EU Trade Deal Negotiations Amid Trump’s Tariff Threat

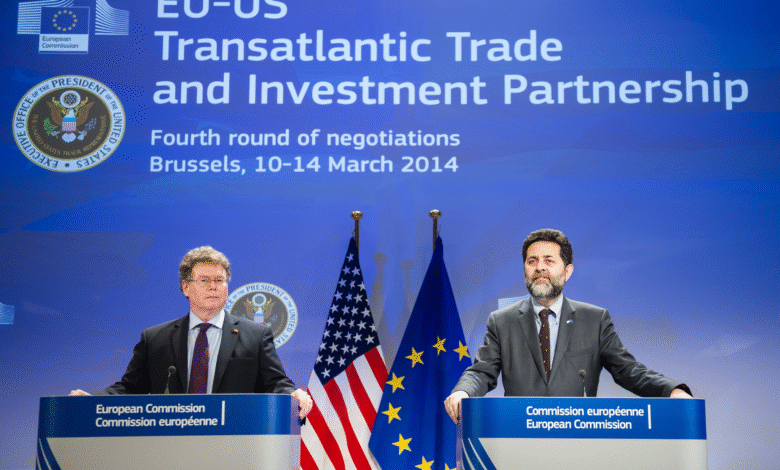

EU Trade Deal Negotiations have taken center stage as the European Union races to secure a favorable agreement with the United States ahead of an impending tariff crisis. With President Trump threatening to impose a staggering 30% tariff on goods from the EU, the stakes have never been higher. This high-pressure environment has prompted EU officials to implement a strategic approach, outlined in a four-part plan designed to mitigate the potential trade war impact. They are not only negotiating earnestly with U.S. representatives but also preparing countermeasures to counteract Trump’s bold moves. As tensions rise, both sides recognize that a U.S.-EU tariff agreement is vital to maintaining a balanced economic relationship that benefits both parties in the face of unprecedented global trade challenges.

Currently, the discussions surrounding trade agreements between Europe and the United States are crucial for maintaining economic stability in both regions. As the EU seeks to finalize a deal, the implications of the looming tariffs threaten to escalate into a significant trade confrontation. In this context, the EU’s strategy includes preparing responses to U.S. import restrictions while actively pursuing avenues to lower tariffs on goods, particularly in the automobile sector. The negotiations have become a balancing act, where EU officials must address President Trump’s proposed tariffs while ensuring that their own economic interests remain safeguarded. This comprehensive approach reflects the complex interplay of international trade relations and the urgent need for collaboration amid rising tensions.

Understanding the EU Trade Deal Negotiations

The EU’s current trade negotiations with the U.S. are centered around reaching a beneficial agreement before President Trump’s impending deadline. With Trump’s proposed 30% tariff on EU goods looming, discussions are heated as the EU seeks to protect its economic interests. The urgency is palpable, as EU officials recognize that a breakdown in negotiations could lead to detrimental outcomes for both sides, especially in terms of international trade dynamics.

A successful trade deal can significantly reshape tariff obligations and facilitate smoother commerce between the regions. The stakes are heightened by the historical context of U.S.-EU tariff relations, where trade wars have previously led to retaliatory measures, including the so-called Trump tariffs, which would further dissolve bilateral trust. Thus, understanding the intricacies of these negotiations is critical for both policymakers and businesses alike as they navigate potential outcomes.

Impact of Trump Tariffs on International Relations

Trump’s tariffs have sparked a complex web of responses from the EU and other countries, showcasing the broader implications of unilateral trade actions. The tariffs have not only strained U.S.-EU relations but have prompted discussions on countermeasures, as seen in the EU’s strategic preparatory actions. This trade war impact ripples through international markets, affecting industries from automobiles to agriculture, while also stirring public sentiment against perceived unfair trading practices.

As countries grapple with the ramifications of trade wars, the need for cooperative dialogue becomes evident. The EU’s willingness to negotiate on tariffs, such as potentially lowering its automotive tariffs in exchange for U.S. concessions, highlights an eagerness to stabilize relationships despite the ongoing tensions. The complex scenario underscores the need for both parties to consider the long-term benefits of collaboration over conflict in a world increasingly reliant on interconnected economies.

EU Countermeasures: A Prepared Response

In preparation for potential escalations in the trade conflict, the EU is formulating a range of countermeasures. These include reciprocal tariffs and strategic alliances with other nations facing similar U.S. tariff challenges. This proactive stance demonstrates the EU’s commitment to protecting its economic interests while aiming for a resolution that avoids a full-blown trade war. Baranowski’s remarks about having 72 billion euros in countermeasures highlight the seriousness of the EU’s approach.

Moreover, these countermeasures are not merely reactive; they signal a robust negotiation tactic intended to deliver a message to the U.S. about the economic repercussions of continued tariff impositions. The EU aims to portray its readiness to reciprocate in the event of unfair trade practices, thereby ensuring that its position is respected in the negotiation process.

The U.S.-EU Tariff Agreement: A Mutually Beneficial Path Forward

The potential for a U.S.-EU tariff agreement stands as a beacon of hope amidst ongoing tensions. By offering to eliminate high tariffs on automobiles reciprocally, both parties can pave the way for a more favorable trade landscape. This collaborative approach can help mitigate the adverse effects of previous trade wars while bolstering economic growth on both sides of the Atlantic.

However, for such an agreement to be successful, it requires a delicate balance of concessions and commitments from both parties. A well-crafted tariff agreement could not only help stabilize current trade relations but also set a precedent for future negotiations. As the EU seeks to enhance its competitiveness, the stakes are high for finding common ground that benefits both economies.

The Role of Automobile Tariffs in Trade Negotiations

Amidst the broader EU trade deal negotiations, automobile tariffs emerge as a critical focal point. The proposed reciprocal tariff reductions on cars indicate the EU’s strategic pivot toward reaching a compromise that serves both regions’ interests. The U.S. has historically imposed tariffs that have adversely impacted European automakers, contributing to heightened tensions in trade relations.

Addressing these automobile tariffs could significantly lower the roadblocks to a successful trade deal. By presenting solutions that reduce costs for manufacturers on both sides, negotiators can foster goodwill and create a more conducive environment for discussions regarding other sensitive sectors affected by the trade war. Ultimately, securing a balanced approach could lead to a sustainable future for the automotive industry amidst fluctuating international trade dynamics.

Strategies to Enhance European Competitiveness

As the EU navigates through the complexities of trade negotiations, enhancing European competitiveness is a top priority. This involves not just the reduction of tariffs but also strategic investments in technology, innovation, and infrastructure. By focusing on these areas, the EU can bolster its economic resilience against external shocks, such as heavy U.S. tariffs.

Moreover, strategic alliances with other countries similarly affected by U.S. trade policies can amplify the EU’s negotiating power. By sharing insights and tactics, the EU can craft a more cohesive strategy that strengthens its position at the negotiation table. This multidimensional approach is essential to safeguard the interests of not just individual countries but the collective European economic landscape.

The Importance of Timeline in EU Trade Negotiations

Time is of the essence as the EU engages in trade negotiations with the U.S. The looming August 1 deadline imposed by President Trump creates an urgent backdrop, necessitating swift yet strategic decisions. The pressure associated with this timeline could spur more flexible negotiations; however, it could also lead to rushed decisions that may not serve the EU’s long-term strategic interests.

In this context, both parties face the challenge of balancing urgency with due diligence. The EU’s ability to navigate this timeline effectively could determine the feasibility of reaching an agreement that mitigates potential tariffs and fosters a healthy trade environment. Strategies tailored to address time constraints can lead to more favorable outcomes and a lasting solution to ongoing trade issues.

Public Sentiment Towards Trade Policies

Public opinion plays a crucial role in shaping trade policies. As Trump’s administration pursues aggressive trade tactics, the resulting backlash can influence negotiations between the U.S. and EU. Citizens concerned about job losses and increased prices due to tariffs are likely to amplify calls for fairer trade agreements that consider economic welfare over protectionist measures.

The EU, understanding the weight of public sentiment in such negotiations, must navigate these discussions with a keen awareness of the impact trade policies have on everyday consumers. By placing the economic well-being of citizens at the forefront, the EU can strengthen its bargaining position and foster public support for agreements that aim to lower trade barriers and enhance mutual prosperity.

Potential Economic Outcomes from a Trade Deal

If the EU achieves a favorable trade deal with the U.S., the anticipated economic outcomes could be substantial. Lowering tariffs and fostering open trade can lead to increased investment flows, job creation, and a more competitive market for goods and services. Such outcomes would enhance the trade relationship, improving overall economic health on both sides of the Atlantic.

Conversely, failure to reach an agreement could have dire consequences, further amplifying the trade war’s impact on businesses and consumers alike. The complex interdependencies of global markets render it essential that both regions find common ground, as the economic stability of numerous sectors hangs in the balance. With strategic negotiations, the EU can work towards establishing a trade environment that catalyzes economic growth while minimizing risks associated with international trade conflicts.

Frequently Asked Questions

What impact do Trump’s tariffs have on EU trade deal negotiations?

Trump’s proposed 30% tariffs on EU goods create significant pressure on EU trade deal negotiations. The European Union is motivated to secure an agreement before the August 1 deadline to avoid heightened tariffs that could worsen the trade war impact.

How are EU countermeasures being prepared in light of U.S. tariffs?

In response to the potential 30% tariffs proposed by Trump, the EU is implementing a strategy that includes preparing countermeasures. This involves having plans ready for tariffs on steel and aluminum, along with reciprocal tariffs amounting to 72 billion euros.

What is the status of the U.S.-EU tariff agreement negotiations?

As the August 1 deadline approaches, U.S.-EU tariff agreement negotiations are ongoing, with the EU eager to negotiate. They are exploring ways to lower tariff and non-tariff barriers while preparing significant countermeasures if an agreement is not reached.

What role do automobile tariffs play in the EU’s trade negotiation strategy?

Automobile tariffs are crucial in the EU’s ongoing trade negotiations with the U.S. The EU is willing to offer reciprocal tariff reductions, proposing to eliminate its 10% tariffs on U.S. cars if the U.S. lowers its tariffs below 20%.

How does the trade war impact the EU’s economic strategy?

The trade war led by the U.S. impacts the EU’s economic strategy by forcing the bloc to enhance its competitiveness and prepare countermeasures. The EU views the U.S. as a vital economic partner, making it crucial to reach an agreement to avoid exacerbating tariffs.

What are the consequences of failing to reach a trade deal before the deadline?

Failing to reach a trade deal with the U.S. before the August 1 deadline could result in the implementation of Trump’s 30% tariffs on EU goods, significantly affecting trade flows and economic relations between the parties involved.

How does the EU’s strategy compare with other countries negotiating with the U.S.?

The EU is in touch with other countries affected by U.S. tariffs to understand the broader context without direct coordination. This is part of their strategy to ensure they remain competitive while negotiating their own trade deal.

What is the significance of U.S. tariffs on the EU’s international trade relationship?

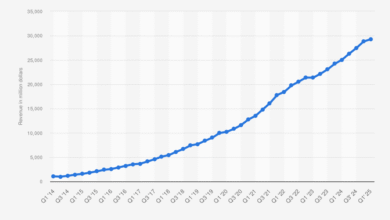

U.S. tariffs significantly impact the EU’s international trade relationship, which constitutes about 30% of global trade in goods and services. A trade deal is critical to maintain this relationship and to mitigate the negative effects of tariffs on economic growth.

Why is the U.S.-EU trade relationship described as the most vital economic relationship?

The U.S.-EU trade relationship is described as the most vital economic relationship because it represents nearly 30% of global trade and 43% of global GDP. Both sides have much to gain or lose from these discussions, emphasizing the importance of reaching a favorable trade agreement.

| Key Point | Details |

|---|---|

| EU’s Trade Deal Efforts | The EU is aiming to secure a trade deal with the U.S. before the August 1 deadline set by Trump, who proposed a 30% tariff. |

| Four-Part Strategy | 1. Good faith negotiations with U.S. officials; 2. Prepare countermeasures; 3. Coordinate with other affected countries; 4. Enhance European competitiveness. |

| Potential Tariffs | The U.S. is set to impose 30% tariffs if negotiations fail, prompting the EU to prepare for various countermeasures. |

| Bilateral Trade Relationship | The U.S. and EU hold the largest global bilateral trade relationship, accounting for nearly 30% of international trade. |

| Auto Tariff Negotiations | The EU might reduce its 10% duties on U.S. cars if the U.S. lowers its tariffs below 20%. |

Summary

EU Trade Deal Negotiations are pivotal as they seek to prevent the impending 30% tariffs proposed by President Trump. The European Union is employing a strategic approach consisting of good-faith negotiations, readiness for countermeasures, informational alignment with other affected countries, and efforts to boost competitiveness to secure a favorable outcome. As both parties navigate the complexities of international trade, the stakes remain high, with significant economic implications for both the U.S. and the EU.