Stablecoin Market Decline: USDT Nears $150B Cap

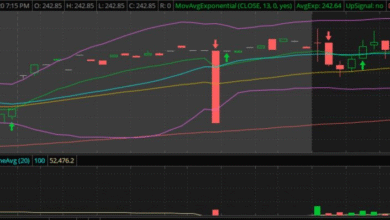

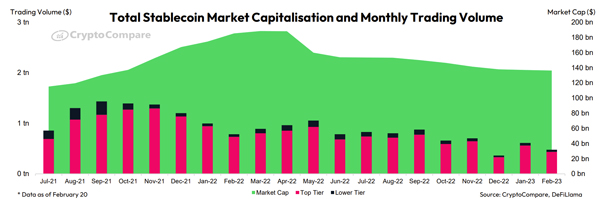

The stablecoin market decline has captured the attention of many investors as recent data indicates a slight contraction of $36.95 million over the past week, translating to a mere 0.02% dip in overall market cap. Currently valued at $242.97 billion, the stablecoin sector continues to stand firm, notably with tether (USDT) maintaining its stronghold, boasting a market cap nearing $150B. As the largest stablecoin by market cap, USDT comprises an impressive 61% of the total stablecoin value, reflecting its critical role in the cryptocurrency landscape. However, alongside this dominance, there are subtle shifts in stablecoin performance across the board, with tokens like USDC experiencing minor declines. This fluctuation in the stablecoin market cap highlights the evolving cryptocurrency trends and the competitive nature of fiat-pegged cryptocurrencies as traders navigate towards alternative investments.

The decline in the stablecoin sector has created a ripple effect within the cryptocurrency sphere, leading to various market movements and shifts in investment strategies. As fiat-collateralized digital currencies witness slight downturns, encompassing fluctuations in the USDT market cap, investors are increasingly focusing on alternative assets. This trend has opened discussions about the overall performance of stablecoins in relation to broader cryptocurrency trends, showcasing the delicate balance between stability and growth. With fluctuations in market value and investor sentiment, these low-volatility assets attempt to adapt to changing market dynamics while competing for attention against more volatile cryptocurrencies. The current landscape thus encourages a renewed focus on how these financial instruments can maintain their significance in an ever-evolving market.

Understanding the Stablecoin Market Decline

The recent decline in the stablecoin market, specifically a slight contraction of 0.02% amounting to a decrease of $36.95 million, points towards an evolving landscape within this segment of cryptocurrency. The current market cap of $242.97 billion reveals that while stablecoins like USDT maintain a predominant position, the overall sector is experiencing shifts in investor preferences. The minor reduction could be indicative of a broader market trend, where investors are reallocating their funds into more volatile crypto assets as they seek higher returns.

As fiat-pegged cryptocurrencies, stablecoins are designed to mitigate volatility; however, market dynamics can still lead to fluctuations. The stablecoin market cap has been observed to react to the performance of major cryptocurrencies, such as Bitcoin and Ethereum, which have shown strong upward momentum recently. This suggests that as bullish trends develop in the wider crypto markets, investor appetite for stablecoins may contract as they chase potential gains in more speculative assets.

Frequently Asked Questions

What is the current state of the stablecoin market cap amidst the recent stablecoin market decline?

The stablecoin market cap has experienced a slight contraction of $36.95 million, now totaling $242.97 billion, reflecting a 0.02% decrease. This indicates a marginal decline in the stablecoin sector, yet major players like USDT maintain strong positions.

How has the USDT market cap responded to the recent decline in the stablecoin market?

Despite the stablecoin market decline, the USDT market cap has shown resilience, holding steady at $149.87 billion, which represents approximately 61% of the total stablecoin market. USDT experienced a modest gain of 0.36% over the past week.

What trends are impacting stablecoin performance during the current market decline?

During this stablecoin market decline, mixed performance among individual stablecoins has been observed. While USDT remains dominant, other stablecoins like USDC fell by 1.21%, and competitors like DAI saw gains, indicating varied investor sentiment influenced by broader cryptocurrency trends.

Are fiat-pegged cryptocurrencies like USDC affected by the stablecoin market decline?

Yes, fiat-pegged cryptocurrencies, particularly USDC, are experiencing a negative impact from the stablecoin market decline, as it has decreased its market cap by 1.21%, now sitting at $60.808 billion. This trend reflects investors’ shifting interests towards more volatile cryptocurrencies.

What can we expect from the stablecoin market as the cryptocurrency trends evolve?

As cryptocurrency trends shift towards bullish momentum for assets like bitcoin and ethereum, the stablecoin market might continue to feel pressure. Investor reallocations towards appreciating tokens signal a potential further decline in the stablecoin sector, affecting overall stablecoin performance.

How significant is the recent decline in the stablecoin sector compared to historical trends?

The recent stablecoin market decline of 0.02% is relatively minor compared to historical trends, suggesting that while there is a contraction, the overall stability of the stablecoin market remains intact, particularly led by strong performers like USDT.

What influences the investor sentiment towards stablecoins during the market decline?

Investor sentiment towards stablecoins during the market decline is influenced by overall cryptocurrency trends, with rising interest in speculative assets leading to a shifting focus away from stablecoins. The varied performance among stablecoins also reflects differing perceptions of value and risk.

How do market cap changes in stablecoins indicate the health of the cryptocurrency market?

Changes in the market cap of stablecoins can signal investor behavior and market health; a stable or increasing market cap may indicate confidence in fiat-pegged cryptocurrencies, while declines, as seen recently, can suggest shifting investments towards more volatile crypto assets.

| Metric | Current Value | Weekly Change | Market Share |

|---|---|---|---|

| Total Stablecoin Market Cap | $242.97 billion | -0.02% | |

| USDT Market Cap | $149.87 billion | +0.36% | 61% |

| USDC Market Cap | $60.808 billion | -1.21% | |

| DAI Market Cap | $4.372 billion | +6.39% | |

| BUIDL Token Market Cap | $2.897 billion | +1.33% | |

| USDS Market Cap | -5.5% | ||

| USDe Market Cap | -0.56% |

Summary

The stablecoin market decline observed this week reflects a minor contraction in the overall market, with a slight dip of $36.95 million leading to a total market cap of $242.97 billion. Despite this decline, major stablecoins like USDT continue to showcase resilience, indicating that while the overall sector is experiencing a decrease, key players are maintaining stability and adaptability in a competitive landscape. As investor interest begins to shift towards more speculative cryptocurrencies, the stability of stablecoins might face further scrutiny in the coming weeks.