Tesla Shareholder Lawsuits: New Bylaws Limit Legal Actions

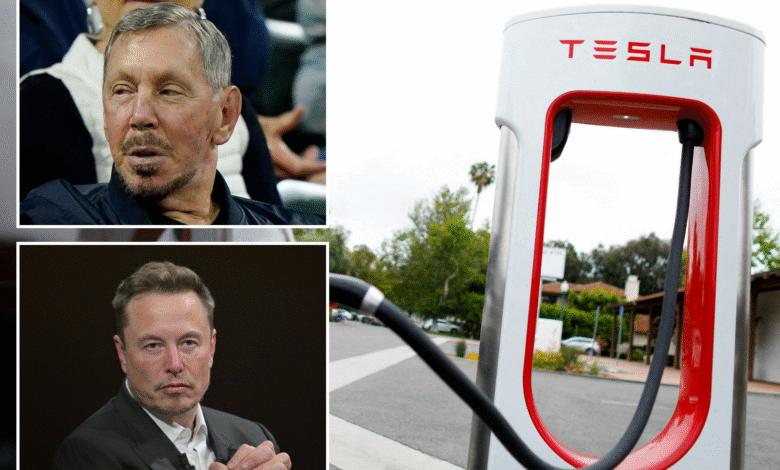

Tesla shareholder lawsuits have taken center stage in recent discussions about corporate governance and shareholder rights, particularly in the wake of the company’s recent bylaw amendments. The changes, aimed at protecting the company against derivative lawsuits by requiring shareholders to own at least 3% of the company’s stock, reflect a strategic move bolstered by Texas corporate law. This threshold poses a significant barrier for individual investors seeking to hold Tesla’s executives accountable for breaches of fiduciary duty. Notably, the controversy surrounding Elon Musk’s hefty compensation package has magnified the importance of understanding these legal frameworks. As Tesla continues to grow, the implications of these amendments on shareholder power and corporate ethics remain to be seen.

In the realm of corporate governance, disputes involving Tesla’s investors have sparked significant interest, particularly following the amendments to the company’s bylaws. These regulatory changes have effectively altered the landscape for shareholders wishing to initiate legal action against the company, now mandating a minimum ownership requirement of 3% before filing a derivative suit. This critical shift stems from a broader strategy under Texas corporate law, aimed at fortifying the company’s management against lawsuits that may challenge executive decisions. The fallout from Elon Musk’s controversial compensation plan illustrates the heightened scrutiny surrounding shareholder rights and corporate fiduciary responsibilities. As Tesla navigates this evolving legal environment, the tension between investor protections and corporate governance practices will continue to be a focal point of discussion.

Tesla’s New Bylaws: A Shift in Shareholder Rights

In a significant move, Tesla has amended its corporate bylaws, marking a notable shift in shareholder rights. The implications of these changes have raised concerns among investors and legal experts, particularly regarding the limitations imposed on shareholders seeking redress for breaches of fiduciary duty. The new bylaw stipulates that shareholders must hold at least 3% of Tesla’s outstanding shares to file a derivative lawsuit, a measure designed to deter frivolous litigation while also shielding executives, including CEO Elon Musk, from potential legal challenges that could arise from smaller shareholders.

According to the regulatory filing, this bylaw change is effective immediately and articulates Tesla’s strategy to strengthen its governance structure under Texas corporate law. By increasing the threshold for initiating lawsuits, Tesla is attempting to create a more stable environment for decision-making at the top levels of the company. However, this has sparked a debate regarding the balance between corporate governance and shareholder protections, as many fear that limiting access to legal recourse could undermine the accountability of the board and executives.

Understanding the Impact of the 3% Ownership Requirement

The 3% ownership threshold required for initiating a shareholder lawsuit is poised to have a significant impact on the dynamics between Tesla’s management and its shareholders. This regulatory change follows a legal precedent set by the Tornetta case, where a shareholder’s minority ownership led to a landmark ruling against Musk’s 2018 compensation package. Now, with such a high bar to clear, it may become increasingly difficult for shareholders, particularly those holding smaller stakes, to challenge decisions they deem harmful or irresponsible.

Elon Musk’s compensation and the board’s oversight have come under scrutiny, especially in light of the court’s earlier findings against the Tesla board’s handling of compensation decisions. By mandating a 3% ownership stake, Tesla effectively narrows the landscape of potential plaintiffs, leading to fewer derivative actions. This shift raises questions about the protective measures available to smaller shareholders and whether they have sufficient avenues for recourse in situations where they believe fiduciary duties have been breached.

Legal Experts Weigh In on Tesla’s Bylaw Amendments

Legal experts are examining the ramifications of Tesla’s recent bylaw amendments, particularly how they interact with fiduciary duties outlined in Texas corporate law. Ann Lipton, a noted corporate law scholar, underscored the importance of these changes, providing insight into their potential to present barriers for shareholders seeking accountability through legal channels. By invoking state laws that enable corporations to limit shareholder lawsuits, Tesla’s bylaw changes could embolden corporate leaders while simultaneously challenging shareholders’ rights to hold them accountable.

Furthermore, experts are looking closely at how this approach may influence corporate governance practices not just at Tesla, but across other companies as well. The move signals a potential trend in which corporations might seek to enhance their protective measures against legal challenges, which could disproportionately affect smaller investors who may lack the necessary financial clout to meet the new ownership requirements.

The Future of Tesla Under New Governance Structures

Tesla’s transition to Texas has not only been a logistical move but a strategic repositioning within the corporate governance landscape. The changes to the bylaws reflect a broader vision for the company’s governance and operations, allowing it to navigate corporate law that favors limiting shareholder litigation. As Tesla continues to grow and evolve, these new governance structures will shape the company’s responsiveness to shareholder concerns and its overall corporate culture.

As discussions around Elon Musk’s compensation and broader strategic decisions unfold, stakeholders will be watching closely to see how these bylaws manifest in practice. This shift could redefine the relationship between the corporation and its shareholders, establishing a precedent for how companies handle internal disputes. The outcome of these changes will likely influence future legislation regarding shareholder rights and corporate governance, especially in states with similar corporate structures.

Shareholder Lawsuits: A Historical Perspective

The historical context of shareholder lawsuits reveals the delicate balance between protecting investors’ rights and allowing companies to operate without the fear of constant litigation. In Tesla’s previous experience while incorporated in Delaware, for instance, the Tornetta case highlighted how even minor ownership stakes could lead to substantial legal challenges against corporate executives. This prompted a reevaluation of protective measures that companies may impose to shield themselves from frequent and potentially damaging legal scrutiny.

As the automotive manufacturer adapts its corporate structure to better align with increasing market demands, it remains to be seen how the historical precedents of shareholder lawsuits will influence its operational stability. The Tornetta ruling serves as a salient reminder of the power shareholders wield, especially those who can adeptly navigate corporate bylaws and legal frameworks, shaping the future landscape of corporate governance.

Elon Musk’s Leadership Style: A Double-Edged Sword

Elon Musk’s leadership style has often been described as visionary yet controversial, creating both admiration and concern among investors and analysts. His approach to corporate decisions has garnered significant media attention, particularly regarding the maximum compensation stakes that can lead to legal battles like the one experienced with the Tornetta lawsuit. With the new bylaws in place, shareholders may struggle to challenge Musk’s compensation packages, despite potential concerns over fiduciary duties and executive responsibility.

While Musk’s innovative strategies have propelled Tesla to remarkable heights, this same strategy may also generate friction between management and shareholder expectations. The bylaw changes might reflect an effort to reinforce his decision-making power, but they also risk alienating investors who feel marginalized by the new legal structures. The balance between encouraging visionary leadership and maintaining fiduciary responsibility is delicate, yet crucial for Tesla’s sustainable growth.

Navigating Corporate Governance in the Age of Tesla

As Tesla continues to navigate the complexities of corporate governance, the recent bylaw amendments are indicative of broader trends within corporate America. Companies are increasingly faced with the challenge of adapting to an environment where shareholder activism is on the rise. With laws and regulations evolving, the implications of such bylaw changes pose critical questions about how corporations can maintain authority while ensuring shareholders remain adequately represented and able to voice their concerns.

The interplay of shareholder rights, fiduciary duties, and corporate governance will define the future landscape for companies like Tesla. As such, it will be important for other corporations to observe Tesla’s approach and consider similar defensive strategies to protect themselves from potential litigation while balancing their obligations to shareholders. The ongoing discourse around these bylaws may signal the beginning of a new era of corporate governance with an emphasis on strategic limitations on shareholder lawsuits.

The Regulatory Landscape for Shareholder Rights

The regulatory landscape surrounding shareholder rights is continually evolving, with changes in state laws influencing how companies manage their corporate governance structures. Tesla’s decision to increase the threshold for initiating lawsuits reflects larger trends wherein companies might seek to insulate themselves from litigation risks. Texas corporate law, which allows for such protective measures, could lead to a shift in how other corporations assess their own bylaws and operational frameworks, potentially altering the landscape of shareholder activism.

It is essential for shareholders and potential investors to remain acutely aware of these regulatory changes as they seek to understand how such governance models may impact their rights. The implications of Tesla’s recent amendments are a case study in the relationship between corporate governance and shareholder activism, prompting a necessary dialogue on the importance of maintaining robust legal structures that protect investor rights while fostering an environment conducive to corporate innovation.

Future Implications for Corporate Governance and Shareholder Activism

As the debate over corporate governance practices and shareholder activism continues to gain traction, Tesla’s recent bylaws demonstrate a crucial turning point for corporate America. The groundwork being laid by companies like Tesla may set a precedent for how similar organizations govern themselves moving forward. This shift towards requiring larger stakes for shareholder litigation could dissuade potential claims, ushering in a new generation of corporate governance that prioritizes internal decision-making over external challenges.

The implications of these developments stretch beyond Tesla, as other corporations may take cues from its approach to shareholder relationships and litigation thresholds. How this impacts the balance of power within corporate structures remains to be seen, but it is clear that shareholder activism will need to adapt to these changing parameters. The landscape of investor rights and corporate accountability will continue to evolve, driven by the responses of stakeholders to governance changes exemplified by Tesla’s recent bylaws.

Frequently Asked Questions

What are the implications of Tesla’s shareholder lawsuits following the recent bylaw changes?

Tesla’s amendment to corporate bylaws significantly raises the bar for initiating shareholder lawsuits, specifically by requiring a minimum ownership of 3% of the company’s stock to file derivative actions. This move limits shareholders’ capacity to sue the company for breaches of fiduciary duty, challenging shareholder rights and making it harder for individual investors to hold the board accountable.

How do the changes in Tesla’s bylaws affect shareholder rights?

The changes in Tesla’s bylaws restrict shareholder rights by prohibiting lawsuits unless shareholders own at least 3% of the company’s stock. This was implemented to protect Tesla’s executives and board from frequent litigation over fiduciary duties, thereby making it more difficult for small shareholders to challenge corporate decisions through legal means.

What triggered Tesla to change its bylaws regarding shareholder lawsuits?

Tesla modified its bylaws based on the precedent set by a previous derivative lawsuit where a small shareholder successfully contested CEO Elon Musk’s 2018 compensation package. The company aims to prevent similar legal challenges in the future, leveraging Texas corporate law to impose higher thresholds on shareholder lawsuits.

Why did Tesla opt for Texas corporate law to limit shareholder lawsuits?

Tesla’s decision to utilize Texas corporate law allows the company to enforce stricter control over shareholder lawsuits regarding breaches of fiduciary duty. This legal framework permits Texas corporations to require shareholders to hold a substantial percentage of stock, thereby reducing the likelihood of frequent and potentially damaging derivative actions against the company’s board or executives.

What are the concerns surrounding Elon Musk’s compensation amid Tesla shareholder lawsuits?

Elon Musk’s compensation is under scrutiny due to its connection to prior shareholder lawsuits that challenged the validity of his pay package. The recent bylaw changes signal Tesla’s efforts to safeguard executive compensation packages from shareholder litigation, following the adverse ruling against Musk that voided his 2018 compensation.

How might the new bylaw changes impact future Tesla shareholder lawsuits?

The new bylaws may deter future Tesla shareholder lawsuits by creating a significant barrier to entry, as investors are now required to own at least 3% of the company’s shares to sue for breaches of fiduciary duty. This could lead to fewer claims being filed, thereby providing protection for the board and executives against frequent litigation.

| Key Point | Details |

|---|---|

| Amended Corporate Bylaws | Tesla has amended its bylaws to restrict shareholder lawsuits regarding fiduciary duties. |

| Ownership Requirement | Shareholders must now own at least 3% of Tesla’s stock to initiate a derivative action. |

| Effect Date | The new regulation took effect on May 15. |

| Reason for Change | This change follows a previous lawsuit where a shareholder with only 9 shares successfully questioned Musk’s 2018 compensation package. |

| Texas State Law | Texas allows corporations to impose such requirements, unlike Delaware law. |

| Impact on Lawsuits | The new bylaws create a significant barrier for potential lawsuits, benefiting the management. |

| Tornetta Decision | The previous lawsuit, initiated by Richard Tornetta, led to a court ruling against Musk’s pay package. |

| Future Actions | Tesla has appealed the Tornetta decision and seeks to keep the controversial shares. |

Summary

Tesla shareholder lawsuits have recently become a focal point due to the automaker’s new bylaws, which impose significant restrictions on litigation initiated by shareholders over breaches of fiduciary duties. By mandating a minimum ownership threshold of 3%, Tesla aims to deter frivolous lawsuits and protect its executives from minor shareholder grievances. This strategic amendment reflects Tesla’s shift to Texas laws, enhancing corporate governance while potentially shielding management from legal challenges. As Tesla navigates these changes, the implications for shareholder rights and corporate accountability remain crucial considerations for investors and legal analysts alike.