Stock Market News: Major Companies Making Headlines Today

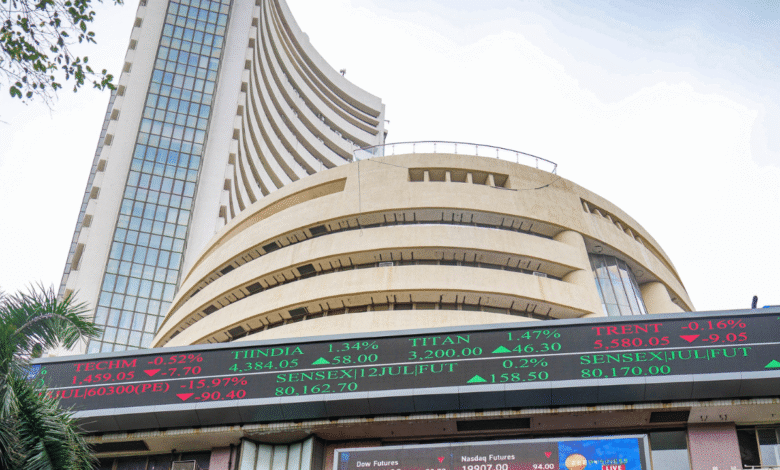

In the world of finance, staying updated with stock market news is crucial for both seasoned investors and novices alike. Today’s latest stock market updates reveal significant shifts, such as Charter Communications witnessing a remarkable 7% surge due to a merger with Cox Communications. Meanwhile, Constellation Brands enjoyed a 3.4% bounce after Berkshire Hathaway upped its stake in the beer importer, drawing attention among stocks to watch. Conversely, Applied Materials experienced a disappointing 5% drop following an underwhelming earnings report that failed to meet analysts’ expectations. As these stock price movements unfold, investors must keep an eye on company earnings reports to make informed choices in today’s dynamic environment.

Today’s financial landscape is charged with volatility, and understanding the evolving trends is essential for effective investing news. The market is buzzing with announcements and developments that could impact your portfolio. Major players like Charter Communications have made headlines with their strategic merger, while others like Constellation Brands are enjoying gains due to heightened investor interest. On the flip side, companies such as Applied Materials are grappling with disappointing fiscal results, leading to significant stock price adjustments. Keeping track of these fluctuations is pivotal for identifying promising stocks and formulating investment strategies.

Latest Stock Market News Highlights

In today’s stock market news, several notable companies have made headlines, impacting their stock prices significantly. Charter Communications has surged by 7% following a merger announcement with Cox Communications, a strategic move that could reshape the cable industry. Investors are keenly observing how this merger will enhance their market reach and operational efficiencies in a competitive landscape. Meanwhile, Constellation Brands experienced a 3.4% increase in shares after Berkshire Hathaway revealed it had doubled its stake in the popular beer importer, highlighting investor confidence in the company’s long-term growth prospects.

On the other hand, not all news is positive. Applied Materials has seen a decline of 5% in stock value after falling short of earnings expectations, reporting revenue of $7.10 billion compared to the anticipated $7.13 billion. Such stock price movements reflect the market’s sensitivity to earnings reports and forward-looking guidance, making it crucial for investors to monitor these updates closely. Additionally, Take-Two Interactive’s stock dipped by 1.3% post the announcement of weaker than expected guidance, further emphasizing the importance of earnings reports in shaping market sentiment.

Top Stocks to Watch This Week

As we look ahead, investors should keep a close eye on stocks that are making headlines and warrant attention. Vistra Corp. is one such stock that has captured market interest with its recent acquisition of seven natural gas facilities for $1.9 billion. The stock jumped more than 5% as a result, showcasing how strategic investments can positively influence stock performance. Analysts suggest that this move could strengthen Vistra’s position within the energy sector, potentially leading to further opportunities for growth amid evolving energy demands.

Another stock that investors should consider is Novo Nordisk, which recently saw its shares slip by 5%. The decline came after CEO Lars Fruergaard Jørgensen announced his resignation amidst market challenges. Such leadership changes can often lead to increased volatility, prompting investors to reassess their positions. The pharmaceutical company’s search for new leadership will be watched closely, as the transition period may impact investor confidence and share price dynamics.

Impact of Company Earnings Reports

Company earnings reports serve as critical indicators of financial health and future performance, influencing stock market trends. For instance, both Doximity and Applied Materials experienced stock price declines after disappointing earnings projections. Doximity’s stock tumbled by 19% after issuing guidance below analyst expectations, highlighting how earnings reports can swiftly affect market valuation and investor strategies. As such, stakeholders are increasingly vigilant in analyzing these reports to make informed decisions.

On the flip side, positive earnings surprises, as seen with Cava’s first-quarter earnings per share exceeding forecasts, can bolster investor sentiment. Despite expectations of moderating sales growth, Cava’s ability to surpass earnings estimates by a notable margin showcases the potential for resilience in challenging markets. Investors are advised to keep a close watch on upcoming earnings reports to gauge not only existing performance but also future trends in specific sectors.

Investing News Today: Key Takeaways

Today’s investing news is laden with valuable insights that can inform traders and investors alike. The landscape is ongoing and dynamic, with key events such as mergers, acquisitions, and earnings reports driving market activity. For instance, Charter Communications’ merger with Cox Communications has the potential to alter competitive dynamics within the cable industry, prompting investors to rethink their positions regarding cable stocks. This merger aligns with broader market trends focusing on scalability and operational efficiency.

Additionally, Berkshire Hathaway’s decision to increase its stake in Constellation Brands indicates a positive sentiment flowing into the beverage sector, which could signal a larger trend. These movements present opportunities for diligent investors to capitalize on emerging trends and shifts in market dynamics. Keeping an eye on investing news is essential for those looking to stay ahead of the curve and make strategic investment choices.

Key Market Movements to Monitor

Significant shifts in stock prices often reflect broader market sentiments and economic conditions, making it essential for investors to monitor key market movements. Recent reports indicate a high degree of volatility in stocks like Doximity and Take-Two Interactive, as disappointing forecasts led to steep declines. Investors should pay particular attention to these fluctuations, as they offer insights into market reactions and investor psychology. Understanding these movements can aid in developing strategies that take advantage of buying opportunities or mitigate risks.

Furthermore, sectors such as technology and energy may exhibit pronounced movements based on economic indicators and earnings announcements. For example, Applied Materials’ disappointing quarterly results illustrate the sensitivity of tech stocks to market expectations. In contrast, Vistra Corp.’s acquisition strategy has resulted in upward momentum, indicating that positive strategic decisions can counterbalance broader market trends. Tracking these key market movements can provide investors with a detailed understanding of sector performance and potential investment pathways.

Strategic Insights for Investors

Investors often seek strategic insights that can guide their decision-making processes and help them navigate volatile market conditions. Analyzing recent stock performance and company announcements can yield critical information about potential investment risks and rewards. Companies like Charter Communications and Constellation Brands present interesting case studies in terms of how industry innovations and high-profile investments can impact share prices. Keeping abreast of such developments can enable investors to make more informed choices.

Moreover, utilizing trend analysis tools and market sentiment indicators can equip investors with actionable insights. Understanding which stocks are on the rise or decline can help in fine-tuning portfolio strategies. For instance, investors observing the downward trend in Doximity’s stock may choose to reconsider their positions ahead of upcoming earnings reports. Strategic foresight in timing entries and exits in the market can significantly optimize investment outcomes, making the comprehension of market dynamics vital for successful investing.

The Role of Mergers and Acquisitions in the Stock Market

Mergers and acquisitions play a pivotal role in shaping the stock market landscape, often leading to substantial shifts in company valuations and stock prices. The recent merger between Charter Communications and Cox Communications illustrates how consolidation can create competitive advantages and enable companies to leverage synergies. Such strategic alignments not only boost shareholder confidence but also resonate throughout the entire industry, prompting other firms to evaluate their own strategic positions.

Additionally, the stock price surge observed in Vistra Corp. following its acquisition of natural gas facilities further underscores the positive impact of mergers on market performance. Investors often respond favorably to well-structured acquisitions, viewing them as signs of growth and sustainability. For investors, understanding the implications of these corporate actions can provide insights into potential stock movements and the overall health of the market.

Investor Confidence and Stock Price Reactions

Investor confidence is a crucial element in driving stock price reactions, as seen in the current marketplace. Positive news, such as Berkshire Hathaway’s increase in investment in Constellation Brands, can boost market confidence, fueling stock price increases. This highlights the interconnectedness of investor sentiment and stock performance, where strategic moves by influential investors often lead to a ripple effect across the market.

Conversely, negative projections, like those from Applied Materials and Doximity, can lead to a swift decline in stock prices, reflecting a market reaction to perceived weaknesses. For investors, understanding the relationship between company forecasts and market reactions is essential for making timely investment decisions. Staying attuned to how investor confidence fluctuates in response to company performance can significantly impact portfolio management and strategy development in a volatile market.

Future Outlook for Prominent Stocks

Looking ahead, the future outlook for significant stocks is contingent upon upcoming earnings announcements and strategic developments. Investors are keenly watching stocks like Take-Two Interactive to evaluate how their guidance reflects broader market trends in the video gaming industry. Concerns regarding weaker than expected bookings could prompt shifts in investor focus towards stocks that exhibit stronger growth potential.

Additionally, the pharmaceutical sector, represented by entities like Novo Nordisk, presents a dual-edged sword—while leadership changes may add uncertainty, they can also create opportunities for new strategic directions. forecasting the market’s response to these evolving dynamics is crucial for setting informed investment strategies. As earnings reports approach, maintaining vigilance around the future outlook of these prominent stocks will be vital for investors seeking sustainable growth.

Frequently Asked Questions

What are the latest stock market updates involving Charter Communications?

Charter Communications’ stock recently rose by 7% following an announcement of its merger with rival Cox Communications. The merged entity is set to adopt the Cox Communications name within a year, reflecting a significant move in the latest stock market updates.

How did Berkshire Hathaway’s recent investment impact Constellation Brands in today’s investing news?

In today’s investing news, Constellation Brands saw its shares increase by 3.4% after Berkshire Hathaway disclosed that it has doubled its stake in the beer importer. This move makes Warren Buffett’s investment in Constellation worth approximately $2.2 billion.

What were the stock price movements for Applied Materials after their earnings report?

After Applied Materials reported a fiscal second-quarter revenue of $7.10 billion, below the expected $7.13 billion, its shares dropped 5%. This disappointing earnings report triggered notable stock price movements on Wall Street.

What influenced Take-Two Interactive Software’s stock performance this week?

Take-Two Interactive Software’s shares fell by 1.3% largely due to the company’s weaker-than-expected guidance for full-year bookings, which are projected between $5.9 billion and $6 billion. This fell short of the anticipated $7.82 billion, impacting their stock performance based on the latest stock market news.

What are Cava’s expectations for same restaurant sales growth according to recent stock market news?

Cava has announced expectations for a moderation in same restaurant sales growth throughout the year, projecting a full-year improvement of 6% to 8%. This comes after a strong first quarter performance despite a slight decline in shares.

Why did Doximity experience a significant drop in stock price recently?

Doximity’s stock tumbled 19% after the company issued disappointing guidance for first-quarter adjusted EBITDA, which is expected to be less than the market consensus of $74 million, leading to significant stock price movements in today’s market.

What recent acquisition boosted Vistra Corp.’s stock by over 5%?

Vistra Corp.’s stock surged more than 5% after the company acquired seven natural gas facilities for $1.9 billion from Lotus Infrastructure Partners. This acquisition is part of Vistra’s strategy to enhance its portfolio in key markets.

How did Novo Nordisk’s leadership change affect its stock performance?

Shares of Novo Nordisk slipped 5% after CEO Lars Fruergaard Jørgensen announced his departure amid market challenges. His step down created uncertainty, affecting investor confidence and contributing to the stock’s decline.

| Company | Stock Movement | News |

|---|---|---|

| Charter Communications | +7% | Merger with Cox Communications, name change expected. |

| Constellation Brands | +3.4% | Berkshire Hathaway doubled its stake to $2.2 billion. |

| Applied Materials | -5% | Q2 revenue fell short of expectations ($7.10B vs $7.13B). |

| Take-Two Interactive | -1.3% | Weaker guidance for full-year bookings; expectations missed. |

| Cava | Little Changed | Quarterly earnings exceeded estimates but full-year growth outlook lowered. |

| Doximity | -19% | Disappointing guidance for Q1 and full-year revenue. |

| Vistra Corp. | +5% | Acquired seven natural gas facilities for $1.9 billion. |

| Novo Nordisk | -5% | CEO announced resignation amid market challenges. |

Summary

In today’s stock market news, several companies are making headlines with significant movements in their stock prices. Charter Communications has made a notable gain of 7% following its merger announcement with Cox Communications. Conversely, Doximity has faced a sharp decline of 19% due to disappointing future guidance. Meanwhile, Vistra Corp. shows strong performance after acquiring natural gas facilities for $1.9 billion. These developments highlight the dynamic nature of the market and point to the importance of staying informed on stock market news to anticipate future trends.