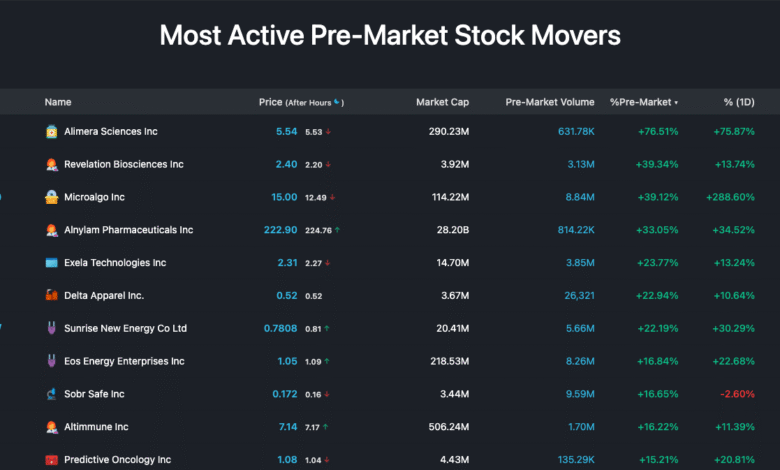

Premarket Stock Movers: Synopsys, Tripadvisor, and More

In the world of finance, premarket stock movers serve as a crucial indicator of market sentiment before the official trading day begins. Investors and analysts closely monitor these shifts to identify stocks to watch and gain insights into potential stock market trends. Currently, notable premarket trading is spotlighting companies like Synopsys and Tripadvisor, whose stock movements are largely influenced by recent earnings reports and industry developments. Understanding these major stock movements can help traders strategize effectively and stay ahead of the curve. As financial news unfolds, keeping an eye on these premarket stocks becomes essential for anyone looking to navigate today’s dynamic investment landscape.

Exploring the early shifts in stock values, premarket trading highlights significant changes in market positions and investor confidence. This pre-opening analysis reveals which companies are making headlines, often due to their latest earnings results or shifting economic conditions. Traders evaluate these fluctuating stock prices to identify emerging investment opportunities and strategies. With key players such as Datadog and Robinhood in the spotlight, understanding these market dynamics is vital for predicting future trends. By paying attention to these essential stock movements, investors can align their portfolios with the current market pulse.

Premarket Stock Movers Overview

In the realm of premarket trading, many investors are keen to identify the stocks making significant moves as they can set the tone for the trading day. Notable premarket stock movers this week include Synopsys, which has gained attention following impressive quarterly earnings results. As financial analysts dissect these results, the positive sentiment surrounding Synopsys suggests a bullish trend moving into regular market hours.

Similarly, other premarket stock movers like Tripadvisor and Datadog are also attracting investor interest. Tripadvisor’s stock demonstrates volatility as it responds to fluctuating travel trends, while Datadog sees adjustments in analyst price targets following its latest earnings report. Both of these stocks exemplify how external factors and company performance can influence premarket trading, providing potential opportunities for investors.

Stocks to Watch: Synopsys and Its Implications

Synopsys has emerged as a standout in the premarket trading scene due to its strong quarterly earnings report, which outperformed market expectations. This positive performance not only highlights the resilience of technology stocks but also reinforces the trend where companies in the tech sector continue to drive major stock movements. Investors are taking note, as successful fiscal reports often correlate with upward shifts in stock prices.

As market dynamics shift in response to economic uncertainty, Synopsys serves as a benchmark for other tech stocks. Investors paying close attention to stocks to watch may find that Synopsys’ performance can offer insights into broader stock market trends, particularly within the technology sector. Keeping an eye on such stocks could be crucial for those looking to make informed decisions in a volatile market.

Current Financial News You Shouldn’t Miss

This week in financial news, the spotlight is on several prominent stocks, including Robinhood, as it navigates scrutiny while simultaneously gaining new users. Despite regulatory challenges, Robinhood’s ability to attract a growing user base indicates a resilient business model that may keep the stock buoyant in turbulent markets. Investors are keenly observing how Robinhood responds to criticism and what that means for future earnings.

In addition to Robinhood, ongoing coverage of Datadog’s latest earnings report showcases how the tech sector continues to be impacted by evolving market conditions. Financial news is instrumental in shaping investor sentiment, as traders react not only to earnings but also to analyst forecasts and industry news. Staying updated with these developments can provide a competitive edge in making investment decisions.

Analyzing Major Stock Movements

Major stock movements in premarket trading can signify shifting trends in investor sentiment. As seen with companies like Tripadvisor, fluctuations can occur quickly, influenced by recent updates or market news. This makes it essential for traders to actively analyze these movements to anticipate market openings and strategize their investments accordingly.

Investors focusing on active stocks in premarket trading often utilize insights from major stock movements to gauge market sentiment. Whether it’s the tech industry’s response to economic indicators or consumer services adapting to travel demand changes, these stock movements provide a clearer picture of the factors driving market trends.

Understanding Premarket Trading Dynamics

Premarket trading serves as an indicator of how the stock market may perform once it officially opens, allowing investors to react to news and earnings reports before traditional trading hours. During this period, stocks like Synopsys can see accelerated movement based on investor reactions, often leading to significant gains or losses by market open.

Furthermore, premarket trading dynamics can reflect the overall economic environment. Investors need to track the performance of notable premarket movers to understand what sentiments are influencing market conditions. This analysis is pivotal for predicting how stocks may behave once trading resumes, making it an essential aspect of trading strategy.

Key Insights from Recent Earnings Reports

Recent earnings reports from companies such as Datadog demonstrate that financial disclosures remain a fundamental component driving investor decisions in the stock market. Analysts are recalibrating their price targets based on the new data, indicating that earnings can drastically influence stock valuations. For example, Datadog’s adjustments highlight its importance in ongoing technology growth amidst economic fluctuations.

Earnings reports provide a wealth of information that can help investors identify potential stock movers before they occur. Observing these reports closely allows investors to capitalize on perceived undervalued stocks or identify stocks hitting all-time highs based on strong performances, thus positioning themselves advantageously in premarket trading scenarios.

The Impact of Travel Trends on Stocks Like Tripadvisor

Travel trends significantly affect stocks like Tripadvisor, where fluctuations can be attributed to seasonal shifts and broader economic conditions. With travel seeing a resurgence, Tripadvisor’s stock movements in premarket trading often reflect changing consumer behaviors and sentiment. Monitoring these trends is crucial for investors wishing to stay ahead of potential shifts in stock prices.

Investors looking closely at Tripadvisor must consider how ongoing travel trends can create opportunities for profit. By analyzing fluctuations in the stock based on consumer interest, traders can strategically position themselves before major market movements occur, underscoring the importance of real-time news updates in making informed investment decisions.

Stock Market Trends to Monitor This Week

As we look at the stock market trends this week, the focus is on how companies are responding to economic indicators ranging from inflation to consumer sentiment. Investors should closely monitor premarket movers for any signs of market trends possibly setting the stage for the remainder of the week. Strong earnings results from tech companies can signify a rebound in investor confidence.

In addition, observing stocks like Robinhood can offer insights into emerging trends in the online trading landscape. With more investors engaging through platforms like Robinhood, the implications on market liquidity and trading behavior could reflect broader behavioral shifts in the financial markets.

Exploring Future Stock Opportunities

Investors continuously search for future opportunities in an evolving stock market landscape. By keeping an eye on the performance of premarket movers, such as Synopsys and Datadog, traders can identify potential long-term prospects. Early indicators, like positive quarterly earnings or analyst upgrades, often hint at larger market trends that can be capitalized on.

Looking ahead, companies demonstrating resilience amidst economic fluctuations could become focal points for investment. Assessing the premarket movements alongside implications from quarterly reports provides a comprehensive overview, equipping investors to make well-informed decisions regarding stocks to watch.

Frequently Asked Questions

What are the key premarket stock movers to watch today?

Today, the key premarket stock movers include Synopsys, Tripadvisor, Datadog, and Robinhood. These stocks are reacting to earnings results, travel trends, analyst updates, and user growth. Monitoring these stocks can provide insights into potential market trends.

How do premarket stock movers impact investment decisions?

Premarket stock movers can significantly influence investment decisions as they indicate stocks poised for major movements during regular trading hours. By tracking these stocks, investors can gain insights into potential buying or selling opportunities based on market sentiment and financial news.

Why is it important to follow stocks to watch in premarket trading?

Following stocks to watch in premarket trading is important because it helps investors identify momentum and trends that may carry into the regular trading session. Key premarket movements can indicate how investors are reacting to recent financial news or company announcements.

What are the common reasons for major stock movements in premarket trading?

Major stock movements in premarket trading commonly occur due to earnings reports, market news, analyst upgrades or downgrades, and macroeconomic factors. These events can lead to increased buying or selling pressure as traders respond to new information.

How can I find information about financial news affecting premarket stock movers?

You can find information about financial news affecting premarket stock movers by following trusted financial news websites, subscribing to market alerts, and using financial platforms that provide real-time updates on stock market trends.

| Stock | Key Points |

|---|---|

| Synopsys | Shares expected to react positively after strong quarterly earnings results. |

| Tripadvisor | Stock fluctuates following recent travel trends and company updates. |

| Datadog | Analysts adjusting price targets based on the latest earnings report. |

| Robinhood | Faces scrutiny but continues to attract new users. |

Summary

Premarket stock movers are showing significant activity with notable companies such as Synopsys, Tripadvisor, Datadog, and Robinhood capturing investor attention. Stocks like Synopsys are responding well to favorable earnings, indicating strong market confidence. Conversely, Tripadvisor is experiencing volatility due to changing travel trends, while Datadog’s market position is being reassessed by analysts. Meanwhile, Robinhood, despite its challenges, is successfully onboarding new clients, which could hint at a resilient user base. Investors should keep a vigilant watch on these premarket stock movers to gauge market sentiments and make informed decisions.