Stocks Making Big Moves Midday: Key Market Highlights

Stocks making big moves are capturing the attention of investors and traders alike as midday trading heats up. Tesla, known for its groundbreaking electric vehicles, is currently on the rise thanks to promising production figures that exceeded expectations. Meanwhile, IBM’s shares are climbing after the announcement of an innovative AI product, suggesting a strong future in cloud computing. Union Pacific is facing challenges as its stock dips due to a reported decline in freight demand, raising questions about the company’s earnings ahead. In contrast, American Eagle Outfitters is shining bright, reporting impressive earnings driven by robust online sales, which have kept investors optimistic despite overall market volatility.

The financial landscape is constantly shifting, with specific equities making significant strides as the trading session progresses. Major players like Tesla and IBM are at the forefront of market discussions, especially with the recent surge in interest surrounding electric vehicles and AI technologies. Conversely, Union Pacific’s recent stock depreciation highlights the importance of staying informed about industry trends and their impact on performance. Notably, American Eagle Outfitters stands out with its positive quarterly results, reflecting a successful adaptation to consumer needs. As these midday stock updates pour in, market participants remain vigilant in analyzing the dynamics shaping today’s investment opportunities.

Tesla Stock News: Driving Market Momentum

Tesla’s recent surge in stock price can be attributed to its impressive production numbers that surpassed market expectations. Investors and analysts are buzzing with excitement over the company’s ability to scale its manufacturing processes effectively. The latest figures indicate a robust increase in vehicle production and deliveries, affirming Tesla’s dominant position in the electric vehicle (EV) market. This positive momentum in Tesla stock is not only bolstering investor confidence but also reshaping perceptions about the EV sector’s growth potential.

In addition to production metrics, Tesla’s ongoing innovations continue to attract investor interest. As the company explores advancements in autonomous driving technology and battery efficiency, analysts predict further increases in stock value. The supportive environment for EVs, bolstered by rising demand and expanded manufacturing capabilities, positions Tesla favorably against competitors. Therefore, vigilant investors should remain attentive to Tesla’s quarterly earnings reports as they often provide deeper insights into the company’s strategic direction.

Union Pacific Stock Analysis: Navigating Turbulent Waters

Union Pacific has faced a challenging period with recent reports indicating a decline in freight demand. This downturn has raised eyebrows among investors and stock analysts, prompting concerns about potential earnings impacts. As one of the largest freight rail networks in North America, Union Pacific’s performance often serves as an economic indicator; lower demand could suggest a broader economic slowdown. This is particularly relevant in the face of current volatility in markets, affecting investor sentiment around Union Pacific stock.

Moreover, the downward trend in Union Pacific’s stock highlights the importance of closely monitoring freight transportation trends. While the company holds a substantial share of the rail market, external factors such as fluctuating commodity prices and changing trade flows could significantly influence its operations. Analysts are encouraged to balance the current challenges with the company’s strategic initiatives to optimize operations and cost-effectiveness, which could spur a turnaround in stock performance.

IBM AI Product: Revolutionizing Cloud Technology

In a surprising turn for investors, IBM’s stock saw an uptick following the announcement of a new AI-driven product designed to enhance the cloud experience for businesses. This product aims to leverage artificial intelligence to optimize cloud operations, positioning IBM at the forefront of the tech industry. The positive market reception reflects a broader trend of businesses adopting AI solutions to drive efficiency and productivity, underpinning expectations for strong future growth.

IBM’s commitment to innovation within its cloud offerings aligns perfectly with the current demand for advanced tech solutions. By integrating AI capabilities, the company could significantly differentiate itself from competitors. With a market increasingly leaning towards intelligent computing, IBM’s strategic moves into AI stand to enhance its appeal to investors and stakeholders looking for growth opportunities within the tech sector.

American Eagle Outfitters Earnings: A Strong Retail Performance

American Eagle Outfitters recently reported its quarterly earnings, showcasing exceptional results that exceeded analyst expectations. The strong performance is largely credited to robust online sales and an effective back-to-school campaign that resonated well with consumers. This remarkable growth amid a competitive retail environment signals that the company is adapting well to shifting consumer behaviors and preferences, which is crucial for sustaining stock performance.

The retail landscape is rapidly evolving, and American Eagle’s agility in leveraging e-commerce strategies is proving beneficial. Investors interested in retail stocks should take note of how the company’s initiatives respond to changing trends, particularly the increasing importance of digital sales channels. With consumer demand for online shopping remaining high, American Eagle’s proactive approach positions it strongly for future earnings growth, making it a focal point for value-driven stock investments.

Midday Stock Updates: Key Movers to Watch

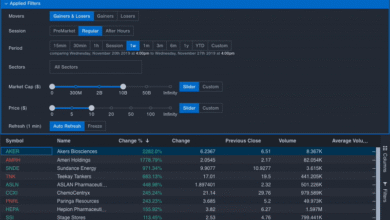

As midday trading unfolds, several stocks are making significant moves that warrant attention from investors. Companies like Tesla, IBM, Union Pacific, and American Eagle Outfitters are at the forefront, showcasing fluctuations that may set the tone for the remainder of the trading day. Staying abreast of these updates is essential for making informed investment decisions, as market conditions can change rapidly, impacting stock prices and investor outlook.

Investors should utilize midday stock updates not only to track performance but also to identify emerging trends and potential opportunities. With the interconnected nature of the market, developments in one sector can influence others, leading to substantial ripple effects. Thus, keeping an eye on stocks making big moves during the afternoon session may reveal insights into broader market dynamics, ultimately guiding investment strategies for success.

Frequently Asked Questions

What recent news is driving Tesla stock’s big moves?

Tesla stock is making big moves due to recent production numbers that exceeded Wall Street’s expectations. Investors are reacting positively to a significant increase in production and delivery metrics compared to previous quarters, leading to a surge in the stock’s price.

How is IBM’s new AI product affecting its stock performance?

IBM’s stock is experiencing notable gains following the announcement of a new AI-driven product aimed at improving cloud services. This innovative development suggests strong future growth potential, making IBM stock one to watch as it makes big moves in the tech sector.

What factors are influencing the midday stock update for Union Pacific?

Union Pacific stock is currently facing challenges, with a dip in share prices due to a reported slowdown in freight demand. This situation raises concerns regarding the company’s earnings outlook, contributing to its notable movements in the market.

What are the latest earnings results for American Eagle Outfitters, and how are they impacting its stock?

American Eagle Outfitters stock is making big moves as the company reports better-than-expected quarterly results. Strong online sales and a successful back-to-school campaign have driven gains, reflecting positively on the stock’s performance in today’s market.

How do midday stock updates reflect market sentiment on companies like Tesla and IBM?

Midday stock updates provide insight into market sentiment, as seen with Tesla and IBM. Positive news such as Tesla’s production increase and IBM’s AI product launch can lead to significant stock movements, indicating investor confidence and reactions to company performance.

| Company | Stock Symbol | Recent Movement | Reason for Movement |

|---|---|---|---|

| Tesla | TSLA | Up | Investors reacting positively to increased production and delivery numbers. |

| IBM | IBM | Up | Unexpected rise after the launch of a new AI-driven product. |

| Union Pacific | UNP | Down | Stock price falls due to reports of declining freight demand. |

| American Eagle Outfitters | AEO | Up | Notable gains from better-than-expected quarterly results due to strong online sales. |

Summary

Stocks making big moves this midday include notable players like Tesla, IBM, Union Pacific, and American Eagle Outfitters. Tesla’s stock is on the rise following positive production metrics, while IBM has seen an unexpected increase due to its innovative AI product launch. Meanwhile, Union Pacific’s stock has dipped amid concerns over freight demand, impacting its earnings outlook. Conversely, American Eagle Outfitters is thriving with strong quarterly results, primarily fueled by online sales. These movements reflect dynamic shifts in investor sentiment, closely tied to company performance and market trends.