Elliott Wave Theory Bitcoin: Patterns and Trading Insights

Elliott Wave Theory Bitcoin offers an intriguing framework for traders seeking to navigate the tumultuous waters of cryptocurrency. By analyzing Bitcoin price patterns through the lens of this advanced technical analysis, traders can uncover crucial insights about market psychology and potential price movements. The interplay of impulse and corrective waves allows for a structured approach to Bitcoin trading, helping traders identify optimal entry and exit points. Embracing Elliott Wave analysis equips traders with effective cryptocurrency trading strategies tailored to the unique volatility of Bitcoin. As a result, understanding these price patterns and underlying trading psychology becomes essential for anyone looking to thrive in the ever-evolving crypto market.

The Elliott Wave Theory represents a compelling method for those eager to grasp the dynamics of Bitcoin’s price fluctuations. This analytical technique revolves around the recurring wave structures that manifest within Bitcoin trading, revealing the rhythm of market sentiment. By employing this theory, traders can decode patterns within the Bitcoin price movements, gaining valuable knowledge that informs their trading decisions. Moreover, integrating Elliott Wave insights enhances one’s cryptocurrency trading strategies, making it easier to navigate the complex psychological factors that influence market behavior. Ultimately, leveraging this wave analysis can empower traders to anticipate shifts in the Bitcoin landscape with greater accuracy.

Understanding Elliott Wave Theory in Bitcoin Trading

Elliott Wave Theory presents a compelling framework for analyzing the cyclical nature of bitcoin price movements. Given the unpredictable volatility characteristic of cryptocurrency markets, this theory helps traders delineate between periods of price surges and corrective pullbacks. By meticulously studying historical price patterns, traders can better understand how human sentiment influences bitcoin’s behavior. This understanding is critical for developing effective cryptocurrency trading strategies that capitalize on anticipated market trends.

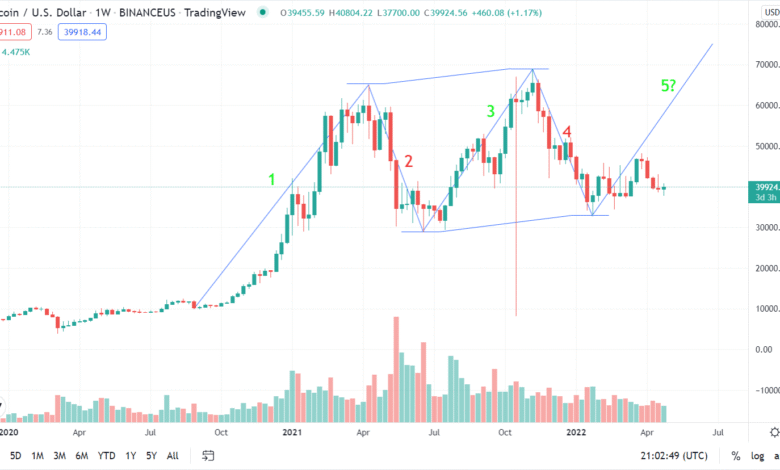

Utilizing Elliott Wave analysis, traders can identify key patterns that signal potential market reversals or continuations. For instance, the five-wave pattern in bullish phases indicates strong buying interest, while three-wave corrective sequences point to temporary downturns. By integrating tools like Fibonacci retracement levels alongside wave counts, traders enhance their predictive capabilities, making informed decisions based on anticipated price movements in bitcoin against the backdrop of historical behavior.

The Psychology Behind Elliott Wave Bitcoin Trading

Trading psychology plays a crucial role in the application of Elliott Wave Theory to bitcoin. Given that the theory is rooted in crowd psychology, understanding how fear and greed affect market behavior is essential for accurately interpreting wave patterns. A trader who can masterfully navigate this psychological landscape is better positioned to identify not just the waves themselves, but also the emotional drives that push markets higher or lower. This awareness helps traders to remain disciplined, avoiding impulsive decisions driven by market sentiment.

Moreover, developing a robust trading mindset allows traders to adhere to their strategies through market fluctuations. When applying Elliott Wave techniques, patience is critical; each wave contains market psychology that must be respected. A successful trader will learn to distinguish genuine trends from temporary sentiment-driven spikes, thus maintaining an edge in volatile environments like bitcoin. Cultivating this psychological resilience supports well-rounded investment strategies that leverage both market analysis and trader behavior.

Elliott Wave Patterns in Bitcoin Price Movements

The identification of Elliott Wave patterns within bitcoin price movements is fundamental for traders seeking to harness market trends effectively. An observable pattern begins with an impulse wave consisting of five sequential sub-waves that signify upward momentum. Recognizing this pattern as it develops encourages traders to enter the market in anticipation of continued bullish movement, particularly during the surge of wave three, which is often the most powerful.

Conversely, traders must also be vigilant during the corrective waves (A-B-C). This pullback allows traders to reassess their positions, determine entry points, and institute risk management strategies to protect their investments. The ability to read and react to these patterns in real-time is what sets successful traders apart in the competitive bitcoin market. Understanding these waves in relation to price retracement points, as dictated by Fibonacci ratios, further refines entry and exit strategies.

Navigating Bitcoin’s Volatility with Elliott Wave Analysis

Navigating the churning waters of bitcoin’s volatility is challenging, yet Elliott Wave Theory provides a structured methodology to anticipate market shifts. By tracing the wave formations on price charts, traders can forecast potential trend reversals and the likelihood of continued motion within established patterns. This analysis is invaluable, especially in a market that is notorious for rapid price fluctuations that can lead to significant financial loss without the proper foresight.

Traders employing Elliott Wave analysis typically adopt a multi-timeframe approach, ensuring that they align their strategies with the broader market perspective while remaining cognizant of finer fluctuations on shorter time scales. This layered analysis allows for better timing in entries and exits, reducing exposure to sudden market whipsaws. Thus, by applying Elliott Wave Theory to bitcoin trading, individuals can navigate its volatility with greater precision, balancing risk and reward effectively.

Implementing Advanced Trading Strategies with Elliott Wave Theory

Implementing advanced trading strategies using Elliott Wave Theory requires a keen understanding of both wave structures and market dynamics. Traders often use the insights gleaned from wave counting to formulate targeted approaches that maximize profitability. For example, entering positions in wave two or wave four positions during an uptrend taps into anticipated momentum gained in wave three or wave five, thereby optimizing returns.

Additionally, consistent practice and discipline in wave counting is essential, as strict adherence to the core rules—like ensuring wave two does not retrace more than 100% of wave one—maintains the integrity of the analysis. Without this discipline, traders can easily become misaligned with market movements, leading to poor decisions. As such, incorporating advanced strategies supported by Elliott Wave analysis can significantly increase the chances of success in the dynamic realm of cryptocurrency trading.

Multi-Timeframe Analysis in Elliott Wave Bitcoin Trading

Multi-timeframe analysis is a cornerstone of effective Elliott Wave trading strategies in the bitcoin market. By analyzing charts over various timeframes—from minutes to weeks—traders can identify overarching trends while pinpointing short-term opportunities. This holistic approach provides a clearer picture of market sentiment and potential price movements, as more comprehensive wave patterns often emerge when viewed across different durations.

A trader might observe a larger five-wave impulse on a weekly chart, while simultaneously identifying smaller, discernible five-wave patterns within that larger structure on daily or hourly charts. This ability to connect multiple perspectives not only enhances the trader’s insight into the market but also allows for better alignment of entry and exit strategies across different trades. Ultimately, multi-timeframe analysis forms an essential tool for adequate risk management in volatile bitcoin markets.

Key Rules for Effective Wave Counting in Bitcoin

Establishing key rules for wave counting is critical to maintaining discipline and accuracy in Elliott Wave analysis, especially within the volatile context of bitcoin. Important regulations include ensuring that wave two never retraces beyond the start of wave one, ensuring that wave three is never the shortest among waves one, three, and five, and confirming that wave four doesn’t overlap with wave one. Adherence to these guidelines underpins the reliability of the wave count, ultimately influencing trading decisions.

Failure to comply with these foundational rules can lead to incorrect wave identification, resulting in misguided trading strategies. Traders must therefore continuously validate their wave counts and adjust their strategies accordingly, reinforcing the understanding that Elliott Wave Theory is inherently subjective. This often necessitates an integration of other technical indicators, such as moving averages or momentum oscillators like RSI, providing additional layers of confirmation in the decision-making process.

Integrating Fibonacci Ratios with Elliott Wave Theory

The integration of Fibonacci ratios into Elliott Wave analysis serves as a powerful enhancement for traders analyzing bitcoin movements. Fibonacci levels, including retracement and extension points, help traders identify critical support and resistance levels, particularly during wave corrections. By aligning these levels with current price points, traders can establish more informed entry and exit strategies, enhancing their overall market effectiveness.

For instance, during the development of wave two, traders look for retracements to key Fibonacci levels, which could signify a potential buying opportunity as bitcoin’s price approaches these levels. Similarly, understanding wave extensions allows for the anticipation of wave three’s potential targets, further equipping traders with the necessary insights to make strategic moves in the complex cryptocurrency landscape. This fusion of Fibonacci analysis with Elliott Wave Theory provides a comprehensive toolkit for navigating bitcoin’s unpredictable market.

Critical Evaluation of Elliott Wave Theory in Bitcoin Trading

While Elliott Wave Theory offers valuable insights into bitcoin trading, critical evaluation remains essential for effective implementation. The theory’s subjective nature often leads to different interpretations among analysts, creating debates about the accuracy and reliability of wave counts. The lack of empirical precision in pinpointing wave transitions can lead to confusion, especially in rapidly evolving markets like bitcoin.

Nevertheless, its merit lies not only in the identification of price trends but also in the broader understanding of market psychology. By combining Elliott Wave Theory with other technical analyses, traders can mitigate ambiguity and improve their interpretative skills, honing their decision-making capabilities well. Consequently, a balanced, multifaceted approach to technical analysis can yield better outcomes than reliance on any single trading theory.

Frequently Asked Questions

What is Elliott Wave Theory in Bitcoin trading?

Elliott Wave Theory in Bitcoin trading is a technical analysis method used to forecast price movements by identifying recurring price patterns, or ‘waves,’ that reflect market psychology. Developed by Ralph Nelson Elliott, this theory helps traders anticipate Bitcoin’s volatile cycles and trend reversals by mapping impulse and corrective wave structures.

How do I apply Elliott Wave analysis to Bitcoin price patterns?

To apply Elliott Wave analysis to Bitcoin price patterns, traders first identify the primary trend—whether Bitcoin is bullish or bearish. Following this, they label the waves according to their characteristics, looking for five-wave impulse patterns during uptrends and three-wave corrective patterns during downtrends.

What are the common strategies for trading Bitcoin using Elliott Wave Theory?

Common trading strategies for Bitcoin using Elliott Wave Theory include entering trades during pullbacks in Wave 2 or Wave 4 of an uptrend and exiting positions as Wave 5 matures or when corrective patterns A-B-C begin. Multi-timeframe analysis is also essential to align trades with different market horizons.

What are the key rules for wave counting in Elliott Wave analysis of Bitcoin?

Key rules for wave counting in Elliott Wave analysis of Bitcoin include: Wave 2 cannot retrace more than 100% of Wave 1, Wave 3 cannot be the shortest among waves 1, 3, and 5, and Wave 4 must not overlap with the price territory of Wave 1. Violating these rules invalidates the wave counts.

Why is trading psychology important in Elliott Wave Bitcoin trading?

Trading psychology is critical in Elliott Wave Bitcoin trading because it influences how traders react to market movements and price patterns. Understanding market sentiment can help traders make better decisions based on Elliot Wave analysis, especially since the interpretation of waves can be subjective.

Can Elliott Wave Theory help predict Bitcoin price movements?

Yes, Elliott Wave Theory can help predict Bitcoin price movements by identifying patterns within price actions that reflect the market’s underlying psychology. While it doesn’t guarantee outcomes, it provides a framework to anticipate potential trend directions and reversals.

How does Elliott Wave Theory interact with other cryptocurrency trading strategies?

Elliott Wave Theory can be integrated with other cryptocurrency trading strategies, such as using moving averages, oscillators like the RSI, or volume analysis for confirmation. This combined approach enhances the probability of successful trades while managing risks effectively.

What challenges do traders face when using Elliott Wave Theory in Bitcoin trading?

Traders face several challenges when using Elliott Wave Theory in Bitcoin trading, including the subjective nature of wave counting, the potential for different interpretations among analysts, and the need for significant practice to apply the method correctly and effectively in volatile markets.

| Key Concepts | Description |

|---|---|

| Elliott Wave Theory | A method for analyzing market psychology and price trends in volatile assets like bitcoin. |

| Wave Types | Impulse waves (5 sub-waves) and corrective waves (3 sub-waves), representing market movements. |

| Bitcoin’s Application | Used to recognize potential trends and reversals in bitcoin’s price movements. |

| Trading Strategies | Entry during pullbacks in wave patterns and strategy alignment across multiple timeframes. |

| Key Rules | Rules for wave counting ensure consistency: Wave 2 must not exceed 100% of Wave 1, etc. |

Summary

Elliott Wave Theory Bitcoin serves as a crucial tool for traders aiming to navigate the volatile cryptocurrency market. By understanding the psychology behind market movements and recognizing distinct wave patterns, traders can enhance their decision-making process. Utilizing Elliott Wave Theory not only helps in identifying potential price trends but also equips traders with strategies that align with various timeframes, thereby allowing for better risk management and informed trading decisions.