Xpeng Electric Vehicle Growth: Deliveries Surge This Year

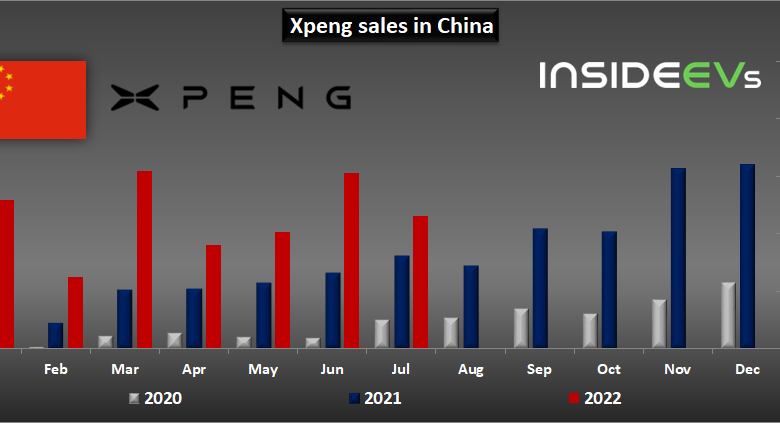

Xpeng electric vehicle growth is rapidly reshaping the landscape of the Chinese EV market, particularly as driver-assist technology becomes essential for modern driving experiences. With an impressive rise in Xpeng stock and a surge of over 30,000 car deliveries a month since November, the company is on a path toward maintaining its momentum. Expected sales projections point to a doubling by 2024, largely due to the popularity of the cost-effective Mona M03 and the advanced P7+ model equipped with cutting-edge driver-assist features, often at no extra cost. Bank of America has noted that strong model pipelines could solidify Xpeng’s robust growth, prompting analysts to increase their target prices significantly. As the company poised for profitability this year, observers are keenly watching how these developments will further accelerate its presence in the competitive EV sector.

The recent advancements in the electric vehicle sector, particularly regarding Xpeng’s expansion, highlight a transformative moment for the automotive industry in China. This local manufacturer is significantly benefiting from investments in technology that enhances driving assistance, allowing it to flourish amidst challenges in the EV landscape. With various new models, including the attractive Mona-branded vehicles, Xpeng is gaining traction not only in sales but also in public interest. As the focus on affordable EV options intensifies, key analysts underscore a favorable outlook for Xpeng’s future performance in the rapidly evolving market. With anticipated increases in production and sales volumes, the company is well-positioned to capitalize on the growing demand for innovative and accessible electric vehicles.

Xpeng Electric Vehicle Growth: A Rising Titan in the Chinese EV Market

In 2023, Xpeng has witnessed an impressive surge in growth, positioning itself as a formidable player in the Chinese electric vehicle (EV) market. As the demand for electric cars increases, particularly those equipped with advanced driver-assist technology, Xpeng’s innovative offerings have begun to resonate with consumers. Their commitment to integrating state-of-the-art features has not only bolstered their sales figures—reaching over 30,000 cars delivered monthly—but has also significantly increased their stock value, which has risen more than 80% this year. This remarkable growth trajectory underscores the company’s strategic focus on making EVs accessible and appealing to a broader audience, particularly with models like the Mona M03 and the P7+, which have gained substantial traction in the market.

Analysts predict that Xpeng’s growth will continue to accelerate as they expand their model lineup and enhance existing features. With plans for a greater emphasis on the cheaper Mona brand and the introduction of new vehicles, industry experts have raised their sales projections for Xpeng. This optimistic outlook is reflected in Bank of America’s analysis, which anticipates strong volume growth in the coming years, suggesting that Xpeng is not just riding the wave of current market trends but is also paving the way for long-term success in the EV sector.

Moreover, the Chinese EV landscape is rapidly evolving, with Xpeng at the forefront of these changes. As domestic competition intensifies, particularly from companies like BYD, Xpeng’s investment in driver-assist technology could be its ace in the hole for maintaining a competitive edge. Innovating within this realm allows Xpeng to differentiate itself, offering features that are increasingly becoming the standard in the market, such as L2 and aspiring to L3 autonomous capabilities. As the company gears up for significant model releases in 2025, its strategy appears firmly rooted in committing to sustainable growth backed by technological advancements.

The Impact of Driver-Assist Technology on Xpeng’s Market Position

Driver-assist technology has emerged as a pivotal factor influencing consumer preferences in today’s automotive landscape. Xpeng’s early commitment to integrating advanced driver-assist systems has positioned it uniquely to capitalize on this trend, particularly within the fiercely competitive Chinese EV market. The popularity of features like adaptive cruise control and lane-keeping assistance has made vehicles equipped with such technologies highly sought after, aligning well with the expectations of tech-savvy Chinese consumers. As these systems evolve from basic functionalities to more complex, semi-autonomous capabilities, Xpeng’s persistence in innovation is critical for its continued relevance and appeal in the market.

Bank of America analysts have highlighted that the strength of Xpeng’s model pipeline is likely to reinforce not only sales but also consumer confidence. As the automotive industry shifts towards autonomy, encompassing L2 and future L3 features, Xpeng’s ability to deliver cutting-edge technologies while maintaining affordability is essential for capturing a larger market share. The success of vehicle models like the P7+—which includes these advanced systems at no extra cost—illustrates that Xpeng is on the right track to meeting consumer demands and enhancing driver safety.

Additionally, as the market demands accelerate, the influence of driver-assist features is expected to grow, potentially driving Xpeng’s sales projections even higher. With increasing consumer awareness and preference for vehicles that promise safety and ease of use, Xpeng stands to benefit substantially as it continues to innovate. However, the company must remain vigilant of competition, particularly from industry heavyweights like Tesla and BYD, who are also advancing in this space. Xpeng’s proactive approach, combined with its established reputation for quality and safety, should enable it to maintain growth momentum amidst ongoing market changes.

Xpeng Stock Rise: Analyzing Current Trends

The recent surge in Xpeng’s stock, reflecting an increase of more than 80% this year, points to a growing investor confidence in the company’s strategic direction and market placement. Analysts attribute this rise not just to immediate sales figures but also to the long-term vision that Xpeng demonstrates through its commitment to innovation in driver-assist technology and sustainable vehicle production. Price target revisions from firms like Bank of America and Barclays serve as indicators of optimism, further enhancing Xpeng’s allure in the investment community. These adjustments signify not only a recognition of current performance but also expectations of continuous growth, especially with new model releases underway.

The mount in stock performance follows notable trends in the overall EV market, where player diversification and technological advancements, like BYD’s fast-charging technology, encourage investor enthusiasm. Xpeng’s capacity to pivot and adapt in response to market demands shows shareholders a promising future. Whether through its competitive pricing strategy or the ongoing development of key models equipped with advanced technology, stakeholders are betting on Xpeng to maintain its upward trajectory. Moreover, as consumers continue to flock towards vehicles with superior tech capabilities, this presents a favorable environment for Xpeng’s investments to flourish.

Despite recent fluctuations in share prices following a remarkable ascent earlier this month, analysts remain positive about Xpeng’s long-term prospects. The company’s strategy to double sales and maintain a consistent delivery pace aligns with broader market trends and consumer preferences, indicating a healthy outlook. J.P. Morgan’s adjusted earnings projections reaffirm the notion that Xpeng is strategically positioning itself well within the dynamic landscape of the Chinese EV market. As the firm plans significant investment in research and development to enhance its offerings, the future appears bright for investors who perceive potential in a forward-thinking automaker like Xpeng.

The Competitive Landscape of the Chinese EV Market

The competitive landscape of the Chinese EV market is increasingly intense, with numerous startups and established automakers vying for dominance. Xpeng has managed to carve out a niche by focusing heavily on technology, particularly driver-assist systems, which have become a key selling point for consumers who prioritize safety and innovation. With the market projected to grow, other companies are consistently innovating, introducing new models that compete directly with those of Xpeng. It is essential for Xpeng to focus not just on current offerings but also on anticipating future trends and consumer demands to sustain its market share amidst fierce competition.

Additionally, as leading automakers such as BYD and Tesla expand their product lines and technological offerings, Xpeng must leverage its strengths in driver-assist technology to maintain an edge. The introduction of more affordable vehicles, along with premium models, has broadened Xpeng’s appeal. Analysts speaking about the competitive landscape emphasize the need for continuous innovation and adaptability to meet the evolving expectations of the increasingly tech-savvy consumer base in China. The ability of Xpeng to innovate while keeping prices competitive will be central to its growth strategy.

In navigating this highly competitive environment, Xpeng’s strategic focus on the affordability of their models like the Mona M03—paired with cutting-edge technology—positions the company to attract a wider demographic of potential buyers. However, the successful execution of marketing and product placement will be crucial. The growing consumer expectation for driver-assist technologies as standard features means that Xpeng must not only meet these expectations but also differentiate its models from those of competitors. This necessitates a thorough understanding of market dynamics and consumer preferences—a challenge that Xpeng appears well-equipped to tackle as it continues to evolve its offerings in the fast-paced Chinese EV market.

Xpeng’s Sales Projections: Future Growth and Profitability

Looking ahead, Xpeng’s sales projections suggest an ambitious yet attainable future marked by sustained growth and profitability. As outlined in recent earnings presentations, Xpeng anticipates doubling its sales by 2024, fueled by a robust delivery pace that has already reached consistent monthly figures since late 2022. This forward-looking approach is further reinforced by strong analyst sentiment, underscoring the credibility of Xpeng’s optimistic forecasts. As consumer demand for electric vehicles continues to rise, driven in part by growing environmental awareness and government incentives, Xpeng’s projections seem increasingly plausible, creating a favorable investment outlook for stakeholders.

Moreover, with the strategic launch of new models combined with enhancements to existing ones, Xpeng is positioning itself to tap into various market segments. The introduction of models featuring advanced driver-assist systems is expected to captivate a broad audience, enhancing Xpeng’s presence in both the domestic and global EV markets. As outlined by analysts, maintaining this trajectory towards sustained sales and profitable operations will hinge upon Xpeng’s ability to remain agile in responding to shifting consumer preferences and competitive pressures in the rapidly evolving EV landscape.

Furthermore, financial analysts emphasize the importance of managing R&D expenses even as sales volumes increase. Xpeng’s planned investments into technology and product development suggest a commitment to innovation that should yield positive long-term returns. The potential for profitability by the end of 2023 aligns with analyst predictions, making Xpeng a noteworthy contender in the competitive EV market. The focus on balancing growth with financial prudence will be crucial as Xpeng navigates this pivotal juncture in its business strategy. The company’s ambitious roadmap is set to play a critical role in defining its position in the electric vehicle industry, establishing it as a key player for years to come.

Mona M03 Popularity: Driving Xpeng’s Growth

The Mona M03 has emerged as a sensational model within Xpeng’s lineup, significantly contributing to the company’s growth trajectory. Launched with the aim of providing an affordable entry point into the electric vehicle market, the M03 has resonated with consumers looking for cost-effective options without compromising on technology. Its popularity reflects the increasing consumer shift towards EVs, especially models equipped with robust driver-assist systems that enhance safety and convenience. The success of the Mona M03 demonstrates that there is a substantial market for well-priced electric vehicles that meet the demands of the average consumer, positioning Xpeng favorably against its competitors.

In addition to affordability, the M03’s advanced driver-assist technology sets it apart from traditional vehicles. This focus on innovation in an accessible format has appealed to a generation of drivers who prioritize not just the economic aspect of their purchase but also the technological features that enhance their driving experience. Given the competitive nature of the Chinese EV market, the M03 serves as a strategic pillar for Xpeng, as it continues to build its brand and consumer trust. With projections for increasing sales stemming from the success of this model, Xpeng’s commitment to innovation and affordability may serve as a blueprint for future vehicle releases.

As Xpeng continues to refine and expand its model range, the lessons learned from the M03’s success will undoubtedly inform their strategies moving forward. The blend of accessible pricing and advanced technology not only strengthens Xpeng’s competitive edge but also establishes a customer base loyal to the brand. Looking towards 2025 and beyond, maintaining and building upon the success of the M03 will be crucial as Xpeng plans to introduce more models targeting various segments of the market. The continued alignment between vehicle features, consumer affordability, and burgeoning demand for electric vehicles will drive Xpeng’s future growth and solidify its standing within the automotive industry.

Frequently Asked Questions

What factors are driving Xpeng electric vehicle growth in the Chinese EV market?

Xpeng electric vehicle growth in the Chinese EV market is largely driven by its investment in advanced driver-assist technology, which has significantly improved the functionality and appeal of its vehicles. The introduction of cost-effective models like the Mona M03 and the Xpeng-branded P7+ has also contributed to increasing sales, with Xpeng achieving over 30,000 monthly deliveries since November. Analysts predict continued growth due to strong model pipelines and rising consumer acceptance of driver-assist features.

How is the popularity of the Mona M03 affecting Xpeng’s sales projections?

The popularity of the Mona M03 is positively affecting Xpeng’s sales projections, as it is among the more affordable models that resonate well with Chinese consumers. The successful launch of the Mona brand has helped Xpeng recover sales momentum, leading analysts to project a doubling of sales compared to 2024. The combination of affordability and advanced driver-assist technology are key factors in boosting Xpeng electric vehicle growth.

What role does driver-assist technology play in Xpeng’s electric vehicle strategy?

Driver-assist technology is central to Xpeng’s electric vehicle strategy, enhancing vehicle safety and driving experiences. Xpeng has made significant investments in this area, setting itself apart in the competitive Chinese EV market. By offering advanced driver-assist features at no additional cost in models like the P7+, Xpeng aims to attract consumers who prioritize technology-driven vehicles, thus fueling Xpeng electric vehicle growth.

How is the competitive landscape in the Chinese EV market impacting Xpeng’s growth?

The competitive landscape in the Chinese EV market significantly impacts Xpeng’s growth, as it leads to continuous innovation and adaptation. Competitors like BYD are introducing new technologies, including ultra-fast charging and advanced driver-assist systems. Xpeng must maintain its edge by expanding its product lineup and enhancing existing models to ensure that its electric vehicle growth trajectory remains positive amidst fierce competition.

What are the implications of Xpeng’s stock rise for future investment in electric vehicles?

Xpeng’s stock rise indicates increased investor confidence in the company’s growth potential, fueled by favorable sales projections and strategic investments in driver-assist technology. As Xpeng continues to deliver strong sales and expand its market presence, it may attract more investment in the electric vehicle sector, signaling a robust future for Xpeng electric vehicle growth and the wider EV market.

How are analysts viewing Xpeng’s projections for 2025 in terms of sales growth and profitability?

Analysts view Xpeng’s projections for 2025 positively, with consensus earnings expectations increased by 10% in recent months due to anticipated strong sales volume. The company is targeting profitability in the fourth quarter, supported by its strategic focus on driver-assist technology and a strong model pipeline, which bodes well for sustained Xpeng electric vehicle growth.

Why is the rise of autonomous driving significant for Xpeng’s electric vehicle growth?

The rise of autonomous driving is significant for Xpeng’s electric vehicle growth as it represents a shift in consumer expectations and technology standards. By prioritizing advancements in driver-assist technology, Xpeng positions itself as a leader in the evolving landscape of autonomous driving within the Chinese EV market. This focus on innovation not only enhances vehicle appeal but also supports Xpeng’s overall growth strategy.

| Key Point | Details |

|---|---|

| Stock Performance | Xpeng’s shares have risen over 80% in 2023. |

| Delivery Rates | Xpeng has achieved over 30,000 car deliveries monthly since November. |

| Future Projections | Expectations to double sales by 2024 and achieve profitability by Q4. |

| Popular Models | The affordable Mona M03 and Xpeng P7+ with advanced features. |

| Market Growth Expectations | Analysts predict robust growth in 2025-26 due to a strong model pipeline. |

| Price Target Adjustments | Bank of America and Barclays raised their price targets for Xpeng shares. |

| Competitive Landscape | The EV market in China is competitive with advancements from BYD and others. |

| Technological Advances | Xpeng is focusing on L2 driving assistance and plans for L3 features. |

Summary

Xpeng electric vehicle growth is being bolstered by its proactive investment in driver-assist technology, which is starting to yield significant results. The company’s stock has surged, and its car deliveries have been consistent, reflecting a strong demand for its affordable models. As the autonomous driving market evolves, Xpeng’s commitment to innovation and expansion positions it well for future profitability and growth. The expectation of a doubling in sales speaks to the confidence analysts have in Xpeng’s strategies, highlighting the competitive nature of the EV landscape in China.