Student Loan Repayment Impact on Low-Income Americans

Student loan repayment impact has emerged as a pressing issue as the U.S. Department of Education takes decisive action to resume collections on defaulted loans. Recent analysis indicates that this resurgence could extract billions from consumers each month, posing significant financial burdens, especially for low-income individuals already grappling with substantial consumer debt levels. In fact, forecasts suggest that disposable personal income may decline by as much as 1.8%, reflecting the broader ramifications of student loan delinquency amid rising tariffs and inflationary pressures. Notably, the nearly $1.6 trillion in outstanding student debt contributes extensively to the financial strain many borrowers face. As collection efforts intensify, understanding the implications of student loan repayments becomes increasingly vital for maintaining financial stability in America’s economy.

The pressure of paying off education debt is becoming a decisive factor in personal finance as federal student loan collections re-emerge. As families struggle with the aftermath of educational borrowing, the financial consequences ripple through various economic sectors, particularly affecting those in vulnerable financial situations. The increase in consumer debt and the proportion of borrowers experiencing delinquency reflect a troubling trend that could hinder overall economic health. With the U.S. Department of Education actively engaging in debt recovery efforts, the financial landscape for many individuals is poised for significant changes that warrant close attention. An understanding of the repercussions associated with these repayments is essential for both consumers and policymakers alike.

The U.S. Department of Education’s Resumption of Student Loan Collections

The U.S. Department of Education has recently made headlines by resuming collections on defaulted student loans after a five-year hiatus. This strategic move to enforce student loan repayments poses significant implications for borrowers who have found themselves struggling to keep up with their payments. According to estimates from JPMorgan, this renewed focus on collections could see billions extracted from consumer pockets monthly, with a staggering potential impact on disposable personal income. Given that low-income Americans are often more vulnerable to financial strain, this policy could exacerbate their existing challenges, particularly amidst rising consumer debt levels.

As financial institutions assess the broader effects of student loan collections, insights from analysts at Bank of America indicate that the burden will disproportionately affect subprime borrowers. For this group, the resumption of payments isn’t just a return to normalcy; it’s a financial trap that could impact their ability to manage other debt obligations, increasing student loan delinquency rates. The heightened scrutiny on collections and the resulting economic pressure may lead to cascading effects, potentially tipping a fragile financial situation into a far more precarious scenario.

The Financial Impact of Student Loans on Borrowers

The financial impact of student loans extends beyond mere numbers; it shapes the lives and decisions of millions of Americans. With student loans accounting for 30% of consumer debt after excluding mortgages, they represent a significant financial burden on borrowers. Total outstanding student loan debt in the U.S. has ballooned to $1.6 trillion, highlighting a decade-long trend of increasing reliance on such financing. This overwhelming debt load contributes to a cycle of student loan delinquency, where borrowers struggle to meet obligations, leading to further long-term financial distress.

Moreover, as student loans continue to rise, the economic landscape shifts. Reports indicate that nearly one in four borrowers are currently behind on their payments, illustrating a growing crisis. This scenario not only impacts individual borrowers but poses a risk to consumer spending at large, as households allocate finite resources toward debt repayment. The resulting strain from student loans can severely restrict discretionary income, further hampering economic growth while simultaneously increasing pressures on the U.S. Department of Education to manage its student loan portfolio effectively.

Consumer Debt Levels: A Growing Concern in Debt Management Strategies and Policy Making

As the nation grapples with consumer debt levels, the ramifications of student loan policies become ever more apparent. Rising debt levels across various sectors, including auto loans and credit cards, mean that many borrowers face competing priorities when it comes to managing their finances. The decision to resume collections on student loans by the U.S. Department of Education reflects an emerging reality where consumers are expected to balance multiple financial obligations. This scenario has led to a greater emphasis on forming effective debt management strategies that take into account the complexities of financial obligations in today’s economy.

In light of high levels of consumer debt, understanding the implications of student loans is paramount for both policymakers and borrowers. The intersection of delinquency rates and other consumer debts can create a vicious cycle that leads to long-term economic ramifications for borrowers who are unable to meet repayment obligations or access financial assistance. As consumers strive to navigate their financial realities, it underscores the need for systemic solutions that can ease the burden of student debt without adversely affecting other critical aspects of personal finance.

Understanding Student Loan Delinquency versus Defaulting

To effectively address the issues surrounding student loan repayment, it’s essential to differentiate between delinquency and defaulting. Delinquency refers to any loan with a late payment, which can signify that a borrower is struggling to keep up but has not yet reached a critical threshold of failing financial responsibilities. In contrast, defaulting indicates a more severe situation where the borrower has not made timely payments for an extended period, leading to dire consequences, such as wage garnishment or severe credit damage. This distinction is crucial for both borrowers and financial advisors when formulating repayment strategies and understanding the broader implications of student loan policy changes.

The recent spike in delinquency rates regarding student loans highlights a growing crisis in borrowers’ ability to manage their financial responsibilities. As the U.S. Department of Education resumes collections, individuals who have previously been delinquent must grapple with the risk of defaulting, driving home the importance of proactive payment management. Understanding these terms and the stakes involved provides borrowers with the necessary knowledge to navigate their financial obligations while seeking out alternative repayment solutions that can safeguard against the detrimental effects of defaulting.

The Consumer Sentiment Landscape Amid Economic Changes

Consumer sentiment plays a vital role in the economy, impacting spending and financial behavior. Over the past two months, sentiment data collected by the University of Michigan has dipped to some of its lowest recorded levels in history, with many factors contributing to this decline, including the ramifications of renewed student loan collections. For low-income borrowers, the prospect of wage garnishment and financial penalties may result in heightened anxiety, ultimately affecting their consumer behavior and willingness to engage in spending. The re-entry of student loan payments into the financial equation creates another layer of uncertainty, particularly for these vulnerable borrowers.

Despite these challenges, some economists argue that the broader economic effects of student loan collection may not be as severe as perceived. As noted by analysts like LPL’s Roach, much of the recent consumer spending activity has been dominated by higher-income earners, overshadowing the lower-income groups significantly impacted by student debts. This disconnect raises questions about the resilience of the economy in light of rising consumer pressures and the potential implications for overall economic stability.

Navigating Discretionary Income in a High Debt Environment

In a debt-heavy landscape, the significance of discretionary income becomes increasingly important for borrowers, especially in light of student loan repayment changes. With the looming threat of wage garnishment, many borrowers may find themselves grappling with reduced income levels, which can drastically alter their consumer spending habits. The negative impacts on discretionary income are particularly pronounced for those already stressed by rising living costs and job market instabilities. As disposable income declines due to renewed loan payments, families are likely to face difficult choices regarding necessary expenses versus savings and investments.

The anticipated decrease in discretionary income is alarming, particularly as economic predictions suggest that consumer spending may be a vital driver of growth in the post-pandemic economy. Borrowers confronting decreased disposable income due to student loans may be hesitant to engage in spending behaviors traditionally seen as important for economic vitality. As government and financial institutions strategize ways to alleviate these pressures, the focus must remain on fostering an environment that encourages responsible borrowing and sustainable financial practices, ensuring that borrowers can thrive despite economic challenges.

The Role of Policy in Shaping Student Loan Repayment Strategies

The landscape of student loan repayment is largely shaped by federal policy decisions. Recent policy changes underscored by President Donald Trump’s administration have reignited the conversation around student loan collections, raising concerns about borrowers’ financial stability. As lenders commence collection efforts on loans categorized as defaulted, it’s critical for policymakers to evaluate how these collections impact consumer sentiment and overall economic health. Balancing the need for accountability in loan repayments with the need for compassion and understanding of borrower situations could drive legislation to improve the repayment landscape.

Additionally, a critical examination of policies instituted by the U.S. Department of Education reveals the necessity for more sustainable repayment options, especially for low-income and subprime consumers. Creating programs that offer flexible repayment plans or loan forgiveness for qualifying borrowers could alleviate stress on struggling borrowers while ensuring responsible debt management. In this sense, policy plays an integral role in shaping not only the dynamics of student loan repayments but also the broader economic fabric, creating pathways forward for a healthier financial environment.

Economic Forecasts and the Future of Consumer Spending

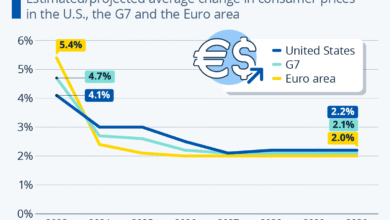

As economic forecasts suggest potential struggles for the U.S. economy, analyzing the anticipated future of consumer spending requires a closer look at how student loan repayments impact borrowers. While leaders within the financial sector express concerns about escalating consumer debt levels, the impact of student loans cannot be overlooked. If repayments begin to siphon off discretionary income from households, the ripple effect could curtail overall spending, creating a less vibrant economic landscape. The ability of consumers to navigate through higher tariffs and continued inflation portfolios also comes into play, as these factors further complicate the situation.

Moreover, projections hint at a possible divergence in consumer spending habits between different income brackets. Analysts speculate that while high-income consumers may continue to propel market dynamics, low-income borrowers facing student loan repayment challenges could further exacerbate economic stagnation. This looming reality underlines the need for policymakers to consider comprehensive solutions that address the issues of student loan burdens while bolstering consumer confidence among financially constrained individuals. Innovative approaches to easing financial pressures will be instrumental in shaping the future trajectory of consumer spending.

Addressing the Challenges of Student Loan Repayment

The challenges surrounding student loan repayment extend far beyond financial implications; they affect families, communities, and the economy at large. As collections resume, it’s vital for stakeholders to recognize the emotional and psychological toll that repayment can take on borrowers. Discussions about student loan collections often overlook the mental strain associated with accruing debt and the fear of financial instability. Providing adequate resources such as financial counseling or mental health support can help equip borrowers with the tools necessary to manage their repayment journeys effectively.

Furthermore, fostering dialogue around student loan solutions is essential for informing borrowers about their options. This encompasses not only awareness of possible repayment plans but also understanding the consequences of delinquency and defaulting versus proactive repayment methods. By emphasizing education and outreach, borrowers can be better prepared to navigate the complexities of their loans, ensuring they remain informed and empowered to make financially sound decisions. Addressing these multifaceted challenges can ultimately contribute to healthier borrowing practices and a more favorable economic environment.

Frequently Asked Questions

How does the resumption of student loan repayment impact consumers financially?

The resumption of student loan repayments significantly impacts consumers, particularly low-income individuals. According to JPMorgan, collections on defaulted student loans could decrease disposable personal income by $3.1 billion to $8.5 billion monthly, which could translate to a 0.7% to 1.8% drop in disposable income year-over-year. This reduction in income could constrain spending and worsen financial stress for affected borrowers.

What are the consequences of student loan collections on borrowers?

Borrowers facing student loan collections may experience severe consequences, including wage garnishment and penalties for falling behind on payments. The U.S. Department of Education’s increased focus on collections could lead to a significant rise in student loan delinquency, impacting nearly 25% of all borrowers if enforcement continues. Such financial pressures create challenges for borrowers, especially those already in fragile economic conditions.

What role does student loan delinquency play in overall consumer debt levels in the U.S.?

Student loan delinquency contributes to the rising consumer debt levels in the U.S., which currently comprises about 30% when excluding mortgages. The New York Fed reports that nearly one in four borrowers are currently delinquent on their student loans, a drastic increase that reflects broader financial instability. This growing delinquency can strain overall consumer finances and impact economic stability.

How might the financial impact of student loans affect consumer sentiment?

The financial impact of student loans, particularly through increased collections, can negatively affect consumer sentiment. With reduced disposable income due to wage garnishment or penalties, consumers may feel more stressed and pessimistic about their financial outlook. Recent data from the University of Michigan indicates a notable decline in consumer sentiment, which may be attributed to the burden of student loan repayments amid already high prices and inflation.

What are the implications for low-income borrowers in the context of student loan repayment impact?

Low-income borrowers are at a greater risk of facing severe repercussions from the resumption of student loan repayments. Wall Street analysts warn that these borrowers could experience the most significant financial strain as their disposable income diminishes due to collections. This situation creates unique challenges for them, particularly as they navigate high consumer debt levels and overall economic pressures.

What strategies can borrowers utilize to manage the impact of student loan repayments?

Borrowers can manage the impact of student loan repayments by exploring income-driven repayment plans, seeking loan deferment or forbearance options, or working with loan servicers to address repayment terms. Staying informed about student loan policies and engaging in financial planning can help mitigate the financial strain associated with potential delinquency and collections.

How does the U.S. Department of Education’s approach to student loans affect the broader economy?

The U.S. Department of Education’s approach to enforcing student loan repayments may have mixed effects on the broader economy. While some analysts believe that the economic impact of student loan collections may not be as significant as other factors, the strain on low-income consumers could dampen overall spending and contribute to economic uncertainties amidst other inflationary pressures.

| Key Point | Details |

|---|---|

| Resumption of Collections | The U.S. Department of Education has resumed collections on defaulted student loans for the first time in about five years. |

| Impact on Disposable Income | Collections could reduce disposable personal income by $3.1 billion to $8.5 billion monthly, affecting low-income Americans especially. |

| Rising Delinquency Rates | Nearly 25% of borrowers may fall into default if seriously delinquent loans are counted, as delinquencies surged from 0.5% to 8% this year. |

| Economic Concerns | The impact of student loan repayments may stress consumer spending amid broader economic challenges like inflation. |

| Discretionary Spending | The anticipated decrease in discretionary income raises concerns about consumer spending, essential for economic support. |

| Overall Economic Impact | The effects of student loans on the economy may be less significant compared to other economic factors, according to analysts. |

Summary

The impact of student loan repayment on consumers is projected to be significant, as it may result in billions of dollars being extracted from disposable income. With the resumption of collections on defaulted loans, low-income borrowers are at a heightened risk of wage garnishment and other penalties, leading to increased delinquency rates and financial strain. Amidst broader economic challenges, including inflation and high prices, this situation questions the sustainability of consumer spending, essential for economic growth. Policymakers and economists will need to monitor these developments closely to assess their implications for the overall economy.