Understanding Blockchain: The Foundation of Cryptocurrencies

Understanding Blockchain is crucial in today’s digital landscape, as this transformative technology forms the backbone of various cryptocurrency technologies. At its core, blockchain serves as a decentralized and distributed ledger, ensuring transparency and security in transactions—traits that have garnered massive attention, especially with Bitcoin leading the charge. By reducing reliance on a centralized authority, this system utilizes a consensus mechanism to validate transactions, eliminating the risk of double spending. As the adoption of Bitcoin blockchain continues to expand, the importance of comprehending decentralization becomes increasingly apparent to both developers and users alike. This comprehensive understanding paves the way for innovations and applications across countless industries, reinforcing the need for a solid grasp of blockchain’s foundations and functionalities.

Grasping the nuances of this groundbreaking technology can be referred to as exploring the principles behind distributed ledgers and decentralized networks. Often synonymous with cryptocurrency, such as Bitcoin, this digital framework employs a consensus system to authenticate and document transactions securely. Decentralization is a key element that allows users to interact without the interference of a central entity, making it a popular choice for financial innovations. Furthermore, with the emergence of smart contracts and other applications utilizing this technology, understanding the broader implications of blockchain becomes essential for navigating the future of digital transactions. This exploration not only highlights the mechanics of how data is stored and transferred but also emphasizes the role of cryptocurrency in fostering a new era of financial freedom.

Understanding Blockchain: The Backbone of Cryptocurrency

Blockchain technology serves as the foundational framework for most cryptocurrencies, with Bitcoin being the most notable example. At its essence, blockchain can be visualized as a series of interconnected chains or blocks, much like a complex spider web. This decentralized approach allows the technology to function without reliance on a single central authority, which is crucial for maintaining security and trust within transactions. As users interact with the Bitcoin network, they participate in a community that shares a distributed ledger, where every transaction is logged and verified by multiple nodes, enhancing transparency and resistance to fraud.

The importance of blockchain goes beyond just Bitcoin. The underlying principles of decentralization, inherent in its architecture, pave the way for various applications, including smart contracts and decentralized finance (DeFi). Understanding blockchain means recognizing the innovative potential of this technology in transforming how transactions are conducted, data is stored, and trust is established in digital environments. With advancements like Ethereum’s programmable contracts, blockchain showcases a future where decentralized applications (

Frequently Asked Questions

What is blockchain technology and how does it relate to cryptocurrency like Bitcoin?

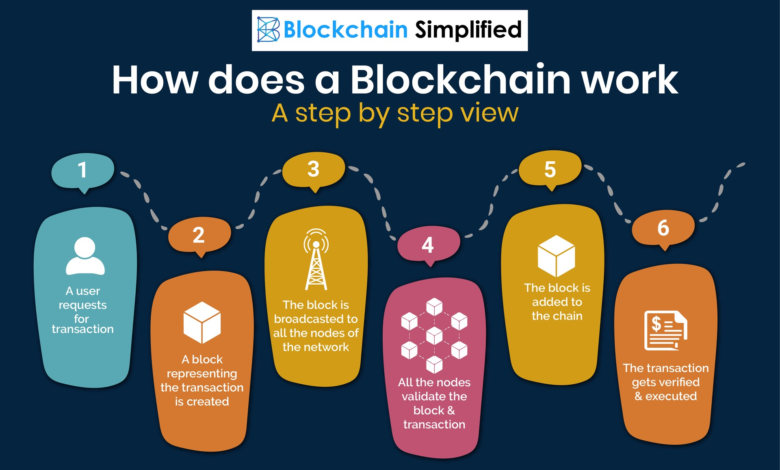

Blockchain technology is the foundational framework for cryptocurrencies such as Bitcoin. It is a decentralized digital ledger that records transactions in a secure, immutable manner. Each transaction is grouped into blocks, which are then linked in a chronological chain, ensuring transparency and preventing tampering.

How does decentralization improve the security of the Bitcoin blockchain?

Decentralization enhances the security of the Bitcoin blockchain by distributing data across numerous nodes rather than relying on a central authority. This structure makes it harder for malicious actors to gain control or manipulate transaction records, thereby increasing trust in the network.

What is a consensus mechanism in the context of blockchain and why is it important?

A consensus mechanism is a protocol used within blockchain networks to achieve agreement on a single data value among distributed processes or systems. In the Bitcoin blockchain, the Proof of Work consensus mechanism ensures that transactions are verified and blocks are securely added to the chain, preventing issues like double-spending.

Can you explain the concept of a distributed ledger and its advantages for cryptocurrency technology?

A distributed ledger is a type of database that is consensually shared and synchronized across several sites, institutions, or geographies. In cryptocurrency technology, it allows transactions to be recorded transparently and securely without central oversight, minimizing risks of fraud and enhancing efficiency.

What are some practical applications of blockchain beyond Bitcoin?

Beyond Bitcoin, blockchain technology has numerous applications including smart contracts on platforms like Ethereum, supply chain tracking, secure voting systems, and decentralized finance (DeFi) operations such as lending and trading on decentralized exchanges (DEX).

How does the Bitcoin blockchain ensure transaction immutability?

The Bitcoin blockchain ensures transaction immutability through its design; once a block is added to the chain and confirmed by the consensus mechanism, it cannot be altered or deleted. Every block contains a hash of the previous block, creating a secure and traceable chain.

What role do miners play in the Bitcoin blockchain and how do they earn rewards?

Miners validate and verify transactions on the Bitcoin blockchain by solving complex mathematical problems. When they successfully add a new block to the chain, they are rewarded with Bitcoin and transaction fees, incentivizing their participation in maintaining network security.

What is the significance of smart contracts in blockchain development?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code on a blockchain. They enable automated operations and reduce the need for intermediaries, enhancing trust and efficiency in various applications like finance, real estate, and logistics.

How does the blockchain technology address the double-spend problem in cryptocurrency?

Blockchain technology addresses the double-spend problem by utilizing a consensus mechanism like Proof of Work to verify and confirm transactions. Each transaction is recorded in a block, and once it reaches consensus, it prevents the same digital tokens from being spent more than once.

Could you explain the concept of a Merkle tree and its importance in blockchain data structure?

A Merkle tree is a data structure that enables efficient and secure verification of the integrity of a large set of transactions in a blockchain. It allows miners to summarize multiple transactions into a single hash, improving storage efficiency and making validation straightforward.

| Key Points | Description |

|---|---|

| Understanding Blockchain | Blockchain is the foundational technology for cryptocurrencies like Bitcoin, illustrating a decentralized architecture. |

| Decentralization | A blockchain operates without a central authority, managed through distributed nodes. |

| Consensus Mechanism | Utilizes a ‘Proof of Work’ system to solve the double-spending problem and secure transactions. |

| Smart Contracts | Ethereum popularized smart contracts, enabling programmable transactions on blockchains. |

| Immutability | Once recorded, data on the blockchain cannot be altered or deleted. |

| Transparency | Most blockchains are publicly accessible, allowing transaction tracking without revealing personal identities. |

| Mining Process | Miners compete to solve complex mathematical problems to validate transactions and create new blocks. |

Summary

Understanding Blockchain is essential for grasping the underlying mechanisms of cryptocurrencies like Bitcoin. This revolutionary technology fosters decentralization, ensuring that transactions are secure and immutable without a central authority. As we delve deeper into the features of blockchain, we uncover attributes such as transparency and the ability to implement smart contracts, ultimately redefining various sectors from finance to healthcare. With its continuous evolution, blockchain remains a pivotal force in reshaping our digital landscape.