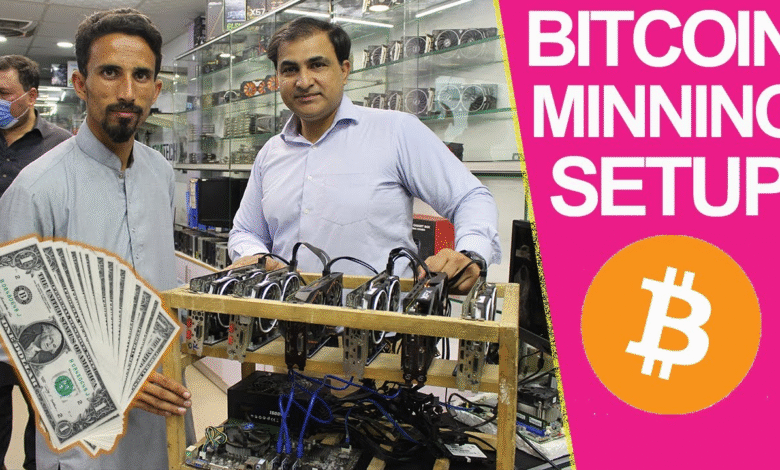

Bitcoin Mining Pakistan: 2,000 MW Initiative Announced

Bitcoin mining in Pakistan has emerged as a pivotal component of the nation’s ambitious strategy to modernize its energy sector. On May 25, the government announced an innovative initiative to allocate 2,000 megawatts (MW) for this purpose, setting the stage for substantial progress in the cryptocurrency field. With the aim of harnessing excess energy generation capacity, this move not only positions Pakistan on the global bitcoin mining map but also stimulates economic growth through the creation of high-tech jobs. Coupled with the burgeoning interest in AI data centers in Pakistan, this initiative underscores a commitment to investing in renewable energy in Pakistan, providing a sustainable and attractive environment for foreign investors. As developments unfold, the focus on Pakistan’s bitcoin mining capacity is expected to generate waves of interest in the latest updates from the Pakistan energy sector news.

The surge of cryptocurrency activities in the region is evident as the Pakistani government embarks on a groundbreaking project to support digital currency operations. The allocation of substantial energy resources, specifically 2,000 MW, marks a crucial phase in advancing the country’s technological capabilities. This initiative not only underscores the potential of bitcoin mining but also highlights the growing demand for green energy resources as the nation explores innovative solutions. By integrating artificial intelligence facilities alongside cryptocurrency ventures, Pakistan is positioning itself as a hub of digital economy growth. This evolution in the energy landscape secures a promising future for both local and foreign investments in emerging technologies.

Understanding Bitcoin Mining in Pakistan

Bitcoin mining in Pakistan is gaining traction as the government recognizes the potential of this digital currency to revitalize the economy. With the recent initiative to allocate 2,000 MW for bitcoin mining and AI data centers, Pakistan is positioning itself as a competitive player in the global crypto market. The strategic use of the country’s excess energy capacity not only addresses power surplus issues but also shows a commitment to embracing technological advancements.

The initiative aims to leverage low-cost energy sources, enhancing the profitability of bitcoin mining operations. As awareness of cryptocurrencies increases, more local entrepreneurs are looking to invest in mining. By tapping into renewable energy options and potentially lowering operational costs, Pakistan could see significant growth in its bitcoin mining capacity, attracting both domestic and foreign investments.

Frequently Asked Questions

What is the Pakistan Bitcoin Mining Initiative?

The Pakistan Bitcoin Mining Initiative refers to the national effort announced by the government to allocate 2,000 megawatts (MW) of electricity specifically for Bitcoin mining and AI data centers. This initiative aims to utilize the country’s excess energy capacity while fostering technological growth and attracting foreign investment in Pakistan.

How does Pakistan’s renewable energy sector impact Bitcoin mining?

Pakistan’s renewable energy sector plays a crucial role in Bitcoin mining by providing alternative and sustainable power sources. With the country’s rapid expansion in solar energy, miners can benefit from lower electricity costs, making Bitcoin mining in Pakistan more viable and eco-friendly.

What is the current Bitcoin mining capacity in Pakistan?

The current Bitcoin mining capacity in Pakistan is being enhanced by the recent initiative to provide 2,000 MW for this purpose. This allocation is expected to significantly increase the mining capacity, positioning Pakistan as a favorable location for Bitcoin mining operations, coupled with its abundant energy resources.

What are the benefits of AI data centers in Pakistan alongside Bitcoin mining?

The establishment of AI data centers alongside Bitcoin mining in Pakistan offers significant benefits, such as job creation in high-tech industries and the potential for boosting the local economy. This initiative also aims to attract foreign investment, thereby enhancing Pakistan’s tech infrastructure.

What are the implications of high tariffs on Bitcoin mining in Pakistan?

High tariffs in Pakistan’s energy sector have historically hindered Bitcoin mining operations. However, the new initiative to allocate 2,000 MW seeks to alleviate this issue by providing more affordable electricity specifically for miners, thereby improving the overall profitability and feasibility of Bitcoin mining ventures in the region.

| Key Point | Description |

|---|---|

| New Initiative | Pakistan allocates 2,000 MW for bitcoin mining and AI. |

| Date Announced | May 25, 2023 |

| Energy Utilization | Reuses excess generation capacity from the energy sector. |

| Economic Benefits | Aims to create high-tech jobs and boost foreign investments. |

| Strategic Goal | First step in a multi-stage rollout of digital infrastructure. |

Summary

Bitcoin mining in Pakistan is set to undergo significant transformation with the government’s recent allocation of 2,000 megawatts. This initiative aims to tap into the country’s excess energy generation capacity, addressing longstanding challenges in the energy sector while creating jobs and attracting foreign investments. As the nation embraces digital infrastructure, this move positions Pakistan to capitalize on the rapidly evolving landscape of cryptocurrency and artificial intelligence.