U.S. Job Market: Challenges for Recent Graduates in 2023

The U.S. job market is currently facing significant challenges, particularly for recent college graduates seeking entry-level positions. With hiring rates at their lowest in over a decade, many aspiring professionals are grappling with the reality of limited job opportunities. Labor experts indicate that the abundance of caution among employers is leading to a hesitation in filling even critical roles, making the landscape even more daunting. As the economy fluctuates, the impact of these uncertainties on jobs is palpable, leaving many to reconsider their networking strategies for jobs in this competitive environment. Consequently, it becomes crucial for job seekers to adapt and enhance their skills through training, ensuring resilience in a tough job market ahead.

The current landscape of employment in the United States is marked by a noteworthy slowdown in job availability, particularly impacting young professionals just entering the workforce. Many college graduates find themselves competing for scarce positions in an increasingly cautious hiring environment, showcasing the urgent need for effective job-seeking strategies. Observations from labor analysts reveal how the intersection of economic conditions and employer behaviors are shaping the prospects for job seekers. As hiring becomes more selective, particularly for roles that demand a degree, individuals must explore innovative approaches to connect with industry networks and leverage their qualifications. Understanding the trends impacting available roles can better equip candidates to navigate the complexities of this evolving employment scene.

Understanding the Current U.S. Job Market Dynamics

The U.S. job market is witnessing a complex and challenging landscape, particularly for recent college graduates. While the national unemployment rate sits fairly low at 4.2%, the underlying factors reveal a different narrative. Economists indicate that the hiring rates have significantly slowed down, with employers exhibiting increased caution in their recruitment efforts. This slow pace of hiring has reached levels not seen since 2014, making it a daunting environment for those entering the workforce for the first time.

In this climate, recent graduates find themselves competing against seasoned professionals who are also struggling to secure positions. As shared by career coach Mandi Woodruff-Santos, the job market currently feels quite unfriendly, leading to a scarcity of viable job opportunities. This phenomenon raises questions about future job openings and potential career trajectories for young job seekers.

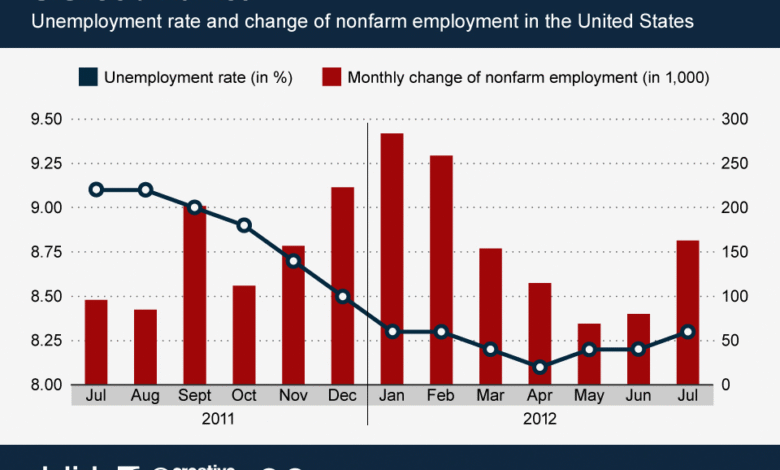

Analyzing Hiring Rates and Their Implications

In an in-depth look at hiring rates, the current statistics demonstrate a troubling trend for job seekers. Companies are hiring at their slowest rate in over a decade, which in turn directly impacts job availability across various sectors. The labor market once characterized by robust growth is now under scrutiny as employment trends reflect a tepid response from employers. This may be critical for recent college graduates who often rely on an influx of entry-level roles to kickstart their careers.

Moreover, the decline in the rate at which employees are quitting raises further concerns about job security and employer confidence. Fewer resignations signal a hesitance among workers to make moves, suggesting that many are opting to stay put during uncertain economic times. This stagnation can also contribute to a more competitive job search landscape, where fresh graduates face heightened difficulty in securing positions that align with their skills.

Navigating Job Opportunities for College Graduates

Despite the apparent obstacles in the current job market, there remain opportunities for college graduates prepared to navigate the landscape strategically. Understanding industry needs is crucial; graduates should focus on aligning their skills with sectors that are actively hiring, even amidst broader slowdowns. Key industries such as technology and healthcare, for example, may still offer job opportunities despite overarching hiring trends.

Furthermore, graduates should leverage internships and volunteer experiences as stepping stones to gaining relevant experience, which can bolster their resumes and enhance employability. Participating in projects, freelancing, or taking part in research can also demonstrate initiative and commitment to potential employers, potentially setting candidates apart from other applicants.

The Impact of Economic Trends on Job Availability

The shifting economic landscape undeniably plays a critical role in the availability of jobs for recent graduates. With significant caution observed in employer behavior, it’s crucial to understand how macroeconomic factors spill over into individual job opportunities. Economic uncertainties and concerns regarding trade policies have contributed to slow hiring practices, leading many employers to adopt a ‘wait and see’ approach.

As the economy faces challenges, the narrative remains that businesses are inclined only to fill essential roles. This changes the dynamics of job search significantly, creating a job market that’s more competitive and less favorable for those just starting. Graduates need to remain informed about economic trends to better align their skills and expectations with the demands of the job market.

Effective Networking Strategies for Job Seekers

In navigating a tough job market, effective networking strategies can serve as a powerful tool for recent graduates. Mandi Woodruff-Santos emphasizes the importance of building professional relationships to expand job prospects. Engaging with industry professionals can introduce job seekers to hidden job markets and provide insights that are not available through traditional job search methods.

Networking can take many forms – from informational interviews to attending industry-related events and joining professional organizations. By connecting with alumni or leveraging platforms like LinkedIn, graduates can enhance their visibility and access industry insights that could lead them toward viable job opportunities.

The Role of Skill Development in Career Advancement

As job seekers confront harsh hiring realities, the development of relevant skills emerges as a crucial strategy for future success. Woodruff-Santos suggests that candidates focus on acquiring certifications or training that align with their career aspirations. This proactive approach can significantly improve their marketability in a competitive job landscape.

Additionally, taking short courses or participating in workshops can help graduates stay updated with industry trends and demands. The more skills they acquire, the better equipped they will be to navigate job listings effectively, making them attractive candidates for potential employers during this cautious hiring phase.

Preparing for Future Job Market Challenges

Looking ahead, it’s essential for job seekers to prepare for ongoing fluctuations in the job market. While the current scenario may be challenging, it’s also important to recognize that market conditions can change rapidly. Understanding historical trends and being proactive about individual career strategies can make a substantial difference in how graduates respond to emerging opportunities.

Moreover, it’s beneficial for graduates to maintain a resilient mindset. As Woodruff-Santos advises, many people have faced difficult job markets before, and a sense of perseverance can cultivate a more robust approach towards job searching, potentially leading to breakthroughs even in tough conditions.

Addressing Job Market Anxiety among Graduates

The anxiety surrounding job prospects for college graduates is a growing concern in today’s economic climate. As they face uncertainties, it’s pivotal to address these concerns head-on rather than letting them spiral out of control. Understanding common challenges faced by peers can provide reassurance and encourage current students to share their experiences.

Additionally, graduates can benefit from forming support networks that focus on collective job-seeking efforts. Engaging in discussions about hurdles associated with the job market can foster a sense of community, making individuals feel less isolated in their experiences. This support can bolster confidence and offer new perspectives to tackle job searching creatively.

Long-Term Career Planning Beyond Initial Employment

While securing initial employment is of paramount importance, recent graduates should also consider their long-term career planning strategies. A solid foundation allows them to advance beyond entry-level roles into more fulfilling positions over time. Emphasizing skill acquisition, mentorship, and continuous professional development can help graduates pave their career paths effectively.

Moreover, being open to exploring diverse career trajectories can lead to unexpected opportunities. Embracing various experiences, even those outside of their chosen field, can enlarge their professional network and enhance their adaptability in the workforce. This forward-thinking approach ensures that graduates remain prepared for future job market shifts.

Frequently Asked Questions

What is the current state of the U.S. job market for recent college graduates?

The U.S. job market for recent college graduates is currently challenging, characterized by slow hiring rates and high competition. Many employers are being cautious, as they fill only critical roles, making it difficult for new graduates to secure job opportunities.

How do hiring rates analysis reflect on job opportunities in the U.S. job market?

Hiring rates analysis shows that employers are hiring at the slowest pace in over a decade, which directly impacts job opportunities. The current hiring trends indicate that the job market is becoming increasingly competitive, particularly for recent graduates.

What are effective networking strategies for jobs in the current U.S. job market?

Effective networking strategies for jobs in the U.S. job market include building personal connections, attending industry events, and joining professional organizations. These strategies can help job seekers expand their networks and improve their chances of finding job opportunities.

How does the economy impact jobs in the U.S. job market?

The economy significantly impacts jobs in the U.S. job market, with current economic caution leading employers to hesitate in hiring. Concerns over stability and potential job cuts create a cautious atmosphere, making it tougher for job seekers.

Are there specific job opportunities for college graduates in the U.S. job market right now?

While there are job opportunities for college graduates in the U.S. job market, they are limited due to slow hiring rates. Graduates may need to focus on developing their skills and networking to access these opportunities more effectively.

What trends are affecting hiring rates in the U.S. job market?

Current trends affecting hiring rates in the U.S. job market include decreasing quitting rates and a rise in economic caution among employers. This leads to fewer job openings and a more competitive environment for job seekers.

How can job seekers navigate a difficult U.S. job market?

Job seekers can navigate a difficult U.S. job market by enhancing their skill sets, actively networking, and being open to various job opportunities, even those that may not align perfectly with their aspirations. Proactivity in building connections can significantly improve job prospects.

What should recent graduates do to improve their chances of employment in the U.S. job market?

Recent graduates should focus on developing relevant skills through training and certifications, expanding their professional networks, and considering internships or part-time roles to boost their employability in the U.S. job market.

What role do professional organizations play in the U.S. job market?

Professional organizations play a vital role in the U.S. job market by providing networking opportunities, resources for skill development, and industry insights. Joining these organizations can help job seekers connect with potential employers and enhance their career prospects.

How can one prepare for an uncertain U.S. job market?

To prepare for an uncertain U.S. job market, individuals should stay informed about economic trends, continuously develop their skills, and actively engage in networking to enhance their visibility to potential employers. This proactive approach can mitigate some challenges posed by the job market.

| Key Points | Details |

|---|---|

| Slow Hiring Rates | Employers are hiring at the slowest pace in over a decade, with April hiring levels similar to those in August 2014. |

| Decreased Quitting Rates | The quitting rate has fallen below pre-pandemic levels, indicating a drop in job confidence. |

| Economic Caution | Businesses are hesitant to hire, only filling essential positions, making it difficult for new graduates to find jobs. |

| Networking Strategies | Job seekers should enhance networking efforts, build connections, and consider skills development to improve job prospects. |

Summary

The U.S. job market currently presents significant challenges for recent college graduates and job seekers. With hiring rates stagnating and worker confidence declining, many potential employees are finding it increasingly difficult to secure fulfilling positions. Experts suggest a strategic focus on networking and developing skills to navigate this tough economic landscape.