Trump’s Tariff Policy: Revenue Projections and Economic Impact

Trump’s tariff policy has stirred considerable debate among economists and policymakers alike. While White House officials, including trade adviser Peter Navarro, projected that tariffs could generate $600 to $700 billion annually, many experts warn that actual tariff revenue will likely fall short of these ambitious estimates. The implications of these tariffs extend beyond mere financial gain; they could significantly impact the U.S. economy, potentially increasing the national debt and complicating ongoing tax reform discussions. As consumers face higher prices due to these taxes on imports, the anticipated revenue could dwindle, leading to a slew of economic challenges. Overall, the actual effects of Trump’s tariff policy are expected to reverberate throughout various sectors, prompting a reevaluation of its longer-term viability and economic consequences.

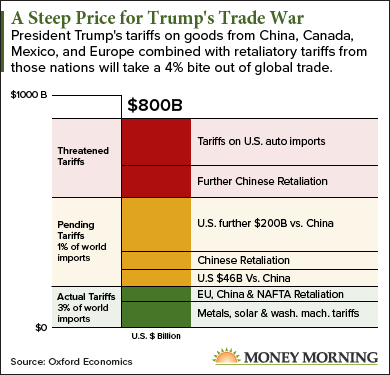

The trade measures introduced under the Trump administration, often referred to as protective tariffs, are designed to impose taxes on imported goods, aiming to bolster domestic industries. Such tariffs are meant to address trade imbalances and generate revenue, yet their effectiveness is widely debated among analysts. By increasing the costs of foreign products, these taxes could safeguard American jobs but may also lead to retaliatory measures from other countries, which threaten U.S. exports. This intricate balance of benefits versus drawbacks is pivotal to understanding the broader trade dynamics and their implications for the national economy. Ultimately, as economists analyze the potential earnings versus the impact on consumer spending, the complexities of these protective tariffs reveal a nuanced reality that goes beyond simple revenue calculations.

Trump’s Tariff Policy and Revenue Predictions

In recent discussions surrounding President Trump’s tariff policy, significant discrepancies have emerged regarding expected tariff revenue. White House trade adviser Peter Navarro claimed that annual tariff revenues could soar to about $600 billion to $700 billion. However, various economists strongly challenge this projection, anticipating that actual revenues would be closer to $100 billion to $200 billion. This stark difference raises concerns about the long-term sustainability of these tariffs as they are integrated into fiscal policy.

The implications of these predictions are substantial not just for the immediate economic outlook, but for the financial strategies the administration might adopt moving forward. If the anticipated revenue fails to materialize, it could compel lawmakers to reconsider funding strategies for initiatives such as tax cuts—a critical point of contention in the current legislative landscape. As the national debt continues to climb, reliance on optimistic revenue forecasts may lead to serious fiscal repercussions.

Factors Influencing Tariff Revenue

Several factors can heavily influence tariff revenue, ranging from the specific rates applied to the goods targeted and the duration of these tariffs. While a sweeping 20% tariff on U.S. imports seems to match Navarro’s projections, it overlooks potential economic dynamics that could alter the effectiveness of such a revenue-generating strategy. Key among these dynamics are the relationships between tariff rates, consumer purchasing behavior, and possible retaliatory tariffs from other nations.

Economists like Mark Zandi argue that while increased tariff rates could theoretically boost revenue figures, they must also contend with the unintended consequences that often accompany such drastic trade measures. The potential for retaliatory tariffs from partner countries can further complicate revenue expectations, limiting the overall financial gain that the U.S. might hope to generate. Thus, understanding these factors is essential for crafting realistic economic projections.

Economic Consequences of Increased Tariffs

The economic consequences of Trump’s tariff policy extend well beyond simple revenue calculations. As tariffs raise consumer prices, they effectively reduce the purchasing power of American households, which can lead to decreased demand for imported goods. For instance, estimates suggest that a 20% tariff could cost consumers between $3,400 and $4,200 annually, resulting in diminished consumption and lower overall tariff revenue, a paradox that raises questions about the effectiveness of such trade measures.

Further ramifications include the potential for retaliatory actions from foreign nations, which could severely impact U.S. exporters. Such retaliatory tariffs could trigger broader economic slowdowns, potentially leading to job losses within sectors reliant on international trade. The ripple effects of these tariffs may culminate in a net negative outcome for the U.S. economy, contradicting the perceived benefits of increased revenue.

The Role of Tariffs in U.S. Economic Strategy

Understanding the role of tariffs in U.S. economic strategy is critical in analyzing both near-term effects and longer-term implications. Tariffs are not just tools for revenue generation; they are also leveraged to protect domestic industries from foreign competition. However, the effectiveness of this strategy hinges on the balance between safeguarding American jobs and fostering a competitive marketplace.

As seen in previous trade strategies, the implementation of tariffs can often lead to unintended economic repercussions. Aiming to protect domestic businesses, the government risks escalating tensions with international trade partners. As tariffs become contentious conversation points, ongoing debates about their legitimacy and impact underscore the complexities at play within U.S. trade policy.

Long-term Viability of Tariffs

The long-term viability of tariffs imposed under Trump’s administration is under scrutiny given their reliance on executive orders. Many economists assert that the likelihood of maintaining these tariffs over an extended period is low, particularly as they confront adverse effects from both domestic and global markets. Experts like Zandi have expressed skepticism, suggesting that if these tariffs last beyond the upcoming year, it would be surprising, highlighting their tenuous nature.

Moreover, the total dependence on tariff revenue to support modifications in tax policy raises concerns about future economic stability. Failure to meet the projected revenue could lead to substantial budget deficits, thereby exacerbating national debt levels. Increased scrutiny over these policies may prompt calls for budget cuts or alternative methods to manage the economic fallout from both tariffs and tax reforms.

Impact on National Debt

The implications of tariffs extend into broader financial discussions, particularly concerning the national debt. As the Trump administration integrates tariffs into its fiscal strategy, the anticipated revenue from these tariffs is seen as a potential offset to the national debt. However, economists caution that failing to achieve these revenue targets could necessitate increased borrowing, amplifying the existing debt burden.

The relationship between tariff revenue and national debt is a fraught one. As the administration aims for ambitious tax cuts, reliance on potentially inflated revenue estimates from tariff policies raises the specter of larger fiscal challenges ahead. Clarity and accuracy in these revenue forecasts are vital to prevent exacerbating the national debt.

Consumer Behavior and Tariff Revenue

Understanding consumer behavior in the context of tariffs is crucial to grasp how they might affect overall economic health. Tariffs increase the costs of goods, leading to reduced purchasing power among consumers. As they adjust their spending habits in response to rising prices, the anticipated gains from tariffs could diminish. This cyclical dynamic illustrates how tariffs, instead of bolstering revenue, could potentially lead to economic contraction.

Economic predictions emphasize that declining consumer purchasing can stunt economic growth, particularly if tariffs deter foreign spending on U.S. goods. The delicate balance between protecting domestic interests and maintaining competitive pricing in the global market underscores the complicated tableau of U.S. tariff policy.

Global Response to U.S. Tariff Initiatives

The global response to U.S. tariff initiatives reveals a multi-faceted landscape, as foreign nations often retaliate with their own tariffs targeting American goods. This cycle of retaliation can escalate quickly, impacting international trade relations and complicating the revenue expectations initially projected by the U.S. administration. These geopolitical factors underscore the interconnectedness of global markets and highlight the vulnerabilities inherent in unilateral tariff implementations.

Economists warn that the retaliatory measures taken by other nations not only limit the anticipated gains from tariffs but could also destabilize existing trade relationships, which are critical for shared economic growth. The broader implications of this strategy prompt discussions about the necessity for collaboration and negotiation rather than confrontation in trade policies.

Tariffs and Job Market Stability

The implementation of tariffs presents implications for job market stability in the U.S. While intended to protect domestic industries, tariffs can also lead to higher consumer prices that negatively impact overall economic activity. Reduced purchasing power often translates to diminished consumer spending, which, in turn, can hinder job growth across multiple sectors. Layoffs may rise as companies readjust to decreased demand driven by higher prices.

Furthermore, sectors reliant on exports face unique challenges as foreign retaliatory tariffs could stifle demand for U.S. goods abroad. Such dynamics further complicate the labor market landscape as companies grapple with declining sales and profits, presenting a dual challenge of protecting American jobs while balancing economic sustainability.

Legislative Challenges in Tariff Policy

The intersection of tariff policies with legislative agendas creates a complex environment. As lawmakers debate the best approach to address the U.S. national debt and economic growth, tariffs play a critical role in shaping these discussions. The administration’s fiscal strategies increasingly hinge on an optimistic revenue forecast from tariffs, but with experts issuing warnings, the political landscape remains fraught with uncertainty.

Additionally, potential budget cuts or alterations to tax reform proposals may emerge if tariff revenues fall short. This dynamic raises fundamental questions about the ability of lawmakers to navigate competing interests while striving to enhance economic stability and fiscal responsibility in the face of fluctuating revenues from tariff policies.

Frequently Asked Questions

What is Trump’s tariff policy and how does it impact tariff revenue?

Trump’s tariff policy seeks to impose tariffs on various imports with the goal of generating significant tariff revenue for the U.S. government. While estimates by White House officials project annual revenues of $600 billion to $700 billion, economists predict actual revenue will be much lower, potentially only $100 billion to $200 billion. This discrepancy highlights concerns about the real economic impact of tariffs and raises questions about the sustainability of such policies.

How will Trump’s tariff policy affect the U.S. economy?

The U.S. economy could face several challenges due to Trump’s tariff policy. Increased tariffs generally lead to higher consumer prices, which can reduce purchasing power and overall economic activity. Additionally, retaliatory tariffs from foreign nations may harm American exports, further complicating the economic landscape. As a result, tariffs could adversely impact growth and contribute to inflation, straining the U.S. economy.

What are the implications of Trump’s tariff policy for the national debt?

Trump’s tariff policy aims to generate revenue that could potentially offset part of the national debt. However, if actual tariff revenues fall significantly short of expectations, as many economists predict, lawmakers may face pressure to implement budget cuts or increase the national deficit further. The effectiveness of tariffs in reducing national debt ultimately depends on their ability to generate consistent and substantial revenue.

What are the key factors influencing the economic impact of Trump’s tariff policy?

The economic impact of Trump’s tariff policy is influenced by several factors, including the specific tariff rates, the duration of their implementation, and the range of products affected. Economists caution that higher tariffs, such as a proposed 20% across-the-board tariff, may generate significant revenue but could also lead to increased consumer prices and retaliation from trading partners, complicating the overall financial outcomes.

What are economists predicting regarding the future of Trump’s tariff policy?

Economists are skeptical about the longevity and effectiveness of Trump’s tariff policy. Many predict that the tariffs, which are subject to executive order, may not endure long-term, with forecasts suggesting they could last no longer than a year. This uncertainty surrounding the policy raises questions about its potential contribution to revenue generation and its overall impact on the U.S. economy.

How might Trump’s tariff policy affect jobs in the U.S.?

The impact of Trump’s tariff policy on jobs in the U.S. could be mixed. While the intention is to protect domestic industries, higher tariffs often lead to increased consumer prices, which can decrease demand for imports and potentially harm companies reliant on exports. This could lead to job losses in sectors affected by retaliatory tariffs or reduced economic activity, highlighting the complex relationship between tariffs and employment.

What are some potential repercussions of retaliatory tariffs in response to Trump’s policy?

Retaliatory tariffs could significantly harm U.S. businesses that rely on exports, leading to broader economic downturns. As foreign nations impose their own tariffs in response to Trump’s policy, American companies may face reduced sales abroad, potentially causing job losses and decreased investments. These repercussions could also exacerbate economic challenges at home, complicating the overall impact of tariffs on the U.S. economy.

How do tariffs under Trump’s policy influence consumer prices?

Tariffs implemented under Trump’s policy are likely to increase consumer prices as companies pass on the costs of higher import fees to consumers. For example, a 20% tariff could add an estimated $3,400 to $4,200 annually to the average consumer’s expenses. This rise in prices could decrease consumer demand for imports, impacting the overall effectiveness of tariff revenue generation.

What are the long-term forecasts for the sustainability of Trump’s tariff policy?

Long-term forecasts for Trump’s tariff policy suggest that it may not remain sustainable, as many economists expect the tariffs could expire or change under future administrations. Given that these tariffs are enacted through executive order, there is a consensus that their duration will likely be shorter than the ten years projected by some officials. Ongoing political shifts and economic conditions will ultimately determine the future of this policy.

What strategies might lawmakers consider if Trump’s tariffs fail to generate expected revenue?

If Trump’s tariffs fail to generate the anticipated revenue, lawmakers may consider several strategies, including budget cuts or increasing the national deficit to cover fiscal shortfalls. Additionally, lawmakers could revisit tax policies or explore alternative revenue-generating strategies to offset the funding gaps created by lower-than-expected tariff revenues, reflecting the interconnected nature of tariff policy and broader economic planning.

| Aspect | Details |

|---|---|

| Projected Revenue | Trump’s administration estimates $600-$700 billion annually. |

| Expert Estimates | Economists suggest actual revenue may only be $100-$200 billion annually. |

| Economic Impact | Higher tariffs may lead to increased consumer prices, impacting purchasing behavior. |

| Retaliation Risks | Other countries may impose tariffs on U.S. goods, decreasing export opportunities. |

| Long-Term Viability | Many economists doubt the sustainability of tariffs; may not last more than a year. |

Summary

Trump’s tariff policy presents a contentious potential for revenue generation, with current estimates likely falling below the administration’s expectations. Despite optimistic projections, the economic repercussions and uncertainties surrounding tariff implementation may significantly alter the landscape of U.S. trade and fiscal policies.