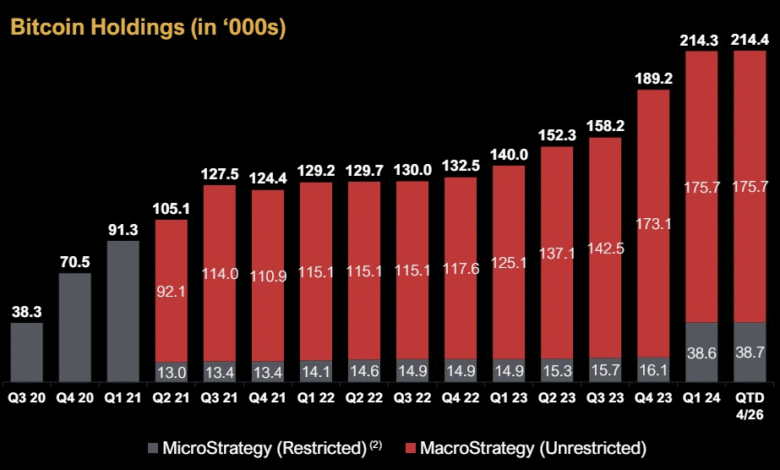

Strategy Bitcoin Holdings: Now at 628,946 BTC Acquired

Strategy Bitcoin Holdings is making headlines once again as it expands its impressive portfolio, recently acquiring an additional 155 BTC. This latest addition, valued at approximately $18.0 million, brings Strategy’s total holdings to an astounding 628,946 Bitcoins. Founded by Michael Saylor, the company has positioned itself as a leading investor in the cryptocurrency landscape, solidifying its influence among Bitcoin corporate holders. With this acquisition, Strategy not only showcases its commitment to a robust Bitcoin strategy but also continues to drive market dynamics in its favor. The company’s substantial holdings represent over 3% of the total Bitcoin supply, making its market influence pivotal to future trends in cryptocurrency investing.

Introducing Strategy Bitcoin Holdings, a formidable player in the cryptocurrency arena, which has recently bolstered its assets with a strategic purchase of 155 Bitcoins. This move, led by its founder Michael Saylor, highlights a calculated approach to Bitcoin accumulation, reinforcing its position as a dominant corporate entity within the digital currency sphere. The holding of 628,946 BTC signifies not just wealth but also a critical influence in the ever-evolving Bitcoin marketplace. As one of the largest stakeholders, Strategy’s actions are likely to shape investor sentiments and market trends, establishing it as a key figure in the ongoing narrative of Bitcoin acquisition and corporate engagement with digital assets. This strategic positioning showcases a visionary path toward leveraging Bitcoin’s potential for long-term growth.

Michael Saylor’s Leadership in Bitcoin Acquisition

Michael Saylor has emerged as a pivotal figure in the world of Bitcoin, particularly through his leadership at Strategy. His vision for digital currency adoption has propelled the company to become the largest corporate holder of Bitcoin, amassing an impressive 628,946 BTC. This strategic acquisition not only underscores Saylor’s commitment to Bitcoin but also highlights his understanding of the market dynamics that benefit from such investments. Saylor’s insights into Bitcoin’s potential have fostered a culture within Strategy that prioritizes long-term growth and sustainability in the cryptocurrency market.

Under Saylor’s guidance, the company’s approach to Bitcoin acquisition, often referred to as “Strategy BTC acquisition,” has contributed significantly to its portfolio diversification. By leveraging market downturns and seizing buying opportunities, Strategy has positioned itself as a leader among Bitcoin corporate holders. The calculated decision to invest approximately $18 million into another 155 Bitcoin serves as a testament to Saylor’s strategic foresight and his belief in Bitcoin’s potential to yield significant returns in the future.

Impact of Strategy’s Bitcoin Holdings on Market Dynamics

With a staggering 3.16% of the total circulating Bitcoin supply, Strategy’s holdings have considerable influence over the market. This status as the largest corporate holder amplifies Strategy’s voice in discussions related to Bitcoin pricing and market trends. As the market continues to evolve, such corporate investments are crucial indicators of Bitcoin’s acceptance among institutional investors. The presence of influential players like Strategy can lead to increased legitimacy for Bitcoin, attracting further investment from both institutional and retail investors.

Moreover, Strategy’s continued accumulation of Bitcoin can significantly affect market stability and pricing dynamics. As seen in previous trends, large acquisitions can lead to upward pressure on Bitcoin prices, especially when market sentiment is bullish. The recent news of acquiring additional Bitcoin at around $116,401 per unit reflects a growing confidence in the asset’s future performance. Therefore, Strategy’s strategy and its substantial holdings play a vital role in shaping Bitcoin market influence, solidifying its position as an essential asset class.

The Significance of Holding 628,946 BTC

Holding 628,946 BTC is not just a numerical achievement; it represents a strategic milestone for Strategy in the ever-competitive cryptocurrency landscape. This impressive quantity equates to a staggering investment of approximately $46.09 billion, making Strategy a key player amid Bitcoin corporate holders. By holding such a significant amount of Bitcoin, Strategy not only manifests its belief in the asset’s value but also signals to the market the potential for further institutional adoption. This level of investment showcases a profound commitment to the digital currency ecosystem, indicating confidence in Bitcoin’s scalability and longevity.

Moreover, the yield of 25.0% year-to-date, as reported by Saylor, demonstrates that Strategy’s investment strategy is not merely about holding but also optimizing returns from their Bitcoin assets. As the cryptocurrency market evolves, such yield rates can reinforce investor confidence and highlight an effective strategy for capital growth. Holding a considerable share of Bitcoin also allows Strategy to engage more actively in transactions and innovations within the blockchain technology space, positioning itself as a beacon for future advancements in cryptocurrency investments.

Bitcoin’s Role in Corporate Investment Strategies

As the digital asset landscape matures, Bitcoin continues to be a focal point in corporate investment strategies. Companies like Strategy, led by Michael Saylor, are pioneering this trend by incorporating Bitcoin into their portfolios. This shift towards cryptocurrency reflects a broader acceptance among corporate holders seeking diversification and hedging against inflation. By viewing Bitcoin as not just a speculative investment but as a viable reserve asset, corporations are reshaping their financial strategies to align more closely with innovative technological trends.

Furthermore, Bitcoin’s resilience in the face of market volatility makes it an attractive option for corporate investment, allowing firms to navigate economic uncertainty while potentially reaping substantial gains. The influence of Strategy’s substantial holdings also serves as a blueprint for other corporations considering similar paths. The critical takeaway is that Bitcoin’s strategic importance in corporate finance is increasingly recognized, and organizations that integrate cryptocurrencies into their investment strategies may stand to benefit significantly in the long run.

The Future of Bitcoin Holdings in Corporate Finance

Looking ahead, the trajectory of Bitcoin holdings within corporate finance seems increasingly promising. With bold moves by companies like Strategy, there is a high likelihood that more firms will follow suit, further institutionalizing Bitcoin as an asset class. The presence of significant holders can lead to increased confidence among smaller investors, which can result in heightened market activity and price stabilization. This domino effect could spark a new wave of corporate participation while simultaneously reinforcing Bitcoin’s position as a mainstream financial asset.

Moreover, as the regulatory environment for cryptocurrencies continues to evolve, companies that have already established substantial Bitcoin holdings may have competitive advantages. By positioning themselves early in the market, these corporations could benefit from potential regulatory clarifications and innovations that facilitate broader adoption. Thus, the strategies employed by firms like Strategy may not only determine their success but also impact the overall progression of Bitcoin in the financial landscape.

Understanding Bitcoin Yield and Its Implications

The concept of yield in the context of Bitcoin is pivotal for investors aiming to evaluate the profitability of their cryptocurrency holdings. As outlined by Michael Saylor, Strategy has achieved an impressive yield of 25.0% year-to-date, turning heads within the investment community. Yield represents the earning potential of an asset over a specific timeframe, and in the case of Bitcoin, this metric can guide corporate holders like Strategy in making informed decisions regarding their portfolios. By optimally managing holdings to maximize yield, companies can enhance their financial performance amidst the inherent fluctuations of the cryptocurrency markets.

Moreover, understanding Bitcoin yield also aids in assessing long-term investment strategies. Corporate entities looking to enter the Bitcoin space can benefit from analyzing previous yield data alongside market trends. As Strategy’s performance highlights, the potential for a substantial yield creates a compelling argument for more organizations to explore Bitcoin as a viable component of their investment portfolios. Ultimately, awareness of yield implications may drive a greater emphasis on informed decision-making and active management of Bitcoin holdings among corporate investors.

The Growing Importance of Bitcoin Corporate Holders

As Bitcoin gains traction as a mainstream financial asset, the role of corporate holders becomes increasingly significant. Companies like Strategy not only demonstrate individual commitment to Bitcoin but also serve as case studies in corporate responsibility and risk management within the cryptocurrency space. Their substantial holdings reflect confidence in Bitcoin’s potential for long-term growth, while also influencing market perceptions among other potential investors. This trend of increasing corporate ownership could lead to a more stable Bitcoin ecosystem, as large holders often have vested interests in maintaining the asset’s value.

Additionally, the rise of corporate Bitcoin holders might encourage more businesses to evaluate their treasury management practices. By incorporating Bitcoin into their asset allocations, companies can diversify risks and hedge against inflation-induced financial pressures. This paradigm shift in corporate financing, driven by giants like Strategy, is indicative of the growing recognition of Bitcoin’s strategic value. As more corporations embrace this digital currency, it paves the way for broader acceptance and integration within the global financial system.

Exploring the Market Influence of Major Bitcoin Holdings

Analyzing the market influence stemming from significant Bitcoin holdings is crucial for understanding the cryptocurrency’s economic dynamics. Major players like Strategy contribute to market fluctuations due to their ability to buy or sell large quantities of Bitcoin. This ability not only affects market prices but also influences public perception around the viability and stability of Bitcoin as an investment. Keen market participants often watch these corporate holders closely, looking for signs of confidence or bearish sentiment that could sway the overall market direction.

Consequently, major holders have a responsibility to maintain transparency regarding their activities and the implications of their holdings. As Strategy continues to grow its Bitcoin stature, its market influence can foster an environment of trust and stability that can attract additional investments from both institutional and retail fronts. By fostering legitimacy within the market, corporations like Strategy play a foundational role in the future stability and growth of Bitcoin.

Strategic Growth of Bitcoin Holdings into 2025 and Beyond

The strategic growth of Bitcoin holdings into 2025 and beyond is indicative of the evolving landscape of institutional investment. With companies like Strategy leading the way, the narrative surrounding Bitcoin is shifting from skepticism to acceptance. As they continue to accumulate Bitcoin at significant rates, there lies an expectation for more institutions to recognize Bitcoin’s value proposition, thereby increasing their participation in this digital frontier. The recent news of Saylor’s acquisition of another 155 BTC further reinforces a commitment to strategic growth, setting benchmarks for others to follow.

In the coming years, as Bitcoin’s network effect strengthens and more enterprises consider the benefits of holding digital assets, we are likely to see an explosion in corporate Bitcoin investments. This could result in increased collaboration between tech firms, financial institutions, and cryptocurrency enterprises, paving the way for innovative solutions that enhance the utility of Bitcoin. Strategy’s aggressive stance in acquiring Bitcoin reflects not only immediate benefits but also a long-term vision that incorporates sustainable growth trajectories within the crypto space.

Frequently Asked Questions

What is Strategy Bitcoin Holdings and who is Michael Saylor?

Strategy Bitcoin Holdings is a corporate entity co-founded by Michael Saylor, known for its significant acquisition of bitcoin (BTC). As of August 2025, it has amassed a total of 628,946 BTC, making it the largest corporate holder of bitcoin, with a substantial influence on the cryptocurrency market.

How much bitcoin has Strategy acquired under Michael Saylor’s leadership?

Under Michael Saylor’s leadership, Strategy Bitcoin Holdings has acquired a total of 628,946 BTC, with the latest addition being 155 BTC at a cost of approximately $18.0 million, indicating the company’s aggressive strategy in BTC acquisition.

What impact do corporate holders like Strategy Bitcoin Holdings have on the bitcoin market?

Corporate holders like Strategy Bitcoin Holdings significantly influence the bitcoin market due to their large-scale purchases. With 3.16% of the total circulating BTC, Strategy’s actions can affect market dynamics, price movements, and investor sentiment towards bitcoin.

What is the average acquisition price per bitcoin for Strategy Bitcoin Holdings?

Strategy Bitcoin Holdings has acquired its 628,946 BTC for an average price of approximately $73,288 per bitcoin, which underlines the company’s strategic approach to investing in the cryptocurrency space.

How does Strategy’s recent BTC acquisition reflect its investment strategy?

Strategy’s recent acquisition of 155 BTC for around $116,401 per bitcoin highlights its ongoing investment strategy focusing on expanding its bitcoin holdings. This approach showcases confidence in bitcoin’s long-term value and is indicative of Saylor’s bullish stance on cryptocurrency.

Why is Strategy Bitcoin Holdings considered a key player in BTC acquisition?

Strategy Bitcoin Holdings is considered a key player in BTC acquisition due to its substantial holdings of 628,946 BTC, representing over 3% of the total bitcoin supply. This strategic accumulation has cemented its status as a major influencer in the cryptocurrency market.

What are the benefits of being a large corporate holder like Strategy Bitcoin Holdings?

Being a large corporate holder like Strategy Bitcoin Holdings allows for significant market influence, potential bargaining power in bitcoin transactions, and the ability to generate yields, as evidenced by a year-to-date BTC yield of 25.0% for the company.

How does Strategy Bitcoin Holdings’ acquisition strategy differ from other corporate investors?

Strategy Bitcoin Holdings, under Michael Saylor, adopts a more aggressive bitcoin acquisition strategy compared to other corporate investors. Its focused approach on accumulating vast amounts of BTC positions it uniquely in the market, emphasizing long-term investment rather than short-term trading.

What does Michael Saylor’s leadership imply for the future of Strategy Bitcoin Holdings?

Michael Saylor’s leadership implies a forward-looking and confident approach for Strategy Bitcoin Holdings, as evidenced by its substantial BTC acquisitions and market strategies. His vision is likely to guide the company toward continued growth and influence in the bitcoin space.

What is the significance of holding 628,946 BTC for Strategy Bitcoin Holdings?

Holding 628,946 BTC is significant for Strategy Bitcoin Holdings as it not only makes it the largest corporate bitcoin holder but also enhances its market credibility and influence, enabling the company to set trends and impact prices in the cryptocurrency landscape.

| Key Point | Details |

|---|---|

| Acquisition Amount | 155 BTC for approximately $18 million at $116,401 per BTC. |

| Total Holdings | 628,946 BTC valued at around $46.09 billion at an average price of $73,288 per BTC. |

| Market Influence | Owns 3.16% of the total circulating supply of bitcoin. |

| Year-to-Date BTC Yield | 25.0% year-to-date in 2025. |

| Status | Strategy is the largest corporate holder of bitcoin as of August 2025. |

Summary

Strategy Bitcoin Holdings has significantly solidified its position in the cryptocurrency market by acquiring an additional 155 BTC, thereby bringing its total holdings to 628,946 BTC. This strategic move not only illustrates the company’s immense financial investment in the digital currency, worth approximately $46.09 billion, but also positions it as a powerful player, controlling over 3% of the total circulating supply. With a notable year-to-date BTC yield of 25.0% for 2025, Strategy Bitcoin Holdings continues to influence market dynamics, underscoring the importance of corporate investment in the evolving landscape of cryptocurrency.