Bitcoin Reserve Pakistan: Government Creates Confusion

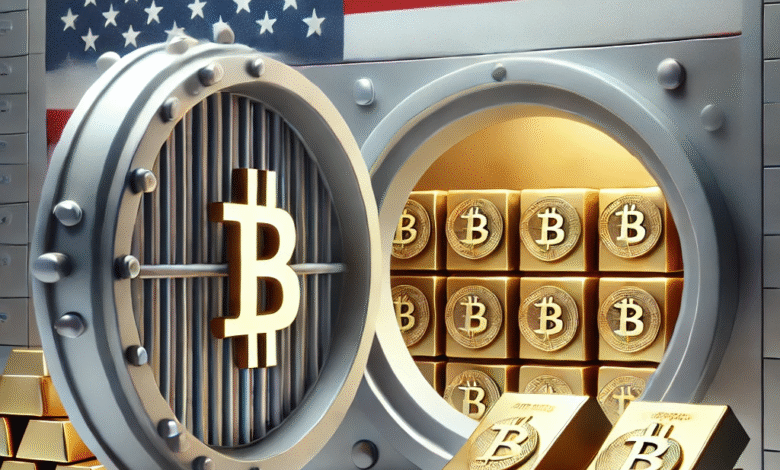

Bitcoin Reserve Pakistan has recently captured the attention of both local and international investors with its ambitious plans to establish a state-backed Bitcoin reserve. This bold initiative was prominently announced during the Bitcoin Vegas 2025 Conference, where significant strides were outlined by Pakistan’s Special Assistant to the Prime Minister. However, these plans faced immediate backlash as top officials refuted any changes in cryptocurrency regulations in Pakistan, emphasizing that current policies still deem cryptocurrency illegal. The conflicting messages have raised questions about the future of Pakistan’s engagement with digital assets, especially amidst ongoing discussions regarding the Pakistan Crypto Council’s role in streamlining these innovations. As the nation grapples with its stance on Bitcoin mining and digital currencies, the potential for a thriving crypto economy remains uncertain yet intriguing, particularly for foreign investment and local entrepreneurs.

The recent developments surrounding Pakistan’s plans for a national Bitcoin reserve have sparked considerable interest, particularly regarding the nation’s approach to virtual currencies. Following a bold announcement at a key cryptocurrency conference, officials found themselves embroiled in a wave of controversy, with statements from finance authorities clarifying that current regulations deem these digital assets illegal. While the notion of establishing a dedicated cryptocurrency reserve remains appealing to many, concerns linger about the lack of a legal framework governing such initiatives. Furthermore, discussions about cryptocurrency mining and regulation reveal a complex landscape, at odds with the aspirations of a burgeoning digital economy. As Pakistan navigates these turbulent waters, the balance between fostering innovation and adhering to existing financial regulations will be crucial for the future of its cryptocurrency sector.

Bitcoin Reserve Pakistan: A Glimpse into the Future of Digital Finance

The prospect of a Bitcoin Reserve in Pakistan represents a seismic shift in the nation’s approach to cryptocurrency and digital finance. With the announcement by Bilal Bin Saqib at the Bitcoin Vegas 2025 Conference, the dream of integrating cryptocurrencies into the mainstream economy seemed tangible. This initiative promised to utilize surplus electricity for mining operations while potentially placing Pakistan on the map as a crypto hotspot. For many, a state-backed Bitcoin Reserve signifies a commitment to modernizing the financial landscape and harnessing technology to attract foreign investments.

However, the immediate disavowal by senior government officials raises critical questions about the momentum of these initiatives. Without substantial regulatory support and a clear legal framework, visions of a Bitcoin Reserve may remain just that—visions. The legal uncertainty surrounding Pakistan’s cryptocurrency regulations casts a shadow over potential investments and developments in the digital assets space. Stakeholders must navigate these turbulent waters, balancing innovation with regulatory compliance to achieve meaningful progress.

Frequently Asked Questions

What is the current status of Bitcoin mining regulations in Pakistan?

As of now, cryptocurrency regulations in Pakistan remain strict, with Bitcoin mining under scrutiny. Officials have stated that cryptocurrencies like Bitcoin are illegal under existing laws. However, there is ongoing dialogue about creating a legal framework that may support initiatives such as the proposed Bitcoin Reserve. This ongoing regulatory environment reflects the complexities of aligning Bitcoin mining with Pakistan’s energy policies and economic strategies.

How does Bitcoin Vegas 2025 relate to Pakistan’s cryptocurrency initiatives?

At the Bitcoin Vegas 2025 conference, Pakistan’s Special Assistant to the Prime Minister announced bold plans for a Strategic Bitcoin Reserve. This event showcased Pakistan’s potential involvement in the global cryptocurrency landscape, despite subsequent denials by government officials about the legal status of cryptocurrencies in the country. The conference was seen as a significant opportunity to position Pakistan as a future hub for digital assets.

What role does the Pakistan Crypto Council play in the country’s digital finance strategy?

The Pakistan Crypto Council, led by Bilal Bin Saqib, is pivotal in shaping the country’s approach to cryptocurrency and blockchain technology. Its formation coincides with efforts to explore the integration of digital assets like Bitcoin into Pakistan’s financial system and the development of a regulatory framework to support such initiatives.

Will Pakistan’s plans for a Bitcoin Reserve impact its digital economy?

While the announcement of a Bitcoin Reserve generated excitement, the conflicting statements from officials raise uncertainty. If implemented, digital assets like Bitcoin could potentially drive innovation and attract foreign investment, further integrating Pakistan into the global digital economy. However, critics caution against the volatility associated with cryptocurrencies.

How is Pakistan addressing concerns from the International Monetary Fund (IMF) regarding cryptocurrency?

The IMF has expressed concerns regarding the speculative nature of cryptocurrencies and the implications of subsidizing Bitcoin mining through public funds. As Pakistan formulates its cryptocurrency regulations, these concerns will be essential in guiding the legal framework that supports a balanced approach to digital assets while ensuring economic stability.

What initiatives are in place to support the development of digital assets in Pakistan?

The recent establishment of the Pakistan Digital Assets Authority aims to develop a regulatory framework compliant with international standards, such as those set by the Financial Action Task Force (FATF). This authority is tasked with overseeing virtual asset service providers and integrating blockchain technology, positioning Pakistan to better navigate the global crypto landscape.

What are the potential benefits of establishing a Bitcoin Reserve in Pakistan?

If successfully implemented, a Bitcoin Reserve in Pakistan could catalyze innovation, attract foreign capital, and enhance the country’s integration into the global financial system. Supporters of this initiative believe that leveraging Bitcoin and other digital assets could diversify the economy and modernize financial services.

| Key Point | Details |

|---|---|

| Bitcoin Reserve Announcement | Pakistan announced plans for a Strategic Bitcoin Reserve at the Bitcoin Vegas 2025 Conference, aiming to integrate decentralized finance. |

| Government Contradiction | Top officials quickly denied any formal policy change, emphasizing that cryptocurrency remains illegal in Pakistan. |

| Role of Bilal Bin Saqib | Bilal Bin Saqib, the Special Assistant to the Prime Minister, led the announcement and is also the CEO of the Pakistan Crypto Council. |

| Pakistan Digital Assets Authority | Newly formed authority focuses on creating a regulatory framework for digital assets and compliance with international standards. |

| Internal and External Criticism | Critics, including the IMF, have raised concerns about the volatility of cryptocurrencies and their impact on public funds and electricity subsidies. |

| Potential Economic Impact | Supporters argue that embracing digital assets could attract foreign investment and position Pakistan effectively in the global financial landscape. |

Summary

Bitcoin Reserve Pakistan has sparked significant interest and controversy in the crypto community with its ambitious announcements. While the potential for a Bitcoin reserve could drive economic growth and innovation, the swift government rejections highlight a disconnect in policy and regulation that must be addressed. As Pakistan navigates its stance on cryptocurrency, balancing innovation with regulatory caution will be critical in shaping its digital economy.