Quantum Computing: IonQ Hires JPMorgan Research Head

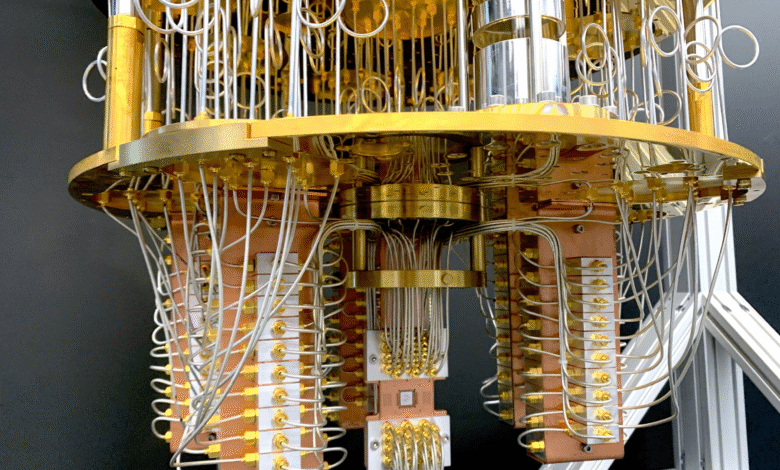

Quantum computing stands at the forefront of technological evolution, promising to revolutionize how we process information. IonQ, a pioneering quantum computing firm, is making headlines with its recent hiring of Marco Pistoia, the former head of applied research at JPMorgan Chase. This strategic move highlights the growing importance of quantum computing adoption among corporate giants eager to leverage next-generation hardware and algorithms. As both public interest and investment in quantum technology advancements surge, the demand for solutions like quantum-safe encryption is becoming increasingly paramount. The partnership between IonQ and industry leaders like JPMorgan signals a significant shift towards integrating quantum solutions across various sectors, shaping the future of secure communications and complex computations alike.

The innovative field of quantum computation is gaining traction as businesses and researchers alike explore its transformative potential. With recent developments such as IonQ’s new leadership and focus on bridging quantum technology with real-world applications, the landscape is rapidly evolving. Many believe that the imminent arrival of commercially viable quantum systems will redefine the approaches we take to handle vast datasets and security measures. As firms work towards implementing robust quantum-safe encryption, the dialogue surrounding the impact of these advancements on industries is becoming increasingly critical. Notably, the collaboration between pioneering experts and established financial institutions illustrates a pivotal moment in transitioning towards quantum capabilities.

IonQ’s Strategic Hire for Quantum Computing Adoption

IonQ has recently made a significant move by hiring Marco Pistoia, the former head of applied research at JPMorgan Chase, to bolster its efforts in helping corporate clients adopt quantum computing technologies. Pistoia’s extensive experience leading JPMorgan’s internal research group positions him as an invaluable asset in navigating the complex landscape of quantum integration. His primary role at IonQ will involve guiding corporations on how to effectively implement next-generation hardware and algorithms, ensuring they are prepared for the quantum revolution that is currently underway.

With Pistoia’s guidance, IonQ is poised to play a pivotal role in the transition to quantum computing, which is critical for various industries across the globe. This strategic hire comes at a time when businesses are increasingly recognizing the need to understand and utilize quantum computing technologies to remain competitive. As more organizations consider the potential of quantum computing adoption, IonQ aims to be at the forefront, offering insights and support that will facilitate this shift.

The Importance of Quantum-Safe Encryption

One of the pressing topics Pistoia intends to address in his new role at IonQ is the urgency of implementing quantum-safe encryption. As advancements in quantum computing progress, traditional encryption methods face the risk of becoming obsolete. A powerful quantum computer may possess the capability to breach the encryption that underpins the security of sensitive data across financial and personal domains. Pistoia emphasized that it is critical for industries to transition to quantum-safe encryption measures to safeguard against potential threats posed by malicious entities capable of exploiting quantum technology.

The financial sector, in particular, has a vested interest in adopting quantum-safe encryption protocols. Banking institutions handle vast amounts of sensitive transactions and personal information that require robust security measures. By prioritizing quantum-safe encryption, organizations can not only protect their data but also instill greater confidence among clients and stakeholders. As Pistoia asserts, failing to adapt to these new challenges could leave businesses vulnerable to attacks, potentially compromising their integrity and trust.

JPMorgan’s Continued Interest in Quantum Technology

JPMorgan Chase has been at the forefront of exploring quantum technology advancements, reflecting its commitment to integrating cutting-edge innovations into its operations. Despite the reshuffling of its research leadership, the bank’s initiative in quantum research remains robust. As a key player in the financial industry, JPMorgan recognizes the importance of being ahead in the quantum race, collaborating with firms like IonQ to foster advancements that can redefine the future of financial services.

The collaboration between IonQ and JPMorgan, fueled by Pistoia’s previous experience within the bank, can lead to groundbreaking developments in quantum computing applications for finance. The two entities may work together to pilot initiatives that not only enhance operational efficiency but also develop unprecedented financial tools using quantum algorithms. By leveraging Pistoia’s expertise, both firms are gearing up for an era where quantum computing becomes integral to financial operations.

The Race for Quantum Computing Advancements

The landscape of quantum computing is characterized by intense competition among technology giants and startups alike. Companies such as IonQ, Rigetti Computing, and D-Wave are vying to lead the market, as they capitalize on the growing excitement surrounding quantum innovations. The advancements in quantum computing not only promise to revolutionize computing capabilities but also present new opportunities for solving complex problems that classical computers struggle with.

As the race continues, the focus is not solely on technological advancements but also on how these innovations can be commercialized effectively. IonQ’s strategic moves, such as hiring top talent like Marco Pistoia, underscore the critical importance of having the right expertise to bridge the gap between quantum research and real-world application. With predictions about the impending arrival of commercially viable quantum computers, organizations are eager to harness these advancements to stay competitive in an increasingly digital world.

Commercial Viability of Quantum Computers

With Pistoia predicting that usable quantum computers are just two to three years away, the anticipation surrounding their commercial viability is palpable. As the demand for faster and more efficient computational power grows, businesses are beginning to prepare for the impending shift brought forth by quantum technology. This timeline indicates that companies must strategize and invest in quantum readiness now, ensuring that they are not caught off guard when these powerful machines become accessible.

In preparation for this quantum revolution, organizations are also beginning to consider the implications of such technologies on their current infrastructure and processes. The commercial viability of quantum computing means that businesses will soon have the opportunity to leverage quantum algorithms for various applications, from supply chain optimization to advanced data analysis. Companies like IonQ that are on the frontline of quantum development will be instrumental in guiding industries through this transformative era.

Collaboration Between Tech and Financial Sectors

The intersection of technology and finance is becoming increasingly evident as firms recognize the potential of quantum computing in enhancing financial services. The collaboration between tech companies like IonQ and large financial institutions such as JPMorgan brings together the necessary expertise to foster advancements in quantum technology. This synergy is essential for the development of solutions that can streamline operations, enhance security, and provide a competitive edge in the market.

Through strategic partnerships, both sectors can accelerate the adoption of quantum computing, facilitating a smoother transition into this new domain. By leveraging technology advancements, banks and financial services can enhance their analytical capabilities and risk management processes, translating to better decision-making and customer service. Collaborations like these signify a forward-thinking approach, ultimately benefiting end-users and driving growth across the industry.

Understanding Quantum Algorithms and Their Applications

Quantum algorithms are the heart of the transformative potential of quantum computing, enabling tasks that are computationally intensive for classical computers. As IonQ focuses on assisting corporations in adopting these algorithms, understanding their varied applications becomes essential. Industries can harness quantum algorithms for optimization problems, which are prevalent in logistics, finance, and research, leading to improved efficiency and output.

Moreover, the integration of quantum algorithms with existing business models presents organizations with opportunities to innovate and stay ahead of competition. Companies must invest in training and development to foster a workforce that is equipped to work with quantum technologies. By embracing these advancements, businesses not only enhance their operational capabilities but also position themselves as leaders in their respective fields.

The Role of Quantum Research in Business Strategy

As firms amplify their focus on quantum research, incorporating findings into business strategies is critical for maintaining a competitive edge in an evolving marketplace. Quantum computing isn’t just a technological advancement; it is a strategic tool that can influence decisions across sectors. As demonstrated by JPMorgan’s research group restructuring, organizations must align their research efforts with practical applications to realize the benefits of quantum computing.

Investing in quantum research underlines a company’s commitment to innovation and adaptation. By establishing dedicated teams to explore quantum technologies, organizations can potentially uncover new markets and solutions that were previously thought unattainable. The integration of quantum research into a company’s core strategy can lay the groundwork for sustainable growth in the future, as industries anticipate the mainstream adoption of quantum-capable solutions.

Anticipating the Future of Quantum Computing

The future of quantum computing appears bright, with numerous experts predicting widespread adoption and application across various sectors. As noted by Pistoia, the imminent arrival of viable quantum computers could reshape industries as we know them. Organizations that begin preparing now by investing in research, partnerships, and training will be best equipped to capitalize on these changes. This anticipation of future developments in quantum technology underscores the necessity for businesses to remain agile and forward-thinking.

Furthermore, as the commercial landscape adapts to include quantum technologies, new standards and practices will emerge, necessitating ongoing research and dialogue among stakeholders. The excitement surrounding quantum computing is not merely about what is currently possible but also about the vast potential yet to be discovered. By actively participating in the discourse surrounding quantum technology advancements, businesses can help drive its evolution and make informed decisions that benefit their operations in the long run.

Frequently Asked Questions

What is quantum computing adoption and why is it important?

Quantum computing adoption refers to the integration of quantum computing technologies into various industries. It is important as quantum computing promises exponential increases in processing power, enabling breakthroughs in fields such as cryptography, material science, and complex problem-solving. Companies like IonQ are leading efforts to facilitate this adoption, ensuring businesses can leverage advanced quantum technologies.

What recent news has emerged regarding IonQ and quantum computing?

Recent IonQ news highlights the hiring of Marco Pistoia, the former head of applied research at JPMorgan, as senior vice president of industry relations. This strategic move aims to boost quantum computing adoption among corporate clients, focusing on next-generation hardware and algorithms while emphasizing quantum-safe encryption solutions.

How does quantum-safe encryption relate to quantum computing?

Quantum-safe encryption is a form of cryptography designed to secure data against potential threats posed by quantum computing. As quantum computers develop, traditional encryption methods may become vulnerable. Therefore, transitioning to quantum-safe encryption is crucial for protecting sensitive information, particularly in finance and communication, to mitigate risks highlighted by experts like Marco Pistoia.

What is JPMorgan’s role in quantum computing research?

JPMorgan is investing in quantum computing research and has revamped its leadership to enhance its focus on quantum technologies. This strategic initiative is part of their broader commitment to integrate advanced computing methods, as they acknowledge the significant potential of quantum computing to transform financial services and risk management.

What advancements are expected in quantum technology in the near future?

Experts, including Marco Pistoia, predict significant advancements in quantum technology within the next two to three years. These advancements could lead to commercially viable quantum computers, enabling breakthroughs in various sectors and accelerating the adoption of quantum computing technologies in industries worldwide.

| Key Point | Details |

|---|---|

| IonQ’s New Hire | Marco Pistoia, former head of applied research at JPMorgan Chase, will join IonQ as senior vice president of industry relations. |

| Role and Responsibilities | Pistoia will assist corporate clients in adopting quantum computing technologies, including quantum-safe encryption, and report to IonQ CEO Niccolo de Masi. |

| Recent Developments at JPMorgan | JPMorgan has restructured its research leadership focused on quantum technologies, highlighting the growing importance of quantum computing in the financial sector. |

| Market Competitors | IonQ is regarded as a leading pure-play quantum company, competing with firms like Rigetti Computing and D-Wave. |

| Threats to Cryptography | Pistoia warns that powerful quantum computers could compromise existing encryption methods, necessitating a shift to quantum-safe cryptography. |

| Timeline for Quantum Advancement | Pistoia believes that commercially viable quantum computers are expected within the next two to three years, which could significantly impact industries. |

Summary

Quantum computing is at the forefront of innovation as IonQ hires Marco Pistoia to lead efforts in enhancing corporate adoption of this transformative technology. Pistoia’s background with JPMorgan Chase positions him uniquely to bridge the gap between quantum computing advancements and practical applications in the financial sector, especially concerning quantum-safe encryption. As the world gears up for the imminent arrival of usable quantum computers, industries must prepare for the significant implications on security and computing power that this next-generation technology promises.