Bitcoin Price Forecast 2025: Experts Predict Major Changes

As we delve into the Bitcoin price forecast 2025, the cryptocurrency market presents a tapestry of expectations that reflect both optimism and caution. Recent insights from a comprehensive cryptocurrency expert survey conducted by BTC-ECHO in collaboration with Prof. Dr. David Florysiak reveal compelling trends in BTC price expectations. Experts from the DACH region predict that Bitcoin could reach an average price of $98,121 by October 2025, though volatility remains a watchword given the significant fluctuations observed recently. The survey’s findings indicate a stark contrast compared to previous predictions, with the best-case scenario now anticipated at $126,773, underscoring the evolving landscape of Bitcoin price predictions. With Bitcoin volatility being a critical factor in investment strategies, understanding these forecasts is essential for investors navigating this dynamic market.

Exploring the upcoming financial landscape, the Bitcoin price forecast for 2025 is increasingly pertinent in today’s investing environment. Insights derived from a recent cryptocurrency expert study reveal varying expectations for BTC values, highlighting the tumultuous nature of this digital asset. Experts have expressed their predictions for future Bitcoin values amidst ongoing market fluctuations, emphasizing the potential ramifications of these forecasts on investment strategies. With Bitcoin’s unpredictable nature influencing market sentiment, understanding these anticipated changes is crucial for anyone involved in cryptocurrency investments. The DACH region has shown particular interest in evaluating BTC price trends, reflecting a broader interest in cryptocurrency dynamics across different markets.

Bitcoin Price Forecast 2025: Predictions from Experts

As the cryptocurrency landscape continues to evolve, the Bitcoin price forecast for 2025 is one of the most hotly debated topics among investors and analysts alike. According to a recent survey conducted by BTC-ECHO, involving experts from the DACH region, there is a consensus around an average anticipated Bitcoin price of $98,121 by October 2025. This forecast provides a compelling insight into market sentiment, particularly given the significant fluctuations Bitcoin has experienced over recent months.

The survey highlighted a notable shift in expectations, especially when compared to previous assessments from Q1 2025. Despite initial bullish projections where the best-case scenario estimated Bitcoin peaking at $170,960, the latest insights reflect the market’s current volatility and uncertainty. Experts attribute this to various factors, including market corrections and broader economic influences, reinforcing the importance of monitoring Bitcoin price predictions as they can fluctuate rapidly.

Understanding Bitcoin Volatility: What to Expect

Bitcoin is renowned for its price volatility, which can have profound implications for traders and investors. The results from the BTC-ECHO expert survey illustrate just how unpredictable Bitcoin can be, with participants predicting a worst-case scenario price of $64,242 and a best-case scenario reaching $126,773. These projections underline the uncertainty that exists in predicting Bitcoin’s true market value, highlighting the necessity for investors to remain cautious.

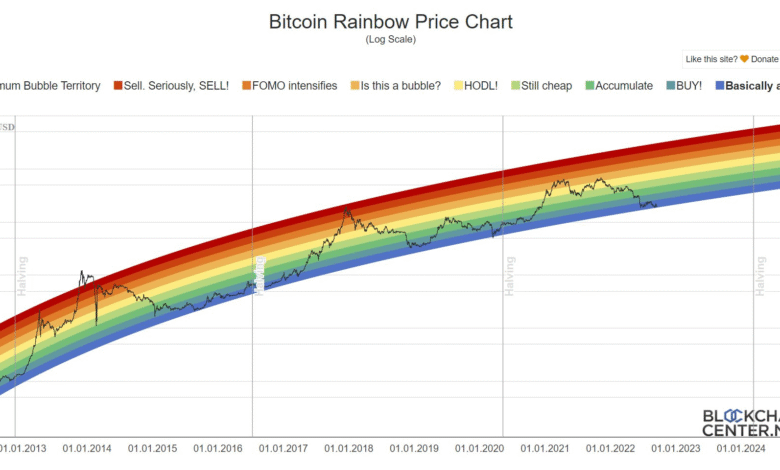

Recent statistics have suggested a decrease in Bitcoin price volatility, as indicated by the BTC-6M Volatility Index, which now stands at 29.7 points. This is a notable reduction from previous quarters, reflecting perhaps a stabilizing period for Bitcoin amid ongoing global economic shifts. However, the inherent volatility of Bitcoin remains a double-edged sword; while it can present opportunities for lucrative gains, the potential for steep losses is equally present, making prudent investment strategies essential.

The Impact of Market Trends on Bitcoin’s Future

The direction of Bitcoin’s price is often influenced by various market trends, economics, and investor psychological factors. In the recent BTC-ECHO survey, it was noted that the Bitcoin price had dipped below $80,000 at one point, only to recover to around $95,000 shortly afterward. This rapid shift exemplifies how sensitive Bitcoin is to market sentiment, crafting an intriguing narrative for future BTC price expectations.

Trends like increased adoption in financial services, regulatory developments, and shifting consumer behaviors are crucial in shaping Bitcoin’s trajectory. With stablecoins gaining momentum, and questions surrounding the dominance of traditional fiat currencies, Bitcoin’s role as a leading cryptocurrency is continuously being re-evaluated. As such, diving deep into these market trends will be essential for understanding the broader implications for Bitcoin’s future in this rapidly developing sector.

The Role of Stablecoins in the Future of Cryptocurrency

As the crypto market matures, stablecoins have emerged as a pivotal element within the financial ecosystem. Their ability to maintain price stability while providing the advantages of digital currency could significantly influence how Bitcoin and other cryptocurrencies are utilized. Survey insights suggest that alternate forms of money, including stablecoins, may dominate future transactions, affecting Bitcoin’s position as a leading asset.

Analysts predict that if stablecoins gain further traction, they may serve as a foundational layer for more complex financial systems within the cryptocurrency sector. This could enable smoother transactions and a reduction in Bitcoin’s historical volatility, providing a stable medium for trade and investment. Understanding the synergy between Bitcoin and stablecoins will be crucial for investors seeking to navigate this evolving landscape.

What Drives Bitcoin Price Predictions?

Bitcoin price predictions are driven by a combination of technical analysis, market sentiment, and socio-economic factors. Based on BTC-ECHO’s recent expert survey, it’s evident that analysts are factoring in recent market corrections when setting their expectations for Bitcoin’s price trajectory. A predicted average of $98,121 underscores a cautious outlook, influenced by the volatility that has characterized the cryptocurrency in recent months.

Additionally, expert opinion emphasizes the role of external influences such as regulatory changes and market sentiment shifts, which can dramatically alter BTC price expectations. The interplay of these elements reinforces the complexity of forecasting Bitcoin’s value, calling for a multi-faceted approach that considers both historical trends and emerging factors in the cryptocurrency arena.

The DACH Region’s Perspective on Bitcoin Investment

In the DACH region (Germany, Austria, and Switzerland), there is a growing interest in Bitcoin as a significant investment vehicle. Insights from the BTC-ECHO expert survey reveal how this area is uniquely positioned to influence Bitcoin price predictions, given its advanced economic landscape and tech-savvy population. Local sentiment appears cautiously optimistic, with experts averaging Bitcoin price forecasts that align closely with other global market trends.

However, local factors such as regulatory environments and economic stability can also impact these forecasts. As crypto-assets become increasingly integrated into financial markets, understanding the regional dynamics in the DACH area will be essential for spotting investment opportunities and risks associated with Bitcoin.

How Recent Trends Affect the Bitcoin Market

Recent trends in the cryptocurrency market have played a crucial role in shaping Bitcoin’s pricing landscape. The expert survey conducted by BTC-ECHO reveals that historical performance and fluctuations have led to a recalibration of BTC price expectations. The marked decrease in anticipated prices over a short span reflects a market grappling with uncertainty, emphasizing the fluid nature of cryptocurrency.

Moreover, the influence of global events, such as economic policy changes and geopolitical tensions, can further exacerbate price movements for Bitcoin. Traders and investors must remain vigilant, as these trends may result in significant price corrections or boosts in the near future, which can directly impact Bitcoin’s standing in the broader market.

Future Outlook for Bitcoin Investments

Looking ahead, the future of Bitcoin investments remains precarious yet full of potential. With the average forecast for Bitcoin set at $98,121, many investors are closely watching the market for any significant developments that could affect this projection. The volatility evidenced in past months serves as a reminder that investors should approach Bitcoin with both enthusiasm and caution.

Moreover, the evolving discourse surrounding Bitcoin, especially comparisons with stablecoins and traditional financial systems, is shaping the investment strategies that many are willing to adopt. These factors, combined with expert insights from the DACH region, point towards a dynamic investment landscape that requires careful analysis and strategic foresight for success.

The Importance of Staying Informed in the Cryptocurrency Market

In the fast-paced world of cryptocurrency, staying informed about market trends, expert analyses, and economic indicators is vital for making sound investment decisions. The BTC-ECHO Insider Report offers valuable insights that can help investors navigate the complex landscape of Bitcoin price prediction and performance. Regular updates and expert evaluations can aid investors in understanding price fluctuations and market sentiment factors.

Furthermore, as Bitcoin continues to evolve, keeping abreast of developments in the cryptocurrency space, including stablecoin innovations and regulatory frameworks, is equally important. This knowledge not only empowers investors to align their strategies with market currents but also helps them to manage risk more effectively while exploring opportunities within this vibrant sector.

Frequently Asked Questions

What is the Bitcoin price forecast for 2025 according to expert predictions?

The Bitcoin price forecast for 2025 suggests that, by October, experts in the DACH region expect an average Bitcoin price of around $98,121. Predictions vary from a worst-case scenario of $64,242 to a best-case scenario reaching as high as $126,773.

How does Bitcoin price prediction change over time?

Bitcoin price predictions are subject to change due to market volatility and external factors. For instance, there was a significant decline in forecasts from three months prior, where the best-case scenario was estimated at $170,960 due to recent price corrections.

What does the cryptocurrency expert survey say about Bitcoin volatility in 2025?

The cryptocurrency expert survey indicates that Bitcoin volatility is expected to be significant, with an average volatility index of 29.7 points for the next six months. This marks a decrease in expected volatility compared to previous quarters.

What are the BTC price expectations for the next six months?

For the next six months leading up to October 2025, BTC price expectations range from a worst-case $64,242 to a best-case scenario of $126,773, reflecting the uncertainty and volatility in the cryptocurrency market.

What trends are impacting the Bitcoin price forecast for 2025?

Current trends impacting the Bitcoin price forecast for 2025 include recent market corrections and geopolitical events such as the ‘Trump chaos’, which have left experts feeling uncertain about sustained high price levels for Bitcoin.

Why is Bitcoin’s price forecast less optimistic than previous estimates?

The Bitcoin price forecast has become less optimistic due to recent price corrections and heightened market volatility, which have caused experts to adjust their BTC price expectations downward from previous quarters.

How can I stay updated on Bitcoin price predictions and market trends?

To stay updated on Bitcoin price predictions and market trends, consider following comprehensive reports like the BTC-ECHO Insider Report, which provides detailed insights from cryptocurrency experts.

What is the significance of the DACH region Bitcoin forecast in understanding global Bitcoin trends?

The DACH region Bitcoin forecast is significant as it reflects the collective insights of cryptocurrency experts within Germany, Austria, and Switzerland, providing a localized perspective on global Bitcoin trends and price expectations.

| Scenario | Expected Price (USD) | Probability |

|---|---|---|

| Average | $98,121 | N/A |

| Worst-case | $64,242 | 10% |

| Best-case | $126,773 | N/A |

| Previous Best-case (Q1 2025) | $170,960 | N/A |

| Previous Baseline (Q1 2025) | $124,400 | N/A |

Summary

The Bitcoin price forecast for 2025 indicates significant changes due to market volatility. Experts predict that by October 2025, the average price will be around $98,121, reflecting a noticeable decline from earlier expectations. This forecast highlights the uncertainty facing the cryptocurrency market, yet it is essential for investors to stay informed about the evolving trends and factors influencing Bitcoin’s value. As the market continues to experience fluctuations, preparing for potential scenarios, including both the worst-case and best-case outcomes, remains crucial for those involved in Bitcoin investments.