Rare Earth Supply Chain: China’s Dominance and Challenges Ahead

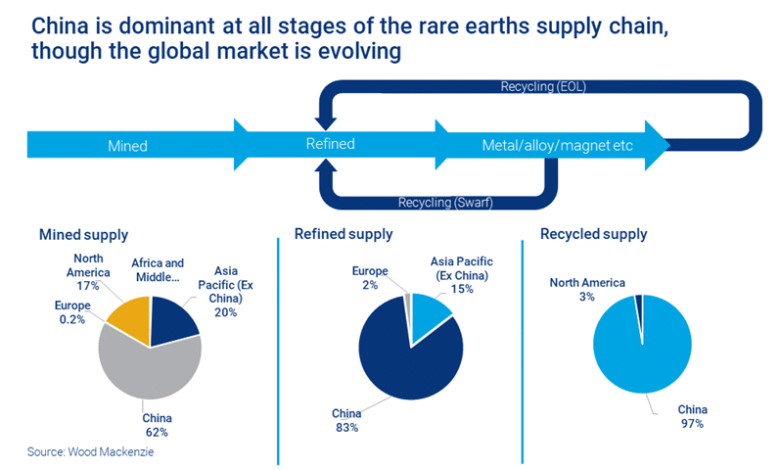

The rare earth supply chain is becoming increasingly crucial in today’s global economy, as nations scramble to secure essential materials for advanced technologies. With China controlling approximately 60% of the world’s rare earth production and nearly 90% of its processing, the implications of this dominance extend beyond national borders and into international markets. Recent developments in China, including newly approved rare earth exports, continue to raise concerns about potential global supply cutoffs that could disrupt industries reliant on these critical minerals. As companies explore alternatives to Chinese rare earths, the challenge remains daunting, given the complexities of establishing secure and reliable sources. Understanding the dynamics of this intricate supply chain is vital for businesses aiming to mitigate risks and adapt to shifting geopolitical landscapes.

The intricate network of sourcing and distributing rare earth elements has become a focal point for industries striving for sustainability and innovation. Often referred to as critical minerals, these elements play an indispensable role in the production of high-tech devices, electric vehicles, and renewable energy solutions. With China poised as a dominant supplier in this domain, the pressure has mounted on companies worldwide to rethink their dependencies while seeking rare earth alternatives. The ongoing fluctuations and potential restrictions in rare earth exports can significantly impact global manufacturing capabilities, leading to an urgent need for diversification in supply channels. As the race for securing these vital resources escalates, businesses must navigate a landscape marked by both opportunity and risk.

The Impact of China’s Rare Earth Supply Chain on Global Markets

China’s rare earth supply chain plays a crucial role in the global economy, particularly in sectors reliant on critical minerals. With around 60% of the world’s rare earth production stemming from China, any disruption in supply has immediate consequences for international markets. Companies worldwide are feeling the pressure as they navigate these complexities, which include unpredictable export controls and the looming threat of supply cuts. As businesses attempt to forecast future demands, they recognize that reliance on China poses significant risks, prompting many to explore alternative sources.

Moreover, the volatility of China’s export policies, coupled with their hold on refining capacities, means industries in Europe and America must prepare for a rocky path ahead. There’s a growing consensus that without a diversified supply chain, just-in-time production models could falter under the pressure of sudden cutoffs. Therefore, as companies weigh their options, they are increasingly focusing on establishing relationships with other countries that have reserve capacity, hoping to reduce reliance on China’s rare earth exports.

Exploring Rare Earth Alternatives in Industrial Applications

As the world grapples with dependency on China’s rare earth supply, the exploration of alternatives becomes increasingly critical. Innovations in material science have prompted researchers to identify substitutes that can perform similarly to traditional rare earth elements. These alternatives can play a significant role in applications such as electric vehicle production, where rare earth magnets are commonly used. By investing in research and development, companies are seeking to create new materials capable of offering the necessary properties without the same dependency on Chinese sources.

Additionally, several nations are ramping up efforts to rediscover rare earth alternatives, pushing the boundaries of technology and manufacturing. For instance, automotive manufacturers are investing in electric vehicles that minimize or eliminate rare earth usage altogether. While it’s a monumental challenge, success in developing viable substitutes could reshape the global landscape, enabling industries to operate with greater resilience against geopolitical tensions surrounding critical minerals.

Navigating Global Supply Cutoffs and their Consequences

Global supply cutoffs of rare earths, particularly those instigated by China, pose a severe threat to various industries, including automotive and technology. As top players in these sectors have already experienced disruptions, the urgency to develop robust contingency plans has never been higher. Non-Chinese firms now find themselves in a precarious position, needing to anticipate and adapt to potential future restrictions imposed by Beijing without diluting their manufacturing capabilities.

In this environment of uncertainty, companies are recalibrating their strategies to implement more flexible and diversified sourcing approaches. This may involve building alliances with non-Chinese rare earth suppliers, or even investing in domestic mining initiatives to secure local sources of critical minerals. The goal is not only to mitigate risks but also to ensure continuity of production in the face of potential market volatility caused by geopolitical tensions.

The Role of Critical Minerals in the Technological Advancement

Critical minerals, including rare earth elements, serve as the backbone of modern technological advancements. From smartphones to electric vehicles, the integration of these materials is essential for innovation. Their rarity, coupled with the concentration of supply chains in China, poses a significant challenge for technologies that rely heavily on these resources. As countries work towards achieving technological independence, the importance of developing domestic capabilities for critical minerals cannot be understated.

The transition to renewable energy technologies like wind turbines and advanced battery systems further intensifies the demand for such critical minerals. This reality underscores the urgency of diversifying supply chains and investing in local sources to ensure sustainable growth in technology. In light of potential trade restrictions, nations must act swiftly to enhance their own capabilities, thereby fostering a more resilient and self-sufficient high-tech ecosystem.

Trade Relations and the Future of Rare Earth Exports

The intricacies of trade relations between China and Western countries heavily influence the dynamics of rare earth exports. Recent discussions between the U.S. and China indicate an uncertain future, especially regarding export controls. Historical trends show that any easing of restrictions often comes with caveats, as seen with the limited licenses for rare earth shipments, which can lead to a false sense of security for American and European businesses.

Understanding these underlying trade tensions is crucial for companies reliant on rare earths. The need for a strategic pivot toward local and diverse alternatives is becoming ever more apparent. Therefore, businesses must navigate these fluctuating relationships and potential regulatory changes with an eye toward long-term sustainability in their supplier agreements.

The European Response to Rare Earth Dependency

Faced with the growing urgency of reliance on Chinese rare earths, European nations are ramping up initiatives to reclaim some level of independence in the supply chain. This includes efforts to enhance domestic mining operations and establish new partnerships with non-Chinese suppliers. A focus on innovation and sustainable practices in sourcing can help Europe secure its access to critical minerals essential for advanced manufacturing and green technologies.

Moreover, European policymakers are recognizing the economic risks associated with over-reliance on China as part of their strategic framework. Integrated approaches that connect environmental sustainability with mineral sourcing are taking precedence, as seen in collaborative efforts across the European Union to bolster the critical minerals supply chain. Such changes not only support economic resilience but also foster greater geopolitical stability in a shifting global market.

Understanding the Long-term Trends in Rare Earth Supply Chains

Analyzing the long-term trends in the rare earth supply chain provides vital insights into future developments in the industry. The historical dominance of China in this sector has shaped the current landscape, but emerging practices and innovative approaches signal potential changes. As countries gain awareness of the vulnerabilities linked to the concentration of supply sources, the push for decentralized networks becomes increasingly urgent.

Long-term trends suggest that stakeholders will actively seek to innovate operational efficiencies and push the boundaries of technology to unlock new mineral sources. Additionally, as stakeholders look to develop sustainable practices, the ethical implications of mining and sourcing practices will likely become integral to the calculus of rare earth supply chains moving forward.

The Challenges of Restructuring Supply Chains Away from China

Restructuring supply chains to reduce dependency on China’s rare earths presents formidable challenges. Companies are pressured to pivot swiftly, yet developing alternative sources often involves substantial investment and the cultivation of new partnerships. While there’s a clear desire to diversify, many businesses still rely heavily on established processes tied to Chinese suppliers, making the transition all the more complex.

Furthermore, logistical and regulatory hurdles can hinder efforts to establish alternative supply chains. Potential suppliers may not meet the stringent quality requirements needed for numerous applications, complicating the shift away from China’s dominant market presence. As industries increasingly prioritize adaptability, the resilience of supply chains will hinge on overcoming these obstacles and fostering collaboration among stakeholders.

Investments in Alternative Mining and Processing Ventures

In response to the challenges posed by a reliance on China’s rare earth supply, investments in alternative mining and processing ventures are emerging as viable solutions. Companies are exploring opportunities beyond traditional frameworks, looking for regions with untapped resources that can offset dependency. This trend reinforces the strategic significance of securing a steady supply of critical minerals.

Moreover, leading tech firms and automakers are beginning to invest in initiatives aimed at increasing domestic production of rare earth elements, especially in regions such as Australia and North America. As these ventures progress, they will play an essential role in reshaping the landscape of the rare earth market, fostering competition that could further drive innovation and stability within the industry.

The Future of the Global Rare Earth Market

The future of the global rare earth market will likely be characterized by a paradigm shift towards greater transparency and diversified supply chains. As companies and governments strive to enhance their sourcing strategies, the need to build robust infrastructure for mining and refining operations becomes paramount. This evolution may result in reduced dependence on any single country and create a more balanced global market.

As we move forward, it will be essential for stakeholders to keep pace with the rapid advancements in technology and adapt to emerging trends that affect the supply of critical minerals. Collaborative efforts between industries and governments can foster an environment where new innovations can thrive, ensuring a steady flow of rare earth elements that meet current and future demands.

Frequently Asked Questions

What is the current status of the rare earth supply chain in relation to China rare earths?

The rare earth supply chain is currently dominated by China, which produces approximately 60% of the world’s rare earth supply and processes nearly 90%. Recent approvals for exports from Chinese companies show a slight willingness to ease restrictions, but significant global supply cutoffs continue to pose risks for businesses relying on China’s rare earths.

How do global supply cutoffs affect businesses relying on rare earth exports?

Global supply cutoffs significantly impact businesses dependent on rare earth exports, often causing production delays in industries such as automotive and technology. As a response, companies are exploring rare earth alternatives and diversifying their supply chains to reduce reliance on Chinese sources, but this transition is challenging due to China’s established market control.

What strategies are companies implementing to address risks in the rare earth supply chain?

Companies are investing in alternative sources and substitutes for rare earths to mitigate risks associated with Chinese supply disruptions. However, establishing these alternative supply chains is complex, as many industries continue to face challenges in scaling production of rare earth alternatives.

How do export controls from China impact the global rare earths supply chain?

China’s strict export controls directly affect the global rare earths supply chain by limiting availability and introducing uncertainties in pricing and supply. These controls are often viewed as strategic measures to maintain leverage in international trade, making it essential for companies to diversify their supply sources or face potential shortages.

Why is China considered a leader in the critical minerals supply chain?

China is the leader in the critical minerals supply chain due to its significant production and processing capabilities, controlling approximately 60% of global rare earth elements. This dominance enables China to influence global markets and makes it challenging for other regions, like Europe and the U.S., to compete effectively.

What challenges do European and U.S. companies face concerning rare earth supply and sourcing?

European and U.S. companies face substantial challenges regarding rare earth sourcing, including limited domestic production capabilities and reliance on Chinese imports. Efforts to diversify supply chains are hindered by the complexities and costs of developing alternative sources, which currently represent only a fraction of global needs.

How is the automotive industry responding to dependency on Chinese rare earth supplies?

The automotive industry is responding to its dependency on Chinese rare earth supplies by researching and developing electric vehicles with minimal or no rare earth content. However, achieving cost-effective and scalable production of such vehicles remains a significant hurdle due to existing market dynamics dominated by China.

What future trends can we expect in the rare earths supply chain?

Future trends in the rare earths supply chain may include increased investment in alternative sourcing and recycling technologies, ongoing pressures for regulatory reforms, and potential geopolitical shifts that could reshape reliance on China. Companies will likely continue to seek permanent solutions to balance risks while ensuring a stable supply of critical minerals.

| Key Points | Details |

|---|---|

| China’s Control of Rare Earths | China produces 60% of global rare earth supply and processes 90%. Limited long-term licenses indicate ongoing control. |

| Export Licenses | Recently approved licenses for rare earth magnets, but restrictions are still tight, allowing only limited shipments. |

| Global Industry Response | Businesses are seeking alternatives and reducing reliance on Chinese rare earths due to supply risks. |

| Challenges with Alternatives | Diversifying supply chains is complex and demands significant investment; efforts to reduce reliance have been slow and met with limited success. |

| Impact on Automakers | Automakers are developing EV tech with little rare earth usage, facing production challenges outcomes. |

| Long-term Supply Threats | Supply cutoffs from China are a constant threat; tensions with the U.S. may lead to further restrictions on exports. |

Summary

The rare earth supply chain is heavily dominated by China, which produces and processes 60% and 90% of the world’s rare earth materials, respectively. Despite recent approvals for limited exports, businesses face significant challenges in diversifying their supply chains due to China’s persistent restrictions and control over production. As global industries strive for alternatives, the urgency of transitioning away from dependence on China has become a critical issue facing automakers and tech manufacturers alike.