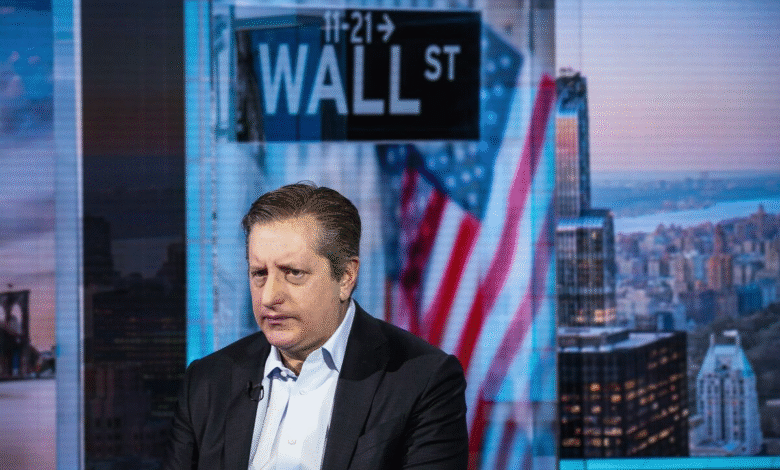

Steve Eisman on Deficits: Why Investors Shouldn’t Worry

Steve Eisman on deficits offers a refreshing perspective that can alleviate investor anxiety surrounding the current economic climate. Renowned for his accurate predictions during the 2008 financial crisis, Eisman emphasizes that the existing deficit levels are justifiable and not as alarming as many believe. His insights reveal that despite widespread deficit concerns, there are underlying factors that support these figures, particularly regarding economic growth and government spending effectiveness. As discussions around fiscal policies evolve, Eisman encourages a broader understanding of the economic landscape rather than fixating solely on deficit figures. His viewpoints are gaining traction among analysts as they reassess their inflation forecasts and the overall impact of budgetary policies on the economy.

When discussing fiscal shortfalls, many thought leaders in finance echo sentiments similar to those of Steve Eisman regarding government budgetary issues. Deficits, often viewed as a source of panic for markets, can also represent opportunities for robust economic expansion and judicious public expenditure. By shifting focus from mere numbers, investors can gain clarity on the broader ramifications of governmental financial strategies. The discourse surrounding these challenges invites a deeper analysis of how strategic spending initiatives can enhance economic dynamics. As such, understanding these elements can provide a more balanced view of what deficits may ultimately mean for future financial stability.

Steve Eisman on Deficits: Understanding Investor Anxiety

Steve Eisman, a prominent figure in the investment landscape, has provided clarity on why investors should not let deficit concerns cause undue anxiety. His insights highlight that despite the common belief that rising deficits are alarming, they can actually signify a growing economy. This perspective is crucial in understanding the broader economic implications of government spending and how it can fuel economic growth.

Eisman argues that there are justified reasons behind the current deficit levels, suggesting that investors should adopt a more nuanced view. By recognizing that strategic government spending can stimulate economic activity, Eisman reassures stakeholders that the potential growth far outweighs the immediate impact of deficits. His approach emphasizes the importance of context over mere numbers, urging investors to focus on the underlying factors that can foster a thriving economy.

Economic Growth vs. Deficit Concerns: A Balanced Perspective

The relationship between economic growth and deficit levels is complex and often contentious. Critics frequently highlight deficits as a source of economic instability; however, advocates like Steve Eisman illustrate that deficits can play a critical role in driving growth. While it’s essential to monitor borrowing levels, the spending enabled by these deficits often leads to infrastructure improvements, innovation, and job creation, all of which contribute to a robust economic environment.

Adopting a balanced perspective allows investors to navigate the turbulent waters of economic forecasts. Investors like Eisman encourage examining how government spending impacts the economy beyond mere deficit figures. The effectiveness of investments made by governments can lead to a compounding positive effect on economic growth, mitigating fears surrounding budgetary issues and instilling confidence in the market.

The Role of Government Spending Effectiveness in Economic Stability

Government spending effectiveness is a crucial aspect of understanding deficits within an economic framework. Effective spending can yield significant returns on investment for the government, ultimately leading to enhanced public services and infrastructure improvements. Investors who appreciate this dynamic recognize that not all deficits are detrimental; rather, they can be valuable if they lead to tangible outcomes that positively influence economic growth.

Moreover, when government initiatives are effectively aligned with economic needs, they can address challenges such as unemployment and stagnation. This strategic allocation of funds fosters an environment where growth can thrive, thereby justifying the current deficit levels that some may view as problematic. As Eisman points out, it’s imperative for investors to distinguish between wasteful spending and productive investment, as the former can indeed lead to continued deficits without benefits.

Investor Confidence Amidst Rising Deficits

Despite concerns over increasing deficits, investor confidence can remain robust if the rationale behind government spending is sound. When investors understand that deficits can be a tool for promoting growth, such as through healthcare, education, and infrastructure, they may feel reassured. Steve Eisman’s insights corroborate this notion, reinforcing the message that a clear strategy in government spending can alleviate anxiety about deficits.

Additionally, historical context plays a crucial role in shaping investor sentiment. Past financial crises highlighted the importance of proactive measures and strategic decisions by governments. Investors looking to gauge future market potential should consider the quality of spending initiatives. The understanding that a well-directed deficit can lead to economic resurgence is vital for maintaining confidence in potentially volatile economic climates.

Analyzing Deficit Concerns through an Economic Lens

Analyzing deficit concerns through an economic lens reveals that apprehensions often stem from a misunderstanding of macroeconomic principles. Investors need to shift their focus from simply viewing deficits as a negative to understanding their role in stimulating economic activity. Steve Eisman’s insights prompt a reevaluation of what deficits signify in today’s economic environment, emphasizing the potential for strategic growth.

A deep dive into historical economic data illustrates that well-managed deficits can lead to periods of prosperity, especially when they are invested wisely in accordance with economic needs. This requires a shift in the analytical focus for many investors, who may traditionally equate deficits with poor fiscal management. Instead of fearing deficits, investors should consider how government spending can act as a catalyst for development and growth.

The Relevance of Steve Eisman’s Insights in Today’s Economy

Steve Eisman’s perspectives are particularly relevant in today’s complex economic landscape where uncertainty looms large. As market dynamics evolve, his insights serve as a guide for investors grappling with anxiety about deficits and rising inflation. Eisman’s emphasis on understanding the broader economic picture encourages a strategic approach to investing amidst volatility, urging individuals to consider long-term benefits over short-term setbacks.

Eisman’s rationalization of deficits as manageable when tied to effective government spending aligns with a more optimistic view of economic growth. His ability to anticipate market shifts, evident during the 2008 financial crisis, underscores his valuable contributions to current discussions among analysts and investors. By adopting a perspective grounded in economic potential rather than solely deficit figures, investors can cultivate a more balanced investment strategy.

Deficit Myths: Debunking Common Misunderstandings

Many misconceptions surround the topic of government deficits, contributing to widespread investor anxiety. A common myth is that all deficits lead to economic decline. However, as Steve Eisman explains, not all debt is created equal; when government spending fosters growth, deficits can actually play a constructive role. By debunking these myths, investors can make more informed decisions that align with economic realities.

Another misunderstanding involves equating high deficits with inability to manage fiscal policy. In reality, effective fiscal management can involve strategic deficits that stimulate growth and future revenues. By clarifying these myths, Eisman provides investors with a framework to understand how deficits can be harnessed positively rather than feared.

Understanding the Macro Effects of Deficits on Economic Growth

The macroeconomic effects of deficits on economic growth are profound and often misunderstood. Investors like Eisman advocate for a perspective that recognizes the interconnectedness of government spending and economic vitality. Large-scale investments in public infrastructure or social programs can yield long-term benefits that outstrip the costs associated with current deficits. Understanding these effects broadens the narrative around deficits and invites a more holistic view of economic health.

Recognizing that deficits can finance significant public projects, such as road improvements or education systems, underscores their potential to drive economic advancement. In the grand scheme of fiscal policy, these considerations become paramount for strategic investment planning. Addressing misconceptions about deficits enables investors to appreciate their role as potential growth facilitators rather than purely burdensome liabilities.

Looking Ahead: Futures in Investment with a Focus on Government Spending

As we look ahead, the future of investment strategy will heavily rely on understanding government spending and its implications for economic growth. Steve Eisman’s analysis serves as a compass for investors navigating these waters, emphasizing the importance of discerning the effectiveness of public expenditure. This forward-thinking approach allows investors to anticipate changes and align their portfolios with potential economic shifts.

Investors who prioritize sectors that benefit from government initiatives are likely to thrive in an environment overshadowed by deficit concerns. By monitoring trends in fiscal policy and understanding how they impact specific markets, stakeholders can better position themselves for growth. The integration of Eisman’s insights into investment strategy will be critical for those aiming to capitalize on future opportunities in a fluctuating economic context.

Frequently Asked Questions

What are Steve Eisman’s insights on deficits and economic growth?

Steve Eisman emphasizes that current deficit levels, while often alarming to investors, can be justified by the potential for economic growth. He suggests that understanding the broader economic landscape—including factors like government spending effectiveness—can help alleviate investor anxiety regarding deficits.

How does Steve Eisman address investor anxiety about government deficits?

Steve Eisman addresses investor anxiety by explaining that certain unique factors underpinning today’s deficits provide a solid rationale for their existence. He encourages investors to look beyond the raw numbers and consider the positive impacts of government spending on economic growth.

What does Steve Eisman say about the effectiveness of government spending in relation to deficits?

According to Steve Eisman, the effectiveness of government spending plays a crucial role in soothing concerns about current deficits. He believes that when government spending is directed towards growth-promoting initiatives, it can contribute positively to the economy, countering traditional fears about deficits.

Why should investors reconsider their fears about deficits according to Steve Eisman?

Investors should reconsider their fears about deficits, as Steve Eisman points out that a strong justification exists for the current levels. His analysis highlights that economic growth potential and the effectiveness of government spending can mitigate negative perceptions surrounding deficits.

How does Steve Eisman view the relationship between deficits and inflation?

Steve Eisman believes that while deficits can raise concerns regarding inflation, it’s essential to view them through a broader lens. He feels that current economic conditions and effective government spending can help maintain stability, reducing inflation worries related to deficits.

| Key Point | Explanation |

|---|---|

| Steve Eisman on Deficits | Eisman provides insights that suggest investors should not be overly worried about current deficit levels. |

| Historical Context | Eisman gained recognition during the 2008 financial crisis for his accurate predictions. |

| Justification for Deficits | There are specific factors, such as potential economic growth and productive government spending, that justify current deficit levels. |

| Broader Economic Understanding | Eisman emphasizes understanding the wider economic landscape rather than just focusing on deficit figures. |

| Reassessing Predictions | As inflation and budget effects are reconsidered, Eisman’s viewpoint is especially relevant. |

Summary

Steve Eisman on deficits highlights that investors need not fear the current deficit levels due to substantial underlying justifications. By focusing on economic growth and efficient government spending, investors can adopt a more informed perspective. Eisman’s insights urge stakeholders to consider the broader economic context, rather than succumb to anxiety over mere figures, making his commentary particularly timely and crucial as analysts reassess their forecasts.