Bitcoin Miners: The 50 Most Profitable Machines in 2025

Bitcoin miners are at the forefront of the cryptocurrency revolution, transforming digital currency into tangible profits. As of August 2025, the most profitable Bitcoin miners showcase a remarkable blend of power, efficiency, and cutting-edge technology, making significant impacts on Bitcoin mining profitability. With the right Bitcoin mining rigs, operators can capitalize on favorable conditions—like low electricity costs at just $0.02 per kilowatt-hour. This article highlights the top Bitcoin mining machines that are pushing the boundaries of performance and profitability, revealing how a select few stand out in this competitive landscape. Understanding the dynamics of these high-performing devices is key for anyone looking to delve into the world of Bitcoin mining.

In the dynamic world of cryptocurrency, BTC mining enthusiasts often seek out the most effective strategies for earning digital assets. The elite class of crypto miners embodies an intersection of raw computational power and immaculate design, carving their niche as leaders in mining efficiency. With terms like ‘Bitcoin mining profitability’ and ‘top Bitcoin mining machines’ now part of the vernacular, potential operators can explore various mining rigs to discover the best fit for their financial goals. Ranging from advanced cooling systems to optimized power draws, these powerful machines optimize performance while minimizing costs. Whether you’re a seasoned miner or a newcomer, understanding the nuances of these mining setups can vastly enhance your investment in BTC mining profitability.

Understanding Bitcoin Mining Profitability

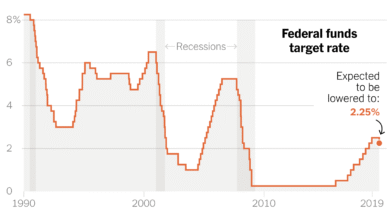

Bitcoin mining profitability fluctuates based on several factors including hash rate, energy costs, and network difficulty. Miners need to remain cognizant of these variables as they can significantly impact their returns on investment. For example, a miner with access to cheaper electricity will see higher profits compared to others operating at higher rates. Additionally, the computing power, or hash rate, of the mining rig plays a crucial role in determining how efficiently a miner can generate Bitcoins.

The current landscape of Bitcoin mining indicates that operators utilizing advanced rigs, such as those ranked among the most profitable Bitcoin miners, are benefiting due to their technological advantages. These machines, equipped with innovative cooling systems and superior energy efficiency, not only maximize output but also ensure stability in a volatile market.

Frequently Asked Questions

What are the most profitable Bitcoin miners available as of August 2025?

As of August 2025, the most profitable Bitcoin miners include Bitmain’s Antminer S21e XP Hydro 3U, which delivers 860 TH/s and earns about $43.56 per day. Other notable machines are Auradine’s Teraflux AH3880, producing 600 TH/s for $28.98 daily, and Bitmain’s Antminer S21 XP+ Hydro, yielding $25.81 from 500 TH/s. These machines represent the top tier in Bitcoin mining profitability under current market conditions.

How does Bitcoin mining profitability change with electricity costs?

Bitcoin mining profitability is heavily influenced by electricity costs. For instance, with electricity priced at $0.02 per kWh, many mining rigs can achieve significant profits. As electricity rates fluctuate, they directly impact the overall profitability of Bitcoin miners, emphasizing the importance of low operational costs for maximizing BTC mining profitability.

Which are the top Bitcoin mining machines in the Tier 2 category?

In the Tier 2 category of Bitcoin mining rigs, prominent machines include Bitmain’s Antminer S21 XP+ Hydro, which produces 500 TH/s for $25.81 daily, and Bitdeer’s Sealminer A2 Pro Hydro, also delivering 500 TH/s at $24.87 a day. These machines are well-regarded for their efficiency and consistent performance in BTC mining profitability.

What factors determine the efficiency of Bitcoin mining rigs?

The efficiency of Bitcoin mining rigs is determined by factors such as hashrate (TH/s), power consumption (watts), and design efficiency. Higher hashrates yield more Bitcoin, while lower power draw relative to performance maximizes profits, making efficiency a critical component in the evaluation of top Bitcoin mining machines.

Are older Bitcoin mining rigs still profitable as of 2025?

While some older Bitcoin mining rigs might still operate, their profitability often diminishes due to increased network difficulty and competition from newer, more efficient machines. As of 2025, it is generally advisable for miners to invest in advanced Bitcoin mining rigs, as they tend to offer better BTC mining profitability under current conditions.

How do immersion-cooled Bitcoin miners compare to air-cooled models?

Immersion-cooled Bitcoin miners often outperform air-cooled models in terms of efficiency and stability. For instance, models like Bitmain’s S21 XP Immersion can produce up to 300 TH/s while maintaining lower operational temperatures, enhancing reliability. As seen in the August 2025 rankings, immersion miners are positioned among the top-performing Bitcoin mining rigs.

What is the significance of ASIC miners in Bitcoin mining profitability?

ASIC (Application-Specific Integrated Circuit) miners like the Bitmain Antminer series are crucial for Bitcoin mining profitability. They are specifically designed for efficient Bitcoin hashing, providing high hashrate outputs while consuming less power compared to other types of hardware. Their advanced technology ensures that miners can remain competitive in the rapidly evolving Bitcoin network.

How often should Bitcoin miners upgrade their equipment for optimal profitability?

To maintain optimal profitability, Bitcoin miners should consider upgrading their equipment every few years, especially given how quickly technology evolves in this field. With the introduction of new mining rigs that offer greater efficiency and higher hashrates, staying updated ensures that miners can capitalize on emerging trends in Bitcoin mining profitability.

| Miner Name | Hashrate (TH/s) | Daily Profit ($) | Power Consumption (W) | Tier |

|---|---|---|---|---|

| Antminer S21e XP Hydro 3U | 860 | $43.56 | 11,180 | Tier 1 – Elite Class |

| Teraflux AH3880 | 600 | $28.98 | 8,700 | Tier 1 – Elite Class |

| Antminer S21 XP+ Hydro | 500 | $25.81 | Power data not provided | Tier 2 – Heavy Hitters |

| Sealminer A2 Pro Hydro | 500 | $24.87 | Power data not provided | Tier 2 – Heavy Hitters |

| Avalon A1566HA 2U | 480 | $23.44 | Power data not provided | Tier 2 – Heavy Hitters |

| Whatsminer M63S++ | 464 | $22.94 | Power data not provided | Tier 2 – Heavy Hitters |

| Whatsminer M63S | 390 | $18.72 | Power data not provided | Tier 3 – Solid Performers |

| Teraflux AI3680 | 375 | $18.63 | Power data not provided | Tier 3 – Solid Performers |

| Whatsminer M66S++ | 356 | $17.60 | Power data not provided | Tier 3 – Solid Performers |

| S21 XP Immersion | 300 | $15.12 | Power data not provided | Tier 4 – Consistent Earners |

| M33S++ | 242 | $10.28 | Power data not provided | Tier 5 – Foundation Level |

| Avalon A15XP-206T | 206 | $9.96 | Power data not provided | Tier 5 – Foundation Level |

Summary

Bitcoin miners who are well-informed about the most profitable mining machines can significantly enhance their earnings. The recent ranking highlights that the Antminer S21e XP Hydro 3U stands at the top with impressive daily profits, emphasizing the importance of technology and efficiency in the mining process. Keeping an eye on electricity costs and equipment performance can lead to better investment decisions for Bitcoin miners aiming for success.