US Trade War and Ukraine Conflict: Analyzing the Impact

The intertwined dynamics of the US Trade War and Ukraine Conflict have become pivotal in shaping international relations and economic strategies. As tariffs escalate and trade wars provoke tensions, the situation in Ukraine continues to evolve, particularly regarding the ongoing support from NATO countries. The imposition of Trump sanctions on Russia adds another layer of complexity, influencing Eastern Europe tensions and the region’s geopolitical landscape. Meanwhile, discussions surrounding a potential Russia Ukraine ceasefire remain fraught with skepticism, even as Western nations grapple with their stances on military support for Ukraine. Understanding these interconnected events is essential as they not only affect bilateral relations but also reflect broader global power shifts.

The complex relationship between economic disputes and regional conflicts emerges vividly in the narratives of the United States’ trade strategies and the situation in Ukraine. As trade tensions escalate, the implications for alliances and security in Eastern Europe become increasingly significant. The sanctions imposed on Russia during Trump’s administration have been a key factor in driving the geopolitical wedge further between the West and Moscow. Additionally, the question of military aid underscores the evolving nature of NATO’s commitment to Ukraine amid doubts about the prospects for a peaceful resolution. Analyzing how these economic and political challenges are intertwined brings into focus the continuous struggles for stability in this tumultuous region.

Impact of Trade Wars on Eastern European Tensions

The ongoing trade wars, particularly those initiated by the U.S. under the Trump administration, have significantly escalated tensions in Eastern Europe. Tariffs imposed on multiple goods have not only affected economic stability but also heightened political animosities between Russia and its neighbors. As both Russia and Ukraine grapple with the fallout from these trade disputes, the specter of past conflicts looms larger, with many analysts drawing parallels between current tensions and the Cold War era. This complex geopolitical chessboard showcases how trade policies can indirectly fuel military confrontations, complicating efforts for peace and regional stability.

Furthermore, the economic repercussions of tariffs extend beyond mere market prices. They have a ripple effect, instigating a climate of distrust among nations that were once allies. Ukraine, for instance, has found its relationships with European partners strained due to perceived shifts in U.S. foreign policy and its own domestic challenges. This atmosphere of uncertainty not only undermines political cohesion within the region but also invites potential aggression from Russia as it capitalizes on the weaknesses created by the trade wars. Ultimately, the interplay of trade and military policies highlights the intricate links between economics and diplomacy in the Eastern European landscape.

How Trump Sanctions Are Reshaping Russia-Ukraine Dynamics

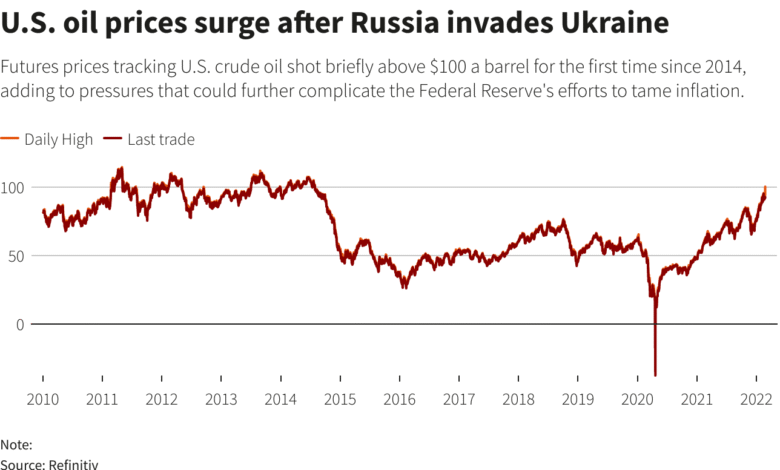

The imposition of U.S. sanctions on Russia, particularly during Trump’s presidency, has created a precarious balance in the ongoing conflict between Russia and Ukraine. These sanctions are designed to cripple key sectors of the Russian economy, but they also lead to a hardened stance from Moscow, complicating negotiations for a ceasefire. The reliance on sanctions as a tool of foreign policy has been met with mixed reactions; while they are intended to pressure the Kremlin, they often foster a siege mentality among Russian leadership, making dialogue with Ukraine more challenging. As a result, the specter of prolonged conflict looms, as both nations remain entrenched in their positions.

As the conflict drags on, Ukraine’s reliance on NATO support becomes increasingly crucial. With U.S. sanctions aimed at crippling Russia’s economic capabilities, Ukraine looks to bolster its defenses with military aid from NATO allies. However, Trump’s recent statements suggesting that Ukraine must take more financial responsibility, including the need for support from other NATO members, have sparked debates about the sustainability of such partnerships. This demand risks alienating European countries that may feel burdened by additional financial obligations amidst their own economic struggles, thereby influencing the broader geopolitical landscape and the ongoing conflict in Ukraine.

The Role of NATO Support in the Ukraine Conflict

NATO’s support for Ukraine has been an essential component in the ongoing conflict with Russia, particularly as tensions have escalated over the past several years. The alliance has provided considerable military assistance, intelligence sharing, and training programs to bolster Ukraine’s defenses against Russian aggression. As pundits argue about the effectiveness of NATO’s involvement, it becomes clear that the alliance’s presence is crucial not only for Ukraine’s military strategy but also for its sovereignty in the face of external threats. NATO’s commitment can be viewed as a deterrent to further Russian incursions, symbolizing a united front against hostile actions in Eastern Europe.

However, the relationship between Ukraine and NATO is not without its complexities. As noted in recent analyses, the transactional nature of international support has left Ukraine feeling marginalized, especially regarding democratic reforms. The perception that NATO’s backing is contingent upon military needs rather than political or democratic advancement has sparked critiques within Ukraine, revealing a disparity between military collaboration and the pursuit of political stability. The essence of NATO’s support is increasingly tested against the backdrop of Ukraine’s internal challenges, prompting discussions about the future of this critical alliance and its role in ensuring a peaceful resolution to the conflict.

Ceasefire Prospects: Russia and Ukraine Negotiation Challenges

The ongoing negotiations for a ceasefire between Russia and Ukraine present significant challenges, with multiple factors contributing to the slow progress towards peace. Despite the looming deadlines stipulated by international actors, skepticism abounds regarding Russia’s willingness to come to the negotiating table in good faith. Historical precedents of failed negotiations, coupled with the current political climate exacerbated by sanctions and trade wars, foster an environment of mistrust that complicates any pursuit of a lasting agreement. Analysts often express concern that without a fundamental shift in attitudes, the hope for a ceasefire may remain just that—hopeful.

Moreover, the implementation of any ceasefire agreement is fraught with difficulties, as both sides grapple with deep-rooted grievances and competing narratives. The international community, particularly Western nations, must navigate a delicate balance in their interactions with both parties, which can influence the behaviors on the ground. As calls for a ceasefire grow louder, the stakes remain high, and the urgency for a resolution is palpable. Unless significant compromises are made by both Russia and Ukraine, the cyclical nature of conflict and ceasefire may continue to plague the region, perpetuating a state of unrest and instability.

Long-Term Effects of Trade Wars on Global Alliances

The ramifications of trade wars extend well beyond the immediate economic impacts, profoundly affecting global alliances and diplomatic relations. As countries prioritize their national interests in the face of tariffs and sanctions, the traditional frameworks of international cooperation are increasingly tested. In the context of Russia and Ukraine, the fallout from U.S.-Russia trade tensions creates a ripple effect on European security dynamics, pushing nations to reevaluate their alliances and strategic partnerships. This realignment poses significant implications for regional stability, as former allies may find themselves at odds over trade and military commitments.

Furthermore, the shift towards more protectionist policies highlights the fragility of established international norms. The consequences of unilateral trade measures can lead to a breakdown in dialogue, as countries may respond to sanctions with retaliatory measures that only escalate tensions. For Ukraine, navigating this changing landscape necessitates a nuanced approach to diplomacy, balancing its reliance on NATO support with the need to engage constructively with neighboring countries. The long-term effect of these trade wars may very well reshape the architecture of global alliances, challenging the foundations upon which international cooperation has historically relied.

Ukraine’s Political Landscape: Government Reshuffles and Reform Efforts

Recent government reshuffles in Ukraine have sparked significant discussions about the effectiveness of its internal reforms and their implications for stability. These changes have raised concerns among European partners regarding Ukraine’s commitment to democratic values, as the political landscape appears increasingly transactional. The pressure for immediate military support from NATO may overshadow the necessity for meaningful political reforms, leading to an environment where long-term governance issues are sidelined. Critics argue that without a solid foundation of democratic principles, any military advantage gained from NATO’s assistance may ultimately prove unsustainable.

The interplay between domestic reforms and international support is critical in shaping Ukraine’s future. As the country grapples with external pressures from Russia and internal frustrations over governance, the path forward will likely require a delicate balance between maintaining military readiness and fostering democratic norms. The international community’s backing must be tied to both military needs and political responsibilities to ensure that Ukraine emerges from the conflict not only as a stronghold against Russian aggression but also as a stable, democratic nation. Thus, maintaining close relationships with NATO and prioritizing reform efforts will be crucial in navigating Ukraine’s complex political landscape.

Sustainability of Western Support Amidst Domestic Challenges

The sustainability of Western support for Ukraine is increasingly under scrutiny, particularly as domestic challenges begin to take center stage amid the ongoing conflict. Analysts point out that international assistance has become more transactional, primarily focused on sustaining military efforts rather than fostering long-term development or democratic reforms. This shift in focus raises important questions about the durability of external support if Ukraine does not address its internal issues, including political instability and public trust in government. If Western allies perceive that their investments in Ukraine yield insufficient reform, the momentum for military and financial backing could diminish.

Moreover, as geopolitical tensions in Eastern Europe fluctuate, the priority given to Ukraine by Western nations may wane, particularly in the face of other pressing global challenges. The repercussions of the trade wars have further complicated this scenario, as Western countries must balance their own economic interests with the need to support Ukraine against Russian aggression. As a result, Ukraine must not only maintain its defense capabilities but also actively work to strengthen political institutions and promote resilience among its citizenry. The challenge lies in ensuring that Western support remains steadfast and multifaceted, addressing both military needs and the pressing Italian reforms that lie at the heart of Ukraine’s future.

Geopolitical Repercussions of U.S.-Russia Relations

The geopolitical ramifications of U.S.-Russia relations have far-reaching effects, particularly in the context of the ongoing conflict in Ukraine. The imposition of sanctions and aggressive trade policies reflects an evolving strategy intended to isolate Russia economically; however, this has led to increased hostility and a rigid stance from the Kremlin. As tensions rise, the potential for conflict escalates, affecting not only Russia’s strategies in Ukraine but also its relationships with other Eastern European nations. The shift towards confrontation raises concerns about the stability of the region and the potential for a realignment of alliances as countries reassess their positions amid heightened tensions.

Additionally, the Cold War dynamics reemerge as old adversaries redefine their roles in a rapidly changing geopolitical landscape. Eastern Europe serves as a crucial battleground where the consequences of U.S.-Russia relations manifest directly in security policies and military engagements. Countries in the region are left to navigate a precarious balance between seeking protection from NATO and managing their sovereignty against Russian influence. As each side jockeys for power, the overarching themes of mistrust and competition continue to shape the political climate, with long-term implications for peace and stability in Europe.

Frequently Asked Questions

How did Trump sanctions on Russia impact the Ukraine conflict?

Trump’s sanctions on Russia were designed to deter aggressive actions in Ukraine but have also led to increased tensions between the U.S. and Russia. These sanctions aimed to weaken Russia economically, yet they also prompted a more assertive Russian posture in Eastern Europe, making it difficult for Ukraine to forge strong alliances and navigate the ongoing conflict.

What role does Ukraine’s NATO support play in the trade wars and the ongoing conflict?

Ukraine’s NATO support is crucial in countering Russian aggression, especially during trade wars that distract from military needs. As tensions rise in Eastern Europe, NATO’s backing provides Ukraine with military assistance and a strategic buffer against Russia, emphasizing the interconnectedness of military alliances and economic policies.

What is the significance of a Russia-Ukraine ceasefire amid trade wars?

A Russia-Ukraine ceasefire is significant as it could stabilize the region and allow both nations to focus on economic recovery amidst ongoing trade wars. However, achieving a ceasefire remains challenging, given the broader geopolitical tensions and sanctions affecting both countries’ economies.

How are the trade wars impacting Eastern Europe tensions?

Trade wars are exacerbating Eastern Europe tensions by creating economic instability in nations like Ukraine that rely on Western support. As countries redirect focus to tariffs and economic policies, the geopolitical landscape becomes more fraught, potentially undermining efforts to achieve peace in the region.

What challenges does Ukraine face in reforming its government amidst the conflict and trade wars?

Amidst the conflict and trade wars, Ukraine faces significant challenges in reforming its government, which include maintaining international support and navigating complex domestic politics. A recent government reshuffle has alienated some European partners, complicating efforts to advance essential democratic reforms and secure needed military aid from NATO.

How does the US Trade War affect international support for Ukraine?

The US Trade War impacts international support for Ukraine by shifting focus towards economic competition rather than military assistance. With the U.S. imposing tariffs and trade barriers, allies may prioritize economic ties over military support, leading to a more transactional approach that undermines Ukraine’s long-term stability and reform efforts.

| Key Points | |

|---|---|

| Impact of Tariffs | Trade distractions hinder focus on the Ukraine conflict. |

| U.S. Sanctions on Russia | Severe sanctions threaten Russia amidst ongoing conflicts. |

| Ukraine’s Partnerships | Recent reforms have alienated some European allies. |

| U.S. Weapons to Ukraine | Trump indicated support only if NATO allies share the cost. |

| Deadline for Peace Talks | Russia is under pressure to respond to peace negotiations by September 2. |

| Analysts’ Skepticism | Doubt remains over Moscow’s willingness to negotiate sincerely. |

| International Support Dynamics | Support has become more transactional and less focused on reforms. |

Summary

The US Trade War and Ukraine Conflict have dramatically reshaped international relations, with trade tariffs distracting from crucial developments in Eastern Europe. As the trade wars escalate, Russia and Ukraine continue to endure significant military challenges, and geopolitical tensions heighten due to sanctions and changing alliances. With the U.S. conditions for military aid to Ukraine and Russia’s impending deadline for peace negotiations, the dynamic between these nations continues to evolve amidst skepticism and uncertainty surrounding their commitments to peace.