Stock Market Outlook June 2025: Key Factors to Watch

As we look ahead to the stock market outlook June 2025, investors are poised to interpret a range of economic signals that could shape market dynamics. Key factors to monitor include ongoing discussions surrounding Federal Reserve interest rates and their implications on investor sentiment. Additionally, the repercussions of Trump’s trade policies could stir volatility, particularly in sectors dependent on international trade agreements. Analysts are keenly observing the correlation between these policy moves and the anticipated growth of US manufacturing jobs, which remain a crucial aspect of economic recovery. As trends in inflation data emerge, understanding these variables will be critical for making informed stock market predictions in the coming weeks.

In the summer of 2025, the financial landscape is set for a tumultuous period, as stakeholders analyze various economic factors influencing market performance. The central bank’s monetary policies, particularly regarding interest rate adjustments, will serve as a primary concern among market strategists. Furthermore, the political arena, particularly regarding trade agreements initiated by former President Trump, remains influential on overall market health. Investors are also examining the potential resurgence of manufacturing jobs in the United States as a bellwether for economic vitality. As these themes dominate conversations about stock market forecasts, professionals will need to stay vigilant in their assessments of market fluctuations.

Understanding Market Trends: Stock Market Outlook June 2025

As we approach June 2025, investors are keenly observing the stock market outlook, particularly for the week of June 2-6. The combination of economic indicators and geopolitical events is shaping market predictions significantly. With the Federal Reserve’s interest rates playing a critical role, any changes in monetary policy will likely influence trading strategies. Investors are advised to stay alert to these market trends and adjust their portfolios to mitigate risks associated with rate fluctuations and investor sentiment.

In the current market environment, there’s a growing tension between anticipated economic recovery and rising costs due to inflation. This conflicting dynamic makes the stock market outlook particularly unpredictable. Analysts suggest that the stock market may experience heightened volatility as participants react to new data, including consumer spending and jobless claims indicators. Hence, aligning investment strategies with the anticipated trends and potential Federal Reserve actions will be crucial.

Impact of Trump’s Trade Policies on Market Sentiment

Trump’s trade policies continue to influence stock market sentiment significantly as we head into June 2025. The uncertainty surrounding tariffs and international trade agreements has spawned conflicting views among investors, resulting in a cautious trading atmosphere. Analysts are assessing how these policies will affect consumer confidence and the broader U.S. economy, especially in the context of manufacturing jobs. The expectation for job growth under these policies is varied, with predictions indicating that tariffs might discourage certain sectors rather than invigorate the manufacturing landscape.

Moreover, many experts suggest that the prolonged geopolitical tensions resulting from these trade policies may deter investment in the stock market. Investors are becoming increasingly sensitive to news regarding tariff announcements and retaliations, which can shift market dynamics rapidly. As such, understanding the direct implications of Trump’s trade strategies is essential for investors looking to navigate the upcoming week’s complexities.

The Role of Federal Reserve Interest Rates in Market Predictions

The Federal Reserve’s interest rates are a pivotal component in shaping stock market predictions for the near future. As investors await signals from the Fed about potential rate hikes or cuts, speculation is rife on how these decisions will impact market performance. Typically, rising interest rates can strain corporate profits and consumer spending, leading to bearish market conditions. In contrast, hints at rate reductions may foster bullish sentiment, prompting increased investment in stocks.

This week, analysts will dissect upcoming announcements from the Fed that could steer market sentiment. Investors are especially keen on grasping the nuances of the Fed’s language, which may indicate how closely policymakers view economic recovery and inflation concerns. Understanding this interplay is fundamental for making informed investment decisions during this period of uncertainty.

Investor Sentiment: Navigating the Challenges Ahead

Investor sentiment is proving to be a critical factor in market behavior as we look toward early June 2025. With multiple variables at play, including economic data releases and geopolitical landscape shifts, how investors feel about the market’s direction will significantly impact stock pricing. Market psychology, driven by fear or optimism regarding economic conditions, will guide trading decisions, making it essential for investors to assess their positions diligently.

In light of the current sentiment toward inflation and Federal Reserve policies, cautious optimism seems to be the prevailing mood among investors. However, this sentiment can quickly evaporate in response to adverse market news, such as disappointing job reports or geopolitical tensions. Thus, effective risk management strategies must be adopted, allowing investors to adjust quickly to changes in sentiment that could affect their financial outcomes.

US Manufacturing Jobs: The Heartbeat of Economic Recovery

The discussion surrounding U.S. manufacturing jobs remains central as we analyze stock market dynamics in June 2025. Recent analyses indicate that there may not be the anticipated surge in manufacturing employment as a result of Trump’s trade policies, which could dampen investor expectations for robust economic recovery. The sustainability of these jobs is paramount, as they directly relate to consumer spending power and overall economic health.

Moreover, the lack of significant job growth in the manufacturing sector can lead to heightened volatility in the stock markets. Investors frequently assess job reports alongside stock performance, searching for predictive indicators of market health. As the week unfolds, attention will be on economic reports that could sway both investor sentiment and stock valuations.

Tech Stocks Under Scrutiny: Earnings and Market Reactions

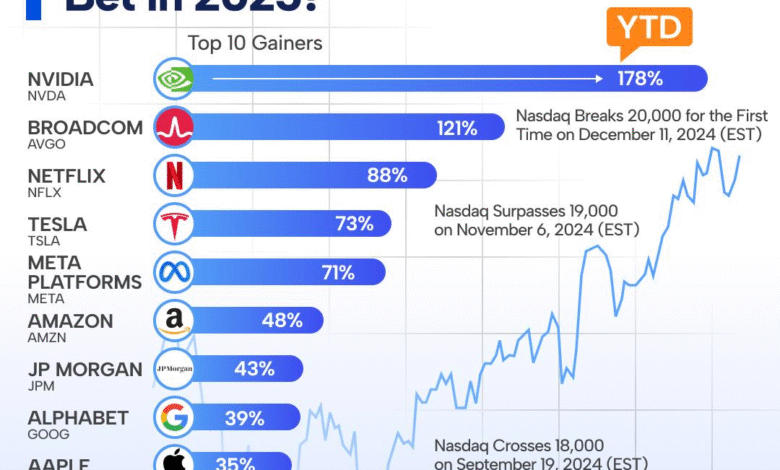

Tech stocks have remained a focal point in the stock market, especially as we analyze the outlook for June 2025. With mixed earnings reports continuing to emerge from significant players like Nvidia, investor reactions will be crucial. The concern regarding future earnings and strategic directives influences the broader tech market sentiment, prompting traders to be selective in their investments.

The mixed nature of these earnings reports signals a potential shift in how tech stocks might perform moving forward. Investors are now looking closely at guidance provided by tech CEOs, interpreting their tones and remarks as indicators of future growth potential versus operational challenges. As a result, understanding individual company metrics versus overall sector performance will be paramount for investors navigating the volatile tech landscape.

Monitoring Economic Indicators and Their Impact on Investments

This week will spotlight pivotal economic indicators that can shape the stock market’s direction. Jobless claims and consumer spending data are particularly relevant, as they offer insights into economic health and consumer confidence. A rise in jobless claims could signal trouble ahead, causing investor sentiment to shift negatively, while robust consumer spending may boost confidence and stock performance.

Investors should keep a close eye on these reports as they are likely to trigger immediate reactions in the stock market. The interplay of these indicators with geopolitical events and Federal Reserve policy announcements will create a complex environment in which investors must carefully analyze all incoming data to position themselves effectively for the week ahead.

Preparing for Market Volatility: Strategies for Success

As we prepare for the upcoming week, the potential for increased stock market volatility is palpable. With various unpredictable factors at play, including Trump’s trade policies and Fed interest rate decisions, investors must be prepared to adapt their strategies accordingly. Establishing diversified portfolios and incorporating stop-loss orders may help in managing risk during turbulent times.

Further, maintaining a vigilant approach to monitoring market developments will be crucial. Investors should continuously evaluate the broader economic landscape and how it might influence individual investments. In doing so, they can better navigate the challenges posed by volatility and position themselves for potential opportunities amid market fluctuations.

Final Thoughts on Stock Market Outlook for June 2025

Looking ahead, the stock market outlook for June 2025 presents a mixed bag of challenges and opportunities. Investors must stay attuned to how geopolitical uncertainties, the Fed’s policy, and the health of the U.S. manufacturing sector influence market movements. Understanding these interconnected factors will help in making informed investment decisions going forward.

In conclusion, preparing for the upcoming week involves not only a strategic review of current holdings but also a proactive stance towards shifting market sentiments and economic indicators. The delicate balance between optimism and caution will define investor experiences in the stock market through June 2-6 and beyond.

Frequently Asked Questions

What is the stock market outlook for June 2025 regarding investor sentiment?

The stock market outlook for June 2025 suggests that investor sentiment may remain cautious due to ongoing geopolitical tensions and uncertainties surrounding economic indicators. Concerns over inflation data and the Federal Reserve’s interest rates are likely influencing this sentiment as traders brace for potential volatility in the market.

How might Trump’s trade policies impact the stock market outlook for June 2025?

Trump’s trade policies are expected to weigh heavily on the stock market outlook for June 2025. Analysts predict that ongoing trade tensions and potential tariff changes could create volatility, affecting investor confidence and market stability. This situation could lead to uncertain predictions regarding stock performance.

What role will the Federal Reserve interest rates play in the stock market outlook for June 2025?

The Federal Reserve’s interest rates will significantly influence the stock market outlook for June 2025. As investors monitor inflation data and the Fed’s monetary policy decisions, any changes in interest rates could affect borrowing costs and overall economic activity, thereby guiding market trends.

What stock market predictions can we expect for tech stocks in June 2025?

Given recent mixed earnings reports and ongoing geopolitical events, the stock market predictions for tech stocks in June 2025 indicate increased scrutiny and potential instability. Companies like Nvidia may face market pressure as investors react to both earnings results and broader economic indicators.

Will U.S. manufacturing jobs impact the stock market outlook in June 2025?

The stock market outlook in June 2025 may be negatively affected by the stagnation of U.S. manufacturing jobs. Analysts suggest that lackluster job growth, partly attributed to Trump’s trade policies, could exacerbate market reactions and investor uncertainty, hindering overall market performance.

How will jobless claims influence the stock market next week in June 2025?

Jobless claims are key economic indicators that could shape stock market trends in June 2025. Any significant changes in jobless claims could impact investor sentiment and, consequently, the stock market outlook, highlighting the ongoing relationship between employment figures and market performance.

What economic indicators should investors watch for when considering the stock market outlook for June 2025?

Investors should closely monitor inflation data, jobless claims, and consumer spending figures for insights into the stock market outlook for June 2025. These indicators will provide critical information regarding economic health and may influence trading decisions as the month progresses.

| Key Point | Details |

|---|---|

| Geopolitical Uncertainties | Investors are concerned about how geopolitical events will impact the stock market. |

| Inflation Data Focus | Market discussions will center around inflation data and interest rate policies set by the Federal Reserve. |

| Impact of Trump’s Trade Policies | Predicted to weigh on market sentiment, with tariff-related volatility expected. |

| Wells Fargo Analysis | Tariffs may not revive U.S. manufacturing jobs as hoped. |

| Tech Stocks Scrutiny | Companies like Nvidia are in focus due to mixed earnings reports. |

| Upcoming Economic Indicators | Jobless claims and consumer spending figures may influence market movements. |

| Investor Sentiment | Expectations of increased volatility as information unfolds during the week. |

Summary

The Stock Market Outlook for June 2025 indicates a period of heightened uncertainty as various factors come into play. As investors prepare for the week of June 2-6, 2025, the focus will remain on inflation and the Federal Reserve’s monetary policy decisions. The implications of Trump’s trade policies, particularly regarding tariffs, present risks that could lead to increased volatility in the markets. Tech stocks may also experience fluctuations based on earnings reports, influencing investor sentiment further. Overall, the stock market outlook will depend on how these economic indicators and geopolitical developments unfold, suggesting that traders should remain cautious and prepared.