Federal Reserve Rate Cuts: What to Expect in September 2025

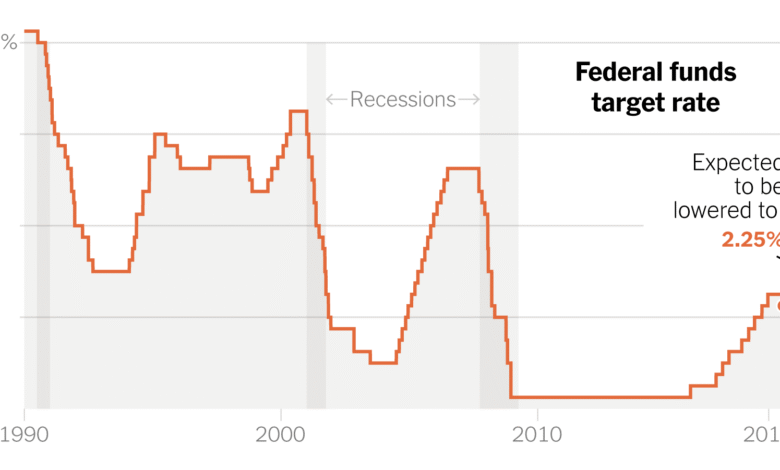

Federal Reserve rate cuts have become a pivotal topic as markets gear up for potential monetary easing in the coming months. Currently, many investors are optimistic that the Fed will implement these cuts as early as September, with expectations stirring around future interest rate decisions. However, insights into Fed rate cut predictions reveal that uncertainty remains, particularly regarding the extent and timing of upcoming reductions. Analysts are closely monitoring the impact of Fed rates on the economy, especially in light of an evolving economic outlook for 2025. The market’s reaction to Fed cuts will undeniably shape investment strategies and economic forecasts in the near future.

The anticipated adjustments to interest rates by the Federal Reserve signify a crucial point in economic policy discussions. As investors analyze the potential for alterations in borrowing costs, alternate terms for these monetary maneuvers come into play, including shifts in fiscal strategy and adjustments to credit conditions. The air is thick with speculation around how significant these cuts might be and their overall effect on market dynamics. With a landscape fraught with varying economic signals, the focus shifts toward understanding the broader implications of these monetary policy changes. All eyes are on the Fed as stakeholders await critical insights into how these decisions will influence the financial sphere moving forward.

Understanding Federal Reserve Rate Cuts

Federal Reserve rate cuts are pivotal decisions that directly influence interest rates across the economy. When the Fed lowers the rates, it aims to stimulate economic growth by making borrowing cheaper for businesses and consumers. This typically leads to an increase in spending, investment, and ultimately, job creation. The anticipation of these rate cuts can significantly affect market dynamics, often resulting in bullish sentiment among investors as they anticipate a more favorable economic climate.

However, the implications of these cuts are not always straightforward. For instance, the market’s response can be mixed, depending on broader economic indicators such as inflation and employment levels. Although traders currently forecast a cut in September, analysts warn that subsequent cuts could be limited. This hesitance stems from concerns over inflation pressures and the resilience of the economy, suggesting the Fed may take a more cautious approach amid global economic uncertainties.

Frequently Asked Questions

What are the likely Federal Reserve rate cuts expected in 2025?

In 2025, the Federal Reserve is expected to implement interest rate cuts, particularly with strong confidence in a quarter-point reduction during the September meeting. Analysts predict a second cut could follow in December, although there is uncertainty regarding the total number of cuts throughout the year.

How do Fed rate cuts impact the economic outlook for 2025?

Fed rate cuts are designed to stimulate economic growth by making borrowing cheaper, which can encourage spending and investment. However, the economic outlook for 2025 is not without challenges, as inflation concerns and labor market conditions may influence the effectiveness of these cuts.

What is the market reaction to anticipated Fed rate cuts?

Market reactions to anticipated Fed rate cuts typically include increased stock prices and decreased Treasury yields. Recent announcements from Fed Chair Jerome Powell have instilled optimism, leading to significant rallies in stock markets. However, caution remains as market analysts express uncertainty regarding the pace and frequency of future cuts.

What factors influence Fed rate cut predictions?

Fed rate cut predictions are influenced by a variety of factors including inflation trends, economic growth indicators, labor market conditions, and political pressure. Economic data released prior to meetings, along with Fed communications, play crucial roles in shaping expectations for future interest rate decisions.

What has been the impact of Fed rate cuts on the previous economic environment?

The impact of Fed rate cuts in previous economic environments has been mixed. In 2024, rate cuts led to rising Treasury yields and mortgage rates, primarily due to concerns that the Fed eased too soon. This raises questions about the effectiveness of similar future rate cuts amid ongoing inflation pressures and robust economic activity.

How do Fed rate cuts affect investors in 2025?

Investors usually respond positively to Fed rate cuts as they lower borrowing costs, thereby potentially increasing corporate profits. In 2025, expectations for rate cuts could encourage more optimistic trading in equities, while also motivating shifts in investment strategies to adapt to changes in interest rates and economic signals.

What does the Federal Reserve’s cautious approach toward rate cuts indicate?

The Federal Reserve’s cautious approach suggests they are weighing the benefits of stimulating the economy against the risks of inflation and market instability. This balancing act reflects a commitment to data-driven policy decisions, influencing their timeline for any potential interest rate decisions in 2025.

| Key Points | |

|---|---|

| Market expectation for Federal Reserve rate cuts in September is high with a probability of 82%. | Concerns about the pace and impact of further rate cuts remain. |

| Implied probability for an October rate cut drops to 42%. | Only a 33% chance for a total of three cuts this year is projected. |

| Analysts call for caution as inflation and economic resilience challenge aggressive rate cuts. | Market reactions indicate uncertainty with stocks declining and Treasury yields increasing after the rally. |

| The Fed’s independence could be threatened by political pressures for further cuts. | Past easing cycles have led to unexpected rises in yields and mortgage rates. |

| Optimistic outlook remains for stocks if rate cuts occur, with projections for S&P 500 growth. | Market analysts are divided on the effectiveness of rate cuts to stimulate growth. |

Summary

Federal Reserve rate cuts are anticipated by markets, particularly for September, where the likelihood of a quarter-point reduction is perceived at 82%. However, uncertainty looms regarding future cuts, with expectations dropping for subsequent months. As analysts evaluate the economic landscape, concerns arise over inflation and the pace of rate adjustments, suggesting a cautious approach from the Fed. Despite skepticism from some quarters about the impacts of easing, the prevailing assumption is that any rate cuts could still bolster stock market performance in the near term.