Trump Impeachment: Senator Calls Meme Coin Gala Offensive

The ongoing Trump impeachment saga has taken a dramatic turn with recent allegations surrounding a gala that features Trump’s meme coin. U.S. Senator Jon Ossoff from Georgia has voiced strong dissatisfaction, labeling the president’s actions as rising to the level of an impeachable offense during a recent town hall meeting. As he pointed out, the event—a private dinner for the top holders of the TRUMP token—may represent a troubling intersection of politics and profit, igniting accusations of pay-to-play corruption. With an event designed to grant exclusive access to the president in exchange for significant investments, questions of ethical conduct and accountability are increasingly in the spotlight. As calls for impeachment grow louder, the implications of this crypto controversy could potentially reshape the political landscape surrounding Trump’s presidency.

At the heart of the current political discourse is the notion of impeaching President Trump, sparked not only by his administrative decisions but also by his questionable engagements with supporters through avenues like his meme coin gala. This event has drawn intense scrutiny, particularly as Senator Jon Ossoff publicly defined Trump’s actions as impeachable. The fusion of cryptocurrency with presidential favoritism raises critical concerns about the ethical ramifications of such arrangements. Tracing back to previous impeachment discussions, the focus on Trump’s conduct has reignited debates on accountability and governance, echoing the alarm over potential corruption behaviors tied to political fundraising tactics. As the situation unfolds, the dialogue around impeachment becomes increasingly complex, intertwining financial ethics with political integrity.

Unpacking Senator Jon Ossoff’s Call for Impeachment

Senator Jon Ossoff’s recent declarations at a town hall have intensified discussions surrounding Trump’s potential impeachment. By labeling the president’s actions at the TRUMP meme coin gala as an “impeachable offense,” he has shed light on what some see as the blurring lines between ethics and political conduct. Ossoff’s remarks signal a significant shift in the sentiment among Democrats, who are increasingly vocal about their plans to seek accountability for Trump’s controversial engagements, particularly involving activities that could be interpreted as ‘pay-to-play corruption.’ The controversy surrounding Trump’s decisions raises vital questions about the ethical implications of intertwining personal financial gain with presidential duties.

Moreover, the implications of this call for impeachment extend beyond the immediate political landscape. The discontent among Democrats points toward a strategic rallying cry—aiming for unity and action against what they perceive as breaches of ethical standards. Ossoff recognizes that impeachment efforts require solid backing from the majority in Congress to have any chance at success. His commitment to rallying support illustrates the urgency perceived by many within his party to address what they deem as Trump’s glaring misconduct, especially in light of the crypto controversy surrounding the TRUMP meme coin.

The Ethical Quagmire: Trump’s Meme Coin Gala and Its Implications

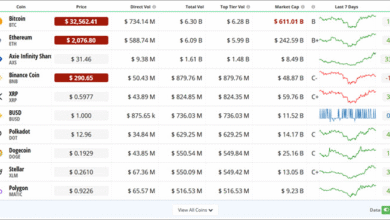

At the center of the ethical storm is the upcoming TRUMP meme coin dinner, an exclusive gathering that has stirred significant backlash. With access being sold to top coin holders, critics argue that this practice resembles a direct breach of ethical norms, categorized aptly as ‘pay-to-play corruption.’ This event has not only heightened the market value of the TRUMP token but also ignited debates over whether this type of financial interaction aligns with democratic principles. The notion that access to a sitting president can be purchased undermines the integrity of the office, leading many, including Senator Ossoff, to underline the potential impeachable nature of such actions.

The ramifications of Trump’s actions could lead to long-lasting implications for U.S. politics; as Ossoff pointed out, the erosion of ethical standards could risk normalizing such conduct in future administrations. As deliberations continue, many Democrats see the meme coin gala as a defining moment—a threshold that could decisively influence support for impeachment discussions in Congress. More than just a financial issue, it represents a pivotal moment that could decide whether Trump’s administration faces serious repercussions for its actions.

Historical Context of Trump’s Impeachment Battles

Understanding the current impeachment discussions necessitates a glance back at the historical context surrounding Trump’s previous impeachments. During his initial term, Trump became the third president in American history to be impeached, yet emerged without convictions after significant obstruction efforts in the Senate. This history frames the current inquiries into Trump’s actions, particularly as Democrats like Ossoff vocalize their intent to revisit impeachment based on new allegations. The stark contrast between past and present circumstances raises questions about whether the political landscape has shifted considerably enough to compel Republican support for action this time around.

Furthermore, the growing calls for accountability from Democratic leaders reflect not only a reaction to Trump’s behavior but also the mounting pressure placed on lawmakers to address misconduct. With individuals like Rep. Al Green and Rep. Jamie Raskin advocating for impeachment based on various charges—including ‘illegal executive overreach’ and actions perceived as damaging to American democracy—these narratives suggest that legislators are preparing to leverage their political clout in ways they feel will safeguard the integrity of the nation. The convergence of historical grievances with contemporary issues could provide the momentum needed for a renewed push towards accountability.

Crypto Controversy: Financial Gains Over National Interests?

The intersection of cryptocurrency and politics has sparked considerable debate around the ethical implications of Trump’s meme coin gala. As the president’s actions draw scrutiny over possible ‘pay-to-play’ schemes, many are left questioning whether financial gains are being prioritized over national interests. This raises alarm bells for those who believe that selling access to political leaders is detrimental to democracy. The situation exemplifies the complexities of contemporary politics, where non-traditional fundraising methods such as cryptocurrencies have entered the mainstream, forcing lawmakers to rethink frameworks surrounding regulation and ethical conduct.

This crypto controversy not only highlights a rift within the political playing field but potentially lays the groundwork for future legislative reform. As the evolving digital economy reshapes the landscape, there may be calls for stricter guidelines on political fundraising efforts, especially those that leverage innovative platforms like meme coins. Advocates for reform argue that only by establishing clear boundaries can the integrity of both political office and public trust be safeguarded against exploitative practices that may arise from a lack of oversight.

The Growing Chorus for Trump’s Impeachment

The increasing calls for Trump’s impeachment reflect broader discontent with his leadership style among Democrats, especially as it relates to perceived constitutional violations and ethical lapses. Ossoff’s outspoken support for impeachment is part of a growing chorus among party leaders, recognizing that the stakes have dramatically shifted since Trump first took office. The urgency for renewed calls to action is rooted in the belief that such actions are critical to restoring faith in democratic governance and upholding the rule of law. As discontent spreads, so too does the mobilization of lawmakers and activists who aim to catalyze formal proceedings against the president.

Moreover, the potency of bipartisan support in such efforts cannot be overlooked. Figures like Raskin express the necessity of finding common ground among Republicans, illustrating the political calculus that plays a crucial role in the impeachment process. While Ossoff emphasizes the need for a majority to make any significant strides, the collective motivation among Democrats rallies around the sentiment that Trump’s conduct has jeopardized both democratic institutions and ethical standards. Moving forward, the strategy will likely involve not only impeachment discussions but also broader dialogues on the structural reforms necessary to prevent the normalization of behavior that threatens public trust.

The Future of Trump’s Leadership Amidst Impeachment Discussions

As the discourse around Trump’s potential impeachment escalates, the implications for his leadership style and political future remain incalculably complex. The discourse is not merely a critique of past actions but a forecast of potential consequences that could reshape the GOP and future administrations. If moves towards impeachment gain momentum, it could signify a departure from traditional political norms and prompt other leaders to reconsider their accountability metrics. Should Trump’s administration be perceived as faltering under pressure, it could usher in a newfound sense of caution among politicians who tread similar pathways.

Moreover, the future of Trump’s presidency hinges not only on the outcome of these discussions but also on public sentiment and the mobilization of his base. Should supporters feel that Trump is unfairly targeted, there could be galvanization that fortifies his position rather than undermining it. Conversely, as more voices within Congress call for accountability, the potential for increased support among moderates for impeachment could significantly impact the 2024 election landscape. As political analysts watch closely, the repercussions stemming from current events may extend far beyond mere impeachment, affecting how future leaders navigate the intertwined relationships between personal gain and public service.

Engagement Strategy for Democrats Ahead of Possible Impeachment

As Democrats prepare for the implications of potential impeachment proceedings, the focus shifts towards crafting an engagement strategy that resonates with constituents. Ensuring that public understanding aligns with the urgency of impeachment calls is crucial to garnering broader support. Effective communication regarding the ethical considerations tied to Trump’s actions, particularly around cryptocurrency and fundraising ethics, will necessitate educational outreach. Emphasizing the potential risks associated with the meme coin gala can motivate constituents to call for accountability while affirming broader democratic principles.

Moreover, mobilizing activists who can drive grassroots efforts will be essential for creating a groundswell of support for impeachment initiatives. Building coalitions that span across various demographics and political affiliations could accrue the necessary visibility and urgency that Democratic leaders require. By connecting the dots between Trump’s conduct and the potential need for restructuring Congressional standards, Democrats can reinforce their messaging and solidify their position as guardians of ethical governance. This proactive engagement strategy will be key to maintaining momentum and sustaining pressure on Republican lawmakers to consider the ramifications of inaction.

Understanding the Role of Media in Trump’s Impeachment Narrative

In the midst of growing impeachment discussions, the role of media in shaping the narrative surrounding Trump’s actions cannot be overstated. News outlets have been pivotal in boosting awareness of the surrounding controversies, such as the TRUMP meme coin gala, thus pushing the conversation into the public domain. As audiences engage with varying depictions of the impeachment discourse, media framing plays a significant role in influencing public perception, which is critical for rallying support for impeachment efforts.

Moreover, the dynamics of social media allow for rapid dissemination of information, potentially fueling outrage and call-to-action among constituents. Activists and lawmakers can leverage these platforms to shape the discourse in real-time, addressing misinformation and emphasizing key issues that underpin the ethical considerations of Trump’s presidency. As impeachment discussions intensify, how media portrays these issues could sway undecided audiences and impact voter sentiment, ultimately playing a crucial role in the political landscape ahead.

Frequently Asked Questions

What are the implications of Trump’s meme coin gala being labeled an impeachable offense?

The implications of Trump’s meme coin gala being labeled an impeachable offense are significant. According to Senator Jon Ossoff, the event, which offers exclusive access to President Trump for the top TRUMP token holders, raises ethical concerns about ‘pay-to-play’ corruption. Ossoff argues that selling access in exchange for financial gains constitutes a clear impeachable offense, as it undermines the integrity of the presidency.

How does Senator Jon Ossoff justify calling Trump’s actions an impeachable offense?

Senator Jon Ossoff justifies calling Trump’s actions an impeachable offense by highlighting how the president is granting exclusive access to individuals who buy his meme coin. He asserts that such conduct exceeds any prior standard for impeachment, as it involves monetizing presidential access, which could be considered a form of corruption related to ‘pay-to-play’ practices.

What is the legal basis for impeaching Trump related to the meme coin controversy?

The legal basis for impeaching Trump in light of the meme coin controversy stems from allegations of ‘impeachable offenses’ linked to corruption and abuse of presidential powers. Critics argue that Trump’s actions to favor those who financially contribute to him through the TRUMP token could constitute a breach of public trust, which is a core rationale for impeachment.

Has Trump faced impeachment before, and what were the outcomes?

Yes, Trump has faced impeachment twice before. The first impeachment in 2019 was over abuse of power and obstruction related to Ukraine, while the second in 2021 centered around incitement of insurrection following the Capitol riots. In both cases, he was acquitted by the Senate, allowing him to complete his term without removal from office.

What are the calls for impeachment surrounding Trump’s meme coin involved in the crypto controversy?

Calls for impeachment surrounding Trump’s involvement in the meme coin and associated crypto controversy stem from concerns about ethical conduct and corruption. Critics believe that Trump’s actions, such as hosting a gala for top token holders, are indicative of ‘pay-to-play’ corruption, thereby prompting some lawmakers like Ossoff to advocate for impeachment once again, asserting that such behavior cannot be overlooked.

What steps are Democratic lawmakers taking towards impeaching Trump?

Democratic lawmakers are taking steps towards potentially impeaching Trump by discussing the necessity for a majority in the House of Representatives to initiate the process. Figures like Rep. Jamie Raskin and Rep. Al Green are vocal about pursuing impeachment based on various offenses, including the recent allegations related to Trump’s meme coin gala, but acknowledge the challenges in achieving bipartisan support.

Can bipartisan support play a role in the future impeachment of Trump?

Yes, bipartisan support can play a crucial role in the future impeachment of Trump. Lawmakers like Rep. Jamie Raskin emphasize the need for a coalition across party lines to move forward with impeachment efforts successfully. Without sufficient Republican backing, any initiative to impeach Trump may struggle to gain traction within the House.

What are the ethical concerns raised by the TRUMP meme coin gala?

The ethical concerns raised by the TRUMP meme coin gala include accusations of ‘pay-to-play’ corruption, where the president allegedly monetizes access to himself for personal gain. The event has sparked discussions regarding the integrity of political office and the possible exploitation of presidential power for financial benefits, prompting further inquiry into the implications of such actions.

| Key Points |

|---|

| Senator Jon Ossoff from Georgia labels Trump’s meme coin gala as an ‘impeachable offense.’ The senator made these remarks during a town hall meeting, expressing that Trump’s actions exceed any prior impeachment standards. |

| Trump’s recent invitation to a dinner for top holders of the TRUMP meme coin, raising ethical concerns over ‘pay-to-play’ access. |

| The private gala for the TRUMP token holders is set for May 22 at Trump’s golf club and values the coin increased by over 65%. |

| Calls for impeachment are gaining traction as several Democratic leaders signal readiness to pursue it if sufficient bipartisan support is found. |

| The history of Trump’s impeachments showcases a pattern where he was previously acquitted. The current push for impeachment is led by figures like Rep. Al Green and Rep. Jamie Raskin. |

Summary

Trump impeachment has become a pressing topic once again, as recent statements from Senator Jon Ossoff highlight a potential shift in the political landscape. Growing dissatisfaction among Democratic leaders regarding Trump’s conduct, particularly concerning his TRUMP meme coin gala, suggests that calls for impeachment may intensify. With impeachment historically being a measure that has affected Trump before, this new wave of inquiries signals a renewed determination amongst some lawmakers to hold him accountable.