Trump Tariffs: Jamie Dimon Warns of Market Complacency

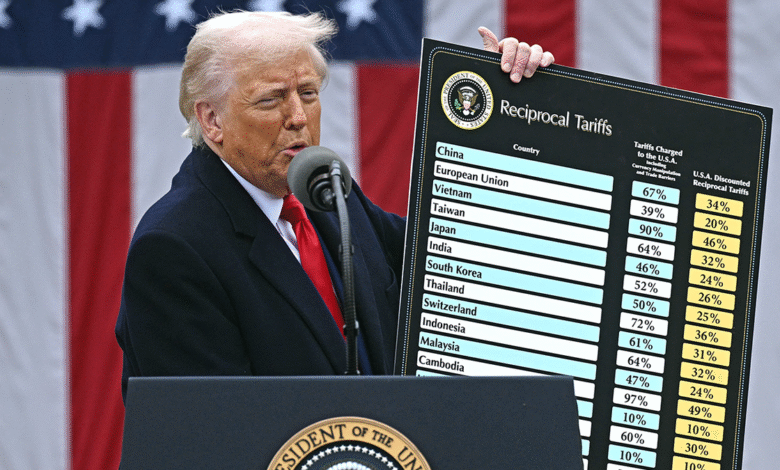

Trump tariffs have emerged as a pivotal discussion point in the current economic climate, especially voiced by industry leaders like JPMorgan Chase CEO Jamie Dimon. During a recent investor meeting, Dimon highlighted the escalating U.S. deficits and the complacency in the stock market, suggesting that such tariffs could bring unforeseen consequences. He believes markets are overlooking significant risks tied to inflation and potential stagflation, which could be exacerbated by aggressive trade policies. Dimon’s concerns resonate particularly as the U.S. grapples with increased international tensions, indicating that the prevailing optimism in the markets might be misplaced. Investors should heed these warnings as they navigate an uncertain landscape shaped by tariff impacts and economic volatility.

The recent discourse surrounding trade tariffs implemented during the Trump administration has shone a spotlight on broader economic implications, as noted by financial experts including Jamie Dimon of JPMorgan Chase. In his remarks, Dimon emphasized that the current stock market is displaying an alarming sense of complacency, suggesting that the ramifications of U.S. deficits and trade tensions are not being adequately factored into market performance. This underestimation poses risks of higher inflation rates and stagflation, phenomena that could disrupt economic stability. As investors remain cautiously optimistic, the specter of increasing national debt and unpredictable tariff outcomes looms large, challenging their adaptability. Thus, an informed approach is necessary, especially given the ever-evolving nature of global economic policies.

The Impact of Trump Tariffs on Market Stability

The introduction of Trump’s tariffs has stirred significant debate regarding their long-term effects on the U.S. economy and financial markets. CEOs like Jamie Dimon have expressed concern that the market’s current complacency might overlook the potential repercussions of these tariffs. As products become more expensive due to increased tariffs on imports, consumers may face higher prices at the register, directly impacting spending and economic growth. This shift could lead to a domino effect, where decreased consumer spending translates into weakened corporate earnings, thus exacerbating U.S. deficits.

Moreover, while some sectors may initially benefit from protective tariffs, the overall economy faces the risk of stagflation. Dimon argues that the market’s optimism does not align with the grim reality of rising inflation rates combined with stagnant economic growth. As tariffs continue to reshape trade dynamics, it is crucial for investors to consider how deepening U.S. deficits might affect corporate profitability, particularly in industries heavily reliant on imported goods. Financial leaders must adopt a cautious approach, analyzing how these trade policies might play into broader economic pressures.

Jamie Dimon Warns Against Market Complacency Amid Rising Risks

Jamie Dimon, CEO of JPMorgan Chase, has been vocal about his worries concerning prevailing stock market complacency, especially in light of the current economic landscape. He highlights that investors seem to believe that central banks can manage inflation and economic threats, a notion he questions. Dimon’s statement that “the odds of stagflation…are roughly double what the market thinks” underscores a critical perspective that many investors may be underestimating serious economic indicators. Without a more cautious approach, markets could face drastic corrections as reality sets in.

Furthermore, Dimon’s assertion that the market rebounded from a 10% drop merely reflects a temporary optimism ingrained in investor sentiment. Even as stock prices rise, the undercurrents of significant national debt and looming international trade tensions create a precarious scenario for future market behavior. The potential for U.S. deficits to spiral further due to ineffective economic policies could lead to a sharp decline in earnings growth for S&P 500 companies, as Dimon anticipates a drop to zero percent growth. This possibility demands that investors reassess their strategies and remain vigilant about external economic forces.

The Dangers of Stagflation and Its Effect on Corporate Investment

The risk of stagflation is a pressing concern for corporate leaders, particularly amidst mounting U.S. deficits and rising inflation rates. Stagflation, defined as a period of stagnation accompanied by inflation, presents unique challenges for businesses that rely on consistent growth. Dimon’s insights reflect a broader unease in the market, where a growing number of corporations are adopting a ‘wait-and-see’ strategy concerning new acquisitions and expansions. As uncertainty looms, businesses are likely to reconsider their capital allocation, thereby cooling investment in critical areas.

Investment banking is beginning to show signs of contraction, with predictions indicating a ‘mid-teens’ percentage decrease in revenue for the upcoming quarter. Dimon’s insights hint at a growing fear among corporate clients who are wary of pursuing aggressive growth strategies during turbulent economic times. As market players adjust their forecasts in response to economic signals, sectors like consumer banking may see shifts in demand and revenue potential. The interplay between stagflation fears and investment behavior will be crucial to monitor as the economic landscape continues to evolve.

Navigating the Challenges of U.S. Deficits and International Trade

As the U.S. grapples with unprecedented deficits, the intertwining of national fiscal policy and international trade becomes increasingly complex. The effects of Trump’s tariffs are not isolated, but instead, they ripple through various sectors, impacting economic health and market stability. Jamie Dimon emphasizes the need for a holistic view of how tariffs influence American businesses and consumer behavior, reinforcing the idea that businesses must account for broader economic implications when planning their growth trajectories.

Moreover, the current economic climate forces corporate leaders to ponder the sustainability of U.S. trade policies. The recent downgrade of the U.S. credit rating by Moody’s highlights the risks associated with expanding deficits, particularly in light of rising international tensions that could lead to further economic isolation. Businesses need to cultivate a resilient strategy that can withstand shifts in trade regulations while ensuring that they remain responsive to the economic realities of higher import costs. As these challenges unfold, companies must develop agile frameworks to navigate the uncertain landscape ahead.

Investor Outlook: Assessing Risks and Opportunities in Volatile Markets

Navigating today’s volatile markets requires a diligent assessment of risks associated with U.S. economic policy and external factors. Jamie Dimon’s warnings about market complacency signal to investors that the landscape is ripe for re-evaluation of current investment strategies. With forecasts predicting a stall in earnings growth, market participants must be proactive in identifying potential opportunities while remaining wary of looming economic threats posed by tariffs and increasing U.S. deficits.

Investors would benefit from a strategic focus on sectors that are less sensitive to fluctuations caused by international trade policies. Looking for companies with robust earnings, minimal debt exposure, and a strong competitive edge can provide a cushion against the unpredictable nature of the current market. As Dimon suggests, now is not the time to disregard the complexities of stagflation and inflation while navigating one’s investment strategy. Those who can recognize these nuanced economic indicators will be better positioned to capitalize on emerging opportunities.

The Role of Central Banks in Managing Inflation and Economic Growth

Central banks play a pivotal role in managing the delicate balance between inflation and economic growth. Jamie Dimon has raised concerns about the effectiveness of current monetary policies, suggesting that the complacent attitude towards inflation management might lead to significant economic repercussions. If the market continues to rely on central banks to rein in inflation without acknowledging the inherent risks of U.S. deficits, we could witness a scenario where growth stalls amid increasing prices.

Moreover, the evolving economic landscape requires central banks to adapt their strategies in response to emerging challenges. With tariffs and international trade dynamics complicating inflation trends, policymakers must consider more robust actions to stabilize the financial system, ensuring that consumer trust remains unshaken. The trajectory of economic recovery hinges on the balance central banks strike between fostering growth and curbing inflation, underscoring their vital role in economic stability and investor confidence.

The Future of Corporate America Amid Financial Uncertainties

The current financial landscape presents both challenges and opportunities for Corporate America, as highlighted by Jamie Dimon. With growing concerns about U.S. deficits and the impact of tariffs, businesses face a pivotal moment that could define their future trajectory. Understanding the interplay between fiscal health and market performance becomes crucial as firms navigate potential economic pitfalls. Companies that adapt to rapidly changing conditions will likely emerge stronger, provided they remain proactive in addressing the underlying economic pressures.

Additionally, corporate leaders must cultivate a culture of resilience that prioritizes long-term strategy over short-term gains. By strategically investing in innovation and cost management, firms can mitigate risks associated with inflation and market volatility. Dimon’s insights stress the need for corporations to remain vigilant and responsive to economic indicators while fostering a proactive approach to leadership and growth strategies. The ability to foresee and respond to these multifaceted challenges will be essential for sustainable success in uncertain times.

Succession Planning and Stability in Leadership

As Jamie Dimon hints at his potential departure from the CEO role at JPMorgan Chase in the coming years, the emphasis on succession planning takes center stage. The transition of leadership is particularly crucial during times of economic turbulence, where consistent strategic vision is essential for navigating market challenges. Dimon’s legacy will shape not only the future of the bank but also the broader financial landscape as businesses adapt to new economic realities brought on by U.S. deficits and shifting trade policies.

Identifying and grooming successors who can maintain the bank’s competitive edge will be critical for JPMorgan Chase in the coming years. As demonstrated by Dimon’s leadership style and focus on risk management, future leaders must exhibit a nuanced understanding of both domestic and international economic trends. Effective management will involve a commitment to transparency and communication, assuring investors and clients alike that the institution remains stable amidst broader market fluctuations. Ensuring continuity in leadership during unpredictable times is paramount to preserving trust and confidence within the financial community.

Frequently Asked Questions

What impact do Trump tariffs have on U.S. trade deficits?

Trump tariffs have significantly impacted U.S. trade deficits by increasing costs for imported goods. This can lead to higher prices for consumers and businesses, which might further exacerbate the existing record U.S. deficits. As tariffs raise the cost of foreign products, they can distort trade flows, prompting strategic adjustments in supply chains.

How might Trump tariffs contribute to stagflation risks?

Trump tariffs contribute to stagflation risks by driving up prices alongside potential economic stagnation. If tariffs lead to increased consumer goods prices without corresponding wage growth or economic expansion, this scenario can create inflation while economic activity slows down, fitting the definition of stagflation.

Are stock market investors too complacent about the effects of Trump tariffs?

Yes, according to Jamie Dimon, many investors may be too complacent regarding the effects of Trump tariffs. He suggests that the market is not adequately accounting for the risks of inflation and potential stagnation due to ongoing trade tensions and resultant tariffs, which might not have fully impacted market perceptions yet.

How do Trump tariffs affect corporate investment projections?

Trump tariffs are affecting corporate investment projections as companies adopt a ‘wait-and-see’ approach. This uncertainty stemming from tariffs can lead to lower investment activities, as businesses might postpone acquisitions and expansion plans, resulting in decreased investment banking revenues according to JPMorgan Chase forecasts.

What did Jamie Dimon say about market complacency in relation to Trump tariffs?

Jamie Dimon has highlighted significant market complacency regarding the impact of Trump tariffs, stating that after recent volatility, the market’s strong recovery is not reflective of the underlying economic challenges posed by tariffs and rising U.S. deficits. He anticipates further declines in Wall Street earnings due to these risks.

How are Trump tariffs linked to rising inflation concerns in the U.S.?

Trump tariffs are linked to rising inflation concerns as they increase the cost of imported goods, which can trickle down to consumer prices. This, combined with existing U.S. deficits, raises worries about inflationary pressures that can erode purchasing power and contribute to stagflation risks, as noted by financial leaders like Jamie Dimon.

What does Jaime Dimon predict for the stock market amidst Trump tariffs?

Jamie Dimon predicts that the stock market might face a significant downturn amidst the realities of Trump tariffs, potentially resulting in zero earnings growth for the S&P 500 companies within six months. He cautions that this decline is not adequately reflected in current stock prices, highlighting risks posed by ongoing trade policies.

| Key Points |

|---|

| Jamie Dimon warns of complacency in the stock market. |

| Concerns over high U.S. deficits and potential stagflation. |

| Effective tariffs may not yet have impacted the market significantly. |

| Downgrade of U.S. credit rating by Moody’s due to rising national debt. |

| Earnings growth for S&P 500 companies expected to drop to 0%. |

| Corporate clients taking a cautious approach towards acquisitions. |

| Dimon to lead for less than five more years, succession plans discussed. |

Summary

Trump tariffs are currently a significant concern highlighted by JPMorgan Chase CEO Jamie Dimon, who argues that the financial markets are underestimating the risks associated with these trade policies. Dimon’s warnings about the implications of tariffs, combined with rising deficits and international tensions, suggest a precarious economic future. As forecasts predict earnings growth may come to a halt and corporate clients adopt a cautious stance, the impact of Trump tariffs on the economy could be deeper and more complex than many investors realize.