Bitcoin Price: Bulls Target $123K Amid Resistance Levels

As Bitcoin price continues to captivate the financial world, it currently stands at an impressive $118,573, drawing attention from traders and investors alike. With a market capitalization of $2.35 trillion and significant trading volumes over the last 24 hours, the cryptocurrency market is ripe with excitement for potential Bitcoin price predictions. Traders are heavily analyzing the recent Bitcoin price analysis, focusing on the resistance around $119,000 and a potential breakout toward the bullish target of $123,000. Amidst these dynamics, critical indicators suggest varying momentum levels, leaving traders eager for the next move in Bitcoin trading. With all eyes on this digital asset, understanding the nuances of Bitcoin’s market trends is essential as they navigate through volatility and volatility surrounding Bitcoin resistance.

The state of cryptocurrency markets remains a focal point for many investors, particularly regarding the valuable asset known as Bitcoin. With its current trading value of $118,573, numerous analysts are crafting their Bitcoin outlook and considering potential trading strategies amid the fluctuations. As discussions intensify around significant barriers, including the resistance at $119,000 and the broader trading range, the anticipated Bitcoin breakout remains a hot topic. Observers are also paying close attention to technical indicators and patterns in the market to establish BTC price targets and strategize their approaches. Ultimately, the ongoing analysis of Bitcoin’s value trends is essential for navigating the complexities of digital asset investments.

Understanding Bitcoin Price Dynamics

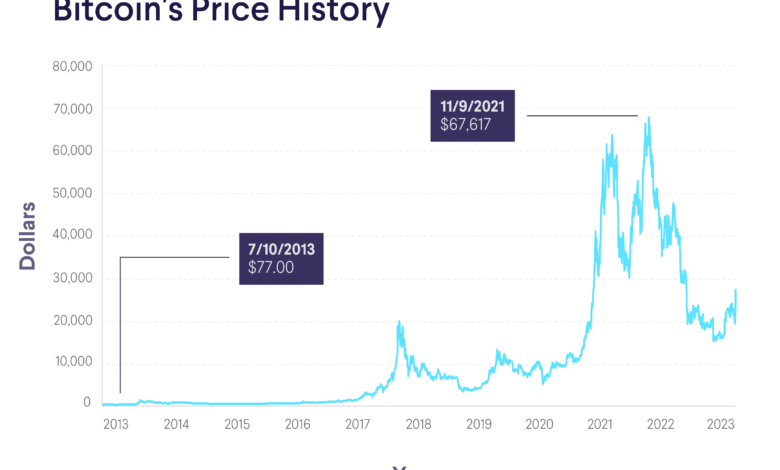

Bitcoin’s price movements are influenced by various factors, including market psychology, regulatory news, and macroeconomic trends. As it approaches key resistance levels like $123,000, traders closely analyze historical price action for signs of potential breakouts or reversals. Understanding the intricacies of Bitcoin price dynamics can provide crucial insights into future trends and price predictions.

In addition to these external factors, technical analysis plays a significant role in traders’ decision-making. Indicators like the moving average convergence divergence (MACD), relative strength index (RSI), and volume analysis help gauge momentum and potential price reversals. For instance, the recent Bitcoin price analysis reveals that while the momentum appears positive, cautious traders might wait for a confirmed breakout above resistance before making significant moves.

Bitcoin Price Prediction for the Coming Weeks

Analyzing current Bitcoin price trends suggests a cautious yet hopeful outlook as it tests upper resistance. With Bitcoin’s current price hovering around $118,573, many analysts predict that if the price breaks through $119,000 with sustained volume, it could lead to a significant bullish run toward $123,000. This potential move aligns with historical patterns observed during previous bull runs.

However, the market is also characterized by volatility and uncertainty. Traders should be conscious of the potential for a pullback toward $116,000 if resistance at $119,000 holds firm. The upcoming weeks will be critical for Bitcoin as traders watch for patterns that may indicate either continuation of the bullish trend or a retraction back to support levels.

Key Resistance Levels: A Bitcoin Trader’s Guide

Understanding resistance levels is crucial for traders in navigating the Bitcoin market. The $120,000 to $123,000 range is particularly noteworthy, as it represents a significant hurdle that could determine the short-term momentum of Bitcoin’s price. Should Bitcoin manage to break through this upper resistance, it may trigger increased buying interest, leading to higher price targets.

Conversely, failure to breach this resistance could lead to a consolidation period or even a pullback. Traders are advised to employ strategies that might include setting stop-loss orders near $117,000 to minimize potential losses, especially as Bitcoin navigates this critical resistance level. Success in breaking through these levels often relies on factors such as increased trading volume and positive news sentiment surrounding Bitcoin.

Analyzing Bitcoin Breakout Potential

Bitcoin’s ability to break out from existing price levels relies heavily on market conditions and trader sentiment. For instance, the recent bullish trend, evidenced by a series of higher highs and higher lows, suggests a ripe environment for a potential breakout. Traders are on high alert for indications of increased volume that can substantiate a breakout above the key resistance point of $119,000.

However, the presence of mixed signals from technical indicators such as the MACD—signaling caution—serves as a reminder of the risks involved in breakout trading. If Bitcoin’s price fails to maintain momentum after a breakout, it could lead to a rapid pullback. Therefore, prudent traders will wait for confirmatory signals before committing capital to ensure they’re not caught in a false breakout.

Short-term BTC Price Targets: What to Expect

As Bitcoin continues to oscillate within its current trading range, setting realistic price targets becomes essential. The immediate focus for traders is to monitor key resistance and support levels, particularly the $119,000 resistance and the $116,000 support zone. A successful breakout beyond $119,000 could lead to aims of hitting $123,000, a target echoed by many analysts in the Bitcoin price predictions.

In contrast, if Bitcoin falters and recedes toward support, traders should prepare for the possibility of further declines. Setting price targets based on current market sentiment, trading volume, and technical analysis will provide a clearer roadmap for trading strategies. Risk management techniques will be critical to navigate the inherent volatility in the Bitcoin market.

The Role of Bitcoin Trading Volume in Price Movement

Trading volume is a key indicator that can often predict Bitcoin’s price movements. Increasing volume typically signifies stronger market confidence in a price direction, while dwindling volume may suggest uncertainty or upcoming reversals. Recent trading volumes around Bitcoin have shown signs of strengthening, particularly with recent upswings that producers of bullish excitement.

Traders should thus look at volume levels as part of their analytic toolkit. A notable increase in volume during a price increase could be interpreted as an indication of a confirmed trend, particularly if it coincides with key breakout attempts at resistance levels. Conversely, low or declining volume during uptrends can signal weakening momentum, warranting caution.

Using Technical Indicators for Bitcoin Price Analysis

Technical indicators provide traders with a framework to analyze Bitcoin’s price action systematically. Indexes like the relative strength index (RSI), commodity channel index (CCI), and moving averages are vital tools in identifying overbought or oversold conditions. In Bitcoin’s current landscape, RSI and CCI readings suggest neutral market momentum, indicating traders may need to exercise patience before acting.

In addition, moving averages offer insights into historical price trends and currents, often smoothing out volatility. By examining the alignment of various moving averages around the $116,000 to $119,000 range, traders can glean possible points of price interaction. These tools collectively aid in crafting informed Bitcoin trading strategies that consider both potential opportunities and inherent risks.

Trends in Bitcoin Market Sentiment

Market sentiment is a crucial factor determining Bitcoin’s price trajectory. Currently, traders exhibit a generally positive sentiment as Bitcoin targets higher resistance levels, creating an environment ripe for speculation. Sentiment analysis can provide insights into the collective mindset of traders, which often influences short-term price movements.

However, it’s also important to remain aware of sentiments that can pivot rapidly, particularly in response to news or significant price movements. As Bitcoin approaches critical resistance, shifts in sentiment can lead to volatility—making it essential for traders to monitor news cycles and social media discussions for additional context around price movements.

Bearish Signals Amidst Bitcoin Recovery

While the overall trend for Bitcoin appears bullish, several bearish signals have emerged that traders need to heed. The MACD’s recent sell signal is particularly concerning, as it suggests a slowdown in momentum despite recent price recoveries. Such divergences between price action and momentum indicators can be a precursor to potential pullbacks.

Moreover, traders should not ignore the implications of decreasing buying volume post-breakout attempts. If Bitcoin fails to sustain upward momentum amidst this decline, it may retreat to lower levels. Awareness of these bearish signals will be instrumental in implementing effective risk management strategies as bullish sentiment reigns.

Frequently Asked Questions

What is the current Bitcoin price prediction for August 2025?

As of August 10, 2025, the Bitcoin price stands at $118,573. Many analysts are eyeing a potential breakout above the $119,000 resistance level, which could set the stage for a price target toward $123,000.

How is Bitcoin price analysis performed to predict market trends?

Bitcoin price analysis typically involves examining various technical indicators such as moving averages, RSI, and MACD. This analysis indicates a bullish sentiment with consolidation between $112,000 and $123,000, suggesting traders should monitor breakout points for entry opportunities.

What does the Bitcoin breakout mean for future price movements?

A Bitcoin breakout above significant resistance levels, such as $119,000, could indicate a strong bullish trend and potentially push prices toward $123,000. Traders are advised to watch for volume confirmation to validate this momentum.

What are the key Bitcoin resistance levels to watch?

In the current market conditions, the primary Bitcoin resistance levels are $119,000 and $123,000. A sustained hold above these levels could signal larger movements upward, while failure to maintain above $117,000 may lead to a pullback.

What is a reasonable BTC price target based on current market analysis?

Based on the latest analysis, the BTC price target appears to be around $123,000 if the market successfully breaks above the immediate resistance at $119,000, supported by strong trading volume.

How does Bitcoin trading volume affect price expectations?

Bitcoin trading volume plays a crucial role in determining market strength. Higher volumes during breakout attempts can validate upward price movements, while declining volume may indicate potential weakness and reversal risks.

| Key Metrics | Values |

|---|---|

| Current Price | $118,573 |

| Market Capitalization | $2.35 trillion |

| 24h Trading Volume | $31.06 billion |

| Intraday Price Range | $116,494 – $118,639 |

| Support Level | $112,000 |

| Resistance Level | $123,000 |

| RSI | 59 |

| Stochastic | 68 |

| CCI | 56 |

| ADX | 16 |

| MACD Signal | +528 – Sell Signal |

| Current Trend Strength | Weak |

Summary

Bitcoin price is currently positioned at $118,573 amidst a critical trading phase. Market sentiment suggests that Bitcoin bulls are eyeing a potential breakout towards the $123,000 mark, especially if the resistance at $119,000 is breached with significant volume. Traders are advised to remain vigilant, as the $112,000 support level holds against a possible retracement, highlighting the volatile yet promising nature of Bitcoin’s trading environment.