Federal Reserve Interest Rate Meetings: Judge Rejects Public Access

The Federal Reserve interest rate meetings are pivotal events in the financial calendar, where the Federal Open Market Committee (FOMC) gathers to determine interest rate policies that can shape the economic landscape. Led by Chairman Jerome Powell, these meetings are closely monitored by investors, analysts, and policymakers alike due to their far-reaching implications on inflation, employment, and economic stability. Recent discussions have stirred controversy, especially surrounding transparency and the legality of keeping such meetings closed to the public. Under scrutiny, the FOMC’s practices have raised questions about government transparency, particularly as some advocate for greater access under the Sunshine Act. As rates fluctuate and economic indicators signal shifts, the decisions made during these high-stakes meetings remain essential for navigating the complexities of today’s financial world.

Interest rate deliberations by the central bank play a crucial role in influencing the economy, drawing attention not only from financial experts but also from everyday citizens feeling the effects of monetary policy. These crucial discussions convened by the Federal Open Market Committee (FOMC) are sometimes enveloped in calls for openness, reflecting a public desire for insight into the Federal Reserve’s decision-making processes. Recently, the debate has intensified around the principles of government transparency, as critics question the appropriateness of private meetings that determine rates impacting everything from consumer loans to mortgage rates. Meanwhile, figures like Jerome Powell find themselves navigating legal challenges regarding the public’s right to know versus the institution’s operational privacy. As the economic climate evolves, so too does the scrutiny surrounding these emblematic discussions that determine the course of interest rates.

Understanding the FOMC and Its Interest Rate Meetings

The Federal Open Market Committee (FOMC) is a critical component of the U.S. Federal Reserve system, responsible for making key decisions about interest rate policies that influence the economy. These meetings, typically held several times a year, are where the committee evaluates economic conditions and determines whether to raise, lower, or maintain interest rates. This delicate balance impacts everything from inflation levels to consumer borrowing rates, making the outcomes of these meetings highly anticipated by economists and investors alike.

Despite their significance, FOMC meetings have historically been held behind closed doors, sparking discussions about government transparency. Critics argue that the decisions made in these meetings should be accessible to the public to foster accountability. The ongoing debate highlights the tensions between the need for confidential discussion during the decision-making process and the public’s right to understand how monetary policy is shaped.

The Role of Jerome Powell in Monetary Policy

As the Chairman of the Federal Reserve, Jerome Powell plays a pivotal role in shaping the monetary policy landscape of the United States. Appointed in 2018, Powell has led numerous FOMC meetings where critical interest rate decisions are made. His leadership style has often been characterized by a commitment to transparency, yet he has maintained the necessity of conducting meetings privately to ensure candid discussions about economic forecasts.

Powell’s approach has not come without scrutiny, particularly following legal challenges like the recent lawsuit from Azoria Capital. The suit emphasized the call for greater transparency, underlining tensions between Powell’s policy decisions and public expectation. As the Fed navigates complex economic challenges, Powell’s leadership will continue to be scrutinized, balancing the need for transparency with the importance of strategic discretion in interest rate policies.

Impact of Government Transparency on Monetary Policy Decisions

Government transparency is a cornerstone of democratic governance, promoting trust and accountability among citizens. In the context of monetary policy, transparency regarding interest rate meetings has become a focal point in discussions about how the Federal Reserve communicates with the public. Advocates argue that making FOMC meetings accessible would demystify the processes behind economic decisions that directly impact individuals and businesses.

However, the need for confidentiality in these settings is often cited by Federal Reserve officials as essential for candid discussion and robust decision-making. The debate continues to revolve around the Sunshine Act’s relevance to the FOMC and its accountability. While the recent ruling against public access may have upheld the Fed’s current operational procedures, it highlights an ongoing struggle for transparency in government that advocates will continue to pursue.

Legal Challenges to Fed’s Closed-Door Policy

The recent legal challenge initiated by James Fishback of Azoria Capital aimed to overturn the Federal Reserve’s closed-door policy regarding FOMC meetings, asserting that it violates the Sunshine Act. This legal maneuver underscores the confluence of finance and public policy, raising questions about the jurisdiction of the Federal Reserve as it operates independently of typical federal agency oversight. The dismissal of this lawsuit by Judge Beryl Howell not only reinforces the Fed’s operational structure but also shines a light on the broader implications of attempts to disrupt established practices.

Such legal challenges, though they may not succeed, initiate crucial conversations about the balance of power between government institutions and the citizenry’s right to access information. The result of this case serves as a reminder that while legal actions can draw attention to issues of transparency, the intricacies of monetary policy governance often remain arcane to the general public. A deeper understanding of these legal frameworks could empower citizens to engage more actively in discussions around monetary policy.

Public Reaction to Interest Rate Decision-Legal Case

Public reactions to the lawsuit surrounding Jerome Powell’s closed-door meetings highlight a growing demand for accountability in government institutions. Many citizens express frustration over how decisions that affect the economy are made away from public scrutiny. Numerous commentators on social media have echoed Fishback’s sentiments about the need for transparency in Fed operations, particularly as interest rate changes have significant ramifications for the average American, impacting loan rates, credit availability, and inflation.

As discussions around this case permeate financial news, citizens are becoming increasingly aware of the relationship between legal frameworks and economic policy. This raises awareness of how monetary policies, while often seen as elite strategies, actually resonate with everyday experiences of economic hardship or benefit. The case has the potential to galvanize public opinion, prompting more calls for democratizing monetary policy discussions.

Jerome Powell’s Stance on Interest Rate Policies

Jerome Powell has consistently advocated for a measured approach to interest rate policies, emphasizing the importance of careful analysis before making changes. Under his leadership, the Federal Reserve has been cautious, often opting to maintain stability amidst uncertain economic conditions. This approach has been particularly relevant given the pressures from various political figures, including former President Donald Trump, who have urged aggressive rate cuts to stimulate economic growth.

Powell’s steadfastness in balancing the Fed’s independence with public and political discourse demonstrates the complexities inherent in monetary policy governance. As the FOMC prepares for its meetings, Powell’s insights will play a critical role in determining the direction of interest rates. This nuanced decision-making reflects his commitment to both economic stability and responsive governance.

The Sunshine Act and Its Implications for the Federal Reserve

The Sunshine Act, enacted in 1976, mandates that federal agencies conduct meetings in public to promote transparency. However, a recent ruling has clarified that the FOMC does not fall under this act, as it operates with a unique degree of independence from governmental oversight. This distinction raises questions about how transparency standards apply to monetary policy discussions and whether public opinion can influence operational changes within the Fed.

Although the act aims to ensure government accountability, its relevance to the FOMC suggests a complex relationship between public interest and institutional autonomy. As legal battles continue to challenge the status quo, the implications of the Sunshine Act may replay a significant role in discussions about governmental transparency in monetary policy. Advocates are likely to continue pushing for reforms that align the Fed’s practices more closely with the ideals of open governance.

Examination of Judicial Decisions Affecting Monetary Policy

Judicial decisions surrounding the Federal Reserve’s practices, including those related to interest rate meetings, can greatly impact public perception and trust in government institutions. The ruling from Judge Howell effectively upheld the Fed’s independence, reinforcing the notion that FOMC meetings can remain closed to public scrutiny. This decision has been met with mixed reactions, highlighting the dichotomy between the need for operational discretion and a public craving for transparency.

Understanding these judicial rulings is essential for those interested in how financial governance operates within the American system. The courts serve as a crucial check on governmental power, but they also reflect broader societal debates about transparency and accountability, particularly in institutions that manage the economy. As future legal challenges arise, active engagement with these judicial processes can illuminate the often-hidden mechanisms of and influences on monetary policy.

Future of Interest Rate Meetings in the Face of Legal Challenges

The landscape of Federal Reserve interest rate meetings may enter a new phase as the public and various stakeholders continue to push for greater transparency. Legal challenges like the one brought by Azoria Capital serve not only to contest current practices but also to ignite discussions around the potential reform of how the FOMC operates. Public interest in these meetings has increased, driven by economic circumstances and general skepticism about government operations.

Moving forward, the Federal Reserve may need to balance its traditional closed-door policies with emerging demands for reform. This balancing act will be pivotal, as the Fed navigates its role amid public scrutiny and evolving political landscapes. The outcomes of future interest rate decisions will likely be influenced not only by economic data but also by the ongoing dialogue surrounding government transparency and accountability.

Frequently Asked Questions

What are Federal Reserve interest rate meetings and how do they affect the economy?

Federal Reserve interest rate meetings, specifically the Federal Open Market Committee (FOMC) meetings, are crucial events where policymakers discuss and set interest rate policies that influence the economy. These meetings determine the federal funds rate, which affects borrowing costs for consumers and businesses, ultimately impacting economic growth, inflation, and employment.

Why are FOMC meetings closed to the public and what does this mean for government transparency?

FOMC meetings are closed to the public to allow for frank discussions among committee members without external pressure. While some argue this violates principles of government transparency, a judge ruled that the Federal Reserve is not subject to the Sunshine Act, which mandates public meetings for federal agencies. This decision maintains the closed-door policy for sensitive interest rate discussions.

What role does Jerome Powell play in the Federal Reserve interest rate meetings?

Jerome Powell serves as the chairman of the Federal Reserve and leads the FOMC meetings. His insights and decisions significantly influence interest rate policies and the overall direction of U.S. monetary policy. As the face of the Federal Reserve, Powell’s communications affect market expectations and financial stability.

How often do the Federal Reserve interest rate meetings occur?

The Federal Reserve holds interest rate meetings approximately every six weeks, resulting in eight scheduled FOMC meetings each year. During these meetings, the committee reviews economic conditions and decides on adjustments to interest rates to achieve the Fed’s dual mandate of controlling inflation and maximizing employment.

What are the potential implications of changing interest rates announced during FOMC meetings?

Changes to interest rates announced during FOMC meetings can have wide-reaching implications for the economy. Lowering rates can stimulate economic growth by making borrowing cheaper, while raising rates can help curb inflation. The Federal Reserve’s interest rate policies are crucial in managing economic cycles and fostering a stable financial environment.

What legal challenges have been made regarding the transparency of Federal Reserve interest rate meetings?

Legal challenges have arisen regarding the transparency of Federal Reserve interest rate meetings, particularly surrounding the claim that the FOMC violates the Sunshine Act. A notable case involved a lawsuit filed by Azoria Capital, which was dismissed by a judge who ruled that the Federal Reserve is not considered a federal agency and is therefore exempt from this public meeting requirement.

Why is the public interest in access to Federal Reserve interest rate meetings growing?

Public interest in access to Federal Reserve interest rate meetings is increasing due to concerns over monetary policy and its impact on economic stability. Many believe that greater government transparency would enhance accountability and allow citizens to better understand the decisions made regarding interest rate policies and their effects on the economy.

What are the typical outcomes of Federal Reserve interest rate meetings?

Typical outcomes of Federal Reserve interest rate meetings include announcements regarding whether to raise, lower, or maintain current interest rates. These decisions reflect the committee’s assessment of economic data, inflation trends, and employment levels, and are closely scrutinized by financial markets and economists for their potential impact on the economy.

| Key Point | Details |

|---|---|

| Judge Blocks Access Request | A judge dismissed the lawsuit to make FOMC meetings public, stating FOMC is not a federal agency. |

| Plaintiff’s Background | James Fishback from Azoria Capital filed the lawsuit; he has a controversial history including previous lawsuits. |

| Sunshine Act Defense | The lawsuit claimed violation of the 1976 Sunshine Act, but Judge Howell argued FOMC is exempt from this requirement. |

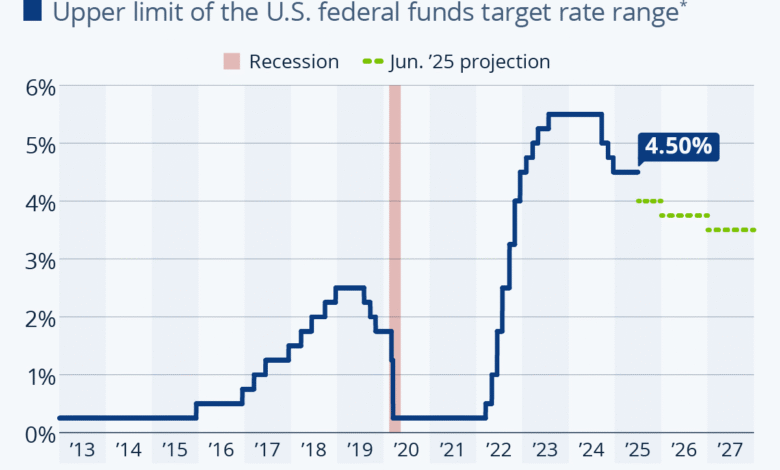

| Interest Rate Meeting Context | FOMC is meeting to decide on potential interest rate changes, with expectations to maintain current rates. |

| Political Dimensions | Fishback’s views parallel Trump’s call for reduced interest rates to address national debt. |

Summary

Federal Reserve interest rate meetings are crucial events where decisions impacting the entire economy are made. In recent developments, a judge has rejected a lawsuit aimed at making these meetings public, underscoring the Federal Reserve’s commitment to maintaining operational confidentiality. The lawsuit, filed by James Fishback of Azoria Capital, raised questions about transparency under the 1976 Sunshine Act, but the court clarified that the Federal Open Market Committee operates outside its jurisdiction. As the FOMC convenes to debate interest rate changes, the implications of these discussions resonate widely, influencing financial markets and broader economic policy.