U.S. Ukraine Minerals Deal: Landmark Agreement Signed

The recent U.S. Ukraine minerals deal marks a significant milestone as the two nations forge a promising economic partnership following extended negotiations. Under this landmark agreement, the United States gains preferential access to Ukraine’s rich natural resources, a crucial step aimed at rebuilding Ukraine post-conflict. This deal, heavily advocated by former President Donald Trump, comes at a pivotal time when the nation is striving to recover from the impacts of Russia’s invasion. By establishing a reconstruction investment fund, both countries aim to strengthen their financial ties while demonstrating a unified front against aggression. As the situation evolves, the minerals deal Ukraine represents not just financial aid but a strategic alliance for sustainable growth.

In a powerful move to enhance collaborative efforts, the agreement between the U.S. and Ukraine on rare earth resources signifies a robust natural resources arrangement. By engaging in this substantial economic accord, the two nations aim to revitalize Ukraine’s economy through shared investment initiatives. This alliance echoes President Trump’s vision for a thorough reconstruction fund aimed at compensating for American support in the ongoing conflict. As Kyiv looks to bolster its mineral extraction capabilities, the partnership underscores a commitment to mutual development while navigating regional challenges. The agreement encapsulates a strategic framework for prosperity that aligns both nations amidst ongoing geopolitical tensions.

Overview of the U.S. Ukraine Minerals Deal

The recent minerals deal between the U.S. and Ukraine marks a significant milestone in their economic partnership. This agreement, which provides the United States with preferential access to Ukraine’s vast natural resources, aims to bolster Ukraine’s economy while ensuring mutual benefits for both nations. Following extensive negotiations, this landmark deal not only reflects the strategic importance of Kyiv’s resources but also highlights the ongoing collaboration in response to geopolitical tensions, particularly amidst the ongoing conflict with Russia.

Yulia Svyrydenko, Ukraine’s Minister of Economic Development and Trade, emphasized that this agreement could greatly enhance both U.S. and Ukrainian economies. The deal facilitates the creation of a reconstruction investment fund, which is crucial for rebuilding efforts in Ukraine as it continues to recover from the impacts of war. This partnership underscores the United States’ commitment to supporting Ukraine’s sovereignty and economic stability, ultimately aiming for a prosperous future.

Impact of the Minerals Deal on U.S.-Ukraine Economic Partnership

The U.S. Ukraine minerals deal is poised to redefine the economic landscape between the two countries, enhancing their longstanding partnership. This collaboration is not merely about resource extraction; it embodies a shared vision for economic recovery and stability in the region. By giving the U.S. preferential access to Ukrainian minerals, the agreement will deepen bilateral ties while promoting investment in Ukraine’s reconstruction efforts.

Furthermore, this deal serves as a catalyst for future initiatives aimed at strengthening the economic partnership. In addition to ensuring access to key natural resources, it reinforces the framework for ongoing cooperation in technology transfer, sustainable development, and security collaboration. The minerals deal is a testament to the potential of strategic agreements in fostering a resilient economic relationship between the U.S. and Ukraine.

Significance of Rare Earth Minerals in the Deal

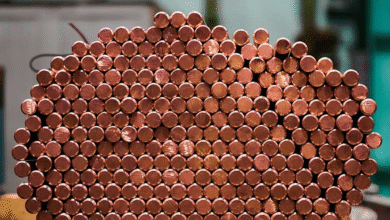

The inclusion of rare earth minerals in the U.S. Ukraine minerals deal signifies a strategic maneuver in the global supply chain landscape. Rare earth elements are critical for various high-tech applications, including renewable energy technologies, defense systems, and electronics. By enabling access to these valuable resources, Ukraine stands to enhance its role as a key player in the global market for critical minerals.

This agreement not only highlights the importance of Kyiv’s rare earth minerals but also indicates a shift towards prioritizing domestic resource development in the context of U.S. geopolitical interests. With the ongoing demand for these minerals growing worldwide, the partnership promises significant economic return while also fortifying national security profiles for both countries.

Collaboration on the Reconstruction Investment Fund

As part of the minerals deal, the establishment of a reconstruction investment fund is critical to addressing the extensive economic challenges Ukraine faces due to the war. This fund will be developed on a collaborative basis, ensuring that both the U.S. and Ukraine share equally in decision-making processes. Such an equitable structure not only reinforces partnership principles but also inspires confidence in the fund’s management.

The innovative approach to designing this fund reflects a commitment to transparent governance and responsible resource management. By leveraging U.S. investment along with Ukrainian resources, the fund aims to catalyze growth and facilitate the recovery of affected regions. This collaborative model could serve as a blueprint for other nations seeking to rebuild in the aftermath of conflict.

Political Context Surrounding the Minerals Deal

The political backdrop of the U.S.-Ukraine minerals deal is essential to understanding its significance. The agreement comes after a tumultuous period marked by Russia’s military aggression, which has prompted U.S. leadership to take definitive action in supporting Ukraine. U.S. President Donald Trump’s administration has been vocal about its dedication to fostering peace and stability in the region, using this minerals deal as one of the tools to demonstrate commitment.

Moreover, this deal sends a clear message to antagonistic forces, particularly Russia, about the U.S. support for Ukraine’s sovereignty. By aligning economic cooperation with security interests, the deal is not merely a transactional agreement; it signifies a strategic partnership that is vital to countering the influence of hostile actors in the region.

Future Prospects of the U.S.-Ukraine Minerals Deal

Looking ahead, the future of the U.S.-Ukraine minerals deal appears promising, with much potential for growth and collaboration. As Ukraine continues to develop its rich natural resources, the partnership may evolve beyond minerals, expanding into areas such as renewable energy and technological innovation. The focus on various sectors aligns with global trends towards sustainability and resilience.

Additionally, as the reconstruction fund begins to take shape, it could unlock significant opportunities for U.S. businesses and investors. Engagement in Ukraine’s market not only offers access to valuable resources but also the chance to be part of a larger narrative of reconstructing and revitalizing a nation. The convergence of these elements positions both countries for a fruitful and strategic partnership in the future.

Challenges and Considerations of the Minerals Deal

While the U.S. Ukraine minerals deal presents numerous opportunities, it is not without challenges. Concerns over security, regulatory compliance, and environmental sustainability are paramount as both nations forge ahead with the agreement. The ongoing conflict necessitates a careful approach to ensure that operations can be conducted safely and effectively, without compromising the local population or ecological balance.

Moreover, transparency in managing the extraction and distribution of resources will be critical to building trust between both parties. Ensuring that the reconstruction fund is utilized effectively to benefit Ukrainians directly is vital for long-term success. The partnership must confront these challenges collectively, ensuring that the framework established not only supports economic goals but also prioritizes the welfare of communities affected by resource extraction.

Role of Trump in the U.S. Ukraine Minerals Deal

Donald Trump’s administration has played a pivotal role in bringing the U.S. Ukraine minerals deal to fruition. His commitment to economic support for Ukraine during its ongoing conflict with Russia is evident through his proactive approach to establishing this agreement. Trump has consistently advocated for policies that prioritize U.S. interests while simultaneously fostering international partnerships.

The former President’s interactions with Ukrainian leadership, including discussions at significant forums, underscore his dedication to securing a beneficial partnership. This engagement has been crucial in shaping the terms of the minerals deal, ensuring that it aligns with broader U.S. foreign policy goals while providing Ukraine with essential resources for recovery.

Local Economic Implications of the Minerals Deal

The signing of the U.S. Ukraine minerals deal carries profound implications for local economies in Ukraine. By granting access to valuable mineral resources and establishing a reconstruction investment fund, the agreement promises to stimulate job creation and enhance local industries. This is particularly important for regions directly affected by the ongoing war, where economic activity has severely declined.

As mineral extraction projects commence, local communities stand to benefit not only from employment but also from infrastructural investments tied to these operations. This focus on revitalizing local economies contributes to a broader goal of achieving sustainable development in post-conflict Ukraine, helping to restore confidence and optimism among citizens.

Environmental Considerations in the Minerals Deal

As the U.S. and Ukraine advance with the minerals deal, careful attention to environmental considerations is paramount. The extraction of natural resources, particularly in sensitive regions affected by war, poses challenges that must be addressed collaboratively. Environmental sustainability practices should be ingrained in the operational framework to mitigate adverse impacts on local ecosystems and communities.

Implementing robust environmental safeguards will not only protect Ukraine’s rich natural heritage but also ensure that the reconstruction efforts are aligned with global sustainability standards. This commitment to responsible resource management will enhance the legitimacy of the minerals deal while fostering a reputation for accountability and care in the industry.

Frequently Asked Questions

What does the U.S. Ukraine minerals deal entail?

The U.S. Ukraine minerals deal involves granting the United States preferential access to Ukraine’s natural resources, including rare earth minerals, in exchange for establishing a reconstruction investment fund. This agreement aims to enhance economic partnerships and aid in Ukraine’s recovery after the conflict with Russia.

How will the U.S. Ukraine economic partnership benefit both nations?

The U.S. Ukraine economic partnership, established through the minerals deal, is designed to bolster economic recovery for Ukraine and increase U.S. access to critical minerals and resources. By collaborating on the extraction and monetization of natural resources, both countries aim to achieve mutual economic success.

What role does the Trump Ukraine reconstruction fund play in the minerals deal?

The Trump Ukraine reconstruction fund is a key component of the U.S. Ukraine minerals deal, designed to facilitate investments in Ukraine’s recovery. It serves as a financial mechanism through which the U.S. can support Ukraine while benefiting from access to its valuable natural resources, including critical minerals.

What are the implications of the minerals deal for Kyiv’s rare earth minerals?

The minerals deal signifies a strategic partnership for Ukraine to leverage its rare earth minerals effectively. It grants the U.S. access to these critical resources, encouraging investments in their extraction while allowing Ukraine to control the operational aspects of resource development.

How long did negotiations for the minerals deal between the U.S. and Ukraine take?

Negotiations for the U.S. Ukraine minerals deal took several months, culminating in a successful agreement after repeated discussions and modifications, reflecting both nations’ commitment to a cooperative economic strategy.

What message does the U.S. Ukraine minerals deal send to Russia?

The U.S. Ukraine minerals deal sends a strong message to Russia, indicating that the Trump Administration remains committed to supporting Ukraine’s sovereignty and economic resilience. It underscores the collaborative efforts aimed at a peaceful resolution to the ongoing conflict.

What are critical minerals, and why are they important in the U.S. Ukraine minerals deal?

Critical minerals, including rare earth elements, are essential for various industries, including technology and defense. In the context of the U.S. Ukraine minerals deal, they represent valuable resources for the U.S., facilitating supply chain security while promoting economic growth for Ukraine.

What was the initial framework of the deal, and who was involved in the discussions?

The initial framework of the U.S. Ukraine minerals deal was agreed upon by U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskyy, with discussions reportedly taking place during high-profile meetings, such as at Pope Francis’ funeral.

How will the U.S. and Ukraine ensure equal partnership in the minerals deal?

To ensure an equal partnership in the minerals deal, both the U.S. and Ukraine will develop the reconstruction fund on a 50-50 basis. This structure is designed to give both nations equal input and decision-making power over resource extraction and investment strategies.

What impact will the minerals deal have on Ukraine’s economic recovery?

The minerals deal is expected to significantly impact Ukraine’s economic recovery by facilitating investments in infrastructure, job creation, and resource management, enabling Ukraine to rebuild its economy while providing the U.S. with access to essential natural resources.

| Key Point | Details |

|---|---|

| Deal Signing | The U.S. and Ukraine signed a minerals deal on May 1, 2025. |

| Economic Benefits | The deal grants the U.S. preferential access to Ukraine’s natural resources in exchange for a reconstruction investment fund. |

| Political Context | The agreement was pursued by U.S. President Donald Trump as a strategic response to Russia’s invasion of Ukraine. |

| Negotiation Background | The deal came after months of challenging negotiations, reflecting both nations’ commitment to economic recovery. |

| Equitable Partnership | The fund will be developed on a 50-50 basis, ensuring equal partnership between the U.S. and Ukraine. |

| Future Implications | The deal is seen as a message to Russia about the U.S.’s dedication to a sovereign Ukraine. |

Summary

The U.S.-Ukraine minerals deal marks a significant milestone in the relationship between the two nations, providing the U.S. preferential access to Ukraine’s rich natural resources while facilitating economic recovery and reconstruction efforts. As both countries navigate the aftermath of conflict, this agreement stands as a testament to their commitment to collaboration in achieving long-term prosperity and stability. The partnership not only aims to enhance Ukraine’s resource management but also reinforces international support against aggression, signaling a unified front in the pursuit of peace and sovereignty.