Adidas Price Increases Due to Tariffs on U.S. Products

Adidas price increases are set to reshape the cost landscape of sportswear in the U.S., as the global powerhouse grapples with the implications of tariffs introduced by the Trump administration. The company announced that all U.S. products will experience a price hike, a necessary step driven by escalating tariffs that could impact manufacturing costs significantly. With Adidas’ recent earnings report revealing a staggering 155% net income surge in the first quarter, the looming global trade disputes and price adjustments leave consumers wondering about the future of their favorite footwear and apparel. As the firm contends with tariffs affecting key suppliers from regions like China, Vietnam, and Cambodia, the uncertainty surrounding U.S. product prices raises questions about consumer demand amidst rising costs. This perfect storm of economic factors underscores the substantial impact of tariffs on retail, as Adidas navigates its strategic response to maintain profitability while ensuring accessibility for its customers.

The potential for increased pricing from Adidas comes amidst rising economic tensions and escalating tariffs, which have forced many retailers to reconsider their pricing strategies. With the ever-changing landscape of international trade, brands like Adidas are compelled to adapt to altering market conditions, including anticipated adjustments for their wide array of products in the U.S. market. The implications of these tariffs not only affect Adidas’ bottom line but also resonate throughout the retail sector, as companies grapple with pricing pressures against a backdrop of unpredictable consumer behavior. As the market braces for the ripple effects from global trade disputes, it’s essential to consider how these developments may influence not only Adidas but countless other brands vying for consumer loyalty in a challenging economic environment. The urgency of this situation highlights the interconnectedness of global trade and retail strategies, making Adidas a case study in the complexities of modern commerce.

Adidas Price Increases Amid Tariff Challenges

Adidas, the leading sportswear brand, has announced an inevitable increase in prices across U.S. products, a response primarily driven by tariffs imposed by the Trump administration. The rising costs are a significant concern for consumers who are already navigating fluctuating economic conditions. While the specific percentage of price hikes remains uncertain, the company has signaled that these adjustments will be unavoidable, affecting the overall landscape of U.S. product prices. With ongoing trade negotiations rendering the situation unpredictable, Adidas aims to manage consumer expectations regarding cost increases and associate them with global trade disputes impacting the retail sector.

The imposition of higher tariffs is not only influencing Adidas’s pricing strategy but also poses challenges to the entire retail industry. As noted, nearly all businesses relying on imported goods are grappling with the repercussions of increased tariffs, which in some cases exceed 40%. This creates a ripple effect, leading to elevated prices for consumers and potential shifts in demand as buyers reassess their purchasing behaviors. Adidas is working diligently to monitor these circumstances, revealing that the vast majority of their manufacturing occurs abroad, making them vulnerable to ongoing trade tensions.

Impact of Tariffs on Adidas Earnings Report

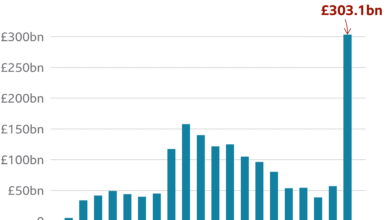

Despite the challenges posed by U.S. tariffs, Adidas reported a remarkable 155% increase in net income from continuing operations for the first quarter, totaling 436 million euros. This positive outcome shows resilience amid turbulent trade relations and reflects the brand’s effective global operations and robust sales strategies. However, the earnings report also highlights a gap between performance gains and future projections, as the company must navigate the uncertainties surrounding tariffs and global trade disputes. Analysts emphasize that while current earnings are strong, the looming prospect of rising production costs could hinder Adidas’s full-year outlook.

Adidas’s financial stability is intrinsically linked to the broader narrative of international tariffs and trade policies. As their earnings indicate a solid performance thus far, there remains caution regarding future profitability. The company may have to revise its revenue and operating profit forecasts if tariffs persist or escalate. This puts Adidas in a precarious position where strong brand sentiment must be balanced against fluctuating costs brought on by tariff-related adjustments, prompting the need for strategic planning to safeguard its market position.

Global Trade Disputes and Retail Pricing Strategies

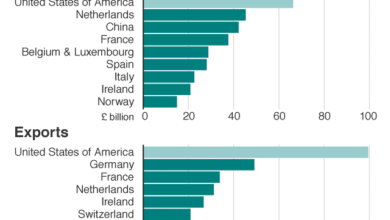

The current global trade landscape is heavily marked by disputes and tariff increases, forcing companies like Adidas to reconsider their retail pricing strategies. As discussions between the U.S. and supplier countries remain uncertain, Adidas has found itself in a tough position, advocating for better clarity on tariff levels to fully assess how to adjust its U.S. pricing structure. The company’s reliance on factories in Vietnam and Cambodia has further exposed them to the vulnerabilities posed by tariffs which add additional costs to their already competitive pricing.

Retailers across various segments are feeling the heat of these global trade disputes, prompting them to reassess their supply chain logistics and pricing strategies. Keeping up with evolving tariffs means that Adidas, along with other brands, must be agile in how they set prices to maintain market share without alienating customers. The current atmosphere calls for heightened awareness of economic factors influencing consumer behavior and a focus on maintaining brand loyalty while managing operational challenges stemming from international trade issues.

The Effect of Tariffs on U.S. Consumer Demand

As Adidas foresees inevitable price increases across all their U.S. products, questions arise about the potential effects on consumer demand. Price sensitivity within the retail market, especially during economic fluctuations, can significantly influence purchasing decisions. Higher tariffs leading to increased prices could dissuade some customers from buying, creating ripples in sales volume for Adidas and its counterparts. With retail competition at a peak, understanding consumer behavior in light of rising product prices is essential for sustaining a loyal customer base.

Retailers, including Adidas, are actively monitoring how these price changes may affect consumer demand. Early indications suggest a complex relationship where customers may pivot to lower-cost alternatives depending on the pricing strategies adopted by brands in reaction to tariffs. Adidas’s emphasis on maintaining brand strength and customer appeal will be crucial in navigating these challenges, particularly through innovative marketing and product offerings that resonate with value-conscious consumers, regardless of impending price adjustments.

Adidas and the Future of U.S. Manufacturing

In light of the current tariff landscape, Adidas faces critical decisions regarding its manufacturing strategies in the U.S. The company has currently minimized its reliance on local manufacturing due to the prohibitive costs associated with tariffs on imported goods from high-demand regions like Asia. With nearly all production occurring overseas, Adidas acknowledges challenges in establishing a more localized manufacturing presence that could mitigate tariff-related pricing impacts.

The path ahead for Adidas involves evaluating the feasibility of expanding manufacturing operations domestically or in tariff-friendly regions to reduce operational costs. However, this transition requires vast investment and adaptive supply chain management to ensure product accessibility to U.S. consumers at competitive prices. The brand’s ability to navigate these complexities effectively will significantly influence its sustainability and market share in an increasingly competitive retail environment.

Tariff Mitigation Strategies for Retailers

Retail giants like Adidas are now exploring various strategies to mitigate the adverse effects of tariffs on their bottom line. Cost management and strategic sourcing are at the forefront, with companies looking into alternative manufacturing locations that may offer lower tariff implications. Diversification in the supply chain and establishing relationships with new suppliers who are less affected by current tariff structures can provide a buffer against impending price increases.

Moreover, companies are also considering more innovative pricing strategies, such as phased increases or promotional discounts, to maintain customer loyalty while gradually adjusting retail prices. By implementing these approaches, Adidas can cushion the impact of tariffs on consumer demand and retain a competitive advantage amidst the ongoing trade challenges. Retailers are tasked with balancing necessary price adjustments with maintaining brand integrity and customer satisfaction.

Adidas Competitors and the Impact of Tariffs

As Adidas navigates the impact of U.S. tariffs, its competitors are not immune to similar challenges. Brands like Nike and Puma also face potential price increases as they grapple with the implications of rising tariffs on products imported into the U.S. market. The competitive landscape requires that companies remain agile with their responses to these economic pressures, often leading to strategic adjustments in pricing and marketing tactics.

Competitors may see this as an opportunity to capture market share by either highlighting their cost-competitive pricing or honing in on specific consumer segments less affected by price fluctuations. Adidas must remain vigilant in anticipating competitor reactions and crafting strategies that underscore the value propositions of their offerings, working to differentiate themselves in a tight marketplace that is increasingly responsive to economic conditions shaped by global trade disputes.

The Future of Adidas amid Tariff Uncertainty

The uncertainty surrounding tariffs poses a significant challenge for Adidas as it looks to solidify its market position going forward. While the company reported tremendous growth in earlier quarters, the lack of clarity regarding future tariffs complicates long-term financial forecasting. Adidas must develop contingency plans that allow for flexible pricing and product offerings in response to evolving trade conditions.

In navigating these uncertainties, Adidas can leverage its strong brand recognition and consumer loyalty to maintain sales momentum despite potential price increases. Understanding the broader macroeconomic trends and consumer sentiment will be crucial in determining effective strategies that not only protect the bottom line but also foster growth amid evolving market dynamics driven by global trade disputes and tariff strategies.

Frequently Asked Questions

How are Adidas price increases related to U.S. tariffs?

Adidas has announced that U.S. tariffs imposed by the government will lead to price increases on all its products sold in the United States. The company indicated that higher tariffs translate to higher costs, which will eventually be passed on to consumers, although the exact price increase remains uncertain.

What impact do Adidas tariffs have on consumer prices?

The Adidas tariffs are expected to significantly impact consumer prices as the company warns that higher tariffs will necessitate price hikes on all U.S. products. This is particularly concerning for customers in light of ongoing global trade disputes affecting import costs.

How might the Adidas earnings report reflect their price increase strategy?

In its latest earnings report, Adidas noted a substantial increase in net income, which could suggest strong brand performance despite upcoming price increases. The company emphasizes that the positive financial results are overshadowed by concerns about how upcoming price hikes due to tariffs will affect consumer demand.

What are the potential implications of Adidas price increases for the retail market?

Adidas price increases, driven by tariffs, could have broad implications for the retail market, influencing not only consumer purchasing behavior but also the pricing strategies of competing brands. As companies like Adidas raise prices, other retailers may follow suit in response to rising costs, impacting overall retail profitability.

Can Adidas avoid price increases despite ongoing global trade disputes?

Currently, Adidas cannot avoid price increases due to ongoing global trade disputes that result in higher tariffs. The company has expressed uncertainty regarding future tariff rates and has minimized exports from high-tariff countries, but it ultimately will have to increase prices to cover the additional costs.

What are Adidas’s views on consumer demand in light of price increases?

Adidas has expressed concern regarding consumer demand in response to anticipated price increases. The company acknowledges that while it expects higher costs from tariffs, how much these price hikes will affect consumers’ willingness to purchase remains uncertain, complicating their sales outlook.

Why might Adidas’s price increases outpace those of other retail brands?

Adidas might experience price increases that outpace those of other retail brands due to its significant reliance on overseas manufacturing, particularly in countries facing high U.S. tariffs. This structure means that any increase in trade costs directly affects Adidas pricing more than brands with more domestic production.

How do global trade disputes affect Adidas’s pricing strategy?

Global trade disputes significantly complicate Adidas’s pricing strategy, as ongoing negotiations and tariff fluctuations create uncertainty regarding cost structures. Higher import tariffs on products from countries like China and Vietnam are likely to lead to unavoidable price increases across their U.S. offerings.

Are Adidas’s price increases consistent with trends in the retail industry?

Yes, Adidas’s price increases are consistent with broader trends in the retail industry where many brands are grappling with rising costs due to tariffs. Retailers across the board are likely to raise prices as they pass on increased expenses to consumers amid economic uncertainties.

What has Adidas stated about future pricing and tariffs?

Adidas has stated that future pricing decisions are difficult to predict due to the ongoing uncertainty surrounding U.S. tariffs and global trade negotiations. The company is monitoring the situation closely and will communicate any significant pricing changes as they validate the necessary adjustments.

| Key Points |

|---|

| Adidas warns of price increases on all U.S. products due to tariffs imposed by President Trump. |

| The company cannot specify the extent of price increases due to uncertain tariff rates from suppliers in China, Vietnam, and Cambodia. |

| Adidas’ net income for the first quarter increased by 155%, surpassing estimates, but the tariffs hindered its full-year outlook. |

| The effective tariff rate on products from China is 145%, and overall U.S. tariffs are currently around 10% while negotiations continue. |

| Adidas cannot manufacture most products in the U.S. and relies on factories in higher-tariff countries. |

| Other retailers are facing similar issues regarding price increases and their impact on consumer demand due to tariffs. |

| Despite tariff challenges, Adidas showed significant sales growth and improved earnings across all regions. |

Summary

Adidas price increases are imminent as the company has announced that all its U.S. products will see a rise due to tariffs imposed by the Trump administration. The uncertainty surrounding tariff rates, particularly from key suppliers, complicates the company’s pricing strategy. Despite a remarkable increase in net income and sales growth, Adidas faces a challenging environment where higher tariffs could affect consumer demand. Moving forward, the company’s ability to adapt and manage the implications of these price changes will be crucial.