful as it reinforces the commitment to expanding Bitcoin’s utility in Asia’s vibrant markets. With EVG’s established presence and expertise in building networks across different regions, the partnership is poised to influence how stakeholders perceive and interact with Bitcoin. EVG’s efforts will likely streamline the onboarding process for businesses looking to integrate Bitcoin into their operations through Stacks.

This collaboration highlights the shift from viewing Bitcoin merely as ‘digital gold’ to recognizing it as a multifaceted financial instrument capable of supporting a wide array of applications. The synergy between EVG’s innovative approach and Stacks’ technological advantages will catalyze Bitcoin’s role in decentralized finance, further enhancing its adoption as users discover the practical benefits of engagement with the L2 layer.

Expanding Bitcoin Utility through Innovative Technologies

Innovative technologies are critical to transforming Bitcoin from an asset primarily viewed as a store of value into a platform supporting various decentralized applications. The introduction of Stacks as a layer two protocol facilitates this transition by allowing developers to create functional applications that utilize Bitcoin, thereby unlocking new use cases and revenue streams. Partnerships with entities like EVG and Aspen Digital bolster this initiative by providing the necessary infrastructure and market access.

As more businesses and developers take advantage of the capabilities presented by Stacks, the potential for Bitcoin to serve as more than just a currency is becoming increasingly apparent. By focusing on educational outreach and promoting practical applications, the collaborative efforts will help to identify and address the barriers limiting Bitcoin’s integration into everyday life across Asia.

Localizing Bitcoin Adoption Strategies in Asia

Localizing adoption strategies is essential for achieving success in various Asian markets, each with its unique cultural and economic landscape. The partnership between Stacks, EVG, and Aspen Digital recognizes the importance of cultural relevance in influencing potential users and investment communities. By developing tailored campaigns that resonate with regional values and behavior, these organizations can foster deeper engagement with the Stacks protocol.

Bringing Bitcoin into everyday discussions through influencers and community-focused events amplifies visibility and understanding of its utility. As EVG curates localized marketing efforts, they will help demystify Bitcoin for many people who may still view it as a complicated asset, paving the way for broader acceptance and utilization in various contexts such as commerce, finance, and personal investment.

The Future of Bitcoin with Layer 2 Technologies

The future of Bitcoin lies in the effective implementation of layer 2 technologies that enhance its functionality and performance. Stacks presents a promising solution that not only addresses some of Bitcoin’s inherent limitations but also empowers developers to innovate and create flourishing ecosystems around the Bitcoin network. As more developers build on Stacks, the opportunities for Bitcoin to become a more versatile and practical financial instrument expand significantly.

With the partnerships aimed at increasing visibility and creating real-world applications, Bitcoin’s evolution could accelerate rapidly. By bridging the gap between traditional financial systems and blockchain-based innovations, Stacks is pivotal in enabling a future where Bitcoin is utilized for diverse purposes, thus engaging a wider audience in its adoption.

Local Partnerships Driving Bitcoin Adoption in Asia

Local partnerships are key to driving the success of initiatives like the one between Stacks, EVG, and Aspen Digital. By leveraging existing networks and relationships within Asian markets, these collaborations can achieve greater outreach and engagement than standalone efforts. Establishing partnerships with local businesses, influencers, and community leaders can create credibility and spur interest in Bitcoin technologies.

For instance, events organized by EVG can serve to educate and inform prospective users about Stacks’ features while creating opportunities for networking among key stakeholders in the Bitcoin ecosystem. This localized focus targets specific pain points and interests within those communities, ensuring that the solutions offered align with their needs and aspirations.

Understanding Bitcoin’s Role in Decentralized Finance

Decentralized finance (DeFi) is reshaping the traditional finance landscape, and Bitcoin’s role in this sector is expanding thanks to innovative protocols like Stacks. By enabling the development of dApps and smart contracts, Stacks provides a bridge between Bitcoin and the broader DeFi ecosystem. This capability allows users to leverage their Bitcoin holdings in more productive and diversified ways, attracting new users to the network.

As interest in DeFi grows, particularly across Asia, Bitcoin must position itself as a relevant player within this space. Initiatives led by Stacks and its partners will play a crucial role in demonstrating practical applications of Bitcoin in DeFi, such as lending, borrowing, and yield farming, ultimately encouraging more individuals to adopt and use Bitcoin.

Challenges and Opportunities for Bitcoin in Asia

Adoption of Bitcoin and its associated technologies in Asia does not come without challenges. Regulatory concerns, market volatility, and the misinformation surrounding cryptocurrency can impede growth. However, partnerships like the one between Stacks, EVG, and Aspen Digital demonstrate a proactive approach to navigating these challenges. By facilitating conversations with regulatory bodies and conducting educational outreach, these organizations can help mitigate some of the concerns held by potential users and investors.

Nevertheless, the opportunities that lie ahead are vast. As Asia continues to be a hotspot for technological innovation and digital transformation, the potential for Bitcoin to integrate into existing financial systems is immense. Emphasizing the utility of Bitcoin and the capabilities of layer two solutions like Stacks may catalyze accelerated adoption across the continent.

Frequently Asked Questions

What is Bitcoin Layer 2, and how does the Stacks protocol utilize it?

Bitcoin Layer 2 refers to protocols built on top of the Bitcoin blockchain that enhance its scalability and functionality. The Stacks protocol is a prominent example of a Bitcoin Layer 2 solution, enabling smart contracts and decentralized applications (dApps) while leveraging Bitcoin’s security as the base layer.

How does the partnership between Stacks and EVG promote Bitcoin Layer 2 adoption in Asia?

The partnership between Stacks and Everest Ventures Group (EVG) focuses on enhancing Bitcoin Layer 2 adoption in Asia through tailored marketing strategies, investor events, and community engagement. This initiative seeks to connect local developers and institutions with the benefits of the Stacks protocol and its capabilities to expand Bitcoin’s utility.

What role does Aspen Digital play in the adoption of Bitcoin Layer 2 technologies such as Stacks?

Aspen Digital supports the adoption of Bitcoin Layer 2 technologies by leveraging its wealth management network to showcase the potential of Stacks to high-net-worth individuals and institutions. By highlighting the investment opportunities in Bitcoin utility, Aspen Digital creates pathways for traditional investors to engage with innovative solutions built on Bitcoin Layer 2.

Why is Bitcoin utility important for Bitcoin Layer 2 solutions like Stacks?

Bitcoin utility is crucial for Bitcoin Layer 2 solutions as it transforms Bitcoin from merely a store-of-value to a versatile financial instrument capable of supporting decentralized applications and financial services. Stacks enhances Bitcoin’s functionality, promoting broader adoption and engagement across various markets, particularly in Asia, where innovative technologies are rapidly evolving.

What markets are targeted for Bitcoin Layer 2 adoption by Stacks and its partners?

Stacks, in collaboration with EVG and Aspen Digital, targets high-growth markets in Asia, including South Korea, Vietnam, China, and Singapore, to ramp up Bitcoin Layer 2 adoption. These areas are viewed as key regions for fostering innovation and tapping into local web3 communities.

How does the launch of sBTC on Stacks influence Bitcoin Layer 2 adoption?

The launch of sBTC on Stacks is significant for Bitcoin Layer 2 adoption as it unlocks over $2 trillion in dormant Bitcoin capital, allowing users to engage with Bitcoin in new ways. This development supports the evolution of Bitcoin from a static asset to an active participant in decentralized finance (DeFi), thereby enhancing its overall utility and reach.

What is the future of Bitcoin Layer 2 technologies like Stacks in the context of Bitcoin adoption in Asia?

The future of Bitcoin Layer 2 technologies like Stacks in Asia looks promising, with strong backing from partnerships and strategic initiatives. As these technologies gain traction, they will likely play a crucial role in driving Bitcoin adoption, providing new tools for developers and users to unlock the full potential of Bitcoin as a programmable asset.

| Key Points | Details |

|---|---|

| Partnership Announcement | Stacks Asia DLT Foundation has allied with EVG and Aspen Digital to boost adoption of Stacks. |

| Target Markets | Expansion will focus on South Korea, Vietnam, China, Singapore, and other Asian markets. |

| EVG’s Role | Curating investor events, marketing campaigns, and partnerships with local web3 communities to increase visibility. |

| Aspen Digital’s Role | Engaging high-net-worth investors and institutions to showcase Stacks’ potential. |

| Impact of sBTC Launch | The launch aims to activate over $2 trillion in dormant Bitcoin capital. |

| Vision for Bitcoin | Transforming Bitcoin into a versatile financial tool that supports DeFi and dApps. |

Summary

Bitcoin Layer 2 solutions, specifically through the recent partnership involving Stacks, EVG, and Aspen Digital, are set to enhance the utility and adoption of Bitcoin across Asia. This collaboration strategically focuses on high-growth markets, tapping into institutional networks, and leveraging localized outreach to foster a robust Bitcoin ecosystem. With increasing efforts to transition Bitcoin from merely a store-of-value to an active participant in decentralized finance, Stacks is positioned to unlock the vast potential of Bitcoin, highlighting its importance as a pivotal layer in the crypto landscape.