Stablecoin Growth: $13.5B Added in July’s Market Surge

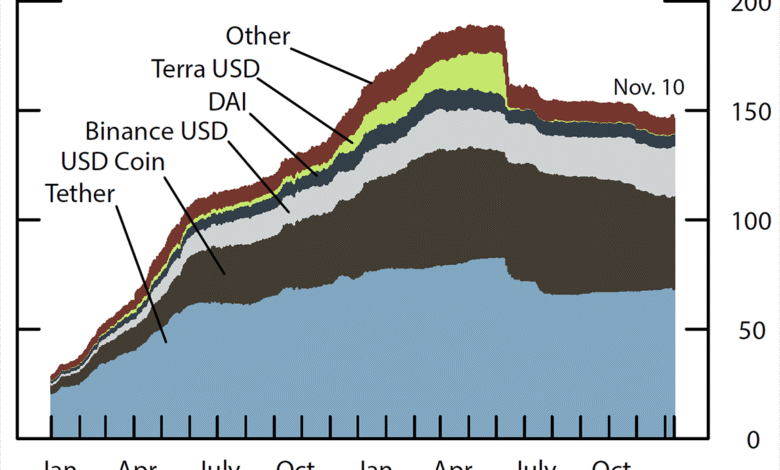

The remarkable growth of the stablecoin market is evident as it added over $13.5 billion in July alone, emphasizing the increasing acceptance of fiat-pegged tokens in the financial landscape. As of early August 2025, this burgeoning sector is on the brink of surpassing the $270 billion milestone, driven primarily by stellar performances from major players like Tether (USDT) and USDC. With Tether commanding a dominant 61.59% of the market share, its impressive market cap of $164.71 billion underscores the critical role stablecoins play in current cryptocurrency trends. The rapid influx of investments into these digital assets highlights a shift in how investors view stability amidst market volatility. As the USDC market cap rises and stablecoin demand continues to soar, this growth narrative signals a transformative phase in the broader cryptocurrency ecosystem.

In recent months, the expansion of digital currencies linked to traditional fiat systems has become increasingly pronounced, showcasing a dynamic shift in investor behavior. More specifically, these asset-backed tokens—often referred to as crypto-pegged coins—have surged in popularity, reflecting an appetite for stability in a fluctuating market. Leading the movement are staples like Tether (USDT) and USD Coin (USDC), whose increasing valuations illustrate a broader trend towards reliability in cryptocurrency. This emerging financial landscape indicates that investors are not only seeking innovative alternatives but also prioritize security offered by these stable currencies. As the digital economy evolves, the growth of such fiat-linked tokens will likely reshape the way we perceive and interact with money.

The Surge of Stablecoin Growth in July 2025

In July 2025, the stablecoin market witnessed an exceptional growth trajectory as it added over $13.5 billion, marking a remarkable 5.33% increase. This surge reflects the increasing adoption of fiat-pegged tokens in the cryptocurrency ecosystem. Such a significant influx of capital suggests that investors are increasingly seeing the value and stability that stablecoins can provide amidst the volatility of other cryptocurrencies. With this latest growth, the total capitalization of the stablecoin market now stands at a robust $267.411 billion.

This rapid expansion not only highlights the resilience of stablecoins but also positions them as a crucial element of the broader cryptocurrency trends. The growth in market capitalization indicates that traders and investors are likely diversifying their portfolios with these digital assets, which are pegged to traditional fiat currencies to reduce risk. As the market nears the $270 billion mark, these developments could pave the way for even more significant investments and innovations within the stablecoin sector.

Analyzing Tether’s Dominance in the Stablecoin Market

Tether (USDT) continues to hold its ground as the leading stablecoin, commanding an impressive 61.59% of the total stablecoin market. This dominance is underpinned by a substantial growth in its circulating supply, which increased by $5.55 billion last month, elevating its market capitalization to $164.71 billion. Tether’s consistent strategy of ensuring its tokens are fully backed by reserves of fiat currencies has instilled confidence among users, making it the go-to choice for many within the cryptocurrency community.

The reliability of Tether as a fiat-pegged token plays a critical role in its sustained popularity. Its infrastructure allows for seamless transactions and conversions to other cryptocurrencies, making it vital for traders looking to hedge against market volatility. As other stablecoins strive to carve out their niche, Tether’s robust market presence sets a high standard, compelling competitors to innovate and enhance the trust factor necessary to attract users in the ever-evolving stablecoin landscape.

USDC and Its Growth Potential in the Stablecoin Landscape

Circle’s USDC has also emerged as a powerful contender in the stablecoin market, showcasing impressive growth with an additional $2.53 billion added to its supply. With a current market cap of approximately $63.99 billion, USDC is gaining traction among investors who are drawn to its regulated nature and full backing of U.S. dollars. The growing recognition of USDC within the cryptocurrency industry marks its position as a reliable alternative to other fiat-pegged tokens.

The stable growth of USDC reflects the increasing demand for regulated stablecoins, especially from institutional investors. With the potential to further expand its market cap, USDC is likely to play a pivotal role in the continued evolution of the stablecoin market. As more entities explore the advantages of using USDC for cross-border payments and smart contracts, its relevance in the cryptocurrency ecosystem is poised to grow, shaping future cryptocurrency trends.

Emerging Stablecoins: The Rise of Ethena’s USDe

Ethena’s USDe has distinguished itself from other stablecoins by recording the most significant monthly increase, soaring by 62.55% in July 2025. This impressive growth saw its market cap reach $8.623 billion, emphasizing the increasing interest in alternative stablecoins. The unique value proposition of USDe, alongside its competitive benefits, suggests that it is attracting users looking for fresh opportunities within the cryptocurrency market.

The rise of USDe illustrates a broader trend where innovative stablecoins are beginning to capture market share traditionally dominated by established players like Tether and USDC. As users seek options that can offer more flexibility and yield generation, Ethena’s USDe seems poised to cater to this evolving demand. This kind of innovation within the stablecoin ecosystem could lead to a dynamic market where multiple players thrive, fostering a competitive landscape.

Understanding Market Movements: The Challenges Faced by Other Stablecoins

While many stablecoins are experiencing growth, others are facing significant challenges. For instance, Blackrock’s BUIDL saw a decline of over $433 million in July, reducing its valuation to $2.398 billion. Such drops in market value highlight the vulnerabilities that some stablecoins face, particularly if they lack the robust backing or investor confidence seen in leaders like Tether and USDC. The decreased traction signals a need for some projects to reevaluate their strategies and adopt measures that can enhance user trust.

Moreover, World Liberty Financial’s USD1 also faced a downturn, dipping by $36.57 million, highlighting the struggles that stablecoins can encounter if they do not meet investor expectations. The stability of a stablecoin ultimately hinges on both its underlying value and the confidence it fosters among its user base. As the market landscape continues to evolve, navigating these challenges will be crucial for the future success of all stablecoins.

The Impact of Cryptocurrency Trends on Stablecoins

As the cryptocurrency trends continue to unfold, stablecoins are becoming increasingly crucial in providing stability and reliability within a volatile market. Their inherent design as fiat-pegged tokens is attracting not only retail investors but also institutional entities looking for safer investment mechanisms amid fluctuating market conditions. Recognizing the integral role stablecoins play is essential as they provide pivotal support, liquidity, and a means of transaction that can facilitate larger movements in the crypto space.

With the overall cryptocurrency market nearing certain milestones, such as the $270 billion stablecoin cap, the influence of these digital assets on financial ecosystems becomes undeniable. This evolution is expected to usher in new standards within the industry, encouraging further integrations of fiat-pegged tokens into payment systems, and value transfers, and potentially paving the way for more advanced financial instruments. In this context, staying informed on cryptocurrency trends and their implications for stablecoins is imperative for all market participants.

Exploring the Future of Stablecoins amidst Regulatory Scrutiny

As the stablecoin market expands, it finds itself under the watchful eye of regulators worldwide. This scrutiny stems from concerns regarding consumer protection, financial stability, and the implications that these fiat-pegged tokens may have on the traditional banking system. As governments grapple with integrating digital assets into their regulatory frameworks, the future growth of stablecoins hinges on establishing clear guidelines that promote innovation while safeguarding investor interests.

Navigating this regulatory landscape will be crucial for the continued proliferation of stablecoins like Tether, USDC, and newer competitors. As stakeholders advocate for balanced regulations, it is vital for stablecoin developers and platforms to engage with regulators proactively. Continued collaboration will ensure that stablecoins not only thrive but can also instill confidence among users wary of potential pitfalls associated with unregulated cryptocurrencies.

The Role of Stablecoins in Digital Finance Evolution

Stablecoins represent a pivotal innovation in the evolution of digital finance, bridging the gap between traditional fiat currencies and the rapidly expanding cryptocurrency landscape. Their stable nature enables diverse use cases, including being a medium for transactions, a method for preserving value, and serving as collateral in decentralized finance (DeFi) applications. This versatility positions stablecoins as essential tools in streamlining financial transactions while reinforcing the appeal of cryptocurrencies to a broader audience.

As stablecoin technology advances, their integration into payment systems, remittances, and financial services is set to increase, shaping the future of digital finance. Innovations in the stablecoin space could lead to more sophisticated financial products that cater to various consumer needs. Consequently, as we continue to witness the convergence of traditional finance and digital currencies, stablecoins are likely to play an impactful role in establishing a new financial paradigm.

Investment Opportunities and Risks in Stablecoin Participation

Investing in stablecoins presents a range of opportunities and risks that potential participants should carefully evaluate. On one hand, stablecoins provide a relatively safer haven against market volatility compared to other cryptocurrencies. With the potential for modest returns and lower risk, they offer an attractive entry point for new investors looking to engage with crypto without exposing themselves to the same levels of risk associated with other assets.

On the other hand, potential investors must also remain vigilant about the risks involved, especially concerning regulatory changes and the stability of the underlying assets backing these stablecoins. The varying degrees of regulatory scrutiny that different stablecoins face could impact their market value and popularity significantly. Therefore, due diligence is essential for those looking to include stablecoins in their investment portfolios, ensuring a balanced approach towards risk and reward.

Frequently Asked Questions

What is driving the growth of the stablecoin market in 2025?

The stablecoin market is experiencing significant growth, largely driven by an influx of capital as seen in July 2025, where over $13.5 billion was added, pushing the market close to a $270 billion milestone. Factors like increased use of fiat-pegged tokens for trading, the stable demand for Tether (USDT), and institutional interest in cryptocurrencies contribute to this robust expansion.

How does Tether (USDT) lead the stablecoin market?

As of August 2025, Tether (USDT) commands a dominant 61.59% share of the stablecoin market, with its market cap reaching approximately $164.71 billion after adding $5.55 billion in circulating supply. USDT’s established position and widespread adoption among traders highlight its pivotal role in the growth of the stablecoin ecosystem.

What recent trends have been observed in the USDC market cap?

In July 2025, the USDC market cap saw a positive trend, increasing by $2.53 billion to reach about $63.99 billion. This growth reflects strong utilization of USDC among users and investors as a reliable fiat-pegged token, further contributing to the overall momentum of the stablecoin market.

Which stablecoin exhibited the largest growth in July 2025?

Ethena’s USDe showed the most significant growth in July 2025, soaring by 62.55% and adding $3.318 billion to its supply, resulting in a market cap of $8.623 billion. This impressive performance underscores the evolving dynamics of the stablecoin landscape and the rising interest in innovative currency solutions.

How are cryptocurrency trends impacting stablecoin investment strategies?

Current cryptocurrency trends indicate a move towards stable assets like fiat-pegged tokens due to their perceived stability during market volatility. Investors are increasingly diversifying into stablecoins, which not only help mitigate risk but also enable users to capitalize on potential opportunities within the ever-changing crypto market.

What are the implications of Blackrock’s BUIDL stablecoin performance on the market?

In July 2025, Blackrock’s BUIDL experienced a decline of over $433 million, reducing its valuation to $2.398 billion. This fluctuation raises questions about reliance on that stablecoin and highlights how market dynamics can affect even established players, impacting investor confidence and strategies across the stablecoin market.

What role do synthetic stablecoins like USDf play in the growth of the stablecoin market?

Falcon’s synthetic dollar, USDf, surged by 103% in value in July 2025, demonstrating the potential of innovative stablecoins in capturing market interest and investment. Such over-collateralized models are becoming increasingly popular, indicating a diversification strategy in the stablecoin sector that contributes to the overall growth of this financial segment.

How do trends in the stablecoin market reflect broader cryptocurrency movement?

The trends in the stablecoin market, including consistent increases in market caps for tokens like USDT and USDC, indicate a broader move towards stability and utility in the cryptocurrency world. As users seek safe havens and fewer fluctuations, stablecoins are becoming integral to overall cryptocurrency strategies and investment practices.

| Stablecoin | Market Cap (July Start) | Change in Supply | Market Cap (End of July) | Percentage Growth |

|---|---|---|---|---|

| Tether (USDT) | $159.16B | + $5.55B | $164.71B | 3.48% |

Summary

Stablecoin Growth has seen remarkable developments in July, with a significant increase of over $13.5 billion, pushing the total market valuation towards a crucial $270 billion milestone. The ongoing expansion is highlighted by Tether’s continued dominance, contributing significantly to this growth. As new funds flow into the stablecoin ecosystem, market players are poised to innovate further, solidifying the role of stablecoins in the financial landscape.