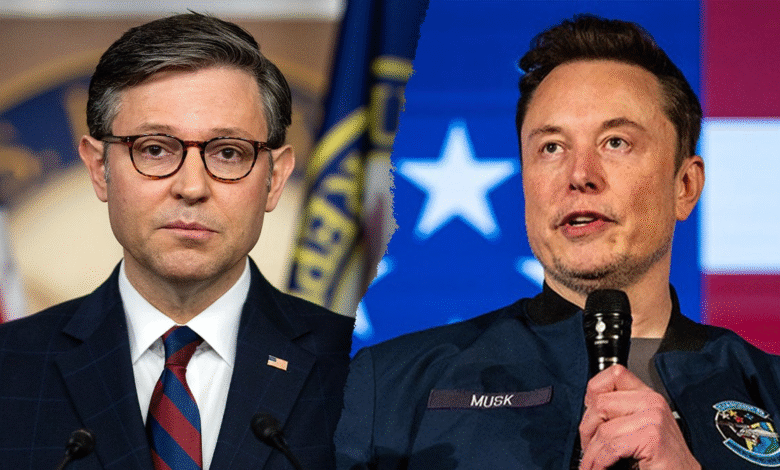

Mike Johnson Advocates for Elon Musk Donald Trump Reconciliation

In recent discussions surrounding Mike Johnson and Elon Musk reconciliation, House Speaker Mike Johnson has expressed optimism about bridging the gap between Musk and former President Donald Trump. Johnson emphasized the importance of unity, stating that despite the emotional tensions from their public disagreements, collaboration serves the nation’s best interests. The Louisiana Republican’s remarks came in light of Musk’s criticism of the GOP spending bill, which he deemed a “disgusting abomination”. While Johnson hasn’t spoken with Musk since the controversy intensified, he remains focused on legislative goals aimed at assisting hardworking Americans rather than appeasing wealthy individuals. This dynamic underscores a critical juncture in political reconciliation, showcasing the intersection of personal relationships and legislative efforts in the current political landscape.

Addressing the recent discord among prominent figures, the discourse around the reconciliation of Mike Johnson, Elon Musk, and Donald Trump highlights the complexities of political relationships today. Speaker Johnson’s expressed hope for a truce between Musk and Trump reflects broader concerns regarding cooperation amidst emotional controversies. The former president’s reluctance to restore ties with Musk, following criticism of the GOP’s spending bill, raises questions about political alliances and their implications for party unity. Moreover, Johnson’s stance on supporting the American public against criticisms from billionaires like Musk illustrates the balancing act of political leadership in a divided atmosphere. This evolving scenario not only emphasizes personal reconciliations but also the potential repercussions for legislative agendas and broader party dynamics.

The Need for Political Reconciliation Amidst Disagreements

In today’s polarized political climate, figures like House Speaker Mike Johnson are advocating for reconciliation as a pathway to unity. Reconciliation in politics is essential, especially when influential leaders such as Elon Musk and Donald Trump express opposing views on significant legislative matters. Johnson’s remarks highlight the importance of dialogue and collaboration, stating, “there’s a lot of emotion involved, but it’s in the interest of the country for everyone to work together.” Such sentiments underscore the necessity of moving beyond personal disputes to focus on the greater good of the nation.

Political reconciliation can lead to more effective governance and policy-making, especially concerning pivotal issues like the GOP spending bill that recently passed. The contrasting opinions from Musk and Trump demonstrate the challenges that arise when significant players in the economy and politics clash. Johnson emphasizes that the goal is not to cater to billionaires but to aid everyday Americans. This focus reflects a broader movement among political leaders to seek cooperation and resolution in the face of discord.

Mike Johnson’s Role in the GOP Spending Bill Debate

House Speaker Mike Johnson has emerged as a key player in the ongoing debate surrounding the GOP-led spending bill, which has faced harsh criticism from high-profile individuals, including Elon Musk. Johnson’s dismissal of Musk’s comments—branding them as irrelevant to the legislative process—highlights a tension between the tech billionaire’s influence and the responsibilities of elected officials. By asserting the need to assist hardworking Americans, Johnson reaffirms his commitment to his constituents over the voices of the wealthy.

The passage of the spending bill, dubbed a “disgusting abomination” by Musk due to its implications for federal deficits, signals a significant moment in GOP politics. Johnson’s leadership is tested as he navigates the pressures from both his party and external critics like Musk. The implications of these discussions are vast, particularly in how they might affect future alliances within the GOP, especially with influential figures like Donald Trump.

Elon Musk’s Critique and the Consequences of Political Fallout

Elon Musk’s sharp critique of the GOP spending bill has significant ramifications, not only for his relationship with Donald Trump but also for his standing within Republican circles. Musk’s description of the spending bill as detrimental suggests a deep divide that could influence voter sentiments among GOP supporters. As House Speaker Mike Johnson aims for unity, Musk’s public stance could serve as a barrier to reconciliation, underlining the challenges faced by leaders trying to foster cooperation.

In the wake of Musk’s comments, both he and Trump have reportedly ceased communications, further illustrating the potential fallout from political disagreements. Trump’s apparent disinterest in mending fences with Musk speaks volumes about the enduring impacts of their dispute. Johnson’s warnings about Musk aligning with Democratic candidates only intensify the sense of an impending electoral battle where reconciliation seems increasingly difficult.

The Implications of Public Opinion on Political Relations

In the current political landscape, public opinion plays a crucial role in shaping the dynamics of relationships between leaders like Mike Johnson, Elon Musk, and Donald Trump. Johnson’s belief that it is healthier for the nation if these prominent figures can reconcile reflects a broader understanding of the intertwined nature of political decisions and public sentiment. A fractured relationship, particularly one involving influential figures such as Musk, can divert attention from pressing policy matters that directly affect citizens.

Moreover, the response of constituents to these public disputes may influence the political ramifications in future elections. Leaders must navigate these waters carefully, balancing their stances on controversial issues against the backdrop of public expectation and opinion. Johnson’s statement regarding the need for collaboration suggests a strategic approach aimed at mitigating potential backlash from voters concerned about political divisiveness.

Key Takeaways from Johnson’s Statements on Reconciliation

House Speaker Mike Johnson’s recent comments indicate a hopeful outlook for reconciliation between foes such as Elon Musk and Donald Trump. His approach emphasizes the importance of collaboration over division, recognizing that political leaders must sometimes set aside differences to work toward the common good. Such statements serve not only to address the immediate fallout from the spending bill but also to foster a culture of dialogue and understanding among differing parties.

The key takeaways from Johnson’s stance reveal the underlying need for political figures to embrace unity amid discord. His calls for friends and allies to come together are reflective of a desire to protect the interests of the American people, showcasing a leadership model that prioritizes community and cooperation over personal grievances.

The Influence of Elon Musk on GOP Dynamics

Elon Musk’s recent foray into political criticism has undeniably impacted the dynamics within the Republican Party. As House Speaker Mike Johnson navigates the delicate balance of legislation and public sentiment, he must consider Musk’s substantial influence as a tech mogul and public figure. Musk’s opposition to the GOP spending bill complicates relationships within the party, particularly as Trump expresses a rigid stance against reconciling with him.

The interplay between Musk and GOP leaders showcases how financial power and public opinion can reshape political landscapes. As influential figures in their own right, both Johnson and Musk must confront the ramifications of their statements and actions, which could resonate with voters and party loyalty in future political endeavors.

Prospects for Future Collaboration Between Tech Giants and Politicians

The future of collaboration between tech giants like Elon Musk and politicians such as Mike Johnson remains uncertain, especially following significant disagreements over policies like the GOP spending bill. Johnson’s hope for reconciliation may be seen as ambitious in light of Musk’s criticisms and Trump’s refusal to extend an olive branch. Nevertheless, the potential for collaboration exists, especially if both parties recognize the importance of working together for the nation’s benefit.

Ultimately, successful collaboration would require open communication and a willingness to listen to diverse perspectives. Johnson’s advocacy for collective efforts could pave the way for healthier political discourse, promoting an environment where tech leaders and elected officials can jointly address the pressing challenges facing our nation. Only time will tell if the path forward can lead to meaningful partnerships that ultimately benefit the public.

Voter Reactions to Influential Figures in Politics

Voter reactions to influential figures like Elon Musk and their critiques of political agendas play a significant role in shaping electoral outcomes. As Mike Johnson navigates the complexities of public sentiment surrounding the GOP spending bill, the need to be attuned to voters’ attitudes toward Elon Musk’s influence cannot be understated. Discontent among voters regarding perceived divides among political leaders could lead to shifts in support and allegiance.

Public perception of figures who publicly criticize legislation, particularly from constituents who might be swayed by Musk’s insights, can serve as a double-edged sword. Johnson, as a political ally of Trump, must balance these reactions carefully, ensuring that the GOP remains relatable and aligned with grassroots sentiments while also addressing the concerns raised by influential voices.

Conclusion: The Path Forward for Political Leaders

As the dialogue surrounding the GOP spending bill continues, the prospects for reconciling relationships between figures like Mike Johnson, Elon Musk, and Donald Trump will determine the political landscape going forward. The ongoing discussions of respect, collaboration, and mutual understanding can serve as cornerstones for effective leadership in both politics and business. Johnson’s attempts at fostering reconciliation reflect a broader necessity for political leaders to engage positively with diverse perspectives.

The path forward may be fraught with challenges, given the tight-knit relationships and differing priorities at play. However, by prioritizing constructive engagement, political leaders can strive to create an environment conducive to progress, ultimately enhancing the opportunities for collaboration between sectors vital for the nation’s prosperity. The pursuit of unity in political discourse remains essential as the country seeks solutions to paramount issues.

Frequently Asked Questions

What role does Mike Johnson see in the reconciliation between Elon Musk and Donald Trump?

Mike Johnson, as House Speaker, believes that reconciliation between Elon Musk and President Donald Trump is crucial for the nation’s interest. He expressed that regardless of their public disagreements, it’s important for influential figures to collaborate for the benefit of the country.

Why is Elon Musk critical of the GOP spending bill supported by Mike Johnson?

Elon Musk labeled the GOP spending bill a “disgusting abomination,” arguing that it would lead to increased federal deficits. His criticism caused a rift, sparking concerns from Mike Johnson that Musk’s stance may hinder political reconciliation within the GOP.

How has the fallout between Elon Musk and Donald Trump affected the GOP?

The fallout between Elon Musk and Donald Trump has raised alarms among GOP leaders like Mike Johnson. Johnson warned that Musk’s support for Democratic candidates could negatively impact Republican interests and political cohesion.

What are Mike Johnson’s hopes for the future of politics regarding Musk and Trump?

Mike Johnson hopes for a resolution between Elon Musk and Donald Trump, emphasizing that working together is more beneficial for the country than remaining divided over political issues.

Is there communication between Elon Musk and Donald Trump following their disagreement?

Currently, there has been no communication between Elon Musk and Donald Trump since their disagreement began, as confirmed by White House press secretary Karoline Leavitt.

What implications does Musk’s criticism of the GOP spending bill have for political reconciliation?

Mike Johnson indicates that Musk’s harsh criticism of the GOP spending bill complicates the potential for political reconciliation, suggesting that a supportive relationship is necessary for unity within the Republican Party.

How does Mike Johnson plan to navigate the divide between Elon Musk and Donald Trump?

Mike Johnson is focused on encouraging dialogue and reconciliation between Elon Musk and Donald Trump, advocating for a collaborative effort that benefits the Republican Party and the American people.

What are the potential consequences of Elon Musk supporting Democratic candidates according to Mike Johnson?

Mike Johnson warns that if Elon Musk supports Democratic opponents of Republicans who voted for the spending bill, it could lead to significant ramifications for GOP unity and their legislative agenda.

| Key Points |

|---|

| House Speaker Mike Johnson expresses hope for reconciliation between Elon Musk and Donald Trump after their public disagreement. |

| Johnson emphasizes the importance of unity for the country’s interests, despite the emotional nature of the conflict. |

| Musk criticized the GOP-led spending bill, referring to it as a “disgusting abomination,” which has fueled tension. |

| Despite Musk’s critiques, Johnson insists the legislation aims to help hardworking Americans, not appease wealthy individuals. |

| The fallout between Musk and Trump is significant, as Trump shows no interest in reconciling, hinting at a potential permanent rift. |

| Johnson cautions Musk against supporting Democratic candidates who oppose Republicans who backed the spending bill, highlighting party loyalty. |

Summary

The Mike Johnson Elon Musk reconciliation discussion highlights important tensions within political and business relationships in the current environment. As Johnson seeks to bridge gaps between Musk and Trump, he underscores the necessity for unity in national interests. Musk’s critical stance towards specific legislation has exacerbated existing divisions, notably with Trump’s refusal to reconcile, which suggests longer-lasting implications for their relationship. Ultimately, Johnson’s warning to Musk about aligning with Democratic candidates emphasizes the significance of loyalty within political affiliations amid these ongoing reconciliations.