XRP Price Analysis: Market Cap Hits $135B with 5.5% Surge

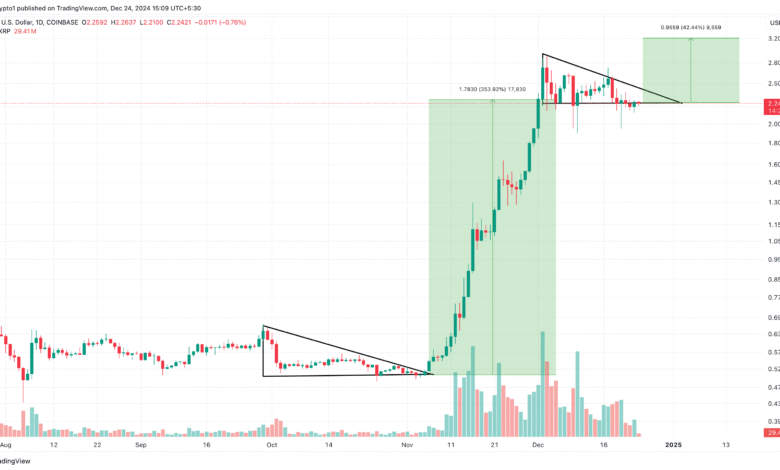

XRP Price Analysis reveals an intriguing landscape within the cryptocurrency market, as the token is currently trading at $2.342, reflecting a significant 5.5% increase over the past week. This surge has propelled XRP’s market cap to an impressive $135 billion, indicative of strong interest and confidence among investors. With its price oscillating between $2.25 and $2.35, traders are keenly watching these movements as they shape potential XRP trading strategies. Moreover, the recent bullish trend emphasizes the necessity for precise XRP price prediction as market dynamics evolve. As trading volume stabilizes at $2.3 billion, vigilance regarding price fluctuations becomes paramount for those seeking to capitalize on this momentum.

In examining the current status of XRP, it’s essential to consider various aspects of its market behavior, including its price momentum and positioning within the broader digital currency ecosystem. With a notable weekly growth, expectations surrounding XRP’s trading performance intensify, leading analysts to explore alternative forecast methodologies. As enthusiasts navigate through price levels and resistance points, they are formulating an effective trading strategy to optimize profits. The ongoing bullish sentiment adds a layer of complexity to market cap evaluations, highlighting how XRP’s standing could influence trading decisions and investment opportunities. Investors keen on harnessing the potential of this cryptocurrency must stay informed on trends and updates to enhance their understanding of XRP’s trajectory.

XRP Price Analysis: Current Market Trends and Predictions

XRP has seen significant movements in recent weeks, with the current trading price reflecting a solid increase of 5.5%. This surge indicates a growing interest among traders and investors within the cryptocurrency market, positioning XRP favorably with a market cap of approximately $135 billion. As the price fluctuates between $2.25 and $2.35, it showcases a controlled yet optimistic sentiment in the market, an important indicator for predicting future price movements. Investors are closely monitoring these levels for potential trading strategies, especially around the pivotal price points that may signify consolidation or breakout opportunities for XRP.

The technical indicators are showing a bullish bias overall, especially with the intraday movements hinting at a possible breakout as XRP holds a strong support level around $2.26. Short-term traders are particularly focused on the 1-hour and 4-hour charts, where bullish patterns are emerging, such as the bounce off key support levels and the presence of green candlesticks. With the resistance level set around $2.40, there is a chance that XRP could push further upwards if momentum is maintained. Consequently, strategic trading decisions should be made considering both entry and exit points, aligning them with market sentiment.

XRP Trading Strategy: Navigating Market Volatility

For investors looking to capitalize on the bullish trend of XRP, an effective trading strategy is essential. Current market behaviors suggest a buying opportunity in the zone near $2.24 to $2.26, where traders can place stop-loss orders at around $2.24 to mitigate losses. As XRP approaches resistances at $2.30 and $2.35, it’s crucial for traders to reassess their positions, taking profits while safeguarding against potential reversals. Additionally, monitoring trading volume can provide insights into market sentiment; lower volumes during upward pushes could indicate a lack of buying pressure and a potential pullback.

In a volatile market, incorporating technical analysis into trading strategies can enhance decision-making. The use of moving averages informs traders of overall momentum, while various oscillators can indicate overbought or oversold conditions. The current reading of the RSI at 57.83 highlights a neutral stance, suggesting that while the market shows bullish potential, caution is warranted as momentum indicators show early warning signs of weakness. Therefore, an informed XRP trading strategy should adapt to these indicators, preparing for swift market changes.

Assessing XRP’s Bullish Trend and Market Cap Stability

As XRP’s market cap stabilizes at around $135 billion, the bullish trend gains strength from a consistent pattern of higher highs and higher lows. These movements reinforce optimistic sentiments among long-term investors, as the price seeks to breach the critical resistance mark of $2.30 to $2.35. Moreover, market participants would benefit from keeping a close eye on the support levels established between $2.15 and $2.20, which provide a strong cushion for any correction that may occur. The overall sentiment remains constructive, bolstered by favorable trading conditions and increasing market interest in XRP.

Should XRP manage to maintain its upward trajectory, the bullish trend might not only attract more investors but also lead to a substantial increase in trading volume, further boosting market cap. Keeping track of such factors is essential for understanding the dynamics at play in the cryptocurrency market. Additionally, XRP’s potential bullish breakout could signal a broader recovery trend for other cryptocurrencies, highlighting the significance of XRP’s performance in shaping market perceptions and influencing trading strategies across the digital currency landscape.

Interpreting Technical Indicators for XRP Trading

Technical indicators are instrumental in forming an understanding of XRP’s potential price movements. For instance, the bullish engulfing pattern observed recently has sparked renewed buying activity, suggesting that short-term traders might find opportunities around the $2.24 to $2.26 price levels. The interplay between various oscillators, such as the ADX and CCI, provides a more nuanced view of market strength, with current levels indicating a cautiously optimistic outlook. Regular monitoring of these indicators helps traders align their strategies with market momentum to optimize profit potential.

Moreover, moving averages serve as critical tools in affirming the overall bullish sentiment surrounding XRP. All short- to mid-term averages indicate buying strength, reflecting a constructive setup for continued upward momentum. Yet, vigilance is necessary as the 200-period SMA indicates bearishness, underscoring the importance of balancing risk while capitalizing on potential gains. Informed traders will leverage this information to navigate XRP trades effectively, maximizing rewards while managing exposure to unforeseen price shifts.

Long-term Outlook for XRP: Key Levels to Watch

The long-term outlook for XRP remains promising as it continues to establish a resilient market presence. With the price consistently making higher highs and maintaining strong support levels, investors are increasingly optimistic about future price developments. The established support zone around $2.15 to $2.20 serves as a reliable base for potential accumulation, especially during pullbacks. Key resistance levels at $2.30 to $2.35 are critical, as a sustained breakout above these points could initiate significant upward movement, bringing XRP closer to its all-time highs.

Furthermore, the overall health of the cryptocurrency market will play a pivotal role in determining XRP’s journey forward. As market cap trends upward, the sentiment in the broader cryptocurrency space influences trader behavior, impacting demand for XRP. Sustained investments and participation from institutional players could further catalyze XRP’s price actions. Hence, keeping an eye on market trends, key levels, and investor movements will be vital in forecasting XRP’s trajectory and ensuring beneficial trading decisions.

XRP Market Sentiment: Analyzing Bullish and Bearish Indicators

Market sentiment plays a crucial role in determining the trajectory of XRP prices, particularly in a landscape characterized by abrupt shifts. Currently, the bullish sentiment suggests an optimistic outlook for XRP’s upward price movements, with the potential for breakouts above key resistances. However, caution is warranted; recent price actions indicate signs of possible exhaustion nearing the $2.30 mark. Thus, it is vital for traders to keep track of volume and buying interest to ascertain whether XRP can sustain its bullish trend or if a bearish correction may be imminent.

As the market evolves, assessing both bullish and bearish indicators is essential for developing effective trading strategies. While the recent gains express confidence among traders, the late-stage momentum indicators signal that XRP could face challenges ahead, particularly if it fails to maintain support around $2.24. Traders are encouraged to remain vigilant, adapting their strategies to shifts in market sentiment while leveraging technical analysis to capitalize on potential opportunities or mitigate risks.

XRP Price Predictions: Evaluating Short- to Long-term Prospects

Making accurate XRP price predictions involves understanding both current market dynamics and historical price movements. Analysts suggest that if XRP breaks beyond the resistance level at $2.35, it might reach targets of $2.40 and upward—the next levels to watch for potential pullbacks. With the ongoing bullish trend, predictions remain optimistic, especially if buyers maintain momentum and volume increases during upward movements. Continuing recovery from previous lows strengthens the case for potential all-time highs, reinvigorating trader interest in XRP.

In contrast, should critical support levels at $2.24 fail, it could lead to more significant corrections, pushing XRP prices back towards the $2.20–$2.15 range. This scenario could jeopardize the bullish structure, warranting a reevaluation of price predictions. Traders must remain informed about market trends and external catalysts that could impact XRP’s price, as the cryptocurrency market is often influenced by regulatory changes, technological advancements, and broader economic factors. These considerations will be vital for anyone looking to navigate the future landscape of XRP trading.

Strategies for Successful XRP Investment

Successful investment in XRP requires a balanced strategy that combines analysis with risk management. Given XRP’s current price dynamics and market behavior, a careful approach involves identifying optimal entry points while keeping stop-loss orders to limit potential losses. By focusing on the support and resistance levels around $2.26 and $2.40, investors can navigate trades more effectively, capitalizing on fluctuations while safeguarding their capital. Furthermore, maintaining flexibility in adjusting investment strategies based on market movements will empower investors to respond proactively to changes in XRP’s price actions.

Moreover, diversifying investment within the cryptocurrency market alongside XRP can enhance overall portfolio stability. By spreading risk across different assets while mainly focusing on XRP’s bullish trends, individuals can mitigate the impact of unpredictable market shifts. In applying these strategies, continuous education about market conditions, price predictions, and trending news will arm XRP investors with the insights needed to make informed decisions. This adaptive approach will help maximize the potential for profits while minimizing inherent risks within crypto trading.

Frequently Asked Questions

What is the current XRP price analysis for July 2023?

As of July 2023, the XRP price is trading at $2.342, reflecting a 5.5% increase over the past week. The market capitalization has reached $135 billion, demonstrating a controlled but optimistic sentiment within the cryptocurrency market.

How does XRP price prediction look for the upcoming weeks?

Based on recent trends and technical analysis, the XRP price prediction suggests potential bullish momentum if the price breaks above the resistance level of $2.30. Continued higher highs and higher lows indicate a positive outlook, although traders should keep an eye on support levels around $2.24.

What are the key components of an effective XRP trading strategy?

An effective XRP trading strategy involves identifying strong support levels as entry points around $2.24 to $2.26 and setting profit targets around $2.35. Keeping stop-loss orders tight can help manage risk, especially if the market shows signs of reversal.

Is there an XRP bullish trend observed in July 2023?

Yes, there is a bullish trend observed in XRP for July 2023. The price has been establishing higher highs and higher lows, reflecting buying pressure as it approaches key resistance levels despite occasional pullbacks in the cryptocurrency market.

What role does market cap play in XRP price analysis?

The market cap, currently at $135 billion, plays a crucial role in XRP price analysis as it reflects the overall value and investor sentiment towards XRP. A higher market cap typically indicates increased trust in XRP, influencing its price movements and stability in the cryptocurrency market.

| Metric | Value |

|---|---|

| Current Price | $2.342 |

| Weekly Surge | 5.5% |

| Market Capitalization | $135 billion |

| Global Trading Volume | $2.3 billion |

| 1-Hour Trend | Sideways with bullish bias |

| 4-Hour Trend | Medium-term recovery trend |

| Daily Trend | Bullish following low of $1.908 |

| Key Support Level | $2.24 |

| Resistance Level | $2.30 to $2.35 |

Summary

XRP Price Analysis reveals a cautious yet optimistic market as the cryptocurrency demonstrates a solid performance with a market cap of $135 billion and a current trading price of $2.342. With various support levels identified and bullish trends apparent on multiple timeframes, XRP is positioned for potential breakout scenarios. However, traders should remain vigilant regarding resistance levels and volume patterns that could indicate shifts in sentiment.