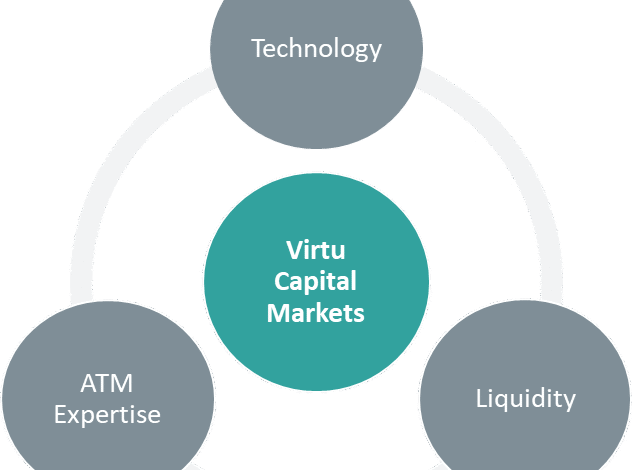

ATM Capital Increase Program Boosts Blockchain Group’s Growth

The ATM Capital Increase Program, recently unveiled by The Blockchain Group, marks a significant leap forward in the integration of capital markets with blockchain innovation. With a robust funding target of $343 million (€300 million) in collaboration with the esteemed TOBAM partnership, this initiative is set to enhance the company’s Bitcoin Treasury strategy. Operating under the unique “At The Market” (ATM) offering structure, the program facilitates efficient capital increments that resonate with current market conditions. By leveraging decentralized technology and innovative financial instruments, this strategic move aims to magnify the number of bitcoins per share, thus empowering shareholders over time. The ATM Capital Increase Program exemplifies a forward-thinking approach in the evolving landscape of digital assets and investment management.

The newly launched ATM Capital Increase initiative by The Blockchain Group represents a groundbreaking method for boosting their capital through market-based mechanisms. This program, in partnership with TOBAM, aims to enhance their Bitcoin holdings while streamlining the fundraising process. By executing capital raises in accordance with market fluctuations, the firm is set to efficiently scale its operations without the complexities of traditional underwriting. This strategic move underscores their commitment to leveraging decentralized technology to reshape investment strategies in the rapidly changing financial environment. Overall, this capital increase is a pivotal step towards establishing The Blockchain Group’s dominance in the Bitcoin space and its broader implications for the future of asset management.

Understanding the ATM Capital Increase Program

The Blockchain Group has unveiled an innovative ATM Capital Increase Program, a move that signals a significant step in the evolution of capital raising strategies in the tech and cryptocurrency space. This $343 million (€300 million) initiative, crafted in collaboration with the esteemed asset management firm TOBAM, harnesses the power of decentralized technology to redefine how companies can access capital. By utilizing the ATM structure, the program operates by allowing securities to be sold directly into the market at current prices, which is a more flexible and market-responsive method than traditional offerings.

This approach benefits The Blockchain Group by not only diversifying its financing options but also optimizing the deployment of its Bitcoin Treasury strategy. The flexibility of the ATM method means that capital can be raised gradually and efficiently, minimizing market disruption. Furthermore, with the ability to execute capital increases in tranches based on market conditions, the program reflects a strategic foresight into price volatility, upholding the integrity of the company’s stock during the capital raising process.

The Role of TOBAM in the Program

TOBAM, a recognized leader in asset management, plays a pivotal role in the ATM Capital Increase Program designed by The Blockchain Group. As a strategic partner, TOBAM is not only facilitating the capital increase but is also contributing to the overarching goals of The Blockchain Group’s Bitcoin Treasury strategy. By subscribing to shares on a daily basis and aggregating those requests for capital increases, TOBAM ensures that the operations remain nimble and aligned with market conditions, which is crucial for maximizing shareholder value.

The partnership signifies a mutual commitment to growth and innovation within the cryptocurrency realm, especially as decentralized technology gains momentum. By collaborating with an established entity like TOBAM, The Blockchain Group demonstrates its confidence in its blockchain capabilities while positioning itself as a leader in decentralization and digital asset management. This partnership is set to enhance the visibility and credibility of The Blockchain Group in the marketplace, attracting attention from potential investors and stakeholders within the crypto district.

Strategic Benefits of the Capital Increase

Implementing an ATM Capital Increase Program presents numerous strategic advantages for The Blockchain Group. First and foremost, the ability to raise funds in response to market conditions provides a level of flexibility that is vital for implementing growth strategies in an ever-evolving industry. The infusion of capital allows the company to invest in advanced data intelligence, further strengthening its capabilities concerning AI and decentralized technologies. The funds can be allocated towards infrastructure improvements, technology advancements, and strategic acquisitions, fueling the company’s growth trajectory.

Moreover, by continuously enhancing their Bitcoin Treasury strategy with fresh capital, The Blockchain Group positions itself uniquely within the European market. As Europe’s first Bitcoin Treasury Company, the focus on capital increase not only solidifies its commitment to innovation but also promotes investor confidence. Such a well-planned and executed capital increase strategy will contribute to a more sustainable and scalable model, aligning with the long-term objectives of maximizing shareholder value through a disciplined approach to growth.

Market Responders: Implications for Investors

For investors, the new ATM Capital Increase Program by The Blockchain Group, in partnership with TOBAM, presents a significant opportunity. This initiative allows investors to benefit from the dynamic pricing mechanism based on the previous day’s closing price or the volume-weighted average price, providing them with a transparent method of acquiring shares. The strategic nature of this program indicates that The Blockchain Group is confidently navigating the complexities of market fluctuations while still giving investors access to capitalize on its growth.

Additionally, from an investment standpoint, the program enhances the attractiveness of The Blockchain Group’s shares, potentially driving up demand as more investors recognize the dual benefits of a flexible capital structure coupled with a commitment to innovative technologies. The proactive stance in utilizing an ATM structure not only differentiates The Blockchain Group from its competitors but also serves to reinforce trust among current and prospective shareholders, ensuring a robust market presence in the decentralized technology landscape.

Decentralized Technology’s Influence on Capital Raising

The rise of decentralized technology has revolutionized traditional business practices, including capital raising. The Blockchain Group’s ATM Capital Increase Program exemplifies how companies can harness blockchain principles to optimize operational efficiency and investor engagement. This program allows for capital to be raised with minimal friction, enabling a more seamless integration of emerging technologies into strategic financial operations. Through decentralized platforms and blockchain technology, fundraising can achieve transparency and accountability, enhancing investor confidence.

As companies like The Blockchain Group adopt decentralized technology, the implications for capital markets become profound. Not only does it streamline processes, but it also opens new avenues for innovation in finance. This pivot towards a decentralized model fosters greater inclusivity for investors and stakeholders who are increasingly interested in participating in the burgeoning digital economy. By committing to these transformative technologies, The Blockchain Group positions itself not just as a financial entity, but as a pioneer in the evolving landscape of capital markets.

Enhancing Bitcoin Treasury Strategy

The Blockchain Group’s decision to integrate an ATM Capital Increase Program into its operations provides robust support for its Bitcoin Treasury strategy. Central to this approach is the aim of enhancing the number of bitcoins held per share, which is critical for maximizing asset value in a volatile market. With the funds raised through this innovative capital increase, the company can strategically purchase more bitcoins, thereby increasing its treasury stock and further solidifying its position in the cryptocurrency ecosystem.

Moreover, aligning the ATM program with the Bitcoin Treasury strategy allows for a methodical approach to asset accumulation. As Bitcoin continues to gain traction among institutional investors, having a well-funded treasury could serve as a competitive differentiator. Ultimately, this enhances shareholder equity and signals The Blockchain Group’s proactive stance in capitalizing on cryptocurrency fluctuations, underlining its commitment to maximizing returns for its investors.

Navigating Market Volatility with ATMs

Market volatility can often present challenges for many companies when attempting to raise capital. However, The Blockchain Group’s ATM Capital Increase Program offers a strategic solution to navigate these fluctuations effectively. By allowing capital increases to be executed under flexible market conditions, the company minimizes risks associated with traditional fundraising methods. This innovative approach gives The Blockchain Group the ability to adjust its funding pace according to market dynamics, ultimately leading to more favorable outcomes for both the company and its investors.

Furthermore, the mechanism of capping capital increases at 21% of daily trading volume serves as a safeguard against excessive dilution of shares, balancing the needs of capital raising while protecting existing shareholders’ interests. This zemu strategy allows The Blockchain Group to remain resilient and adaptable in the face of changing market conditions. As the landscape of decentralized finance evolves, adopting ATM methodologies will be increasingly crucial for companies seeking to maintain financial health and investor trust.

The Future of Capital Raising in Blockchain

The framework established by The Blockchain Group’s ATM Capital Increase Program sets a precedent for the future of capital raising within the blockchain and cryptocurrency sectors. As more companies recognize the effectiveness of this approach in a decentralized marketplace, we can anticipate a shift towards more innovative and flexible capital-raising strategies. This program not only demonstrates the potential for growth through agile funding methods but also highlights the evolving nature of investor relations in the age of digital assets.

As the cryptocurrency landscape continues to mature, embracing innovative financing options such as ATM capital increases will be vital for companies aiming to sustain growth and attract long-term investments. The Blockchain Group, through its collaboration with TOBAM, is leading the way in this new frontier, showcasing how decentralized technology can transform capital markets and redefine success for modern enterprises. The future will likely see a convergence of blockchain principles with traditional finance, paving the way for unprecedented opportunities in the capital-raising arena.

Frequently Asked Questions

What is the ATM Capital Increase Program announced by The Blockchain Group?

The ATM Capital Increase Program is a $343 million (€300 million) initiative launched by The Blockchain Group in partnership with TOBAM. This program follows the U.S. ‘At The Market’ offering structure and is designed to enhance the company’s Bitcoin Treasury strategy by increasing the number of bitcoins held per share over time.

How does the ATM Capital Increase Program benefit the Bitcoin Treasury strategy?

The ATM Capital Increase Program directly supports The Blockchain Group’s Bitcoin Treasury strategy by enabling efficient capital raises under market conditions. This approach increases the number of bitcoins per share on a fully diluted basis, thus strengthening the group’s overall position in the cryptocurrency market.

What role does TOBAM play in the ATM Capital Increase Program?

TOBAM, a prominent asset management firm, plays a crucial role in the ATM Capital Increase Program by facilitating the capital increases upon request. They manage the pricing structure based on market conditions, which allows for daily subscriptions of ordinary shares to optimize capital accumulation.

What are the advantages of the ATM-type capital increase structure?

The advantages of the ATM-type capital increase structure include the ability to raise capital efficiently without the need for traditional underwriting, allowing The Blockchain Group to execute capital increases in tranches as needed. This method ensures flexibility and responsiveness to market conditions.

How does the pricing work in the ATM Capital Increase Program?

In the ATM Capital Increase Program, pricing for capital increases is based on the higher of the previous day’s closing price or the volume-weighted average price, with a cap of 21% of that day’s trading volume. This pricing strategy helps maintain market stability while facilitating fundraising.

What is the significance of The Blockchain Group’s partnership with TOBAM?

The partnership with TOBAM is significant as it aligns The Blockchain Group with a leading asset management firm, enhancing its credibility and investor confidence. Together, they aim to solidify The Blockchain Group’s leadership as Europe’s first Bitcoin Treasury Company focused on decentralized technology and data intelligence.

What technology does The Blockchain Group specialize in through its ATM Capital Increase Program?

The Blockchain Group specializes in decentralized technology, data intelligence, and artificial intelligence. Through the ATM Capital Increase Program, they aim to leverage these technologies to enhance their Bitcoin Treasury strategy and expand their market reach.

How often can TOBAM subscribe to shares under the ATM Capital Increase Program?

TOBAM can subscribe to ordinary shares daily as part of the ATM Capital Increase Program. Requests for capital increases are aggregated and executed on the first business day of the following week, streamlining the process.

What impact does the ATM Capital Increase Program have on shareholders?

The ATM Capital Increase Program is designed to potentially increase the value of shareholders’ investments over time by bolstering The Blockchain Group’s Bitcoin holdings and enhancing its overall market position, thereby creating more value per share in the long run.

Is the ATM Capital Increase Program aligned with current market trends in cryptocurrency?

Yes, the ATM Capital Increase Program is aligned with current market trends as it utilizes innovative funding structures suited to the volatile nature of cryptocurrency markets. This approach reflects a modern investment strategy that caters to dynamic market conditions.

| Key Point | Details |

|---|---|

| Launch of ATM Capital Increase Program | The Blockchain Group has introduced a $343 million (€300 million) ATM-type capital increase program. |

| Partnership with TOBAM | TOBAM, a prominent asset manager, is collaborating on this program as a strategic investor. |

| Objective | The program aims to enhance the company’s Bitcoin Treasury strategy by increasing bitcoins per share over time. |

| Execution Mechanism | Capital increases are carried out under market conditions, which allows for efficient fund-raising without traditional underwriting. |

| Tranche Execution | Capital increases will be executed in tranches upon TOBAM’s request, based on specific pricing criteria. |

| Daily Subscription | TOBAM can subscribe to ordinary shares on a daily basis, aggregating requests weekly. |

| Long-term Strategy | The initiative is designed to consolidate The Blockchain Group’s status as Europe’s first Bitcoin Treasury Company. |

Summary

The ATM Capital Increase Program marks a significant development for The Blockchain Group, aiming to bolster its Bitcoin Treasury strategy through an innovative funding approach. By partnering with TOBAM and implementing this ATM-type structure, the company is set to efficiently raise capital while reinforcing its position as a leader in bitcoin and decentralized technologies in Europe.