Bitcoin Investment Tips: Why You’ll Wish You Bought More

When it comes to Bitcoin investment tips, understanding the evolving landscape is crucial for maximizing your portfolio’s potential. Industry leaders like Michael Saylor frequently share insights on effective strategies to enhance investment in BTC, showcasing trends that could guide your buying Bitcoin strategy. As more companies, such as Microstrategy, bolster their Bitcoin holdings—now reaching a staggering 592,345 BTC—it’s vital to stay aware of the market dynamics and BTC investment trends. Moreover, assessing the S&P 500 Bitcoin impact can provide valuable context on how large institutional purchases might shape the overall market. By integrating these tips into your investing framework, you can navigate the complexities of cryptocurrency investment with greater confidence.

Exploring pathways for investing in digital currencies requires a keen eye on emerging trends and expert advice. Considerations for cryptocurrency investments often revolve around strategies for effectively acquiring Bitcoin and understanding its market positioning. Insights from notable figures, such as Michael Saylor of Microstrategy, can illuminate the benefits of embracing BTC as part of a diversified portfolio. Evaluating the implications of Bitcoin’s relationship with indices like the S&P 500 offers further clarity on how macroeconomic conditions may affect your investment decisions. By engaging with informed perspectives and data-driven approaches, you can enhance your prospects in the cryptocurrency realm.

Michael Saylor’s Bitcoin Strategy: Key Insights

Michael Saylor, the co-founder of Microstrategy, has become one of the most prominent supporters of Bitcoin, often referred to as the ‘Bitcoin Evangelist.’ His unique approach to accumulating Bitcoin has garnered attention from both investors and the media alike. Saylor’s strategy hinges on the premise that Bitcoin is digital gold—an inflation-resistant asset that will only grow in value over time. This belief is supported by his company’s staggering Bitcoin holdings, which now exceed 592,000 BTC, valued at over $64 billion. Saylor’s insights into Bitcoin often highlight its scarcity and potential as a hedge against inflation, making it a compelling investment option.

Saylor’s Bitcoin investment strategy is not just about buying large amounts; it’s also about creating a narrative that resonates with potential investors. By continuously referencing historical trends and potential future valuations, he reinforces the idea that those who invest in Bitcoin now will reap significant rewards later. His assertion that ‘in 21 years, you’ll wish you’d bought more’ serves as a psychological nudge for cautious investors, suggesting they should consider entering the Bitcoin market sooner rather than later. This psychological aspect, combined with a well-timed buying strategy, underlines the essence of Saylor’s investment philosophy.

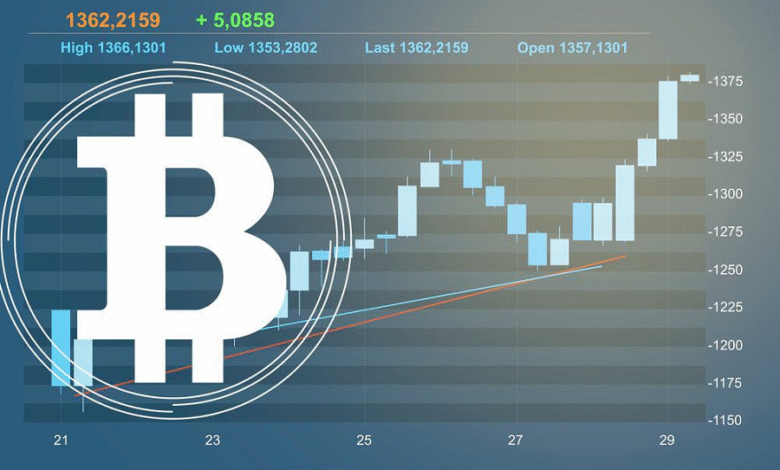

Understanding Bitcoin Investment Trends in 2023

As we move further into 2023, there are palpable shifts in Bitcoin investment trends that potential investors should be mindful of. One notable trend is the growing acceptance of Bitcoin as a legitimate asset class among institutional investors. This shift is underscored by corporations like Microstrategy amassing enormous Bitcoin holdings, which signal a broader acceptance of BTC in corporate treasury management. With companies recognizing Bitcoin’s potential as a store of value, its adoption is likely to escalate, influencing market dynamics in significant ways.

Another trend shaping Bitcoin investments in 2023 is the emphasis on regulatory frameworks that govern cryptocurrency trading. As more regulatory clarity emerges, both institutional and retail investors may feel more confident entering the market. Furthermore, the impact of Bitcoin’s performance on traditional indices like the S&P 500 cannot be understated. With the cryptocurrency market often correlating with stock market fluctuations, understanding these relationships will be critical for investors aiming to optimize their portfolios in a rapidly evolving economic landscape.

Effective Strategies for Buying Bitcoin

Investing in Bitcoin effectively requires a well-crafted buying strategy that aligns with one’s investment objectives and risk tolerance. The dollar-cost averaging (DCA) strategy, as exemplified by Microstrategy’s acquisitions, allows investors to acquire Bitcoin incrementally over time. This method mitigates the risk of market volatility and can lead to more favorable average purchase prices. By consistently buying Bitcoin, investors can take advantage of market dips and increase their holdings without the stress of trying to time the market perfectly.

Additionally, diversifying investment approaches by complementing Bitcoin purchases with other assets can also be beneficial. This strategy not only provides a cushion during market downturns but also allows investors to capitalize on different market trends. For instance, assessing the performance of Bitcoin alongside traditional investments like stocks or bonds, particularly those indexed to the S&P 500, can provide a comprehensive view of one’s portfolio performance. Capturing the upside potential of Bitcoin while managing risks is a central theme for investors striving for long-term success.

The Impact of Microstrategy’s Bitcoin Holdings

Microstrategy’s significant Bitcoin holdings have not only transformed the company’s financial standing but also influenced the wider cryptocurrency market. With nearly 600,000 BTC under its management, the firm represents a substantial player in BTC trading. As such, any large buy or sell activity from Microstrategy tends to have a ripple effect, impacting market prices and investor sentiment. Observers watch Saylor’s moves closely, recognizing that his decisions could lead to considerable price movements in Bitcoin.

Furthermore, Microstrategy’s strategy of leveraging Bitcoin as a treasury asset is paving the way for other corporations to follow suit. The financial implications of holding Bitcoin are evident in Microstrategy’s impressive returns, especially compared to traditional assets like equities in the S&P 500. This trend may encourage more companies to reconsider their treasury strategies and incorporate Bitcoin as a core element, fueling a broader adoption within corporate finance.

S&P 500 and Bitcoin: A Surprising Correlation

The performance of Bitcoin has begun to show interesting correlations with traditional stock indices, particularly the S&P 500. Many investors are increasingly observing how BTC reacts to market trends in the S&P 500, especially given Bitcoin’s recent ascent and the index’s fluctuating fortunes. Understanding these correlations can provide insights into potential risks and rewards associated with Bitcoin investments. As Bitcoin consolidates its status as a mainstream asset, its price movements will likely influence investor behavior in traditional markets.

Additionally, firms like Microstrategy are on the cusp of being listed in the S&P 500, which could further intertwine BTC with traditional finance. If companies with substantial Bitcoin holdings gain entry into major indices, this could lead to a broader acceptance of digital assets among conservative investors. The expectation that Bitcoin’s performance might enhance or detract from a company’s financial viability signals a new era where Bitcoin is not just a digital asset, but also a necessary consideration in corporate and investment strategies.

Long-term Predictions for Bitcoin’s Value

Long-term predictions for Bitcoin’s price often reflect optimism as the mainstream adoption of cryptocurrency expands. Analysts frequently cite Bitcoin’s halving events, increased scarcity, and growing regulatory acceptance as key drivers for future valuations. Predictions that BTC could reach unprecedented levels, supported by demand from corporate treasuries and retail investors alike, underpin many bullish forecasts for the cryptocurrency. Investors are encouraged to consider these dynamics when crafting their own investment strategies, as the potential for significant returns grows over time.

Moreover, historical price patterns suggest that despite periods of volatility, Bitcoin typically rebounds stronger from downturns. For instance, previous significant corrections have eventually led to new all-time highs. This cyclical nature of Bitcoin promotes a long-term investment outlook, where patience and strategic planning can yield substantial rewards. Adopting a long-term view can prove advantageous as the broader macroeconomic landscape evolves, potentially highlighting Bitcoin’s unique position amongst alternative assets.

Navigating Bitcoin’s Volatile Market

Investing in Bitcoin requires navigating a highly volatile market, characterized by dramatic price swings that can influence investor decisions. Sensational news, regulatory announcements, and macroeconomic factors all contribute to the unpredictable nature of Bitcoin pricing. As an investor, it is crucial to be equipped with strategies to mitigate risks associated with this volatility, such as employing stop-loss orders or limiting portfolio exposure to Bitcoin.

In addition to tactical financial measures, maintaining a well-informed perspective regarding market conditions is vital. Staying updated on Bitcoin-related news—like Microstrategy’s acquisition updates or changes in the regulatory landscape—can provide investors with an advantage in making timely decisions. Ultimately, embracing a mindset of adaptability enables investors to better navigate the ups and downs of the Bitcoin market.

The Road Ahead for Bitcoin Investors

Looking ahead, the landscape for Bitcoin investors is filled with opportunities and challenges. As institutional interest increases and regulatory environments continue to evolve, investors should stay agile and informed. The balance of opportunities provided by new market entrants and potential regulatory hurdles could shape the cryptocurrency’s future trajectory. Awareness of these influences will be crucial for those looking to capitalize on Bitcoin’s long-term potential.

Moreover, as figures like Michael Saylor continue to advocate for Bitcoin, the ongoing discourse around digital assets in the finance sector will likely shape widespread perception and adoption. Investors should be prepared to engage with this changing narrative as they formulate their strategies. The road ahead for Bitcoin may hold significant rewards for those who approach it with both caution and enthusiasm, recognizing the transformative potential of digital assets.

Why Invest in Bitcoin Now?

Investing in Bitcoin now can be a strategic decision given the current market conditions and the growing recognition of Bitcoin as a valuable asset. The increasing institutional adoption, spurred by companies like Microstrategy, signifies a shift in the perception of Bitcoin amongst traditional investors. By seizing the opportunity to enter the market at this juncture, investors can position themselves advantageously for potential growth as Bitcoin continues to solidify its place as a mainstream asset.

Furthermore, historical data suggests that the earlier one invests in Bitcoin, the greater the chance for substantial upside. The cyclical nature of Bitcoin’s price movements often leads to impressive recoveries after downturns, making early investments particularly appealing. As the cryptocurrency environment evolves, driven by technological advancements and regulatory developments, those who invest now may find themselves not only ahead of the curve but enjoying considerable financial rewards in the future.

Frequently Asked Questions

What are Michael Saylor’s Bitcoin investment tips for beginners?

Michael Saylor emphasizes the importance of a long-term Bitcoin investment strategy. He suggests acquiring Bitcoin consistently, highlighting a ‘buying Bitcoin strategy’ that includes dollar-cost averaging (DCA) to mitigate volatility risks.

How does Microstrategy’s Bitcoin holdings influence BTC investment trends?

Microstrategy’s Bitcoin holdings, which currently exceed 592,000 BTC, significantly influence BTC investment trends. Their continuous buying patterns often signal confidence in Bitcoin’s long-term value, attracting more investors to adopt similar strategies.

What impact does the S&P 500 have on Bitcoin investment strategies?

The inclusion of companies like Microstrategy in the S&P 500 could enhance Bitcoin’s legitimacy, possibly driving more institutional investments. This growing correlation prompts investors to consider Bitcoin in their strategies, acknowledging potential S&P 500 Bitcoin impact on overall market stability.

What is a recommended buying Bitcoin strategy according to Bitcoin experts?

Experts recommend a systematic buying Bitcoin strategy that incorporates dollar-cost averaging. This approach allows investors to purchase BTC at regular intervals, reducing the effects of market volatility and contributing to a more stable investment over time.

How does Microstrategy’s Bitcoin bet affect potential investors?

Microstrategy’s substantial Bitcoin investment positions it as a market leader, potentially motivating new investors who observe the company’s gains. This can create a ripple effect where more capital flows into BTC, thereby increasing overall market interest and possibly influencing BTC investment trends.

What lessons can investors learn from Michael Saylor’s Bitcoin investment strategies?

Investors can learn the importance of a long-term mindset, as exemplified by Michael Saylor’s strategies. His consistent purchases and public comments emphasize the belief that “you’ll wish you bought more” in the future, encouraging a proactive Bitcoin investment approach.

How does dollar-cost averaging play a role in Bitcoin investment tips?

Dollar-cost averaging is a key component of Bitcoin investment tips. By investing fixed amounts regularly, investors can lower their average purchase cost over time, minimizing the impact of price fluctuations in the BTC market.

What recent trends in BTC investment should potential investors be aware of?

Recent trends indicate a resurgence in BTC investment as institutional players like Microstrategy continue to accumulate Bitcoin. This suggests growing confidence in BTC’s potential, which may encourage individual investors to consider diversifying into Bitcoin.

Can Microstrategy’s Bitcoin strategy lead to higher investment returns?

Microstrategy’s strategy has already yielded significant returns, showcasing the potential for higher investment returns in BTC. By following similar investment principles, new investors may replicate their success if they maintain a long-term perspective and monitor market trends closely.

What should investors consider about the Bitcoin market in Q2 and upcoming quarters?

Investors should watch the Bitcoin market’s performance in Q2, as it has shown strong recovery trends. Historical quarterly patterns indicate potential volatility; thus, staying informed about macroeconomic factors and industry movements will be crucial for adapting Bitcoin investment strategies.

| Key Point | Details |

|---|---|

| Bitcoin Investment by Strategy | Strategy (formerly Microstrategy) continues to buy Bitcoin, recently acquiring 245 BTC, bringing its total to 592,345 BTC valued at $64 billion. |

| Michael Saylor’s Buy Recommendations | Saylor encourages investors with the message that they will regret not buying more Bitcoin in the future. |

| Current Market Position | Despite Bitcoin’s price fluctuations, Strategy’s investments are up by 52.86%, reinforcing the company’s strong Bitcoin strategy. |

| Comparison with Ethereum | Had Strategy invested in Ethereum instead of Bitcoin since 2020, they would have faced significant losses, highlighting Bitcoin’s superiority in value retention. |

| S&P 500 Eligibility | Strategy is nearing inclusion in the S&P 500, with its performance hinging on Bitcoin’s price volatility up until Q2 2025. |

Summary

Bitcoin investment tips suggest that now is an excellent time to consider buying into Bitcoin, as evidenced by Michael Saylor’s ongoing commitment to accumulate Bitcoin. With Strategy’s impressive gains and the potential for future value appreciation, strategic investment in Bitcoin can lead to significant financial rewards. As price trends show volatility, aligning your investment strategy with insights from seasoned investors like Saylor could prove advantageous. Being aware of market trends and making informed decisions is key to maximizing profit in Bitcoin investments.