EU Countermeasures Against US Tariffs: Strategic Response

The EU countermeasures against U.S. tariffs have become a focal point in discussions surrounding transatlantic trade relations, especially as tensions rise amid ongoing negotiations. European Commission President Ursula von der Leyen has publicly remarked on the significant impact of U.S. tariffs on EU products, particularly the recently imposed 20% duty. This action is widely viewed as a potential disruption to global trade dynamics, marking a tumultuous era characterized by unpredictable EU trade policies. Von der Leyen’s assertion that tariffs won’t effectively address systemic issues reflects a broader concern regarding the potential fallout of U.S. tariffs impact on economies worldwide. As the EU prepares to implement countermeasures on around €26 billion worth of U.S. goods, the results of this trade dispute could reshape EU U.S. trade relations and influence the overall landscape of global commerce.

The imposition of tariffs by the United States has prompted the European Union to strategize a robust set of counter-actions, aiming to mitigate the adverse effects on its economy. Recently, trade tensions have escalated, with the European Union expressing strong opposition to U.S. tariff policies, which are seen as harmful not just bilaterally but to the global economy as a whole. Ursula von der Leyen has been at the forefront, conveying the EU’s intent to navigate these challenges through diplomatic and economic avenues. As nations grapple with the implications of protectionism, the EU’s response signifies a pivotal moment in international trade discussions. The ongoing negotiations could determine not only the trajectory of EU and U.S. relations but also the future stability of global trade channels.

Understanding EU Trade Policies in Response to U.S. Tariffs

The European Union’s trade policies are designed to safeguard its economic interests while promoting fair competition in global markets. As tensions rise due to U.S. tariffs, particularly the recent imposition on EU products, the EU faces a critical decision point. EU trade policies are not merely reactive; they encompass a deep-seated approach aimed at fostering sustainable trade relations, emphasizing the importance of multilateral agreements over unilateral actions. Ursula von der Leyen’s leadership is crucial at this juncture, as she navigates the EU’s response not only to protect EU products but also to reinforce its stance against protectionism.

The EU’s readiness to implement countermeasures signals a strategic shift in how the bloc embraces trade negotiations. As von der Leyen articulated, the EU seeks to reduce barriers rather than escalate tensions through tariffs. This approach highlights the EU’s commitment to cooperative solutions and trade fairness, even while facing aggressive policies from the U.S. By preparing counter-tariffs on a significant value of U.S. goods, the EU is asserting its position in international trade dialogue, aiming to deter further unilateral tariff applications from the United States.

The Impact of U.S. Tariffs on Global Trade Relations

The recent U.S. tariffs, particularly the 20% levies on EU products, have sparked significant concerns about their long-term effects on global trade relations. Tariffs not only disrupt the balance of trade between nations but also lead to retaliatory measures, as evidenced by the EU’s planned counter-tariffs. This back-and-forth escalates global trade tensions, impacting not only the U.S. and EU but also other nations that may be affected by such economic conflicts. Trade analysts warn that these tariffs could hinder economic recovery worldwide, particularly in developing countries that depend on stable trade conditions.

Furthermore, the implications of U.S. tariffs extend beyond immediate financial metrics; they can affect diplomatic relationships and trade negotiations in the long term. As economies grapple with the unpredictability of trade policies, stakeholders must brace for changes in market dynamics that could disrupt existing partnerships. The EU’s proactive stance in countering U.S. tariffs is critical not just for its own economy but also highlights the necessity for collaborative approaches to global trade issues.

Ursula von der Leyen’s Role in Navigating Trade Tensions

Ursula von der Leyen’s leadership has become increasingly vital in addressing the challenges posed by escalating trade tensions between the U.S. and the EU. As the European Commission President, she brings a strategic approach towards conflict resolution in trade disputes. Her vocal criticism of U.S. tariffs as chaotic reflects a broader concern over the erosion of established trading principles. By advocating for open dialogue rather than punitive measures, von der Leyen positions the EU as a mediator in an increasingly fragmented trade landscape, demonstrating a commitment to preserving international trade norms.

Von der Leyen’s emphasis on constructive negotiations rather than retaliatory tariffs signifies her vision for EU-U.S. trade relations. She believes in the necessity of addressing systemic trade imbalances through diplomacy rather than escalating trade conflicts. Her careful navigation of the situation aims to protect European interests while promoting a cooperative framework for resolving disputes, ensuring that the EU remains a key player in shaping global trade policies even amid rising protectionist sentiments.

The Strategic Countermeasures of the EU Against U.S. Tariffs

In light of the new U.S. tariffs, the EU’s countermeasures are not just defensive actions but a strategic pivot aimed at reinstating balance in trade relationships. By targeting €26 billion worth of U.S. goods, including steel, aluminum, and various consumer products, the EU is making a decisive statement against unilateral tariff actions. These measures are designed to protect European industries from discriminatory practices while also sending a clear message to the U.S. about the potential fallout of continued tariff imposition.

Additionally, the planned counter-tariffs reflect the EU’s broader strategy to safeguard its economy and maintain trade integrity. As global trade tensions escalate, the EU’s approach under von der Leyen is indicative of a refusal to back down under pressure. The EU’s readiness to engage in tit-for-tat tariffs not only serves to protect its market but also emphasizes the importance of equitable trade practices in the face of aggressive tariff strategies from the U.S.

Navigating Global Trade Tensions Amidst U.S. Tariffs

The global trade landscape is undergoing significant transformations due to rising protectionism, especially exemplified by U.S. tariffs on EU products. These developments have heightened the importance of international cooperation and negotiation. The EU, under Ursula von der Leyen’s leadership, is prioritizing dialogues that foster collaborative trade solutions, essential in reducing the chaos that tariffs propagate. The European Commission aims to mitigate the adverse effects of such disruptions by solidifying its alliances and enhancing trade ties with other partners worldwide.

Moreover, addressing global trade tensions requires a multifaceted approach that considers the interests of all stakeholders involved. The EU’s emphasis on reducing trade barriers and advocating for fair practices serves as a crucial framework for responding to the economic ramifications of U.S. tariffs. As the world watches these developments unfold, the effectiveness of the EU’s strategies will play a pivotal role in shaping future trade policies and ensuring stability in the global economic environment.

The Future of EU-U.S. Trade Relations Post-Tariffs

The future of EU-U.S. trade relations is contingent upon the outcomes of ongoing negotiations amidst the tumult of newly imposed tariffs. The willingness of both sides to engage constructively will determine whether these tariffs evolve into a prolonged economic standoff or if they can be resolved through dialogue. As highlighted by von der Leyen, the EU’s approach remains focused on reducing barriers and avoiding escalation, signaling a desire for collaboration rather than conflict. Such a stance could pave the way for renewed agreements based on mutual understanding and equitable trade practices.

However, the persistent imposition of tariffs and counter-tariffs may lead to a re-evaluation of longstanding trade pacts and could necessitate a paradigm shift in how the EU and U.S. interact economically. Future discussions will need to prioritize addressing the underlying issues that prompted these tariffs, particularly those involving systemic trade imbalances. The path forward will require both parties to seek common ground, highlighting the critical nature of diplomatic engagements in restoring stability to international trade.

The Economic Ramifications of U.S. Tariffs on European Industries

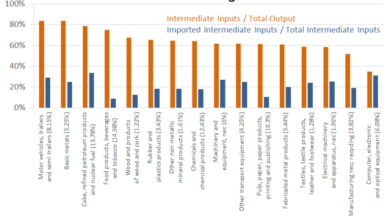

The imposition of tariffs by the U.S. on EU products threatens to disrupt European industries significantly. Sectors such as agriculture, manufacturing, and technology are projected to experience adverse effects as U.S. consumers face increased prices on imported goods. This escalation could lead to longer-term economic repercussions for both regions, impacting jobs and market competitiveness. Von der Leyen’s concerns about the chaotic nature of U.S. trade policies highlight the vulnerability that European industries face as they adapt to a rapidly changing trade environment.

Furthermore, the EU’s countermeasures are indicative of its commitment to protecting its industries from the fallout of U.S. tariffs. While intended as protectionist economic strategies, these tariffs may also ignite competitive retaliatory measures that could further destabilize both economies. European industries may need to innovate and adapt to remain competitive while seeking alternative markets. As the situation progresses, the economic implications will compel policymakers to reevaluate their strategies to safeguard growth and stability.

Reassessing Global Trade Dynamics During Heightened Tensions

The current climate of heightened trade tensions necessitates a reassessment of global trade dynamics, particularly with the U.S. and EU at the forefront. The reliance on tariffs as a primary trade tool has profound implications for the stability of trade relations. Von der Leyen’s call for a more organized approach indicates a growing recognition among trade leaders that constructive engagement is vital. The interconnected nature of global economies means that the impact of U.S. tariffs extends far beyond bilateral relations, influencing trade flows and economic policies worldwide.

As nations grapple with trade uncertainties, it is essential to explore alternative solutions that promote economic cooperation rather than friction. The EU’s strategy of countermeasures encapsulates this necessary shift towards more inclusive trade discussions. By advocating for a re-examination of trade rules and practices, the EU seeks to foster an environment where sustainable and equitable trade can flourish, emphasizing the significance of collaboration in addressing global economic challenges.

The Role of Diplomatic Engagement in Trade Disputes

Diplomatic engagement is crucial in navigating the complex terrain of trade disputes, particularly in light of U.S. tariffs on EU products. The rising tensions underscore the importance of dialogue in mitigating conflicts that arise from unilateral actions. Ursula von der Leyen’s emphasis on open discussions highlights the EU’s belief that diplomatic channels are vital for resolving disputes effectively. By fostering such engagement, the EU aims to counteract the potential fallout of tariffs while advocating for a return to fair trade practices.

Moreover, successful diplomatic engagement could lead to effective negotiation outcomes that benefit all parties involved. As trade leaders explore avenues for cooperation, they must prioritize building trust and mutual understanding to create a conducive atmosphere for discussions. The EU’s proactive approach to maintaining relations amid these challenges reiterates the need for states to engage diplomatically, thereby forming the foundation for robust and sustainable trade partnerships in the future.

Frequently Asked Questions

What are the EU countermeasures against U.S. tariffs and their impact?

The EU is preparing countermeasures against new U.S. tariffs, particularly a 20% tariff imposed on EU products. These counter-tariffs aim to target approximately €26 billion (around $28 billion) worth of U.S. goods, impacting items from industrial-grade steel to bourbon. The EU’s response reflects its strategy to mitigate the negative effects of U.S. trade policies on global trade relations.

How are U.S. tariffs impacting EU trade relations?

U.S. tariffs have strained EU-U.S. trade relations by prompting the EU to consider imposing counter-tariffs on American products. The tariffs are viewed as a significant blow to the global economy and highlight the chaotic nature of U.S. trade policies that affect multiple trading partners, leading to increased global trade tensions.

What did Ursula von der Leyen say about U.S. trade policies?

Ursula von der Leyen criticized U.S. trade policies as chaotic, pointing out the lack of order and clear direction in the current tariff strategies. She emphasized that relying on tariffs will not resolve systemic trade imbalances and that the EU is committed to reducing trade barriers rather than escalating them.

What specific products will the EU target with its counter-tariffs against U.S. goods?

The EU plans to implement counter-tariffs on a variety of U.S. products, including industrial-grade steel and aluminum, as well as consumer goods like bourbon and agricultural items. These countermeasures are a direct response to the recent U.S. tariffs and aim to protect the EU’s trade interests.

Why is the EU responding with countermeasures to U.S. tariffs?

The EU’s countermeasures are a strategic reaction to protect its economic interests against what it views as unbalanced U.S. tariffs. As global trade tensions rise, these measures are intended to assert the EU’s position in international trade discussions and maintain fair trade practices.

What are the potential consequences of rising global trade tensions between the EU and the U.S.?

Rising global trade tensions between the EU and the U.S. could lead to significant economic instability, impacting multiple economies, particularly vulnerable nations. The uncertainty surrounding these tariffs could challenge the stability of the global market and hinder future trade negotiations.

How does the EU’s response to U.S. tariffs reflect its trade policies?

The EU’s response to U.S. tariffs underscores its commitment to fair trade practices and its desire to reduce trade barriers. By preparing countermeasures, the EU is signaling its readiness to protect its economic interests while promoting a collaborative rather than confrontational approach to global trade policy.

What role does Ursula von der Leyen play in shaping EU trade response to U.S. tariffs?

As the President of the European Commission, Ursula von der Leyen plays a crucial role in shaping the EU’s trade response. Her leadership and statements on U.S. tariffs highlight the EU’s strategic approach to navigating complex trade negotiations and maintaining robust trade relations amidst rising protectionist measures.

| Key Point | Details |

|---|---|

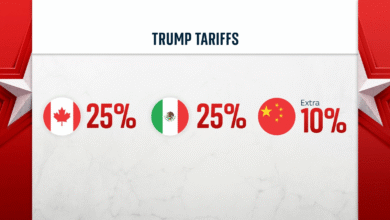

| EU Preparation for Countermeasures | The European Union, led by Commission President Ursula von der Leyen, is preparing additional countermeasures against new U.S. tariffs. |

| Imposition of U.S. Tariffs | U.S. President Donald Trump imposed tariffs set at 20% on EU products, which von der Leyen described as damaging to the global economy. |

| Criticism of U.S. Trade Policy | Von der Leyen criticized U.S. trade policies for their chaotic nature, highlighting a lack of order and a clear strategy. |

| EU’s Strategic Response | The EU plans to implement counter-tariffs on €26 billion worth of U.S. goods, including industrial products and consumer items. |

| Anticipated Impact of Tariffs | The counter-tariffs are expected to take effect by mid-April and may escalate trade tensions between the EU and the U.S. |

| Global Market Concerns | There are growing concerns about how the rising protectionist sentiments will impact global economies, especially vulnerable nations. |

Summary

The EU countermeasures against US tariffs showcase the bloc’s strategic response to escalating trade tensions initiated by the U.S. These proposed tariffs not only aim to protect European interests but also reflect a broader concern over the chaotic nature of U.S. trade policies. As negotiations continue, the EU’s commitment to reducing trade barriers rather than escalating the conflict underlines the complexity of global trade relations today.