Stocks After High Volatility: Historical Insights for Investors

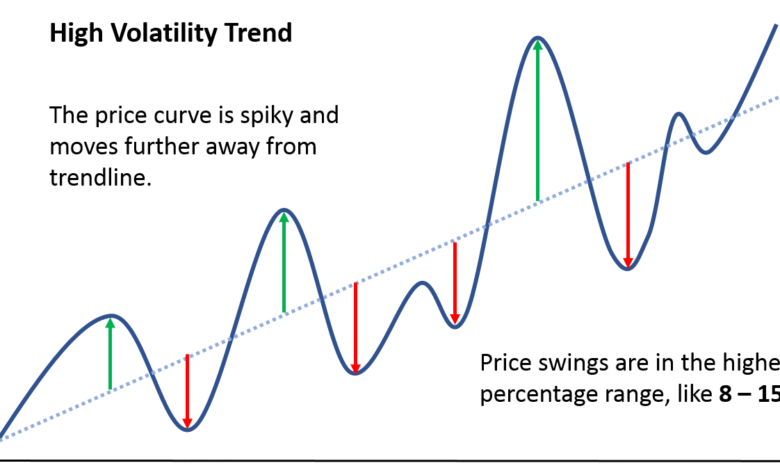

Stocks after high volatility often present a tantalizing opportunity for savvy investors. History indicates that following tumultuous times marked by heightened stock market volatility, such as that reflected by the VIX index, the S&P 500 can rebound significantly. For example, when the VIX surged above 40, analysts have observed average gains of around 30% in the subsequent year for the S&P 500. This phenomenon raises an intriguing question: should investors hold onto their assets or even consider increasing their positions in the market during these uncertain times? With market trends for 2025 leaning towards recovery, understanding these patterns can enhance investment strategies, especially given the potential for substantial S&P 500 returns after pronounced volatility periods.

When examining the aftermath of tumultuous market conditions, it’s crucial to understand how equities respond to substantial fluctuations. In the realm of investing during volatility, seasoned market participants often find themselves facing a paradox; while extreme price variations induce discomfort, they may also pave the way for considerable financial gains. The analytical lens of the VIX index allows investors to gauge expected market fluctuations, highlighting the correlation between stressful trading periods and subsequent stock performance. Ultimately, such dynamics underscore the importance of strategic investment decisions in navigating the complexities of stock market behavior, particularly in the context of projected trends for 2025.

Understanding Stock Performance After High Volatility

After experiencing periods of high volatility, stocks typically display a strong recovery trend, as observed in S&P 500 returns. History suggests that when the VIX (Volatility Index) reaches elevated levels, indicating market fear, investors can find lucrative opportunities. For instance, analysts report that following spikes in VIX above 40, the S&P 500 has historically achieved average returns of 30% within a year. This pattern presents an intriguing phenomenon where panic often precedes profit, urging investors to reconsider their strategies amidst such turbulence.

Investing during volatility may invoke fear and hesitation among many, yet the overwhelming odds favor positive stock returns in the following months. With the chances of positive returns exceeding 90% after major volatility events, it becomes apparent why seasoned investors often regard these high-stress market phases as prime opportunities for acquisition. Rather than fleeing the market, investors can harness the potential upswing that often follows the downturn. Thus, understanding market trends is essential in navigating these challenging periods.

The Impact of the VIX Index on Investment Decisions

The VIX index, known as the fear gauge on Wall Street, serves as a crucial tool in gauging market sentiment and predicting stock performance post-volatility. When the VIX experiences remarkable spikes, such as those seen during significant news events or economic shifts, it often suggests that a market correction may lead to fertile ground for future investment. By analyzing the relationship between VIX peaks and subsequent market performance, investors can make informed decisions that align with historical trends, ensuring greater chances of capitalizing on rebounds.

Market volatility and the VIX shape investor psychology, often leading to unattainable expectations during periods of heightened uncertainty. As calm returns to the market, relief rallies typically occur, where prices rebound faster than anticipated. Investors should thus pay close attention to VIX spikes, recognizing that these moments of fear can create pathways for future gains. By staying informed on VIX trends, investors can make calculated decisions that leverage these market behaviors, reinforcing the importance of strategic planning and adaptability in investment approaches.

Seizing Opportunities in Market Trends for 2025

As we look ahead to 2025, understanding market trends plays a pivotal role in investment strategies shaped by recent volatility. The transitional phases of the stock market can often lead to wealth creation for savvy investors. In periods marked by uncertainty and heightened volatility, like those prompted by political events or economic shifts, recognizing patterns can enhance investment outcomes. The cyclical nature of stock market fluctuations offers multiple entry points, encouraging investors to adopt a forward-thinking approach as they navigate future market changes.

Gaining insights into historical trends, such as the significant gains following high volatility periods, equips investors to better anticipate potential outcomes and develop resilient investment strategies. By preparing for varying market climates, investors cultivate an agile mindset that embraces change and capitalizes on emerging trends. As we approach 2025, positioning oneself strategically during these volatile intervals can lead to substantial long-term growth, making it a wise endeavor for those looking to strengthen their portfolios amidst uncertainty.

Navigating Investor Psychology During Market Volatility

Investor psychology plays a significant role during turbulent times in the stock market. High volatility often incites feelings of fear and uncertainty, which can lead to impulsive decisions, such as liquidating assets. Yet, a deeper understanding of historical performance teaches investors that such emotional responses may hinder potential gains, particularly when the historical data suggests that volatility can precede substantial market rallies. Recognizing the common emotional pitfalls during these fluctuations can empower investors to maintain a level-headed approach, ultimately benefiting their financial strategies.

Furthermore, education regarding market trends and the nature of stock volatility helps investors navigate their emotions while making informed choices. It’s important to remember that investor panic often correlates with the best opportunities for investment, especially when VIX levels indicate significant volatility. As market conditions fluctuate, adapting one’s strategy and reframing threats as opportunities can greatly enhance an investor’s chances of achieving favorable long-term results.

Evaluating Long-Term Returns in High Volatility Environments

High volatility environments can often deter investors, yet they serve as critical junctures for evaluations of long-term returns. Studies reveal that, contrary to market sentiment at the time, assets tend to recover and yield substantial gains. By focusing on investments with a long-term horizon, investors can mitigate the short-term fear created by volatile conditions, instead aligning their strategies with the likelihood of robust returns in the future. This long-term outlook fosters resilience in the face of temporal market frustrations, potentially lifting returns above the averages seen during stable periods.

Moreover, understanding that significant selloffs often set the stage for future escalation is key. Historical analysis backing the trend that the S&P 500 rebounds strongly after periods of high volatility demonstrates the importance of patience and planning. As such, investors willing to endure the short-term fluctuations typically emerge as stronger participants in the market, reinforcing the philosophy of buying during fear and selling during greed. Embracing this paradigm can develop a more profound commitment to informed investment practices.

Capitalizing on Short-Term Rally Opportunities

Investors must recognize that volatility can introduce short-term rally opportunities within broader market trends. Following substantial declines, relief rallies typically prompt stock prices to rebound significantly, often leading to quick wins for those who remain active participants in the market. Understanding historical patterns allows investors to spot these windows of opportunity, equipping them to act promptly and decisively when conditions start to shift positively post-volatility.

Remaining vigilant means keeping tabs on indicators such as the VIX, which can signal potential recovery phases. When volatility subsides, buying momentum often accelerates, creating an advantageous environment for accumulating stocks. Thus, those who perceive high volatility not merely as obstacles, but rather as chances for tactical gains, position themselves to profit from the oscillations of the stock market. Active engagement during these rallies can prove to be beneficial for building a robust investment portfolio.

The Role of Historical Data in Predicting Future Volatility

Historical data serves as a foundational pillar for predicting future stock market volatility, guiding investors through turbulent conditions. By studying past market behavior during similar periods of uncertainty, one can discern patterns that may repeat. For instance, the analysis of the S&P 500’s recovery following significant VIX spikes has consistently shown bullish trends, encouraging investors to align their portfolios accordingly. This reliance on historical data allows for more informed decision-making amidst unpredictable circumstances.

Moreover, recognizing that high volatility often precedes recovery creates a unique angle for forecasting market potential. Investors can equip themselves with insights into future market trajectories by analyzing previous downturns and subsequent upswings. By staying abreast of historical instances where market corrections have led to significant rebounds, investors can strengthen their confidence in making decisions during contemporary fluctuations, bridging their investment journeys with the lessons of the past.

Strategic Investment Approaches Amidst Market Uncertainty

Adopting a strategic investment approach during times of market uncertainty is critical for long-term success. Investors must focus on diversification and sector allocation to navigate high volatility effectively. Diversifying investments across various sectors can minimize risk, ensuring that a downturn in one area does not adversely impact the overall portfolio. By identifying industries historically more resilient during volatile periods, investors can target opportunities that provide growth potential while balancing risks.

Furthermore, dollar-cost averaging becomes a practical strategy when investing during volatility. By systematically investing a consistent amount over time, investors can capitalize on lower prices during market selloffs without trying to time the market perfectly. This approach helps mitigate the emotional decision-making that can derail sound investment strategies and enhances the chance of higher returns as it effectively capitalizes on market rebounds. As such, a well-planned investment strategy can be a powerful asset in harnessing the opportunities presented by periods of high volatility.

Utilizing Market Trends to Implement Proactive Investment Strategies

Leveraging market trends to implement proactive investment strategies is essential for capitalizing on fluctuations in stock prices. Investors are encouraged to develop a keen eye for recognizing downturns associated with volatility, utilizing them as entry points. By staying attuned to market signals, such as changes in the VIX and broad economic indicators, investors can adopt a proactive stance that empowers them to seize opportunities as they arise.

Moreover, integrating market trends into investment frameworks allows for refining risk management practices. A comprehensive understanding of how volatility affects market sentiment enables investors to structure their portfolios favorably, ultimately enhancing potential returns. By combining knowledge of historical trends with proactive strategies, investors can position themselves effectively to navigate the shifting landscape of the stock market, ensuring sustained growth amid volatility.

Frequently Asked Questions

What typically happens to stocks after periods of high volatility in the S&P 500?

Historically, stocks in the S&P 500 tend to experience significant gains in the year following periods of high volatility, as indicated by the VIX index. Analyses show that when the VIX spikes above 40, the S&P 500 averages a 30% increase in the following year, with over 90% of such instances resulting in positive stock returns.

How does stock market volatility influence investing strategies?

Stock market volatility often creates investment opportunities. Historically, periods of high volatility, including those marked by high VIX levels, are associated with subsequent higher returns, suggesting that investors might consider buying stocks during such periods rather than selling.

Can the VIX index be used to predict future stock performance?

Yes, the VIX index, known as the Wall Street fear gauge, measures expected volatility in the S&P 500. A high VIX often precedes significant stock market recoveries, making it a useful indicator for investors looking to gauge potential future stock performance.

What are the implications of investing during periods of high stock market volatility?

Investing during high stock market volatility can be advantageous, as history shows that stocks often rebound strongly afterward. With volatility often leading to investor panic, these periods can provide unique buying opportunities that may yield higher returns over the next 12 months.

What market trends can we expect for stocks following high volatility events?

Market trends suggest that after high volatility events, particularly indicated by a VIX above 40, the S&P 500 is likely to recover with substantial gains in the following year. This trend is rooted in historical patterns observed in the stock market.

Should investors sell their stocks during periods of high volatility?

Investors are generally advised against selling stocks during periods of high volatility. Historical data indicates that markets typically recover and yield positive returns after spikes in volatility, suggesting that holding or buying more stocks can be a more beneficial strategy.

What historical patterns exist for stock performance after volatility spikes?

Historical patterns show that after spikes in the VIX, particularly above 40, the S&P 500 has often rebounded strongly. About half of significant selloffs of 10% or more have seen a recovery within a week, indicating the potential for rapid gains following high volatility.

What factors contribute to the potential success of investing after high volatility?

The potential success of investing after high volatility stems from high drawdowns and investor panic leading to reduced stock prices. This psychological impact creates a favorable environment for investment, as stocks often recover from these lows.

How can relief rallies affect stock performance after high volatility?

Relief rallies can significantly impact stock performance following high volatility. Following extreme volatility events, if market reactions are less severe than expected, investors may quickly re-enter the market, leading to rapid price recoveries.

What advice do analysts give regarding stock investments during volatile periods?

Analysts often recommend that investors view periods of high volatility as opportunities. Rather than panicking, long-term investors are encouraged to strategize their purchases, taking advantage of lower stock prices for potential significant gains in the future.

| Key Point | Details |

|---|---|

| S&P 500 Gains Post-Volatility | The S&P 500 typically sees significant gains in the year following periods of high volatility, as indicated by the VIX. |

| VIX Measurement | The VIX index measures expected volatility; spikes above 40 correlate with future gains of 30% in the following year. |

| Opportunities in Volatility | Periods of high volatility create potential investment opportunities, contrary to investor panic and fear. |

| Relief Rallies | Low expectations often lead to relief rallies after sell-offs, as recovery can happen quickly. |

| Investing Strategy | Analysts advise against selling during volatile times and suggest that long-term investors should consider buying. |

Summary

Stocks after high volatility tend to rebound strongly, providing investors a unique opportunity. Historical data indicates that following spikes in market volatility, particularly as measured by the VIX, the S&P 500 has often experienced significant gains within a year. This pattern highlights the importance of remaining invested rather than reacting emotionally during downturns, as panic selling can lead to missed opportunities. Instead, investors are encouraged to view high volatility periods as chances to purchase stocks at lower prices, setting the stage for substantial returns as the market stabilizes.