Software Crypto Wallet: Why Choose Ledger for Security?

A software crypto wallet is an essential tool for anyone looking to safely manage their digital assets in the ever-expanding world of cryptocurrencies. Unlike hardware wallets, which store information offline, software wallets provide the convenience of access from multiple devices, making them ideal for frequent transactions. When choosing the best software wallet for your needs, considerations such as crypto wallet security, features, and compatibility with various networks come into play. For those requiring flexibility, a well-designed multi-chain wallet can serve multiple cryptocurrencies, simplifying asset management across platforms. As digital finance continues to grow, understanding how to leverage software wallets effectively will become increasingly important for both novice and experienced users alike.

When exploring digital asset management options, the term “software-based cryptocurrency wallets” often arises as a popular method for storing and handling your cryptocurrencies. These applications, unlike their hardware counterparts, provide usable interfaces that allow for seamless transactions and access from multiple devices, accommodating those who often move or travel. A reliable digital wallet is paramount for anyone engaging in the crypto space, particularly as discussions around best practices for crypto wallet security evolve. In addition, the notion of a “multi-chain wallet” is gaining traction, as it enables users to interact with various blockchain networks, offering an all-in-one solution for managing different types of digital assets. As user-friendly software wallets continue to dominate the scene, understanding their functionalities and advantages becomes crucial for effective asset management.

Understanding the Basics of Software Crypto Wallets

Software crypto wallets are essential tools for cryptocurrency enthusiasts, serving as the digital gateway to various blockchain networks. Unlike hardware wallets that prioritize security by storing data offline, software wallets operate through downloadable applications or web interfaces, allowing users to interact with their cryptocurrencies directly online. The key feature of software wallets is their capacity to store private keys securely, enabling users to send, receive, and trade assets effortlessly.

As the use of cryptocurrencies grows, the demand for effective software wallets also rises. The best software wallet caters to a wide range of user needs, from beginners looking for simplicity to experienced traders requiring advanced functionalities. Moreover, software wallets often feature multi-chain capabilities, allowing users to handle different cryptocurrencies from the same interface, increasing their usability and appeal.

Choosing Ledger: The Best Software Wallet for Security

When it comes to selecting a software crypto wallet, Ledger stands out as a frontrunner in terms of security and functionality. Ledger wallets combine the benefits of hardware and software solutions, providing users with robust security features alongside a user-friendly interface. This duality allows users to manage their assets securely while still having an intuitive experience. By incorporating advanced features like two-factor authentication and end-to-end encryption, Ledger promises a level of security that makes it one of the best software wallets available.

Additionally, Ledger supports a wide variety of digital assets, functioning effectively as a multi-chain wallet. This means users can store and manage multiple cryptocurrencies within a single platform, enhancing convenience. The seamless integration with decentralized finance platforms further expands Ledger’s appeal, marking it as a trusted choice for both casual users and seasoned investors who prioritize crypto wallet security.

Software Wallets vs. Hardware Wallets: A Comprehensive Comparison

The debate between software wallets and hardware wallets often highlights key differences that are important for users to consider. Hardware wallets, like Ledger, are designed to keep private keys offline, adding an additional layer of security against online threats. However, software wallets provide quick access and convenience, making them appealing for day-to-day transactions. This distinction is crucial for users deciding which wallet type suits their needs best, particularly when considering factors like security vs. accessibility.

While hardware wallets are often regarded as superior for long-term storage of cryptocurrencies, software wallets have evolved significantly, now offering enhanced security alongside ease of use. This evolution means that users no longer have to sacrifice convenience for protection. The best software wallets incorporate robust encryption methods and user-friendly designs, making it easier for users to engage with their digital assets without the cumbersome processes sometimes associated with hardware wallets.

Exploring the Benefits of Multi-Chain Wallets

Multi-chain wallets represent a significant advancement in the field of cryptocurrency management. They allow users to hold and manage various cryptocurrencies across different blockchains, making transactions much more efficient. One of the standout qualities of the best software wallets, such as Ledger, is their capacity to function effectively as multi-chain wallets. This versatility caters to the ever-growing market of cryptocurrencies, providing users more control over their digital assets.

The advantages of using a multi-chain wallet extend beyond simple transaction capabilities. They facilitate easier access to diverse blockchain networks, enabling users to participate in various decentralized finance (DeFi) projects, access different tokens, and take part in initial coin offerings (ICOs). As the crypto space continues to innovate, the efficiency and flexibility of multi-chain wallets help users capitalize on new opportunities and streamline asset management.

Best Practices for Ensuring Crypto Wallet Security

Ensuring the security of your crypto wallet is paramount, especially in an ever-evolving digital landscape. Users should adopt best practices such as enabling two-factor authentication, regularly updating their wallet software, and using strong, unique passwords to enhance the security measures of both hardware and software wallets. Awareness of phishing scams and only interacting with verified applications also play crucial roles in safeguarding your assets.

For those using software wallets, it’s vital to ensure that you only download applications from reputable sources, such as the official Ledger site or authorized app stores. Furthermore, regularly backing up your wallet helps protect against data loss. By understanding and implementing these best practices, users can significantly reduce their vulnerability to online threats and ensure their digital assets remain secure.

The Future of Crypto Wallets: Trends to Watch

The landscape of crypto wallets is continually evolving, influenced by advancements in technology and shifts in user expectations. As the market demands more sophisticated and user-friendly solutions, the future of software wallets looks promising, particularly with the rise of Web3 platforms. Integration with emerging technologies will likely create more interoperable and secure wallet ecosystems, allowing seamless interactions across various decentralized applications.

Additionally, regulatory changes and growing consumer awareness around crypto security will shape how wallets are developed and used. Future enhancements may include greater integration with biometric security features, enhanced user interfaces, and automated portfolio management tools. As innovations continue to emerge, the adaptability of crypto wallets will be crucial in meeting the needs of their users in the rapidly changing digital finance landscape.

Maximizing Your Investment: Utilizing Software Wallets Effectively

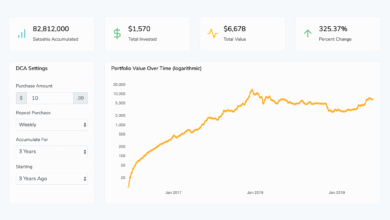

To maximize your investment in cryptocurrencies, effectively utilizing software wallets is essential. This involves more than simply storing your coins; it includes actively managing your portfolio, staying informed about market trends, and engaging in trading opportunities. A software wallet with integrated tools for tracking prices, analyzing trends, and facilitating quick transactions can significantly enhance user experience and investment outcomes.

Additionally, participating in DeFi platforms and utilizing staking options can also be effectively managed through a software wallet. Choose wallets with robust features that support these functionalities, allowing you to diversify your investment strategies efficiently. The right software crypto wallet not only secures your assets but also empowers you to engage actively in the growing world of digital finance.

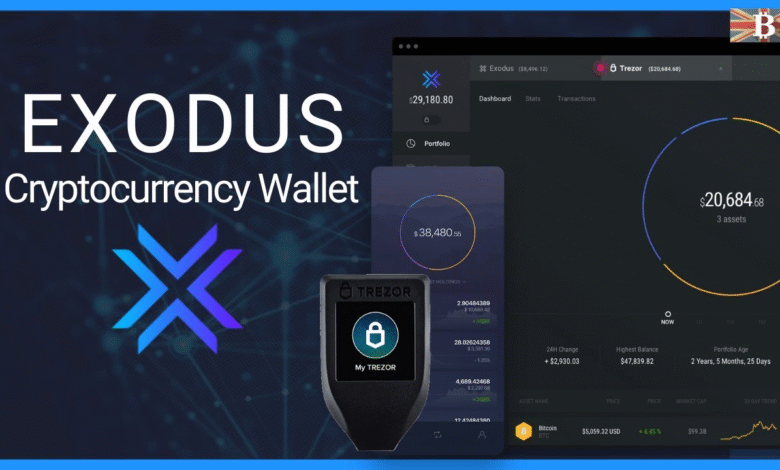

Integrating Software and Hardware Wallets for Optimal Safety

Combining software and hardware wallets can provide users with the best of both worlds—security and ease of access. While hardware wallets like Ledger offer optimal security by storing private keys offline, software wallets can facilitate everyday transactions with greater convenience. Utilizing both types of wallets ensures that long-term holdings are kept safe, while also allowing immediate access to necessary funds for transactions.

In practice, this approach means storing most of your assets in a hardware wallet for added security, while maintaining a smaller balance in a software wallet for daily operations. This strategy mitigates risk while also enhancing user efficiency in managing their digital currencies. The synergy between these two wallet types creates a more comprehensive risk management setup, essential for anyone serious about protecting their investments.

Why Ledger Remains a Trusted Choice for Crypto Enthusiasts

Ledger remains a trusted choice among crypto enthusiasts due to its commitment to security and innovation. Its hardware wallets, such as the Ledger Nano X and Ledger Stax, are certified for resilience against both physical and digital threats. These devices incorporate advanced security measures, such as a Secure Element chip, ensuring that private keys never leave the device, even during transactions.

Aside from security benefits, Ledger continuously evolves its software solutions, providing users with a robust experience for managing their assets. The integration of user-friendly applications allows for seamless interaction with digital currencies, making it accessible even for those new to cryptocurrency. Overall, Ledger’s dedication to combining high-level security with practical usability solidifies its position as a leader in the crypto wallet market.

Frequently Asked Questions

What is a software crypto wallet and how does it work?

A software crypto wallet is an application that allows users to manage and interact with their cryptocurrencies, offering a user-friendly interface accessible on desktops or mobile devices. It stores the private keys necessary for transactions, acting as a gateway between the user and the blockchain networks.

How does a software wallet compare to a hardware wallet?

The primary difference between a software wallet and a hardware wallet is the method of storage. Software wallets are applications that are more accessible and versatile but come with slightly higher risks due to online exposure. In contrast, hardware wallets, like Ledger, store private keys offline, providing enhanced security against online threats.

Why should I use a Ledger wallet as my software crypto wallet?

Choosing a Ledger wallet combines the security of hardware wallets with the convenience of software solutions. Ledger wallets securely generate and store private keys offline while providing interactive applications that allow for easy management of cryptocurrencies.

What are the security features of the best software wallets?

Top software wallets, such as those from Ledger, incorporate robust security features like two-factor authentication, end-to-end encryption, and secure screen verification, ensuring that your crypto wallet security is at the forefront of their design.

Can software wallets serve as multi-chain wallets?

Yes, many software wallets are designed to function as multi-chain wallets, allowing users to store and manage various cryptocurrencies across different blockchain networks seamlessly.

What should I consider when looking for the best software wallet?

When searching for the best software wallet, consider factors like usability, security mechanisms, feature set, and the ability to support a wide range of digital assets, including NFTs and altcoins.

Is it safe to keep large amounts of cryptocurrency in a software wallet?

While software wallets offer convenience and user-friendly access, they may not be the safest choice for storing large amounts of cryptocurrency due to their online nature. For significant holdings, it’s advisable to use a hardware wallet in conjunction with a software wallet for daily transactions.

What are the advantages of using both a software and a hardware wallet?

Combining software and hardware wallets provides optimal security and convenience. Hardware wallets secure primary holdings offline, while software wallets facilitate daily transactions and experimentation with digital assets.

How do I enhance the security of my software crypto wallet?

To enhance your software crypto wallet security, enable two-factor authentication, use strong, unique passwords, and keep your software up to date. Additionally, consider using a hardware wallet for storing larger amounts.

What role does a software wallet play in the future of cryptocurrency management?

Software wallets will continue to play a critical role in the future of cryptocurrency management by facilitating access to decentralized finance (DeFi) projects and integrating with emerging blockchain technologies, aligning with the evolving landscape of digital finance.

| Key Concept | Description |

|---|---|

| What is a Crypto Wallet? | A tool to interact with blockchain networks and securely store private keys for cryptocurrencies. |

| Software Wallets Overview | Software wallets are applications for managing cryptocurrencies easily via desktop or mobile devices. |

| Types of Crypto Wallets | Includes hardware wallets, cold wallets, software wallets, and web wallets, each with its own security level and convenience. |

| Benefits of Software Wallets | Accessible from various devices, offering features for efficient transaction management and integration with DeFi platforms. |

| Combining Wallet Types | Using both software and hardware wallets enhances security while maintaining ease of use for transactions. |

| Security Features of Ledger | Ledger wallets incorporate features like secure screen verification and ANSSI CSPN certification for optimal security on crypto assets. |

Summary

A software crypto wallet is an essential tool for anyone looking to manage their digital assets securely and efficiently. These wallets not only provide a user-friendly interface for handling transactions but also come with advanced features that cater to the needs of both novice and experienced users. By understanding the distinct types of wallets available and the benefits of using a software crypto wallet, individuals can make informed choices that optimize their cryptocurrency experience. Furthermore, integrating the capabilities of reputable hardware solutions like Ledger enhances overall security, ensuring that users can confidently navigate the evolving landscape of digital finance.