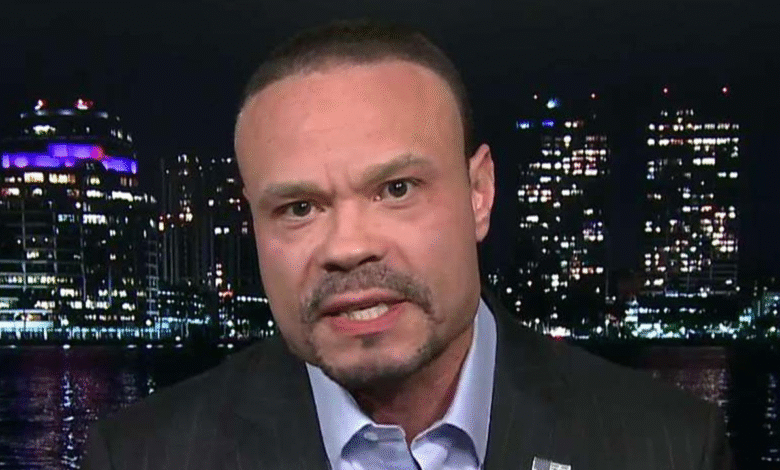

Dan Bongino Resignation: Tensions Over Epstein Files

The recent discussions surrounding Dan Bongino’s resignation have stirred significant controversy within government ranks, particularly against the backdrop of the long-standing FBI Director controversy. Following a heated exchange with Attorney General Pam Bondi about the handling of the high-profile Jeffrey Epstein files—an ongoing investigation linked to numerous powerful figures—Bongino has expressed his frustration, suggesting his tenure may soon come to an end. Sources reveal he feels his career is at risk and even threatened to escalate the situation further unless Bondi faces repercussions. Speculation is rampant as Bongino, typically a staunch supporter of the Trump administration, grapples with dissatisfaction regarding the Justice Department’s response to the Epstein case investigation. This moment in Bongino’s career not only reflects the turbulent nature of political allegiances but also highlights the intricate balance between law enforcement and justice that has captivated public attention.

In light of the ongoing unrest within the FBI, the conversation surrounding Deputy Director Dan Bongino’s possible departure has garnered considerable interest. This development follows his contentious interactions with Attorney General Pam Bondi regarding the administration’s approach to the widely discussed Epstein files. Bongino’s recent grievances have raised eyebrows, particularly as they highlight the tensions related to high-stakes investigations and the management of sensitive information. As discussions intensify over the handling of such prominent cases, it becomes clear that the various dynamics within law enforcement are crucial to understanding both Bongino’s position and the broader implications for the Trump administration’s support. Consequently, the escalating discourse around his resignation illustrates the deep complexities intertwined with the Epstein case and its far-reaching impacts.

The Fallout from Dan Bongino’s Confrontation with Pam Bondi

In the wake of a heated confrontation with Attorney General Pam Bondi, Deputy FBI Director Dan Bongino is contemplating resignation. The incident erupted during a meeting, where Bongino expressed his considerable frustration with the Justice Department’s handling of the Jeffrey Epstein files. According to sources close to him, Bongino believes that the lack of transparency and the management of these sensitive files have not only hindered the investigation but also jeopardized his career. His vocal discontent reflects a broader concern shared among Trump administration allies regarding the handling of high-profile cases like Epstein’s.

This confrontation also raises questions about loyalty within Trump’s law enforcement team. Bongino’s willingness to threaten resignation suggests that he sees a direct connection between the management of the Epstein files and the integrity of the Justice Department. Discontent within top law enforcement ranks could potentially lead to deeper issues of trust, especially if key individuals like Bongino feel sidelined. The fallout from this incident could echo beyond just Bongino’s career, affecting the public perception of the FBI’s and the Justice Department’s ability to handle controversial cases.

The Justice Department’s Response and Its Implications

Amidst the controversy surrounding Dan Bongino’s resignation threat, the Justice Department has chosen a path of silence, providing no comments on the heated exchanges that have taken place. The situation is compounded by the overwhelming dissatisfaction expressed by Bongino and his supporters regarding the handling of the Epstein case investigation. The claims that there is no ‘secret client list’ associated with Epstein, combined with the absence of credible evidence that he blackmailed influential figures, have not assuaged the fears of those who believe a cover-up is ongoing. Such statements from the Justice Department only seem to fuel conspiracy theories rather than quell them.

Furthermore, the Justice Department’s decision not to engage with the media on this matter underscores a potential strategy to avoid inflaming a polarized situation. However, silence can often be interpreted as admission of guilt or incompetence, and this may alienate key support among Trump backers who are frustrated by perceived inaction on an investigation they feel is critical. As political tensions rise, the Justice Department must navigate this landscape carefully to maintain credibility and public trust, especially in the wake of Bongino’s public grievances.

Trump Administration’s Support for Pam Bondi

Despite the internal disputes arising from Dan Bongino’s frustrations, the Trump administration has shown unwavering support for Attorney General Pam Bondi. A White House spokesman emphasized this solidarity, dismissing claims of division within the team. President Trump appears to believe that Bondi’s approach to managing the Epstein files is both effective and necessary, indicating confidence in her decisions amidst rising criticism. This support is crucial, as it sends a clear message to both the public and agents like Bongino that the administration stands firmly behind its decisions regarding ongoing investigations.

Bondi’s role in this controversy is pivotal, as the handling of sensitive cases like those involving Epstein are intrinsically linked to the administration’s approach to justice and law enforcement. The White House’s reiteration of support highlights a concerted effort to project a united front at a time when many supporters are demanding transparency. By aligning with Bondi, the Trump administration aims to provide reassurance that it is steadfast in its commitment to holding individuals accountable, which could ultimately bolster its reputation against allegations of operational fissures.

Conspiracy Theories Surrounding Epstein’s Client Files

The ongoing controversy regarding Jeffrey Epstein’s client files has sparked a myriad of conspiracy theories that have permeated public discourse. Many, including Dan Bongino and some of his followers, have suggested that there is a concerted effort to obscure critical information from the public, further exacerbating their distrust in high-level investigations. Bongino’s podcast platforms his views, affirming suspicions around a potential cover-up regarding Epstein and his connections to powerful figures, which has found fertile ground among conspiracy theorists.

The Justice Department’s repeated claims of no evidence linking Epstein to a list of clients may compound frustration among those who feel the case has been mishandled. As more individuals engage with these theories, the line between fact and fiction blurs, making it increasingly challenging for reputable sources to convey accurate information. The degree of influence that these conspiracy theories wield serves as a reminder of the complexities facing public figures and law enforcement in restoring faith in institutions that many believe prioritize political outcomes over transparency.

Bongino’s Influence within the Trump Supporter Community

As a prominent figure within the Trump supporter community, Dan Bongino’s influence cannot be underestimated. His vocal criticism of the Justice Department’s handling of Epstein’s case resonates deeply with followers who share similar frustrations. Bongino’s assertions on his podcast have bolstered a narrative that questions the integrity of the investigations led by officials like Pam Bondi. His platform provides a voice to those who feel disenfranchised by the political establishment, particularly regarding sensitive matters like Epstein’s connections to high-profile individuals.

Bongino’s ability to connect with the grassroots movement of Trump supporters places him in a potent position. His discontent is not merely personal; it echoes a larger sentiment that seeks accountability and transparency from institutions that many perceive as failing to act in the public’s interest. This dynamic illustrates not only Bongino’s significance but also the potential consequences of his actions, whether it leads to disillusionment within the ranks or rallies support for a more aggressive demand for justice.

The Fallout from Internal Disagreements in the FBI

The internal disagreements within the FBI, exemplified by the confrontation between Dan Bongino and Pam Bondi, bring to light the challenges within law enforcement agencies operating under political scrutiny. Bongino’s threat of resignation illustrates the stakes at play, where individual careers are intertwined with politically charged cases like those involving Jeffrey Epstein. The tensions highlight how investigations can become battlegrounds between personal beliefs and institutional mandates, often complicating the pursuit of justice.

These internal conflicts may also have wider implications for the FBI’s credibility and effectiveness. If key personnel like Bongino feel unsupported, it may lead to disengagement from their roles, hindering the bureau’s capacity to perform its duties efficiently. The repercussions of this discord could reverberate through ongoing investigations, affecting public confidence in the FBI’s ability to tackle high-profile cases fairly. As the nation grapples with these issues, it becomes clear that the FBI must find ways to bridge these internal divides to maintain its integrity and authority.

Epstein Case: A Reflection of Broader Systemic Issues

The Jeffrey Epstein case serves as a critical reflection of broader systemic issues within the judicial and law enforcement systems. Many supporters of Trump and figures like Bongino view the handling of Epstein’s case as emblematic of deeper problems, being indicative of how powerful individuals may evade full accountability. This overarching narrative not only fuels suspicion but also impacts public perceptions of justice in America, leading to calls for more rigorous oversight within these institutions.

The complexity of Epstein’s connections and the resulting case intricacies highlight the need for transparency and comprehensive investigations. Bongino’s frustrations resonate with a segment of the population that feels justice is often compromised due to political affiliations and elite influence. As discussions surrounding this case continue to unfold, it becomes imperative that law enforcement agencies address these systemic issues to rebuild trust and ensure that justice is served for victims, regardless of the power held by those involved.

Navigating Conspiracy Theories in High-Profile Cases

Navigating conspiracy theories in high-profile cases like that of Jeffrey Epstein requires a delicate balance between providing information and countering misinformation. The landscape of public opinion is heavily influenced by figures like Dan Bongino, who amplify suspicions and grievances regarding investigations. Particularly in cases involving sensitive topics and powerful individuals, misinformation can easily spread, making it vital for authorities to actively engage with the public and clarify the facts surrounding the investigation.

While it may seem challenging to challenge deeply entrenched beliefs, providing consistent, transparent communication can help mitigate the damage caused by conspiracy theories. Law enforcement agencies must prioritize transparency and clarity to regain public trust and diminish unfounded speculation. By addressing the root causes of discontent with forthright communication, agencies can foster an environment where citizens feel more validated and confident in the justice process.

Conclusion: The Intersection of Politics and Justice

In conclusion, the situation surrounding Dan Bongino’s potential resignation, coupled with the fallout from the handling of the Jeffrey Epstein files, underscores a tumultuous intersection of politics and justice. As conflicts arise within the FBI and Justice Department, the impact on public perceptions and agency credibility becomes increasingly evident. The various responses and tensions reflect a broader struggle for influence not only over legal proceedings but also over narratives that play out in the media and public discourse.

Going forward, it is clear that the resolution of these issues will require careful consideration of the voices and concerns present within law enforcement and its adversaries. Addressing the discontent among figures like Bongino while remaining steadfast in the pursuit of justice will be key to restoring faith in the institutions tasked with upholding law and order. Ultimately, the balance between political pressures and impartial justice remains a critical challenge for the FBI, the Justice Department, and the Trump administration as a whole.

Frequently Asked Questions

What are the reasons behind Dan Bongino’s resignation following the FBI Director controversy?

Dan Bongino is reportedly considering resignation due to his frustrations with how Attorney General Pam Bondi has handled the Jeffrey Epstein files. His anger stems from a heated confrontation during a meeting where he felt criticized for the lack of transparency around the Epstein case investigation.

How has the Justice Department’s response influenced Dan Bongino’s potential resignation?

The Justice Department’s response, which indicated that there was no secret Epstein client list and affirmed Bondi’s decisions, has likely contributed to Bongino’s dissatisfaction. His trust in the Justice Department’s handling of the Epstein investigation has been undermined, prompting talks of resignation.

What impact does Trump’s administration support have on Dan Bongino’s resignation decision?

Despite Bongino’s grievances, Trump’s administration has publicly expressed support for Pam Bondi and her management of the Epstein files. This backing may pressure Bongino to reconsider his resignation, as it suggests that his criticisms may not align with the administration’s stance.

Are Dan Bongino’s concerns about the Epstein case investigation widespread among Trump supporters?

Yes, Bongino’s concerns echo a broader discontent among Trump supporters regarding the Epstein case investigation. Many believe there is a cover-up, particularly surrounding the release of Epstein files, which has heightened tensions and dissatisfaction within the administration.

How have Bongino’s interactions with Pam Bondi escalated the situation leading to his resignation considerations?

Bongino’s direct confrontations with Pam Bondi over the Epstein files, including reports of an emotionally charged meeting, have escalated tensions significantly. His expressed frustrations and ultimatum to leave unless Bondi is dismissed indicate the severity of his discontent with her handling of the investigation.

| Key Point | Details |

|---|---|

| Dan Bongino’s Frustration | Bongino is considering resigning due to his anger over the handling of Jeffrey Epstein files by the Justice Department. |

| Heated Confrontation | A clash occurred between Bongino, Attorney General Pam Bondi, and White House Chief of Staff Susie Wiles regarding Epstein’s files. |

| Speculation on Resignation | Bongino did not report to work following this incident, fueling rumors about his resignation. |

| Administration Support | The White House reiterated its support for Bondi and the decisions made about the Epstein files. |

| Public Response | Trump supporters are dissatisfied with the lack of additional information on the Epstein case and some believe a cover-up exists. |

| No Evidence of Client List | The Justice Department asserts there is no verifiable client list linked to Epstein. |

Summary

Dan Bongino’s resignation appears imminent following his intense confrontation with Attorney General Pam Bondi over the handling of the Jeffrey Epstein files. This situation highlights the growing tensions within the administration regarding critical issues linked to the Epstein case. Despite support from the White House for Bondi’s management, Bongino’s frustrations indicate a possible rift in the Justice Department and FBI’s approach to such sensitive matters. The dissatisfaction among Trump supporters regarding the handling of Epstein-related information calls for further scrutiny of the ongoing investigations and the administration’s willingness to address public concerns.