Federal Reserve Interest Rates: Trump Advocates for Cuts

Federal Reserve interest rates play a crucial role in the U.S. economy and are a focal point of current financial discussions. Recently, President Donald Trump expressed his belief that the Federal Reserve will begin lowering interest rates following his meeting with Chair Jerome Powell. This meeting has sparked debates around the effectiveness of Fed monetary policy, with many advocating for adjustments to stimulate economic growth. Trump’s assertion reinforces his long-standing push for lower rates to boost consumer spending and invigorate the housing market. As the administration seeks to reshape the central bank’s approach, the implications of these interest rate decisions could resonate throughout various sectors of the economy.

When discussing the actions of the central banking authority, terms like monetary policy and interest adjustments often come into play. The dialogue surrounding interest rate reductions has intensified, especially following influential gatherings involving key figures such as President Trump and Jerome Powell. The objective of easing financial conditions is to foster economic growth and address specific market needs. Analysts observe the interplay between fiscal strategies and how they could potentially invigorate economic activity, notably in areas like real estate. As stakeholders await new developments in the Fed’s approach, the conversation remains dynamic and impactful.

Impact of Federal Reserve Interest Rates on Economic Growth

The impact of Federal Reserve interest rates on economic growth cannot be overstated. Lowering interest rates typically stimulates economic activities by making borrowing cheaper for consumers and businesses. When rates are reduced, individuals tend to spend more, leading to increased consumption and investment. This kind of monetary policy can create a ripple effect throughout various sectors, notably in housing, where lower rates can bolster home sales and construction. Trump’s recent push for the Fed to consider lowering rates aligns with many economists’ views that easier access to credit is essential for sustaining economic momentum.

However, the decision to adjust interest rates is a delicate balancing act for the Federal Reserve. While immediate economic stimulation is crucial, the Fed must also consider long-term impacts such as inflation. Jerome Powell’s cautious stance indicates the Fed’s hesitation in making rapid changes without thorough analysis. The tension between maintaining economic growth and managing inflation is a recurring theme in Fed monetary policy discussions, highlighting the complexities involved in interest rate adjustments.

Trump’s Influence Over the Federal Reserve’s Monetary Policies

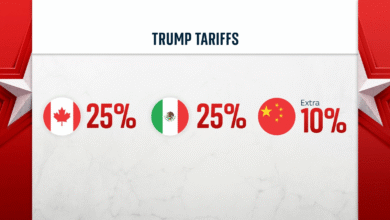

President Trump’s influence on the Federal Reserve, particularly through his public comments and meetings with Jerome Powell, underscores the dynamic relationship between political leadership and central banking policies. Following their meeting, Trump conveyed optimism regarding interest rates, suggesting that Powell is increasingly receptive to calls for lower rates. This reflects a shift in strategy, as previously, Trump had been vocally critical of Fed decisions. The administration’s advocacy for lower rates appears to be aimed at fostering an environment conducive to economic growth, particularly in light of potential challenges posed by tariffs and global economic conditions.

Moreover, the political landscape can significantly impact Federal Reserve actions. While Powell has maintained that policy decisions should be insulated from political pressure, the current meeting with Trump and the vocal support from figures like Russell Vought hint at a complex interplay. Vought’s emphasis on the need for transparency from the Fed aligns with Trump’s call for proactive measures to support the economy. This ongoing dialogue could lead to a reevaluation of the Fed’s monetary strategies, as they navigate the intricate balance between performing their duties independently and responding to administrative encouragements.

The Importance of Transparency in Federal Reserve Operations

Transparency is key to the Federal Reserve’s credibility and effectiveness in managing monetary policy. As highlighted by Russell Vought, the administration is keen for the Fed to enhance its communication regarding decision-making processes, especially related to interest rate changes. This transparency is essential for maintaining public confidence and ensuring that stakeholders understand the rationale behind monetary policies. If the Fed can clearly articulate its strategies and objectives, it can help to mitigate market uncertainties and bolster economic stability.

Furthermore, transparency can foster a more cooperative relationship between the Fed and the government. In times of economic uncertainty, such as during heightened discussions about interest rates and their potential impacts, open communication can facilitate shared understanding and foster collaborative approaches to economic stimulation. Striking a balance between maintaining independence and being transparent about monetary policy can ultimately contribute to a more resilient economic landscape.

Future Economic Prospects and Federal Reserve Policy Adjustments

Looking toward the future, the question of how the Federal Reserve will approach interest rates remains pivotal for the economy. With market expectations indicating limited changes in the short term, the prospect of lower rates being implemented in subsequent months adds anticipation to economic forecasts. Many analysts speculate that if Powell and the Fed act based on Trump’s suggestions for easing rates, it could lead to significant shifts in consumer behavior and business investment.

On the other hand, the Fed’s cautious approach stems from a commitment to sound monetary policy, which considers both current economic data and potential risks such as inflation. Powell’s reluctance to make drastic changes without clear evidence suggests that any policy adjustments may be gradual and contingent on favorable economic indicators. The interplay between the administration’s push for stimulation and the Fed’s careful deliberation will shape economic outcomes in the coming months.

Evaluating the Effects of Economic Stimulation on Different Sectors

Economic stimulation through lower interest rates can have varied effects across different sectors. In the housing market, for example, lower rates can lead to increased home sales as potential buyers take advantage of more favorable loan terms. This sector often serves as a strong indicator of overall economic health, as improvements in housing market activity can generate jobs and increase consumer spending. Consequently, a concerted effort to lower rates could provide the necessary boost to revive sluggish segments of the economy.

Conversely, not all sectors may benefit equally from rate cuts. The banking sector, which relies on interest income from loans, might see reduced profit margins when rates are lowered. This can lead to tighter lending conditions if banks feel pressure on their bottom line. Thus, while the overall aim is to stimulate economic growth, the intricacies of the market mean that outcomes may vary significantly among different industries, necessitating a nuanced approach from policymakers.

Analyzing Powell’s Approach to Federal Reserve Interest Rates

Jerome Powell’s approach to Federal Reserve interest rates reflects a commitment to data-driven decision-making. He has consistently emphasized the importance of waiting for comprehensive economic indicators before making significant policy changes. This methodical approach is often seen as a safeguard against the pitfalls of hasty decisions that could exacerbate financial instability. His stance against immediate rate cuts demonstrates a belief in the resilience of the economy and the need for a thorough assessment of factors at play, such as inflation and employment figures.

Despite external pressures, including those from President Trump, Powell maintains that the Fed’s primary objective is to foster a stable financial environment. His ability to navigate the complexities of monetary policy while addressing political expectations is crucial for the Fed’s independence. As the economic landscape evolves, Powell’s decisions will be pivotal in shaping not just dollar amounts, but broader economic sentiment and confidence across industries.

The Role of Future Fed Meetings in Shaping Economic Policy

Future Federal Reserve meetings will be critical in determining the trajectory of U.S. economic policy, particularly concerning interest rates. With market participants and policymakers alike eager to see if Powell will heed calls for adjustments in monetary policy, each upcoming meeting will be scrutinized closely. Expectations of rate cuts may linger through the summer, but the Fed’s reliance on data may delay decision-making processes if economic indicators do not align with stimulus strategies.

Moreover, these meetings serve as a platform for voicing economic concerns, ranging from inflation rates to employment statistics, which can influence the Fed’s stance on monetary policy. Central bank communications following such meetings will be key to shaping market expectations and providing clarity to investors. As discussions surrounding the economy continue, the Fed’s decisions will remain under the microscope, emphasizing the importance of transparency in its operations.

Power Dynamics Between the Administration and the Fed

The power dynamics between the administration and the Federal Reserve have gained notable attention, especially as President Trump publicly comments on interest rates and monetary policy. While central bank independence is crucial for effective policy-making, the ongoing pressure and dialogue from the White House can complicate this relationship. Trump’s shift from criticism to a more supportive stance towards Powell signifies an attempt to align priorities, even as the Fed navigates its responsibilities.

This evolving dynamic raises questions about the boundaries of influence that political leaders should have over monetary policy. Powell’s commitment to resisting direct pressure symbolizes an adherence to the principles of central bank independence. However, as the administration continues to advocate for lower rates, both parties need to find common ground, ensuring that the Federal Reserve can execute its mandate without compromising its integrity.

The Future of Economic Policy Amidst Global Challenges

As the global economy confronts various challenges, the future of economic policy in the United States hinges on how the Federal Reserve adapts to these dynamics. External factors such as international trade tensions, geopolitical uncertainties, and shifting market conditions are likely to influence economic decisions moving forward. In response, the Fed must remain vigilant and flexible in its approach to interest rates and monetary policy to foster resilience in the economy.

Moreover, collaboration between policymakers and economic experts will be essential to navigate these challenges effectively. By maintaining an open dialog, like Trump’s recent meetings with Powell, the administration can support the Fed in addressing pressing issues while allowing independence in its decision-making. This synergy could help cultivate a favorable economic environment that promotes growth, even as global conditions fluctuate.

Frequently Asked Questions

What is the Federal Reserve interest rate and its impact on the economy?

The Federal Reserve interest rate, often referred to as the federal funds rate, is the interest that banks charge each other for overnight loans. It significantly influences overall economic activity, including consumer borrowing rates, mortgage rates, and business investment. Changes in the Fed’s interest rate can stimulate or cool down the economy, making it a critical tool in the Fed’s monetary policy.

How does President Trump’s influence affect Fed interest rate decisions?

President Trump’s influence has been notable in shaping discussions around Fed interest rates. During meetings with Chair Jerome Powell, he has advocated for lowering interest rates to stimulate economic growth, particularly in the housing sector. His public statements and expectations can create pressure on the Fed to adjust its monetary policy to align with his economic strategies.

What did Trump say about lowering interest rates during his meeting with Powell?

In a recent meeting with Jerome Powell, President Trump expressed confidence that the Federal Reserve would begin lowering interest rates soon. He interpreted Powell’s assurance about the economy as a signal that lower rates were forthcoming, emphasizing the need for the Fed to ease its monetary policy.

What are the arguments against lowering interest rates according to Jerome Powell?

Jerome Powell has argued against immediate cuts to interest rates, stating that the economy is robust enough to handle current rates. He emphasizes the importance of waiting for more economic data to assess the impact of tariffs on inflation before making changes to the Fed’s monetary policy.

How does lowering Federal Reserve interest rates stimulate the economy?

Lowering Federal Reserve interest rates can stimulate the economy by making borrowing cheaper for consumers and businesses. This increased access to credit encourages spending and investment, which can lead to job creation and ultimately boost economic growth.

What are the expectations for future Federal Reserve interest rate cuts?

While President Trump has advocated for lower interest rates, current futures markets indicate a cautious outlook, with limited expectations for an immediate cut in the next Fed meeting. Analysts suggest a potential rate reduction may be more likely in the upcoming September meeting.

Why is transparency important in the Federal Reserve’s monetary policy?

Transparency in the Federal Reserve’s monetary policy is crucial because it helps build trust and predictability within financial markets. This transparency allows investors, businesses, and consumers to make informed decisions based on anticipated changes in Fed interest rates and overall economic conditions.

What challenges is the Federal Reserve facing regarding its monetary policy?

The Federal Reserve faces several operational challenges, including addressing a significant financial shortfall and ensuring effective management of its policies. These challenges affect how the Fed approaches interest rates and its overall monetary strategies, particularly in a fluctuating economic climate.

How might Trump’s relationship with the Fed influence interest rate policy?

Trump’s relationship with the Fed, especially his support for Powell amidst previous tensions, can play a role in shaping interest rate policy. A harmonious relationship between the President and the Fed Chair may lead to more collaborative discussions regarding lowering interest rates to support economic growth.

What is the significance of the Fed’s renovation efforts in relation to interest rates?

The Fed’s renovation efforts focus on reevaluating its policies and operational strategies to better address current economic challenges. This review is particularly important in discussions about interest rates, as it can lead to adjustments aimed at stimulating economic growth in critical sectors, such as housing.

| Key Point | Details |

|---|---|

| Trump’s Confidence in Lowering Rates | President Trump believes the Federal Reserve will soon lower interest rates after a meeting with Chair Powell. |

| Support for Lower Interest Rates | Trump has been advocating for lower rates to promote economic growth, especially in the housing sector. |

| Fed’s Reticence | The Federal Reserve has been hesitant to cut rates, citing concerns about inflation and the impact of tariffs. |

| Future Expectations | Futures markets indicate low probability for an immediate rate cut, with more likelihood in September. |

| Vought’s Influence | White House budget director Russell Vought advocates for transparency and critiques Fed policies to aid the economy. |

| Tension with the Fed | Despite previous tensions, Trump now supports Powell, emphasizing cooperation. |

| Fed’s Operational Challenges | The Fed faces significant operational challenges, including financial shortfalls. |

Summary

Federal Reserve interest rates are at the forefront of economic discussions as President Trump expresses optimism about potential cuts following his recent meeting with Fed Chair Powell. His administration is strategically advocating for lower rates to stimulate growth while balancing concerns about inflation and tariffs. As expectations shift, the market looks to September for possible changes, showcasing the dynamic nature of monetary policy and its significant implications for the economy.