Trump Medvedev Nuclear Comments Spark Controversy

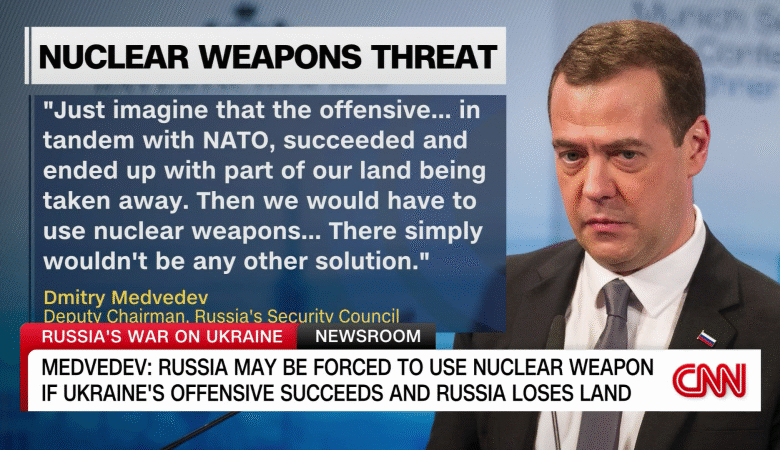

In a dramatic exchange of rhetoric, President Donald Trump took aim at former Russian President Dmitry Medvedev’s controversial nuclear comments, igniting renewed tensions surrounding U.S.-Russia relations. Medvedev’s alarming assertion that several nations are “ready to directly supply” Iran with nuclear warheads following U.S. military strikes has raised concerns about the geopolitical landscape. Highlighting America’s formidable nuclear capability, Trump rejected Medvedev’s remarks and questioned his credibility. As discussions of Iran’s nuclear ambitions gain momentum, both leaders are reinforcing their positions on military might and international diplomacy. This dispute underscores the delicate balance of power as the world watches the evolving situation in the context of Iran’s nuclear weapons program and the fraught relationship between Russia and the United States.

The recent interchange between President Donald Trump and Russian official Dmitry Medvedev reflects growing apprehensions over global nuclear dynamics. Medvedev’s implications of a burgeoning nuclear partnership between Iran and other nations signal potential shifts in the international arena. Trump’s fierce defense of U.S. nuclear strength against such claims illustrates his administration’s hardline stance on nuclear deterrence and foreign policy. This backdrop raises significant questions regarding how these tensions might hinder efforts to stabilize relations between Russia and America, particularly as concerns of nuclear proliferation loom large. As the dialogue progresses, the ramifications of these remarks could have profound implications for international security and diplomatic negotiations.

Trump Responds to Medvedev’s Nuclear Remarks

In a recent outburst, President Donald Trump vehemently criticized Dmitry Medvedev, the former president of Russia, for his alarming comments suggesting that several countries are poised to provide Iran with nuclear warheads. Trump questioned the validity of Medvedev’s statement and referred to it as a worrisome figment of imagination, signaling his discontent with this potentially dangerous rhetoric. This exchange highlights the escalating tensions surrounding Iran’s nuclear aspirations and the ramifications of U.S. military actions in the region.

Trump’s reaction isn’t merely emotional; it reflects a broader geopolitical strategy. By underscoring the seriousness of nuclear discussions, the president reinforced the lethality of U.S. nuclear capabilities. His comments about U.S. nuclear submarines being ‘the most powerful and lethal weapons ever built’ serve to remind both domestic and international audiences of America’s standing in global military capabilities. As U.S.-Russia relations continue to deteriorate, moments like these encapsulate the growing unpredictability in international politics.

Elevated Tensions: U.S. Strikes on Iran’s Nuclear Sites

The recent U.S. strikes on Iran’s key nuclear facilities have stirred significant controversy, not just regarding the immediate implications for Iran’s nuclear program, but also in terms of international relations. Trump and his administration have claimed that these military actions successfully set back Iran’s nuclear ambitions, with recent reports suggesting that the strikes caused no significant uptick in radiation levels, which might imply that the targeted sites were less impactful than anticipated. Nevertheless, concerns linger over Medvedev’s assertion that Iran’s nuclear infrastructure faced only minimal damage and could recover swiftly.

These developments resurrect fears of an escalating arms race, particularly if countries are indeed prepared to back Iran with nuclear weaponry. The dynamics between the U.S. and Russia are strained, and the implications of these strikes could lead to greater involvement from international players who find themselves drawn into this escalating conflict. For many, the focus remains on the potential for Iran to advance its nuclear weapons program despite U.S. attempts to dismantle it.

Iran’s Nuclear Proliferation: The Role of Global Powers

As the conversation surrounding Iran’s nuclear capabilities intensifies, it becomes imperative to consider the roles of various global players, including Russia. Medvedev’s comments suggest a willingness by multiple countries to aid Iran, raising alarms about nuclear proliferation in a region fraught with geopolitical tensions. This potential for collaboration complicates the existing U.S. strategy and raises the stakes for all parties involved, including those who may partner with Iran in its pursuit of nuclear technology.

The implications are far-reaching in the context of U.S.-Russia relations. The Biden administration is required to navigate this delicate situation with diplomatic skill while maintaining national security. Should Russia fulfill Medvedev’s predictions of supplying Iran, the repercussions could drastically alter the balance of power in the Middle East and beyond. The concern over nuclear arms proliferation is a formidable reality that demands immediate and decisive international dialogue.

The Impact of Trump’s Nuclear Posturing on Global Alliances

Trump’s assertive nuclear posturing—a tactic he often employed throughout his presidency—serves both to reinforce his position at home and to send a signal to adversaries abroad. His comments about the advanced nature of U.S. military hardware are not merely bravado; they are a strategic message to Russia and other nations contemplating their own nuclear capabilities. By boasting about U.S. supremacy in nuclear technology, Trump aims to deter potential adversaries from escalating their military threats.

However, this rhetoric can also risk alienating allies who may feel caught in the crossfire of rising tensions. The delicate alliances that the U.S. maintains could be jeopardized if international partners perceive U.S. military threats as reckless or aggressive. The implications of Trump’s statements extend beyond immediate regional conflicts and could foster wider implications for global nuclear non-proliferation efforts. In this context, the relationship between the U.S. and key allies will play a crucial role in shaping responses to any emerging nuclear threat.

Medvedev’s Critique of U.S. Foreign Policy

Dmitry Medvedev’s recent critiques of U.S. foreign policy reveal a growing discontent among Russian officials regarding America’s military interventions. Medvedev stated that Trump’s actions could push the world closer to conflict, suggesting that the U.S. has overstepped boundaries in its pursuit of national security. His comments resonate with a narrative that condemns external interventions as detrimental to international peace and stability, indicating a rhetorical shift towards a more adversarial stance against U.S. strategies in the Middle East.

This kind of rhetoric from Medvedev prompts crucial discussions about the sustainable paths to peace. Instead of promoting dialogue and cooperation, these comments risk escalating tensions and further entrenching opposing viewpoints between the U.S. and Russia. In this heated environment, the potential for disastrous misunderstandings increases. Medvedev’s remarks serve as a reminder of how crucial it is for nations to engage in open discussions to de-escalate the situation before it spirals out of control.

The Future of Iran’s Nuclear Ambitions Amid U.S. Pressure

Amidst the backdrop of recent military strikes and rising tensions, the future of Iran’s nuclear ambitions remains uncertain. While Trump’s administration flaunts the effectiveness of its strategic attacks on Iranian nuclear facilities, experts are divided over whether these actions will yield long-term success. Iran remains resolute in its pursuit of nuclear capabilities, and with support from allied nations, the dream of achieving a functional and robust nuclear arsenal is not out of reach.

As Vice President JD Vance noted, there may be doubt about the extent to which U.S. strikes have crippled Iran’s program. Thus, analysts argue it is essential for the U.S. to pursue diplomatic routes alongside its military approaches to effectively curb Iran’s nuclear ambitions. A multifaceted strategy encompassing both hard and soft diplomatic efforts will be crucial in negotiating any potential agreements that could prevent Iran from advancing its nuclear capabilities further in the years to come.

Assessing the Risks of Nuclear Engagement: A Trump Administration Perspective

The risks associated with nuclear engagement are significant, particularly from the perspective of Trump’s administration, which has often emphasized military strength as a deterrent. Trump’s comments regarding U.S. nuclear capabilities, including sophisticated naval technology, serve to bolster support for a defense strategy heavily reliant on military prowess. The administration’s insistence on showcasing its strength aims to dissuade foreign adversaries from developing their nuclear arsenals or advancing their offensive military strategies.

However, such posturing could inadvertently escalate arms races rather than deter them. The focus on nuclear superiority has historically prompted rival nations to respond in kind, perpetuating cycles of distrust and militarization. Any miscalculation or unintentional provocation could lead to catastrophic outcomes. Understanding the delicate balance required to mitigate risks of nuclear engagement while continuing to assert U.S. influence in global affairs will pose a considerable challenge to future policymakers.

Repercussions of Military Action on U.S. Foreign Relations

The immediate repercussions of U.S. military action in the Middle East extend beyond targeted countries, affecting broader foreign relations significantly. Following Trump’s strikes on Iran, leaders in various nations expressed unease about U.S. unilateral actions that bypass broader international consensus. Trump’s dismissal of multilateral diplomacy in favor of direct military intervention has drawn criticism from allies who feel sidelined in discussions about regional security.

These military actions not only strain relationships with allies but also alter the global perception of the U.S. as a leader in international diplomacy. Critics argue that such aggressive tactics complicate efforts for lasting peace and could foster resentment that fuels anti-American sentiment in impacted regions. The projected fallout from these strikes may thus induce a reevaluation of foreign policy strategies that prioritize dialogue and coalition-building rather than confrontation.

Navigating National Security in a Complex Geopolitical Landscape

As the geopolitical landscape continues to evolve, the navigation of national security concerns becomes increasingly complex for the United States. The tensions surrounding Iran’s nuclear ambitions pose a significant challenge, prompting policymakers to consider a broader range of strategies to enhance security. The intertwining of military actions and diplomatic engagement is crucial in fostering stability in volatile regions.

Establishing a robust national security strategy that acknowledges both the realities of military threats and the importance of international collaboration is essential for long-term peace. By engaging with allies and understanding the nuances of adversarial motivations, the U.S. can better position itself to mitigate tensions while keeping in mind the delicate balance of power that evolves in response to ongoing global developments.

Frequently Asked Questions

What are Trump Medvedev nuclear comments in relation to U.S. nuclear capability?

President Trump criticized Dmitry Medvedev’s comments about several countries potentially supplying Iran with nuclear warheads following U.S. military strikes. Trump highlighted the strength of U.S. nuclear capability, particularly emphasizing the advanced nature of its nuclear submarines, in response to Medvedev’s assertions.

How did Trump respond to Medvedev’s remarks on Iran nuclear weapons?

Trump questioned the validity of Medvedev’s statement about countries ready to supply Iran with nuclear warheads, criticizing the casual mention of nuclear weapons. He stated that such discussions should be treated seriously, given the significance of nuclear capabilities in international relations.

What is the context behind Trump Iran nuclear strikes and Medvedev’s comments?

Trump’s recent military actions against Iran were intended to degrade its nuclear capabilities significantly. In response, Medvedev suggested that these strikes might provoke nations to arm Iran with nuclear weapons, indicating a potential escalation in U.S.-Russia relations regarding nuclear issues.

How do Medvedev’s comments impact U.S. nuclear relations with Russia?

Medvedev’s statements about supplying Iran with nuclear weapons may strain U.S.-Russia relations, illustrating the geopolitical tensions surrounding nuclear armament and military actions in the region. Trump’s emphasis on U.S. nuclear superiority is a direct counter to these claims.

What implications do Trump’s comments on nuclear submarines have on international military dynamics?

By boasting about the advanced capabilities of U.S. nuclear submarines, Trump aims to assert American military dominance in the face of potential threats posed by Iran with assistance from Russia and other countries, reinforcing U.S. deterrent power in evolving international conflicts.

What role does the International Atomic Energy Agency (IAEA) play following Trump Medvedev nuclear comments?

The IAEA monitors nuclear activities globally, and in light of Trump’s military strikes on Iran, they reported no immediate increase in radiation levels, which suggests that the attacks might not have significantly impacted Iran’s nuclear program as claimed by U.S. officials.

Why does Trump criticize Medvedev’s casual approach to nuclear discussions?

Trump’s criticism of Medvedev stems from a belief that the casual mention of nuclear arms escalates tensions and could have severe implications for global security. He emphasized the gravity of nuclear warfare and the need for serious discourse around it.

What are the potential risks of the reactions to Trump Medvedev nuclear comments?

Reactions to the ongoing tensions between the U.S. stance on Iran and Medvedev’s remarks could lead to increased militarization and a nuclear arms race, affecting global stability and potentially triggering conflicts in the region.

What are the public’s reactions to Trump and Medvedev’s statements on nuclear issues?

Public reactions vary, with some expressing concern over the rhetoric surrounding nuclear weapons, fearing it may lead to escalation, while others support the display of military strength as a necessary deterrent against perceived threats.

How do Trump’s and Medvedev’s comments reflect broader geopolitical tensions?

The interplay of Trump’s military actions and Medvedev’s comments signifies a heightened state of geopolitical tension, particularly between the U.S., Russia, and Iran, highlighting the fragility of international agreements regarding nuclear proliferation and military engagement.

| Key Points |

|---|

| Trump criticizes Medvedev’s nuclear comments, questioning if they are a figment of imagination |

| Medvedev claims countries are ready to supply Iran with nuclear warheads after US strikes |

| Trump boasts of US nuclear capabilities, particularly nuclear submarines |

| IAEA reports no increase in radiation post US attacks on Iran’s nuclear sites |

| Vice President JD Vance cautious in asserting destruction of Iran’s nuclear sites |

| Putin condemns US military action as unprovoked and vows to support Iran |

Summary

Trump’s comments regarding the nuclear remarks made by Medvedev underscore the ongoing tensions surrounding Iran’s nuclear ambitions. The Trump Medvedev nuclear comments highlight contrasting perspectives on the situation, with Trump emphasizing U.S. military strength and capability while Medvedev warns of international responses to U.S. actions. This discourse reflects the intricate geopolitical dynamics between the U.S., Russia, and Iran amid rising concerns over nuclear proliferation.