Trump Epstein Letter Sparks Controversy and Criticism

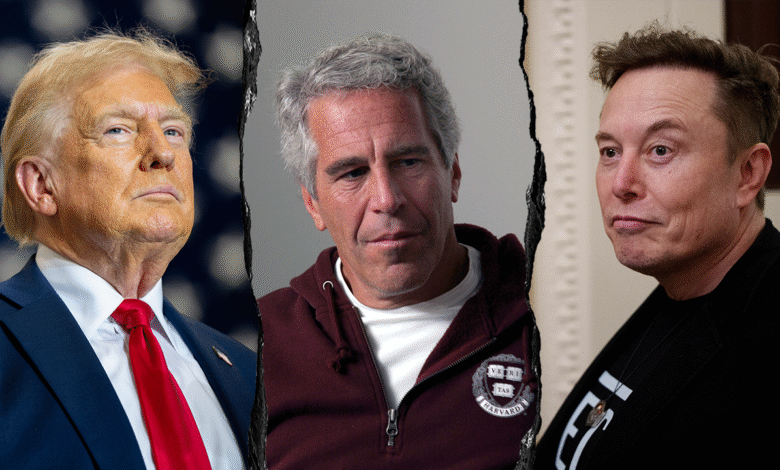

The recent revelation of a “bawdy” letter to Jeffrey Epstein, signed by President Donald Trump, has sparked significant interest and controversy as it sheds light on the past connections between the two figures. This letter, which was included in an album celebrating Epstein’s 50th birthday in 2003, reportedly came at the request of Trump’s associate Ghislaine Maxwell. As the world reflects on the child sex trafficking scandal that engulfed Epstein before his death in 2019, this Trump Epstein letter raises questions about the nature of their relationship and Trump’s involvement in the unfolding Epstein death controversy. The letter features explicit illustrations and text, with Trump denying any authorship. Coverage of this story, including Trump’s distancing from Epstein following the latter’s legal issues, highlights the complex web of relationships in the shadows of power and privilege.

The correspondence between Donald Trump and Jeffrey Epstein has recently resurfaced, centering around an unexpected birthday acknowledgment penned by the former president. This intriguing document, part of an exclusive collection gifted to the financier for his 50th anniversary, reveals the interplay of social connections amidst a backdrop of serious allegations, notably the disturbing child sex trafficking scandal linked to Epstein. As the intrigue deepens, many are left wondering about the extent of Trump’s association with both Epstein and Ghislaine Maxwell, particularly in light of the Epstein death controversy that unfolded post-arrest. Furthermore, discussions regarding Trump’s declarations of non-involvement give rise to questions surrounding the authenticity of the letter that has captivated public attention. The unfolding story serves as a reminder of the complexities and ethical dilemmas entwined within networks of power, celebrity, and transgressions.

The Trump Epstein Letter: A Controversial Birthday Message

In 2003, a letter penned to Jeffrey Epstein by then-businessman Donald Trump surfaced as part of a collection commemorating Epstein’s 50th birthday. The Wall Street Journal revealed that this particular correspondence, which had raised eyebrows due to its bawdy nature, was sent per the request of Ghislaine Maxwell, a known associate of Epstein. This revelation not only reignited discussions surrounding Trump’s associations with Epstein but also highlighted the former president’s attempts to distance himself from his former friend, especially following Epstein’s arrest and subsequent controversies involving child sex trafficking.

The letter’s contents have drawn significant attention, featuring suggestive illustrations that some critics believe reflect on Trump’s character. After Epstein was apprehended by the authorities, Trump’s denial of authorship and claims that the letter is a fabricated piece became a focal point of the dialogue. The public has since scrutinized the implications of such correspondence, drawing connections between Trump’s social circle and the abhorrent realities of Epstein’s actions in connection with the child sex trafficking scandal.

Epstein’s Death and Its Impact on Trump’s Presidency

The unexpected death of Jeffrey Epstein in 2019 triggered a wave of speculation that reverberated through political circles, impacting the perception of Donald Trump’s presidency. Amid ongoing investigations, Epstein’s passing, deemed a suicide by officials, raised questions about the Justice Department’s approach to the allegations of child sex trafficking that surrounded him. The timing of Epstein’s demise coincided with Trump’s administration, creating a narrative that many critics argue favors the idea of a conspiracy to protect influential individuals involved in Epstein’s illicit activities.

Following Epstein’s death, allegations against the former financier continued, linking him with high-profile figures including Trump and Maxwell. Trump’s previously stated distance from Epstein drew skepticism among those questioning the sincerity of such claims, particularly in light of the known connections the two shared. The controversy surrounding Epstein’s death spotlighted not just the figures involved but also the broader implications of elite entanglements in scandals related to sexual abuse, highlighting the intricate web of power and secrecy in such circles.

Ghislaine Maxwell’s Role in the Epstein Scandal

Ghislaine Maxwell’s conviction in 2021 for her role in facilitating Epstein’s abusive operations marked a crucial moment in the ongoing saga surrounding Epstein’s life and his connections. Maxwell, who was considered Epstein’s confidante and accomplice, has been embroiled in controversies regarding her involvement in soliciting underage girls for Epstein, further entrenching the narrative that powerful individuals were complicit in these heinous activities. The connections between Trump, Epstein, and Maxwell present a complex interplay of friendships and business dealings amid serious allegations of wrongdoing.

Amidst the fallout from this scandal, the public and media scrutiny of Maxwell has only intensified, leading to renewed discussions about the extent of her influence and interactions with politically significant figures. The intertwining of her life with both Epstein and Trump exacerbates the ongoing child sex trafficking scandal, raising concerns about accountability and systemic protections that might have existed for influential persons involved in such networks.

The Media’s Role in Revealing Epstein’s Connections

The media has played a pivotal role in unraveling the clandestine connections surrounding Jeffrey Epstein and his acquaintances. Investigative pieces detailing the nature of Epstein’s relationships with celebrities, politicians, and high-profile business figures, including Trump, have fueled public outrage and demand for accountability. The unveiling of Trump’s letter to Epstein not only reaffirmed the need for continued media scrutiny but also underscored the complex narratives that intertwine friendship, influence, and moral responsibility.

As media outlets such as The Wall Street Journal and others probe deeper into the affiliations and histories of those connected to Epstein, the public’s understanding of the failings of powerful networks continues to evolve. This relentless questioning aims to expose not just the individual’s misconduct but the social structures that have long allowed for such behaviors to persist unchecked, weaving a narrative that implicates all who have been complicit by association.

Trump’s Denials: From Birthday Letters to Public Scrutiny

Donald Trump’s repeated denials regarding the authenticity of his letter to Epstein present an intriguing aspect of how public figures navigate controversy. In his defense, he labels the allegation a ‘fake thing,’ illustrating his general approach to media narratives that threaten his reputation. The former president’s claims that he never engaged in drawing or writing content that could be viewed as distasteful ultimately serve as a shield against the broader implications of his connections with Epstein and Maxwell.

As public scrutiny intensifies, Trump’s vehement repudiations may reflect a calculated strategy to separate himself from anyone associated with the abhorrent actions of Epstein, particularly amidst allegations of child sex trafficking. However, his past associations complicate the ease with which he attempts to disavow responsibility or connection, creating an ongoing tug-of-war between personal narrative and public perception.

Investigating the Controversies Surrounding Epstein’s Associates

The controversies surrounding Epstein’s associates, including Trump and Maxwell, present critical questions regarding the responsibility of those within Epstein’s circle. Investigations into Epstein’s network revealed unsettling revelations about the complicit behavior that allowed the financier to exploit numerous young individuals over decades. The scrutiny faced by elite figures in the wake of these investigations underscores a significant shift in societal attitudes towards accountability among the powerful.

With growing pressure for transparency and justice, probes into the relationships of individuals like Trump with Epstein could serve as springboards for broader discussions on systemic failures within legal and social systems. As investigations continue to unfold, the intertwined fates of these infamous characters compel observers to reckon with the complexities of privilege, influence, and the critical need for reform in addressing such pressing social issues.

The Legacy of Jeffrey Epstein and Its Ramifications

The legacy of Jeffrey Epstein remains tainted by the abhorrent crimes of child sex trafficking and the extensive web of connections he cultivated with powerful individuals. This legacy continues to evoke a strong reaction from the public, especially in light of the political ties that have emerged through his relationships with figures such as Donald Trump and Ghislaine Maxwell. Analysts and commentators frequently ponder the ramifications of Epstein’s actions on the broader societal landscape and the call for justice that persists even after his death.

In reflecting on Epstein’s legacy, there is a discernible focus on the need for systemic changes that could prevent similar abuses from happening in the future. It is critical to highlight the responsibilities held by those in positions of power, and how their actions—or lack thereof—contribute to an environment where exploitation can occur unchallenged. Epstein’s narrative hence serves as a catalyst for urging significant reform in laws and safeguards protecting vulnerable populations.

The Ongoing Implications of Epstein’s Investigations on Public Figures

As investigations into Jeffrey Epstein’s actions, associates, and collaborators continue to evolve, the implications for various public figures within these circles remain significant. With names like Trump and Maxwell frequently re-emerging in discussions around Epstein’s network, there is a persistent atmosphere of unease among those connected to the financier. Each revelation adds another layer to the complexities of accountability and morality faced by powerful individuals, demanding that they navigate their legacies amid public scrutiny.

The ramifications of these investigations highlight an urgent societal need for transparent dialogue regarding the ethics of privilege and responsibility. As the time lapse between the alleged crimes and the current revelations widens, understanding the roles of these figures—especially within the context of the ongoing child sex trafficking scandal—will be vital in shaping future action and public opinion regarding the protection of vulnerable populations.

Understanding the Intersection of Power and Exploitation within Epstein’s Network

The intersection of power and exploitation characterizes the environment that allowed Jeffrey Epstein to flourish while simultaneously orchestrating grave abuses. The lingering questions about Trump’s associations with Epstein and Maxwell reveal the often-obsessed nature of power dynamics in elite circles. This convergence of wealth and influence has long been examined, yet the complex relationships established through shared interests and social connections provoke new discussions about accountability.

As narratives unfold around Epstein’s extensive network, understanding how powerful individuals enabled or supported his actions becomes increasingly crucial. The interactions and friendships formed through these networks not only highlight a noteworthy neglect towards ethical responsibilities but also underline a broader societal challenge of ensuring protection against exploitation on any scale. Thus, grappling with this intersection is paramount in fostering a culture that prioritizes justice and integrity.

Frequently Asked Questions

What is the content of the Trump Epstein letter related to Jeffrey Epstein’s birthday?

The Trump Epstein letter, included in a birthday album for Jeffrey Epstein’s 50th in 2003, is described as ‘bawdy’ and features a typewritten note framed by an outline of a naked woman. It reportedly contained a fictional conversation suggesting playful banter between Trump and Epstein, signed by Trump with a squiggly ‘Donald’ beneath the illustration.

How did Donald Trump respond to the claims surrounding the Epstein birthday letter?

Donald Trump denied authorship of the Epstein birthday letter, labeling it as a ‘fake’ in a Wall Street Journal interview. He stated, ‘This is not me. I never wrote a picture in my life,’ asserting that the language and style of the letter do not reflect him.

What connections exist between Trump, Epstein, and Ghislaine Maxwell?

Donald Trump, Jeffrey Epstein, and Ghislaine Maxwell were known to associate socially in the past. The letter for Epstein’s birthday was allegedly sent to him at Maxwell’s request, highlighting a friendship that Trump later distanced himself from after Epstein’s legal issues became prominent.

What allegations were made against Jeffrey Epstein during Trump’s presidency?

During Trump’s presidency, Jeffrey Epstein faced serious allegations involving child sex trafficking, culminating in his arrest in July 2019. Epstein died in custody before he could stand trial on these charges.

What impact did the letter from Trump to Epstein have on public perception?

The revelation of the letter has stirred controversy and speculation regarding Trump’s past associations with Epstein, leading to renewed scrutiny of their relationship and questions about Trump’s character and integrity amidst the broader context of Epstein’s criminal legacy.

Is there any ongoing legal discussion related to the Trump Epstein letter?

Following the publication of the Wall Street Journal article, discussions regarding the letter’s authenticity and implications have prompted legal threats from Trump against the publication, adding to the ongoing discourse about Epstein’s case and the investigations into his actions.

What role did the Justice Department play regarding the Trump Epstein letter?

The Justice Department has been reviewing documents related to Jeffrey Epstein’s case, including the Trump Epstein letter. There remains uncertainty about whether the letter was part of the materials reviewed during earlier investigations into Epstein and Ghislaine Maxwell.

How does the Trump Epstein letter relate to the Epstein death controversy?

The Trump Epstein letter adds complexity to the narrative surrounding Epstein’s death in 2019, which was ruled a suicide following his arrest on multiple charges, including child sex trafficking. Trump’s past friendship with Epstein and the circumstances of Epstein’s death continue to fuel public interest and conspiracy theories.

| Key Point | Details |

|---|---|

| Trump Epstein Letter | A letter signed by President Trump was sent to Jeffrey Epstein for his 50th birthday in 2003. |

| Ghislaine Maxwell’s Role | The letter was sent at the request of Epstein’s friend Ghislaine Maxwell. |

| Content of the Letter | Reported to contain humorous and bawdy elements, including a typewritten note and illustrations. |

| Trump’s Denial | Trump denied authorship and described the letter as fake, claiming it doesn’t align with his style. |

| Epstein’s Criminal Charges | Epstein faced serious charges of child sex trafficking during Trump’s presidency. |

| Ongoing Investigation | The Justice Department is reviewing documents that include the album of letters given to Epstein. |

Summary

The Trump Epstein letter has emerged as a central topic in discussions surrounding the ties between President Donald Trump and the late financier Jeffrey Epstein. As details unfold about the controversial content of the letter sent for Epstein’s milestone birthday in 2003, it has raised eyebrows regarding political and legal implications, especially with Trump’s denials and the investigation into Epstein’s criminal activities. This letter, characterized as ‘bawdy’ and potentially damaging, underscores a complex relationship that has reverberations into current political discourse.