Stablecoin Market Surpasses $270 Billion: A New High

The stablecoin market has reached an impressive milestone, surpassing $270 billion in total value, reflecting its significant growth and vital role within the cryptocurrency ecosystem. As the demand for stablecoins continues to surge, driven by factors such as stablecoin adoption and robust market activity, we are witnessing a transformative phase in the financial landscape. With Tether (USDT) maintaining a dominant presence, accounting for over 61% of market share, a comprehensive stablecoin analysis reveals the increasing acceptance and trust in dollar-pegged assets. Furthermore, the rising interest in stablecoin growth underscores their functionality as essential tools for trading and remittances, solidifying their place in the broader cryptocurrency market. As we explore these dynamics, the future of stablecoins appears bright, with ongoing developments expected to drive further innovation and engagement in the upcoming years.

The market of digital currencies known as stablecoins is flourishing, marking a significant trend in the financial sector with a total capitalization exceeding $270 billion. This sector not only represents a pivotal element of the cryptocurrency landscape but also emphasizes the continuous shift toward reliable and stable digital assets, often pegged to the U.S. dollar. As we delve into the factors influencing stablecoin expansion, it becomes clear that their rising adoption is transforming payment mechanisms and asset trading globally. Tether’s (USDT) market dominance highlights the competitive nature of this space, accompanied by a variety of emerging stablecoin options seeking to capture user engagement. The insights drawn from market analysis reveal that the adoption of these assets is not merely a passing phase but a fundamental shift towards a more stable financial infrastructure.

The Surge of the Stablecoin Market

The growth of the stablecoin market has been remarkable, with its total value recently surpassing $270 billion. This surge not only reflects increasing confidence in digital assets but also underscores the crucial role stablecoins play in the cryptocurrency ecosystem. As more investors seek stability amidst the volatility of traditional cryptocurrencies, stablecoins like Tether (USDT) have emerged as a preferred choice. The data indicates that USDT maintains a commanding market dominance at 61.06%, followed closely by USDC, positioning these assets at the forefront of the financial landscape.

The latest figures pointed out by sources such as defillama.com highlight a steady capitalization increase within the stablecoin sector. A growth of $3.051 billion over just a week not only indicates a robust interest in stablecoins but also suggests a broader adoption pattern that may continue in the years ahead. This trend emphasizes the essential nature of stablecoins in facilitating transactions, providing liquidity, and serving as a hedge against market fluctuations.

Understanding Stablecoin Adoption Trends

Stablecoin adoption is expanding rapidly across various demographics and regions. Recent statistics reveal that approximately 42.8 million addresses interacted with stablecoins last month, showcasing a diverse user base that spans across different blockchain networks such as Ethereum and Tron. Despite a slight decrease in activities, the overall engagement levels remain among the highest in the past five years, highlighting the persistent interest in these digital currencies as a medium for payments and settlements.

One of the notable trends in stablecoin adoption is the increasing participation from institutional investors alongside retail users. As organizations explore the benefits of integrating stablecoins into their financial operations, the demand for USDT and USDC continues to rise. This adoption not only reflects a shift in transactional methods but also illustrates how stablecoins are becoming integral to the future of finance, bridging the gap between traditional financial systems and innovative digital solutions.

Stablecoin Analysis: Key Players and Market Dynamics

In analyzing the stablecoin market, it’s crucial to recognize the dominance of key players like Tether (USDT) and USD Coin (USDC). Tether’s sustained market share has solidified its position as a cornerstone of the cryptocurrency ecosystem, while USDC’s gradual rise indicates competitive dynamics. The market’s composition includes various smaller players, each vying for a fraction of the pie, yet the notable majority remains consolidated amongst a few giants. As per the market forecasts, looking towards 2025, USDT is projected to maintain its substantial lead, while USDC is expected to gain traction.

The ongoing market analysis reveals that, although USDT holds the lion’s share of dominance, emerging assets like DAI and newer entries like Ethena’s USDe are tapping into niche segments. This diversification within the stablecoin sector signifies a healthy market environment where innovation can thrive. By creating alternatives to the established players, these smaller stablecoins can serve specific communities, offering tailored solutions that meet distinct user needs in an ever-evolving market.

The Role of Stablecoins in the Cryptocurrency Market

Stablecoins play a pivotal role in the functioning of the broader cryptocurrency market. By providing a stable asset pegged to traditional currencies like the U.S. dollar, they facilitate easier trading and diminish the volatility associated with conventional cryptocurrencies. This stability allows traders to hedge against price fluctuations, making transactions smoother and more reliable. Moreover, as transaction volumes in stablecoins reach trillions, their contribution to liquidity in the cryptocurrency market cannot be understated.

In recent months, the interchangeability of stablecoins across major exchanges and decentralized finance (DeFi) platforms has substantially influenced market dynamics. The solid volumes reported, estimated around $2.7 trillion for the past month, suggest robust ongoing demand for stablecoins as effective tools for executing large transactions, remittances, and lending. The reliance on stablecoins for these functions cement their status as essential components of the cryptocurrency ecosystem.

Emerging Blockchain Platforms and Stablecoin Issuance

Recent data indicates that emerging blockchain platforms are creating new channels for stablecoin issuance and circulation. Ethereum continues to lead in outstanding stablecoin balances, but newer platforms such as Solana and Base are beginning to show significant contributions. As various blockchain networks evolve, they are establishing themselves as viable alternatives for stablecoin projects, which could reshape the competitive landscape in the coming years.

The diversity of blockchain ecosystems enhances the overall resilience of the stablecoin market. With multiple platforms willing to host stablecoin projects, issuers can leverage different technological capabilities and user bases. This segmentation allows stablecoins to cater to various transaction needs, thus promoting further adoption and facilitating greater market fluidity as users interact across different networks.

Regional Trends in Stablecoin Utilization

An examination of regional trends reveals noteworthy patterns in stablecoin utilization. North America and Asia account for a large volume of adjusted transactions, signaling a strong user engagement in these regions. As stablecoins gain traction among both retail and institutional users, the diverse geographic participation highlights their growing acceptance as a viable means of conducting cross-border transactions.

Furthermore, regions like Latin America and Southeast Asia indicate a burgeoning interest in stablecoins, despite their smaller share relative to North America and Asia. As financial infrastructure evolves worldwide, stablecoins are emerging as critical tools for enhancing financial access, reducing transaction costs, and providing stable value in localized contexts. This regional flow underscores the strategic role that stablecoins play in bridging gaps within the global financial system.

Future Outlook for Stablecoin Market Growth

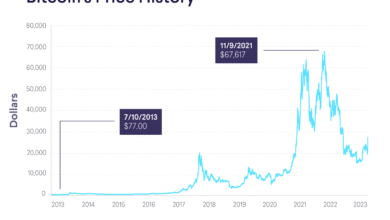

Looking ahead, the future of the stablecoin market appears promising. With the total market cap having surged from less than $10 billion in 2019 to over $270 billion in late 2023, a consistent upward trajectory suggests that stablecoins will continue to gain significance in global finance. The evolving regulatory landscape and increased institutional interest will likely foster a more conducive environment for the further growth of this asset class.

Additionally, as stablecoins maintain their utility for trading and remittance purposes, projections suggest that the market could reach new heights well into 2024-2025. Continued innovation and the introduction of new stablecoin projects may diversify the landscape even further, making the sector increasingly competitive and robust. This positive outlook reinforces the notion that stablecoins are not merely a passing trend but rather an integral part of the future financial ecosystem.

The Impact of Regulatory Developments on Stablecoins

Regulatory developments are pivotal in shaping the future of the stablecoin market. As governments worldwide introduce frameworks to monitor and control cryptocurrency activities, the implications for stablecoins are profound. Enhanced regulations may provide clearer guidelines for issuers and better protect investors, promoting greater trust in stablecoin assets. These measures can catalyze adoption among institutional players who require compliance assurances before engaging with digital currencies.

Simultaneously, regulations that promote transparency and foster innovation could encourage new stablecoin projects to enter the market. As existing players adapt to comply with regulatory standards, stablecoins may be better positioned to integrate seamlessly into traditional finance, facilitating wider acceptance and use. Thus, a careful balance between regulation and innovation will be crucial in determining the future dynamics of stablecoins.

Liquidity and the Role of Stablecoins in Ecosystem Connectivity

Stablecoins serve as a vital bridge connecting various segments of the crypto ecosystem. As liquidity conditions tighten or shift, the reliance on stablecoins gains prominence, allowing users to move seamlessly between different assets and platforms. This interconnectivity is especially critical in decentralized finance (DeFi), where stablecoins underpin many protocols’ functionalities, functioning as collateral, means for transactions, and price stabilization tools.

Furthermore, as we observe increasing on-ramp services integrating stablecoins into their operations, this accessibility enhances the overall market liquidity. Traditional finance institutions are likely to encourage the use of stablecoins to facilitate quicker and cheaper cross-border transactions. This liquidity and connectivity will expand the potential use cases for stablecoins, confirming their status as a foundational element within the broader ecosystem.

Frequently Asked Questions

What factors are driving the stablecoin market growth?

The stablecoin market growth is primarily driven by increased adoption by both retail and institutional users, as well as the rising demand for stable digital currencies in transactions and trading. As of recent analysis, the total capitalization of stablecoins has reached over $270 billion, reflecting a sustained upward trend expected to continue into 2024 and 2025.

How does USDT maintain its dominance in the stablecoin market?

Tether (USDT) maintains its dominance in the stablecoin market by capturing 61.06% of the sector’s market share. This is supported by its widespread use across numerous blockchain networks and platforms, reinforcing its position as a preferred stablecoin for liquidity and operations.

What role do blockchain networks play in the stablecoin market?

Blockchain networks play a crucial role in the stablecoin market by facilitating transactions, settlements, and the movement of assets. Major networks like Ethereum and Tron dominate the supply and usage of stablecoins, allowing for diverse engagement and enhanced transaction volume.

How significant is the stablecoin user activity in terms of transaction counts?

The stablecoin user activity remains significant, with 1.3 billion transactions recorded in the last month. This indicates a strong engagement in payments, settlements, and trading, showcasing the stablecoin’s essential role in the cryptocurrency market.

What trends are observed in the regional flow of stablecoin transactions?

The regional flow of stablecoin transactions is diversified, with significant volumes coming from North America and Asia, while Europe is also increasing its share. This indicates a broad adoption across different markets and highlights the global importance of stablecoins in facilitating financial transactions.

How does the recent performance of stablecoins compare to previous years?

The recent performance of stablecoins has shown significant improvement, with the total market cap rising from less than $10 billion in 2019 to over $270 billion today. This indicates a robust recovery and adaptation of stablecoins within the cryptocurrency market, particularly as a reliable medium for settlement and trading.

Why is understanding stablecoin analysis important for investors?

Understanding stablecoin analysis is important for investors because it provides insights into market trends, liquidity conditions, and overall economic activity in the cryptocurrency sector. Such analysis helps investors assess risks and opportunities within the stablecoin market.

What impact does stablecoin adoption have on the overall cryptocurrency market?

Stablecoin adoption significantly impacts the overall cryptocurrency market by providing stability and liquidity, making it easier for users to trade and transact. As major stablecoins like USDT and USDC gain traction, they help stabilize crypto prices and facilitate mainstream acceptance of digital currencies.

| Key Point | Details |

|---|---|

| Stablecoin Market Value | Surpassed $270 billion, reflecting a significant milestone as reported by defillama.com and artemisanalytics.com. |

| Market Capitalization Increase | Grew by $3.051 billion in the last week, demonstrating a 1.14% increase and steady upward trend expected to continue through 2024 and 2025. |

| Market Leaders | Tether (USDT) leads with 61.06% market dominance, followed by USDC and other emerging competitors like DAI and BUIDL. |

| Active Addresses | 42.8 million addresses interacted with stablecoins last month, despite a 15.2% drop in engagement from the previous 30 days. |

| Transaction Volume | Estimated at $2.7 trillion over the last month, indicating substantial use for payments and settlements, although down 11.19% month-over-month. |

| High Transaction Counts | 1.3 billion transactions in the last month are showing steady usage patterns despite a decline of 23.55% from previous figures. |

| Chain Dominance | Ethereum and Tron hold the largest issuance, while emerging chains like Base and Solana are gaining traction. |

| Geographical Distribution | Active transactions mainly from North America and Asia, with notable growth from Europe and sustained engagement from other regions. |

Summary

The stablecoin market has reached a remarkable $270 billion valuation, marking an impressive growth trajectory for this asset class. This significant milestone is underscored by a broadening activity across various blockchain networks and transaction types. With major players like Tether and USDC leading the charge, the sector displays a robust framework connecting both centralized and decentralized finance. As stablecoins continue to play a pivotal role in transactions, remittances, and asset liquidity, their influence is expected to grow further, underscoring the resilience and adaptability of the stablecoin market.