Syria Tariff Rate: Trump’s 41% Impact on Economy

The Syria tariff, recently imposed by the Trump administration at a staggering 41%, represents the highest tariff rate levied on any nation worldwide. This move comes on the heels of previously announced efforts to lift U.S. sanctions on Syria, raising questions about the true intentions behind such aggressive trade policies. As the war-ravaged nation seeks to revitalize its economy and embark on a path toward reconstruction, the harsh tariff could substantially deter foreign investment in Syria. Analysts fear that these tariffs will only exacerbate the already dire economic conditions, undermining potential growth and stability. With the added strain of U.S. sanctions on Syria, the implications of this tariff extend beyond mere trade disputes, signaling a significant barrier to recovery efforts that are critical in the post-war landscape.

The recent introduction of the highest customs duties on Syria is a pivotal development in U.S. foreign policy that has wide-ranging consequences for the region. These economic barriers, established under Trump’s administration, come at a crucial time for a nation emerging from over a decade of conflict. The consequences for the Syrian economy are profound, as they hinder essential foreign funding needed for rebuilding efforts. Furthermore, the political undertones of these tariffs suggest a tactic aimed at reinforcing U.S. leverage in the Middle East, especially concerning relations with neighboring Israel. As the Syrian state grapples with its reconstruction amidst ongoing sanctions, the imposition of these tariffs poses significant challenges to its economic revitalization efforts.

The Impact of Trump’s Tariff on Syria

The recently imposed 41% tariff on Syria by the Trump administration has raised profound concerns regarding the economic stability of a nation already struggling to recover from years of civil war. With the highest tariff in the world now placed on Syrian imports, analysts foresee not only immediate economic consequences but also long-term implications for U.S.-Syria relations. The tariff acts as a significant barrier to trade, affecting the ability of Syria to engage meaningfully in international commerce and ultimately hindering its economic recovery.

Moreover, after the initial lifting of U.S. sanctions, Syria had hoped for a renewed influx of foreign investment aimed at its reconstruction efforts. However, the re-imposition of high tariffs may deter potential investors who are now faced with the uncertainty and risk associated with engaging in a market stifled by such punitive measures. The psychological impact of the tariff sends a strong message that U.S. economic policies remain harsh and unilateral, reinforcing a sense of isolation for Syria in the global marketplace.

Frequently Asked Questions

What is the significance of the Trump tariffs on the Syria economy?

The Trump tariffs, with a staggering rate of 41%, pose a significant threat to the already fragile Syria economy. These tariffs are the highest imposed globally and seem to hinder any potential for trade and foreign investment, essential for Syria’s reconstruction efforts.

How will U.S. tariffs impact foreign investment in Syria?

The newly established tariffs by the Trump administration complicate foreign investment in Syria. Investors may be deterred by the high tariff rates, which symbolize U.S. control over Syria’s economic recovery and could lead to further economic stagnation.

Why did the Trump administration implement the highest Syria tariff rate?

The Trump administration’s implementation of a 41% tariff rate on Syria appears to be a strategy to exert political pressure, particularly regarding its relations with Israel. This high tariff rate undermines the earlier lifting of sanctions and raises concerns for Syria’s economic stability.

How do Trump tariffs affect Syria’s reconstruction efforts?

Trump’s tariffs are detrimental to Syria’s reconstruction efforts by blocking access to essential trade and financial resources. Analysts argue that these tariffs stifle international support and deter necessary foreign investments that could aid in rebuilding the war-torn nation.

What was the response to U.S. sanctions and tariffs on Syria?

While the U.S. initially lifted sanctions, the subsequent imposition of a 41% tariff rate has created confusion and concern among international investors. Analysts suggest that this inconsistency discourages valuable foreign investment, undermining efforts to revitalize the Syrian economy.

How do the tariffs relate to the broader geopolitical situation involving Syria?

The Trump tariffs on Syria are interconnected with broader geopolitical tensions, particularly regarding U.S. relations with Israel. The tariff serves not only as an economic measure but also as a political tool to influence Syria’s alignment with regional power dynamics.

What are the potential long-term consequences of Trump’s tariffs on Syria?

In the long term, Trump’s tariffs could exacerbate humanitarian crises in Syria by limiting international aid and resource allocation. The tariffs could hinder economic recovery efforts, perpetuating instability and unrest in the region.

What role do tariffs play in the U.S. strategy regarding Syria?

The high tariffs implemented by the Trump administration are a crucial element of U.S. strategy towards Syria, serving both to communicate disapproval of Damascus’s policies and to exert economic pressure in pursuit of political alignment with Israel.

What are the implications of high tariffs on Syria’s trade relations with the U.S.?

High tariffs on Syria significantly limit trade relations with the U.S., leading to a dramatic decrease in Syria’s exports and imports. This regulatory barrier hinders essential economic interactions necessary for both countries’ growth.

Can Syria recover economically with the current tariff situation?

Syria’s economic recovery is jeopardized by the current tariff situation. With the U.S. maintaining high tariffs, the possibility of attracting foreign investment and rebuilding the economy remains severely limited.

| Key Point | Details |

|---|---|

| Trump’s Tariff Rate | Syria faces a 41% tariff rate, the highest imposed by any country. |

| Policy Shift | The tariff was enacted shortly after lifting sanctions, contradicting previous supportive statements. |

| Potential Strategy | Analysts suggest tariffs may pressure Syria to normalize relations with Israel. |

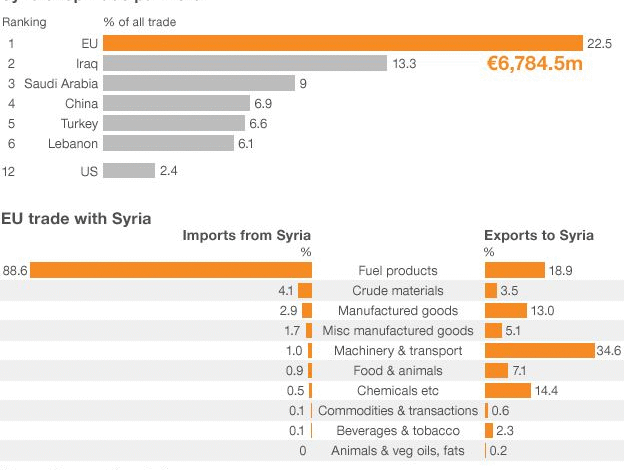

| Trade Limitations | Syria’s trade with the US is limited, with exports of $11.3 million and imports of $1.29 million. |

| Impact on Reconstruction | High tariffs could stifle investment crucial for Syrian reconstruction after years of conflict. |

| Support from Other Nations | Countries like Qatar are moving to assist Syria, but US tariffs may create barriers. |

| Psychological Effects | While immediate economic impacts may be small, the diplomatic message is significant. |

Summary

Syria’s tariff situation highlights the complexities of international relations as the Trump administration has imposed a 41% tariff, the highest on any nation. This unprecedented move comes on the heels of an earlier decision to lift sanctions, which has left Syria in a precarious position. The tariffs are viewed by many analysts as a strategy to leverage influence over Syria’s political alignment with Israel. As the country struggles with the aftermath of a prolonged civil war and seeks foreign investment for crucial reconstruction efforts, these tariffs threaten to impede necessary support and exacerbate humanitarian crises. Without corrective measures and international cooperation, the path to recovery for Syria remains uncertain.