Stock Market Movers: Intel, Centene, Paramount News Today

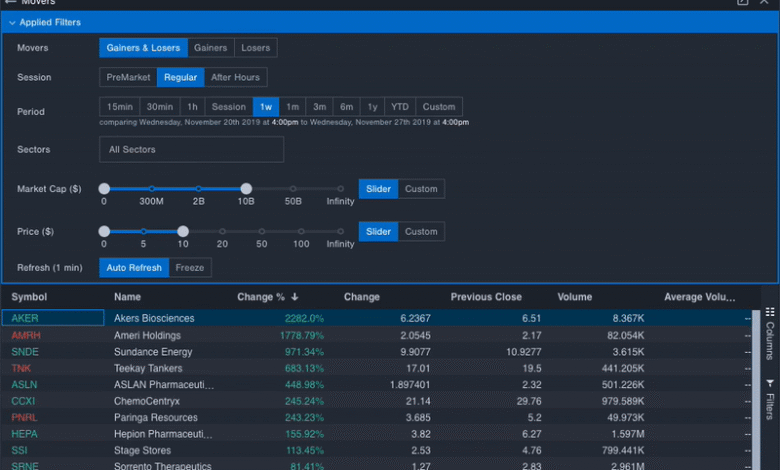

Stock market movers are making headlines this morning as investors keenly scrutinize premarket stock news. With significant fluctuations in shares, companies like Intel and Centene are drawing particular attention. Intel’s stock drop of over 7% follows an announcement of workforce cuts and a reassessment of its chip production strategy, even though it exceeded revenue expectations. Meanwhile, Paramount is seeing a boost of over 1% after the FCC approved a major merger, providing a glimmer of optimism in the media sector. As we delve deeper into the financial landscape, Deckers and Centene’s contrasting earnings reports illustrate the dynamic nature of today’s market.

In the world of finance, market shifts can occur rapidly, and today’s developments highlight some of the leading players causing waves before the trading bell rings. Major corporations, influenced by recent earnings disclosures and strategic decisions, are frequently referred to as market movers. The latest news surrounding Intel’s significant layoffs and Centene’s disappointing financial performance showcases the volatility inherent in stocks. On the other hand, proactive movements like Paramount’s merger approval and Deckers’ impressive earnings report reflect opportunities amidst uncertainty. Overall, today’s stock market activity offers a revealing glimpse into the ebb and flow of corporate fortunes.

Key Stock Market Movers: Intel, Centene, and Deckers

In today’s premarket trading, stocks are showing significant action, with major players like Intel, Centene, and Deckers making headlines. **Intel’s stock drop** of over 7% highlights the challenges the tech giant faces amid restructuring efforts. The decision to reduce its workforce by 15% is a bold move that reflects the company’s need to pivot towards a stronger artificial intelligence strategy. Despite exceeding revenue expectations in the second quarter with $12.86 billion, the adjusted loss of 10 cents per share reveals deeper operational issues that investors are keenly watching.

On the other hand, **Centene** has witnessed a disappointing 14% decline in its stock value following a quarterly loss report that was not aligned with analyst expectations. The managed care provider surprised investors with a second-quarter adjusted loss of 16 cents per share, whereas analysts had hoped for earnings of 11 cents per share. This staggering contrast, despite reporting a revenue of $48.7 billion that surpassed estimates, signals potential instability in its membership across Medicaid and Medicare sectors, raising concerns among shareholders.

Positive Trajectory for Deckers Outdoor

The standout in today’s premarket movers is **Deckers Outdoor**, with its shares surging over 12% after releasing impressive fiscal first-quarter results. With earnings of 93 cents per share on revenue of $965 million, Deckers not only beat Wall Street expectations but also demonstrated resilience in a competitive market. Analysts had forecasted only 68 cents per share and revenues of $901 million, making the company’s performance particularly noteworthy. The surge reflects strong consumer demand, especially for its UGG brand and the increasingly popular Hoka athletic line.

Deckers’ success can be attributed to its strategic focus on product innovation and consumer engagement, which have clearly resonated in the marketplace. This upward momentum poses a stark contrast to peers experiencing setbacks, and as Deckers continues to capitalize on positive consumer trends, it could set a precedent for performance expectations in the retail sector, especially amidst fluctuating market conditions.

Paramount’s Merger and Its Impact on Shares

In a significant development for the entertainment industry, **Paramount** saw its shares rise by over 1% following the Federal Communications Commission’s approval of an $8 billion merger with Skydance Media. This merger is poised to consolidate Paramount’s position in the ever-evolving media landscape. Such strategic moves are critical as companies navigate competitive pressures in streaming and traditional media. The approval signals confidence in Paramount’s future direction and could have implications for its overall stock performance.

Moreover, mergers of this magnitude often bring about increased operational efficiencies and an expanded content library, which may enhance revenue generation in the long run. Investors are likely to keep a close watch on how this merger unfolds and affects Paramount’s market position alongside its competitors, particularly in terms of content creation and distribution efficiencies.

Carvana’s Rise Amid Market Changes

Another noteworthy mover is **Carvana**, climbing nearly 3% after receiving an upgrade to ‘outperform’ by Oppenheimer. This positive outlook follows observations that Carvana has successfully adapted its business model, which is now ‘humming’ in terms of cash generation and operational effectiveness. The strategic pivots made in response to industry trends indicate a promising trajectory for the online used-car retailer.

Carvana’s ability to scale operations while meeting consumer demand trends sets it apart in a rapidly evolving market. As the automotive industry continues to shift towards digital platforms, Carvana stands to benefit from its innovative approach and enhanced customer engagement strategies, making it a company to watch closely for potential growth.

Charter Communications Faces Challenges

In contrast to the positivity surrounding some stocks, **Charter Communications** is facing challenges, with its shares falling nearly 13% due to disappointing financial results that failed to meet market expectations. Although the cable giant reported in-line revenue of $13.77 billion, its adjusted EBITDA fell short, highlighting operational inefficiencies that could discourage investor confidence. This scenario illustrates the difficulty traditional cable companies face in adapting to a rapidly changing consumer landscape.

As unbundled streaming services gain popularity, Charter must rethink its strategies to not only retain existing customers but also attract new ones. The pressure to innovate is paramount as consumers increasingly seek flexibility and customizable content packages. This critical juncture presents both a challenge and an opportunity for Charter to recalibrate its business model in response to shifting viewer behaviors.

Frequently Asked Questions

What were the biggest stock market movers today, particularly Intel and Centene?

Today, the biggest stock market movers include Intel, which saw a sharp drop of over 7% due to announcements of significant workforce cuts and a shift in its chip factory plans. Conversely, Centene’s stock plummeted approximately 14% after reporting disappointing quarterly results, despite beating revenue expectations.

What impact did the Paramount merger news have on its stock price?

The Paramount merger news, specifically the approval of an $8 billion merger with Skydance Media, had a positive impact, leading to a rise of over 1% in its stock price in premarket trading.

How did Deckers earnings report influence their stock performance?

The Deckers earnings report showed better-than-expected fiscal first-quarter results, with earnings reaching 93 cents per share against expectations of 68 cents. As a result, Deckers’ stock surged over 12% in premarket trading.

Why did Intel stock drop despite strong revenue performance?

Intel stock dropped despite reporting a revenue of $12.86 billion, exceeding analyst expectations, due to its announcement of a 15% workforce reduction and a strategic shift in chip factory construction, leading to investor concerns about its future.

What are the financial implications of Centene’s quarterly results for investors?

Centene’s financial results indicate significant challenges, with a large adjusted loss reported and declining membership in key sectors. This unsettling news is likely to raise concern among investors, prompting a 14% drop in stock value.

How do premarket stock news updates affect trading decisions for investors?

Premarket stock news updates, like those for Intel, Paramount, and Deckers, provide critical insights into company performance and market trends. Traders often use this information to make informed decisions, anticipating how stocks will perform at the opening of the market.

| Company | Stock Movement | Key Highlights |

|---|---|---|

| Intel | -7% | Cutting 15% workforce; Revamping AI strategy; Q2 revenue: $12.86B vs $11.92B expected. |

| Paramount | +1% | FCC approves $8B merger with Skydance Media. |

| Centene | -14% | Q2 adjusted loss of $0.16; Revenue of $48.7B vs $44.1B expected; Membership decline. |

| Deckers Outdoor | +12% | Q1 earnings of $0.93 on revenue of $965M; Higher demand for UGG and Hoka brands. |

| Carvana | +3% | Upgraded to ‘outperform’ by Oppenheimer; Positive cash generation noted. |

| Charter Communications | -13% | Q2 revenue met estimates; EBITDA fell short of $5.7B forecast at $5.69B. |

Summary

Stock market movers are making headlines today as key companies such as Intel, Paramount, Centene, Deckers, Carvana, and Charter Communications are experiencing significant stock price fluctuations based on their latest financial results and news. Investors should pay close attention to Intel’s workforce reduction and AI strategy, Centene’s disappointing earnings despite higher revenue, and Deckers’ robust performance due to strong demand for its products. Understanding these dynamics can provide valuable insights for those navigating the stock market.