Bulgaria Eurozone Membership: Pros and Cons Explained

Bulgaria eurozone membership is on the horizon, as the Eastern European nation gears up to become the 21st member of this prestigious economic community. Following a stamp of approval from both the European Commission and the European Central Bank, debates surrounding Bulgaria’s euro adoption have intensified. Supporters, including Prime Minister Rosen Zhelyazkov, argue that eurozone accession promises economic stability, favorable investment conditions, and stronger ties with the European Union. However, concerns about rising inflation and perceptions of lost national sovereignty have sparked public protests, revealing a divided opinion among Bulgaria’s citizens regarding this significant currency transition. As the country prepares for this monumental shift, understanding the economic impact of the euro and the potential benefits it may bring becomes crucial for the nation’s future.

The prospect of Bulgaria joining the eurozone opens a new chapter in its economic narrative, fundamentally shifting the landscape of its monetary policy and global trading relations. This pivotal moment signals the potential for a stronger economic framework as Bulgaria adopts the euro as its official currency, thereby enhancing its integration within the European Union. While the anticipated economic advantages of euro adoption include increased foreign investment and streamlined trade processes, there are pressing concerns regarding inflationary pressures during this transition. Many citizens remain wary, fearing that the socio-political implications of eurozone membership could overshadow the anticipated financial benefits. As Bulgaria embarks on this journey, evaluating the implications of its currency transition will be essential for ensuring that the nation reaps the long-term benefits of greater economic stability within the Eurocommunity.

Bulgaria Joins the Eurozone: A Historic Move

With the recent approval from the European Commission and the European Central Bank, Bulgaria is preparing for a significant economic transition as it prepares to join the eurozone. This decision makes Bulgaria the 21st member of the eurozone, marking a pivotal moment in the nation’s history. Prime Minister Rosen Zhelyazkov advocates this transition, believing that euro adoption will demonstrate economic stability and encourage growth. The announcement, however, hasn’t come without resistance, as many citizens express concerns over potential price hikes and the perceived loss of national sovereignty.

The push for Bulgaria to adopt the euro aligns with the nation’s long-standing economic strategy of maintaining a fixed exchange rate between the Bulgarian lev and the euro. By joining the eurozone, Bulgaria aims to integrate more deeply with the European economy, potentially attracting foreign investment and increasing trade. This historical move is not just about currency but reflects Bulgaria’s desire for stronger ties within the European community and greater economic influence.

Economic Perspectives on Bulgaria Eurozone Membership

Economists have weighed in on the potential economic implications of Bulgaria’s euro adoption, providing a nuanced view of both opportunities and risks. Supporters of this transition highlight that joining the eurozone could enhance Bulgaria’s economic stability by aligning its monetary policy with that of the European Central Bank (ECB). For instance, increased foreign investment could bolster GDP growth, while deeper financial integration would enhance the resilience of Bulgaria’s banking system.

However, the transition to euro adoption comes with inflationary concerns. Experts like Valentin Tataru from ING warn that businesses may exploit the currency change to round up prices, thereby impacting the purchasing power of ordinary Bulgarians, particularly in rural areas. Despite these concerns, Tataru argues that the long-term advantages, such as reduced currency risk and lower interest rates, outweigh the immediate drawbacks of potential inflation.

The Impacts of Euro Adoption on Inflation and Prices

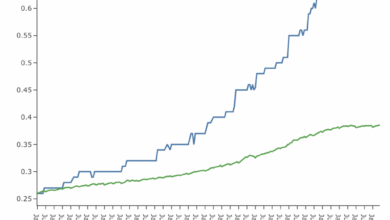

A primary concern surrounding Bulgaria’s transition to the euro is the potential for rising inflation during the currency switch. Economists predict that initial adjustments could lead to industries hiking prices, raising fears among the Bulgarian populace about the future affordability of goods and services. This skepticism is further amplified in poorer regions, where every increase in cost is keenly felt. Analysts believe that while some price increases are likely, they may not be as drastic as feared due to Bulgaria’s established exchange rate with the euro.

On the flip side, proponents argue that adopting the euro may stabilize prices in the long run. With the ECB overseeing monetary policy, the hope is that inflation can be kept in check. In regions heavily impacted by economic volatility and inflationary pressures, euro adoption might stabilize their financial environment. Thus, effective management of the transition process is essential to mitigate short-term disruptions while ensuring smoother economic conditions post-adoption.

Benefits of Bulgaria Joining the Eurozone

Adopting the euro opens up a multitude of benefits for Bulgaria, particularly concerning trade and investment opportunities. As a member of the eurozone, Bulgaria could enhance its attractiveness to foreign investors, reassuring them with the stability that comes with the euro. Moreover, the elimination of currency conversion costs can facilitate greater trade flows between Bulgaria and its eurozone partners, benefiting key sectors like machinery, transport, and tourism.

Economic analysts highlight how euro membership would also position Bulgaria more favorably within Europe’s supply chains. By ensuring streamlined trade operations and fostering deeper integration with other EU nations, Bulgaria could bolster its economic growth. This integration is vital as a significant portion of its exports already targets other EU countries, amplifying the potential benefits of joining the eurozone.

Political Concerns Surrounding Euro Adoption in Bulgaria

Political tensions are a crucial factor in the discourse surrounding Bulgaria’s euro adoption. Protests have emerged from nationalist groups fearing that the shift away from the lev could diminish Bulgaria’s national sovereignty, a sentiment echoed by many Bulgarians who remain skeptical of deeper European integration. The fear that compliance with ECB policies could curtail Bulgaria’s autonomy is palpable, leading to a complex political landscape.

Despite these challenges, experts like Jasmin Groeschl from Allianz SE argue that the long-term benefits of joining the euro outweigh the political risks. While Bulgaria might lose some control over its monetary policy, the advantages of decreased transaction costs, stability, and integration into the EU market present compelling reasons to support euro adoption. These considerations will be important as the nation navigates the socio-political landscape while moving forward with its eurozone aspirations.

Future Economic Outlook for Bulgaria Post-Euro Adoption

Looking into the future, Bulgaria’s economic outlook post-euro adoption will be significantly influenced by how well the transition is managed. Economists suggest that with the right strategies in place, Bulgaria could harness the EU’s economic framework to stimulate growth, improve infrastructure, and enhance overall economic conditions. By fostering consistency in fiscal policies and aligning with EU standards, Bulgaria can strengthen its position as a reliable partner in regional trade.

However, the success of this economic transition is contingent on addressing the anxieties of the citizens. Ensuring public understanding of the benefits, mitigating inflationary fears, and fostering an environment where local businesses and consumers feel secure will be critical. If managed effectively, Bulgaria’s entry into the eurozone could lead to robust economic growth, greater stability, and enhanced international standing.

Understanding the Economic Impact of Euro Adoption

The economic impact of Bulgaria’s euro adoption will be a defining factor in the success of its transition. With the integration into the eurozone, the nation is expected to experience a shift in economic dynamics, including GDP growth and increased foreign investment. The prospect of access to a larger market and the willingness of investors to channel funds into a stable currency are promising outcomes that highlight euro membership’s potential benefits.

Moreover, economic analysts predict that Bulgaria could see a decrease in borrowing costs, which often accompany stable currencies. Lower interest rates could enhance access to credit for businesses and individuals alike, fostering entrepreneurship and consumer spending. Therefore, the overarching economic outlook remains cautiously optimistic, provided that the transition is navigated effectively with strategic fiscal and monetary policies.

The Process of Bulgaria’s Currency Transition

Bulgaria’s transition from the lev to the euro involves meticulous planning and execution. The government is expected to implement a comprehensive strategy that includes monetary adjustments, public education, and logistical arrangements for the currency switch. Ensuring that citizens and businesses are well-prepared for this change is crucial to minimize disruption and build confidence in the new currency.

In parallel, the financial system will have to adapt to the changes brought by euro adoption, including updates to banking processes and systems. Training financial professionals and educating the general public about using the euro will play an essential role in ensuring a smooth transition. By managing these aspects effectively, Bulgaria can enhance the likelihood of a successful integration into the eurozone.

Addressing Public Concerns About Euro Adoption

With half of Bulgaria’s population opposing the euro adoption, addressing public concerns is crucial for a smooth currency transition. Awareness campaigns that articulate the economic advantages of joining the eurozone can help to alleviate fears surrounding loss of sovereignty and rising costs. Ensuring transparency in the transition process and demonstrating the potential benefits can foster trust and support among the citizenry.

Engaging with citizens through public forums and discussions may also provide an avenue for addressing specific fears and misconceptions. By creating an open dialogue about the benefits of euro membership and actively responding to public concerns, the Bulgarian government can work towards building consensus and support for the euro adoption process, ensuring that the transition is embraced rather than opposed.

Frequently Asked Questions

What does Bulgaria’s eurozone membership mean for its economy?

Bulgaria’s eurozone membership is expected to enhance economic stability and growth, as it will be closely monitored by the European Central Bank (ECB). This move could stimulate foreign investment, bolster Bulgaria’s credibility within the EU, and strengthen its financial system. The adoption of the euro may also lead to lower interest rates, making loans and mortgages more affordable for citizens.

What are the potential benefits of Bulgaria adopting the euro?

The benefits of Bulgaria adopting the euro include increased economic stability, decreased transaction costs in trade with Eurozone countries, and enhanced integration with EU markets. This could boost key sectors like tourism and trade, as it eliminates currency conversion costs, facilitating smoother and more cost-effective transactions.

How might inflation impact Bulgaria following euro adoption?

Inflation is a significant concern during Bulgaria’s currency transition to the euro. Some economists predict a temporary price increase as businesses adjust prices. However, due to Bulgaria’s existing fixed exchange rate with the euro, the transition should result in mild inflation, reducing the risk of a substantial loss in purchasing power for citizens.

What concerns do Bulgarians have regarding euro adoption?

Many Bulgarians are concerned about losing national sovereignty and control over monetary policy with the adoption of the euro. Protests have erupted over fears that the transition might lead to higher prices and diminished purchasing power, particularly in poorer rural areas. Public opposition to eurozone membership remains a significant issue, with half of the population reportedly against the move.

Will Bulgaria’s membership in the eurozone affect its monetary policy?

Yes, Bulgaria’s eurozone membership will impact its monetary policy. The Bulgarian National Bank will have to operate under the regulations set by the ECB, relinquishing some control over interest rates and monetary decisions. While this may limit Bulgaria’s economic autonomy, it could also lead to greater financial stability and reduced currency risk.

How does Bulgaria’s accession to the eurozone relate to EU integration?

Bulgaria’s accession to the eurozone is a crucial step towards deeper integration within the European Union. By adopting the euro, Bulgaria will strengthen its financial connections with EU member states, enhance its influence within the bloc, and contribute to a more unified European economy.

What risks does Bulgaria face in adopting the euro?

Bulgaria faces several risks in adopting the euro, including potential inflation spikes during the currency transition and political tensions stemming from public opposition. Additionally, relinquishing control over monetary policy could lead to concerns about national sovereignty and may increase support for Euroskeptic movements.

What impact could euro adoption have on Bulgaria’s tourism sector?

Euro adoption is likely to positively influence Bulgaria’s tourism sector by making it easier for travelers from other eurozone countries to visit, eliminating currency conversion costs. This simplification is expected to facilitate increased tourism, benefiting the economy significantly as the country markets itself as an attractive year-round destination.

| Key Point | Details |

|---|---|

| Bulgaria’s Approval for Eurozone Membership | Bulgaria is set to join the eurozone as its 21st member, having received backing from both the European Commission and the European Central Bank. |

| Public Opinion and Protests | Half of the Bulgarian population opposes euro adoption, with protests fueled by concerns about rising prices and loss of national sovereignty. |

| Economic Concerns | Experts highlight potential inflation and diminishing purchasing power, particularly in rural areas, as businesses may increase prices during transition. |

| Sovereignty and Monetary Policy | Relinquishing the lev in favor of the euro raises concerns over national sovereignty and control over monetary policy. |

| Economic Potential and Stability | Eurozone membership might enhance economic stability and growth, encouraging foreign investment, and facilitating easier trade and tourism. |

| Political Risks | Protests against euro adoption could lead to a rise in populist movements, but experts argue that the long-term benefits would outweigh short-term challenges. |

Summary

Bulgaria’s eurozone membership is a significant step toward economic integration with Europe. Despite facing public opposition and concerns about inflation and loss of monetary control, the potential benefits such as enhanced economic stability, increased foreign investment, and improved trade relations with EU countries present a compelling case for the country. As Bulgaria moves forward with this transition, it remains crucial for policymakers to address public concerns while emphasizing the long-term advantages of euro adoption.