Helicopter Crash New York: Tragic Incident Sparks Investigation

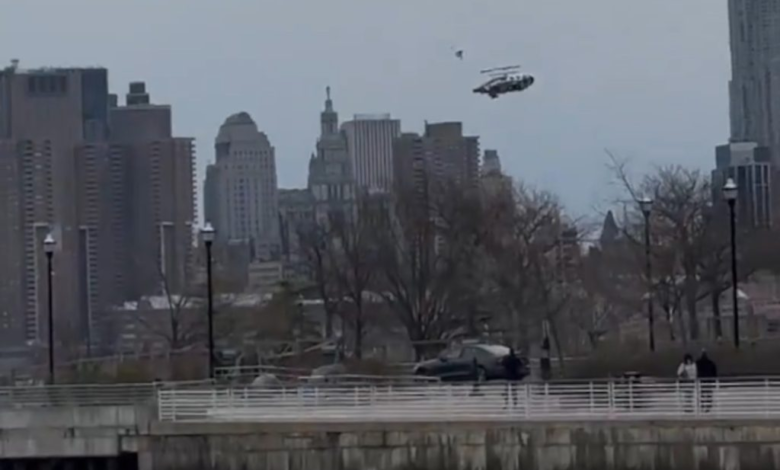

In a shocking incident, the helicopter crash in New York last week has raised grave concerns about aviation safety within the bustling metropolis. The tragedy unfolded when a helicopter plunged into the Hudson River, claiming the lives of all six individuals aboard, including a family of five from Spain, who were embarking on what was meant to be an exhilarating aerial tour. The Federal Aviation Administration (FAA) swiftly responded by announcing that the company responsible for the ill-fated flight would immediately cease operations. This catastrophic NY helicopter accident has ignited a wave of scrutiny over helicopter tours and has drawn attention to existing regulations governing such flights, prompting calls for increased safety measures. As the investigation unfolds, the aviation community and safety advocates are watching closely, hoping this disaster serves as a wake-up call for better helicopter safety practices.

A recent aviation disaster in New York has highlighted critical questions regarding the safety of helicopter operations in urban environments. On a seemingly routine tour, a helicopter collided with waterways, leading to the heartbreaking loss of lives, including a family vacationing from abroad. This incident has not only captured media headlines but has also reignited debates over helicopter tour regulations and the necessity for stringent safety protocols. As inquiries continue and the FAA conducts an in-depth review, the incident serves as a poignant reminder of the risks associated with aerial excursions in densely populated areas. With calls for increased oversight on NY helicopter tours echoing through public discourse, the hope is that such tragedies can be prevented in the future.

Background of the Hudson River Helicopter Crash

On April 10, 2025, a tragic helicopter crash occurred in the Hudson River near Jersey City, New Jersey, claiming the lives of six individuals, including a family of five visiting from Spain. The helicopter, operated by New York Helicopter Tours, descended abruptly into the water, raising urgent concerns about the safety protocols and regulatory compliance in the helicopter tourism sector. This incident has gained overwhelming media attention, reflecting the public’s growing unease regarding the inherent risks associated with helicopter tours in densely populated areas like New York City.

The National Transportation Safety Board is actively investigating the crash, revealing that the helicopter was not equipped with essential flight data recorders or onboard cameras that could provide critical insights into what transpired during the flight. Families and communities are left mourning the loss of the victims, which include three young children and their parents. The subsequent operational shutdown of New York Helicopter Tours marks significant repercussions for the helicopter tourism industry in New York, as the FAA emphasizes the need for enhanced safety measures to prevent such disasters in the future.

FAA Response and Safety Regulations

Following the deadly helicopter accident, the Federal Aviation Administration (FAA) issued an immediate halt to the operations of New York Helicopter Tours. This swift response underscores the agency’s commitment to aviation safety and indicates that a rigorous review of the company’s licensing and operational history will take place. The FAA’s involvement is not merely administrative; it aims to assure the public that the aviation system, especially concerning helicopter safety, is monitored closely and that lessons from incidents like the Hudson River helicopter crash will be integrated into future operational guidelines.

Moreover, the call for ‘ramp inspections’ by Senate Minority Leader Chuck Schumer reflects an escalating demand for accountability in the helicopter industry. These unscheduled safety checks could identify potential operational deficiencies before they lead to tragic outcomes. The contrast between New York City Mayor Eric Adams’ resistance to a complete ban on helicopter tours and Schumer’s calls for reinforced safety protocols encapsulates the ongoing debate about balancing tourism and safety in urban environments.

Victims of the Helicopter Crash

The heartbreaking loss of six lives in the Hudson River helicopter crash has shocked communities both locally and internationally. The victims included Agustin Escobar, his wife Mercè Camprubí Montal, and their three children—Victor, Mercedes, and Agustin. This family was on a vacation exploring the sights of New York City, and their sudden tragedy has left a profound impact on their loved ones and friends. As details emerge about the family’s trip, the spotlight intensifies on how this accident will shape the future of helicopter tours in New York and the safety of passengers.

Additionally, the pilot, Seankese Johnson, a 36-year-old U.S. Navy veteran with considerable flying experience, also tragically lost his life in this accident. The victims’ stories have sparked discussions on the emotional toll aviation accidents take on families and communities, as well as the critical need for compliance with helicopter tour regulations. Those affected by this loss urge for meaningful changes to ensure that such tragedies do not continue to occur in the aviation sector.

Impacts on Helicopter Tour Regulations

In light of the Hudson River helicopter crash, there is mounting pressure to revisit and revise regulations governing helicopter tours in New York City. The FAA and other regulatory bodies are now tasked with the challenge of balancing job creation and tourism needs against the imperative of ensuring public safety. A comprehensive review of existing regulations, including those governing how operators certify their aircraft for flight, is crucial to preventing future accidents. Helicopter tour regulations must not only address emergency preparedness but also ensure passenger safety through stringent oversight.

With heightened scrutiny from lawmakers and safety advocates alike, there is a possibility of tighter regulations being imposed on helicopter tour operators. The existing protocols may be deemed inadequate in light of recent events, compelling stakeholders to advocate for implementing further safety measures, such as mandatory installation of flight recorders and enhanced pilot training. As a result of the FAA’s attention on this incident, broader changes in helicopter safety could set new standards for the industry nationwide.

Emergency Response and Recovery Efforts

The emergency response to the helicopter crash in the Hudson River involved swift action from multiple agencies, including local rescue teams and federal investigators. First responders mobilized quickly to the crash site, demonstrating the urgency and importance of effective emergency preparedness plans in aviation incidents. The coordinated efforts not only aimed to recover the victims but also assess the wreckage in order to piece together the sequence of events leading to this tragic accident.

The recovery phase not only focuses on logistical operations but also on providing support for families of the victims. Authorities are increasingly recognizing the psychological impact of such disasters and have partnered with mental health services to assist families grappling with their loss. This incident underscores the need for a comprehensive approach that not only emphasizes technical aspects of aviation safety but also addresses the humanitarian aspects of aviation disaster response.

Public Concerns and Aviation Safety

The Hudson River helicopter crash has reignited public concerns regarding aviation safety and the regulation of helicopter tours in urban environments. Residents and travelers alike are questioning the safety measures in place for tourist flights, especially in high-traffic areas like New York City. The reliance on helicopter tours for sightseeing has sparked debate about their impact on community safety and public health, as well as the need for stricter enforcement of aviation safety standards.

With public sentiment leaning toward increased safety, many advocates and community leaders are calling for a thorough investigation into helicopter flight standards. They argue that ensuring the safety of flights must take precedence over the allure of tourism. Elevated concerns may lead to widespread support for new regulations that prioritize the well-being of passengers and residents, potentially reshaping how helicopter tours operate in urban settings.

Tourism Industry Fallout After the Accident

The recent helicopter crash has sent shockwaves through the New York tourism industry, particularly impacting businesses that rely on sightseeing tours. Many potential tourists are now hesitant to book helicopter tours, fearing for their safety in light of this tragic event. As a direct consequence of the negative media coverage surrounding the Hudson River helicopter crash, some companies might see significant drops in revenue, impacting jobs and economic stability in the tourism sector.

Tourism boards and operators are now faced with the challenge of rebuilding trust with the public. They may need to implement new marketing strategies that prioritize safety and transparency regarding operational standards. As the industry grapples with this crisis, it is crucial that they emphasize comprehensive safety measures, such as routine inspections and personnel training, to reassure potential customers and restore faith in helicopter tours.

Legal Implications Following the Tragedy

In the aftermath of the Hudson River helicopter crash, legal implications are being thoroughly examined as families of the victims and the public seek accountability from New York Helicopter Tours and regulatory bodies. Lawsuits may arise from the bereaved families asserting that the company neglected proper safety protocols. The legal outcomes of this situation could not only determine compensation for the victims’ families but could also set legal precedents for how aviation regulations are enforced.

Moreover, the FAA and other aviation authorities may need to face scrutiny over their regulatory practices concerning helicopter safety. The legal actions stemming from this incident could lead to revised aviation laws, potentially increasing liability for operators who fail to meet safety standards. This tragic event serves as a reminder that the safety of passengers is paramount, and the legal framework must evolve to reflect the necessary accountability within the aviation industry.

Future of Helicopter Tours in New York

Looking ahead, the future of helicopter tours in New York City remains uncertain following the Hudson River crash. The aviation industry, including tour operators, may need to adapt to new regulations that emphasize passenger safety and aircraft compliance. Stakeholders are likely to engage in discussions about how to enhance safety measures while maintaining the attraction of helicopter tours as a mode of sightseeing in one of the world’s most vibrant cities.

As heightened safety standards are implemented, operators may need to invest in more advanced technology and training to align with regulatory expectations. It could also lead to an evolution of helicopter tour packages that focus more on safety and education rather than just sightseeing. The interaction between tourism and stringent safety measures could redefine how helicopter tours operate in New York City for years to come, with the potential for a safer and more responsible aviation industry.

Frequently Asked Questions

What were the details of the recent helicopter crash in New York?

The tragic helicopter crash in New York occurred on April 10, 2025, when a chopper operated by New York Helicopter Tours plunged into the Hudson River, resulting in the deaths of all six people on board—a family of five from Spain and the pilot.

What actions has the FAA taken regarding the helicopter crash in New York?

Following the helicopter crash in New York, the FAA announced that New York Helicopter Tours would shut down operations immediately. They are also reviewing the company’s license and safety records amid an ongoing investigation by the National Transportation Safety Board.

How has the Hudson River helicopter crash affected safety regulations?

The Hudson River helicopter crash has raised significant concerns regarding aviation safety. Senate Minority Leader Chuck Schumer called for ramp inspections and a review of helicopter safety regulations, highlighting the risks associated with civilian helicopter flights in New York.

What is being done to ensure helicopter tour safety in New York after the accident?

In response to the Hudson River helicopter crash, the FAA is hosting a helicopter safety panel on April 22 to analyze and recommend improvements in safety regulations for helicopter tours in New York, amidst calls for stronger oversight.

What does the FAA’s investigation into the helicopter crash in New York potentially reveal?

The FAA’s investigation following the helicopter crash in New York could uncover critical safety violations, as it has already been noted that the helicopter lacked essential equipment like flight recorders or onboard cameras, which may impact future helicopter tour regulations.

Will New York Helicopter Tours be held accountable for the crash in the Hudson River?

Accountability for New York Helicopter Tours will depend on the outcome of the FAA and NTSB investigations into the Hudson River helicopter crash, which are focused on the company’s operational practices and safety compliance.

What was the response from local officials regarding helicopter safety after the New York crash?

Local officials, including New York Mayor Eric Adams, have emphasized the existing stringent regulations on helicopter tours. However, they acknowledged the need for further scrutiny and safety checks following the Hudson River helicopter crash.

What safety measures are recommended for helicopter tours in New York after the recent tragedy?

In light of the Hudson River helicopter crash, safety measures being discussed include enhanced inspections, stricter adherence to existing regulations, and possibly revising guidelines for helicopter tour operations to improve overall safety standards.

| Key Point | Details |

|---|---|

| Incident Summary | A helicopter crash in the Hudson River, New York, killed all six individuals on board. |

| Company Shutdown | New York Helicopter Tours has ceased operations following the crash. |

| Victims | Victims included a family of five from Spain and the 36-year-old pilot. |

| Investigation | The FAA and the National Transportation Safety Board are investigating the incident. |

| Safety Concerns | Concerns regarding civilian helicopter safety and potential regulation changes have arisen. |

Summary

The helicopter crash in New York has raised serious safety concerns about civilian helicopter operations. The tragic incident involved a helicopter operated by New York Helicopter Tours, leading to an immediate shutdown of the company by the FAA. This disaster claimed the lives of all six individuals aboard, including a family visiting from Spain. As investigations by federal agencies continue, discussions around regulatory measures for helicopter flights are intensifying. This unfortunate event not only highlights the risks associated with helicopter tours but also sparks conversations about the need for enhanced safety protocols in air travel.